Poulssen

Unilever plc (NYSE:UL) is aggressively pursuing new growth prospects via acquisitions and new partnerships. Despite the company’s good position, the market is negative about its prospects, which is why the stock is significantly undervalued. At the same time, investors benefit from a 6% shareholder dividend, which promises to be a superb investment shelter in today’s unpredictable markets.

Accelerated organic growth propelled by the “Five Compass Strategic Decisions” will be central to the company’s efforts to increase value generation at Unilever. Acquisitions, like those that have helped Unilever create rapidly expanding brands in the cosmetics and nutrition sectors, will also be used to further bolster the portfolio.

Strategic acquisitions remain an important aspect of the company’s plan for future expansion. The online skincare brand Paula’s Choice LLC was bought last year. Unilever’s goal all along has been to increase its presence in the lucrative premium skincare industry, so making this purchase made perfect sense. The “Ingredient Dictionary,” a comprehensive online resource that deconstructs the research behind nearly 4,000 ingredients, and Expert Advice, a curated online hub of skin care and ingredient knowledge, are just a couple of the effective resources Paula’s Choice offers to demystify the science behind skin care. The agreement left Unilever executives feeling quite delighted, as Vasiliki Petrou, Unilever EVP and CEO Prestige, said:

We are thrilled that Paula’s Choice will join our Unilever Prestige family. Paula’s Choice is a true pioneer in the digital space for beauty and has created a mission-based brand rooted in truth and transparency. We can’t wait to introduce the brand and its iconic products to an even bigger audience

The firm also revealed that it has reached a deal to buy a majority ownership in Nutrafol, a prominent manufacturer of hair health products. This news was included in the company’s announcement. Through its subsidiary Unilever Ventures, Unilever now has a minority share in Nutrafol, amounting to 13.2% of the company. According to IQVIA Provoice survey for 12 months ending 31 March 2022, in the United States, Nutrafol is the number one hair growth brand that is recommended by dermatologists. Nutrafol provides a selection of solutions that have been put through rigorous scientific testing and have been created by licensed medical professionals to treat thinning hair and damaged hair health. Given that more than 114 million people in the United States struggle with hair health concerns, this purchase paves the way for Unilever to enter another expansive market.

The company’s goal is to expand into new, promising markets, thus it is selling its slow growth businesses and acquires new ones with fast growth opportunities. The firm agreed to sell its Tea business, Ektarra, to CVC Capital Partners Fund VIII in November 2021. The sale price was EUR4.5 billion. Lipton, PG Tips, Pukka, T2, and TAZO are just a few of the 34 brands that Ekaterra manages. The Unilever Tea businesses in India, Indonesia, and Nepal were not included in this transaction. Meanwhile, the firm and RS Group signed a contract to sell the Unilever Life direct sales division in Thailand. In accordance with the terms of the deal, Unilever will be selling its direct selling business unit, which includes three different brands. The divestitures help the firm in generating more funds that are intended to support future expansion. However, the aggressive stance may increase company integration risks and impede the growth of recently acquired businesses.

The business is always on the lookout for new chances to form partnerships, which will enable it to broaden its product offering and reach a broader range of customers. The firm formed a partnership with Holobiome Inc. in January 2022 to find substances that could enhance wellness. The purpose of the cooperation is to determine which components of food specifically interact with important microorganisms. Long-term goals include enhancing these ingredients in specific foods and refreshment products across Unilever’s portfolio in order to naturally boost levels of certain calming neurotransmitters in the gut, which will, in turn, improve mental wellbeing. This will be accomplished through a combination of research and product development.

Meanwhile, the company entered into another partnership contract with A.P. Moller in December 2021. Under the terms of the four-year agreement, Unilever will have its International Control Tower Solution developed and managed by the company. This is an operational management solution that will centralize the way the company handles its worldwide ocean and air transport, with the goal of boosting its productivity, and lowering its carbon footprint.

Threats

The fast-moving consumer goods (FMCG) industry is highly competitive, with companies competing on features such as product quality, brand recognition, new product launches, innovation, customer loyalty, new product launches, marketing and pricing. The business is challenged by rivals on a global, regional, and even local scale. The stiff competition causes problems for the business to achieve its profitability improvement goals and expand its revenues base.

The company reports in euros, while the majority of its revenues are generated in other currencies. So the forex risk is significant for the business given current volatile markets.

