Pekic/E+ via Getty Images

Wag! Group Co. (NASDAQ:PET), a subscription-based mobile pet service marketplace, is a front runner in consolidating a fragmented pet industry and providing consumers access to all their pet-based needs from a single online platform. We’ve seen traditional brick-and-mortar industries repeatedly disrupted through the likes of Airbnb, Uber, and Etsy. PET is doing the same in the animal care space. 90% of its customers had never used a dog walker before the app. PET went public this month on NASDAQ after merging with CHW Acquisition Corp (CHWA.O) at an initial stock price of $8.20, raising $125 million. Although the stock price has dropped to $4.95, we are evaluating a young and unprofitable company with a volatile operational history. It has released a robust set of second-quarter results. Its premium paid subscription licenses have grown from 34% to 50%. On top of that, the US pet industry is a hundred-billion-dollar industry, and most recently, the company has started tapping into ample opportunities in the health and wellness pet sector. For these reasons, I believe investors may want to take a cautious but bullish stance on this company with a lot more upside potential shortly.

Introduction

PET was founded in 2015 in San Francisco. The business model is very similar to Uber. It connects dog owners to a network of caretakers who are independent contractors. PET takes up to 40% of every booking made, and it has a recurring premium license fee of $9.99 per month that platform users can choose to subscribe to. The company multiplied and is now in over 4600 US cities. It attracted several celebrity endorsements and SoftBank’s $300 million investment in 2018, its biggest backer.

For a young company, it already has quite a colourful history of layoffs, failed global expansion plans, and ending a partnership deal with Petco (WOOF). SoftBank also sold its stake in the board at the end of 2019, and then CEO Hilary Schneider jumped ship along with them. Since 2019 Garrett Smallwood has been the CEO and saw them through the recent IPO offering.

The company went public by merging with CHW Acquisition Corp (CHWA.O), which provided them with $175 million in gross cash. CHWA.O is an acquisition company that focuses on providing capital to private companies by merging and subsequently IPOing these companies. PET shareholders own the majority of the company. Blue Torch Capital was also part of the merger with a debt financing of $30 million.

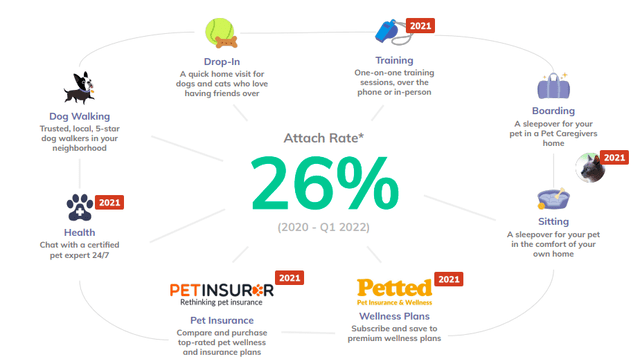

PET competes with another dog walking platform, Rover (ROVR). ROVR has a much larger market share in the world of dog walking in the States. It IPO’d one year ago. However, the stock has yet to succeed. PET distinguishes itself from its competitors by not only offering sitters and walkers. It aims to give you access to a high-quality network of pet wellness services. Services include dog walking, pet sitting, training classes and veterinary care, available in 50 US states. Customers have access to over 400,000 well-rated local caretakers and trainers. In the image below, we can see the services. The attach rate, i.e. services sold together, has increased to 26%. The company still has plans to go international.

PET services (Investor Presentation 2022)

Financials and Valuation

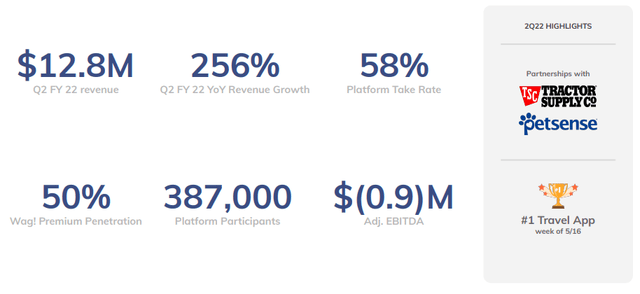

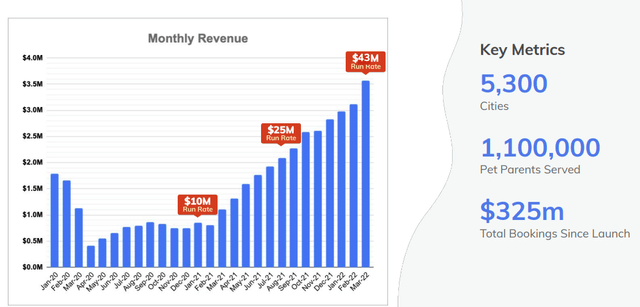

Although PET is still a loss-making company, it is in the early growth stages. It officially started trading on NASDAQ on 10 August 2022. We want to look at the trends in annual and quarterly results, the number of premium subscriptions, the booking activity through the site and the growth in customer lifetime value. Keeping that in mind, what we can see from the Q2 2022 financial results is exciting to review. Revenues increased year on year by 256% to $12.8 million. There were significant improvements with adjusted EBITDA, which exceeded analyst expectations. The company’s gross bookings increased by 141% yearly to $17.5 million. Net loss improved by $1.3 million to a $1.1 million YoY and adjusted EBITDA improved by $1.4 million to a loss of $900,000 YoY.

Q2 2022 Performance Highlights (Investor Presentation 2022)