Dividends And Share Buybacks

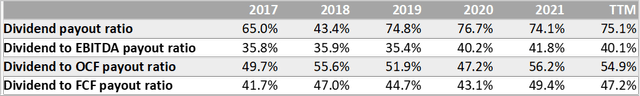

The company pays a 4% dividend yield, which is 25% higher than its 5-year median yield of 3.19%. During the last 10-year period, the company managed to record dividend CAGR of 4.4%, while the growth rate slowed down substantially during the last 3-year period, decreasing to 1.1%.

Despite the significantly high yield, the payout ratios are in safe range, as the TTM Dividend to EBITDA payout ratio is 40% and the Dividend to FCF is just 47%. During the last 5-year period, we see slow growth of payout ratios, which indicates that they still have room to grow.

Dividend payout ratio (Author)

At the same time, the management has initiated a share buyback program. During the second quarter they have finished the first tranche of EUR3 billion buyback program (EUR750 million). For the upcoming 12-month period, the company is intended to spend another EUR2.25 billion on the program, which promises additional 2% yield to shareholders. So for the upcoming year, the management is going to return 6% yield to shareholders.

Valuation

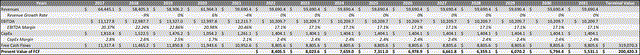

We used a reverse DCF technique to examine the stock from a valuation standpoint.

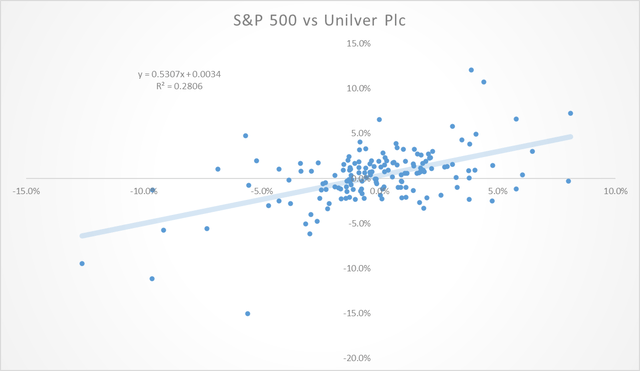

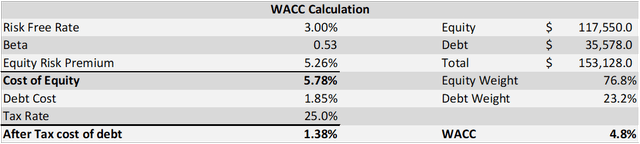

First, we estimated the 3-year beta coefficient using weekly data, which is equal to 0.53. According to the data, the stock is low correlated with the market, providing a considerable diversification potential (R squared of 28%).

As a result, we get a WACC of 4.8%.

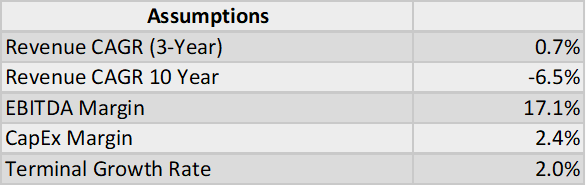

For the remaining inputs, we used a more conservative approach. We assumed a 20% lower EBITDA margin than the 2017-2021 period average, and we expect CapEx to remain consistent. We picked 2% as the final growth rate, which is lower than the current 10-year treasury yield.

Unilever DCF (Author) Unilever DCF (Author)

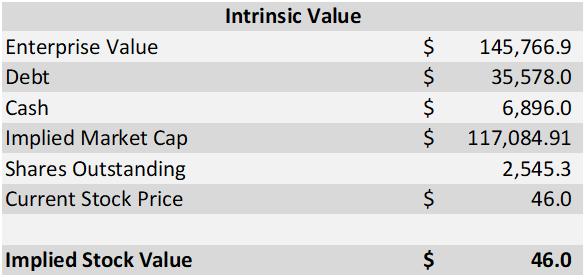

As a result, our model indicates that the current stock price reflects a 50% revenue decline expectation until 2031.

Unilever DCF (Author)

Given the excessively gloomy estimates, we believe the stock is significantly undervalued, thus we created a new model to represent more accurate forecasts. As a result, we assume 0% revenue growth in the future decade, a 20% decline in EBITDA margin, and the same CapEx margin and terminal growth rate. As a consequence, our model yields a stock value of $94.5, which is more than 100% higher than the current stock price.

Conclusion

So we see a strong company that is proactively increasing its growth potential. The new purchases and relationships bode well for the company’s future. However, the present market price reflects very negative trends that appear irrational and inappropriate, thus we rate the stock as Buy.

Be the first to comment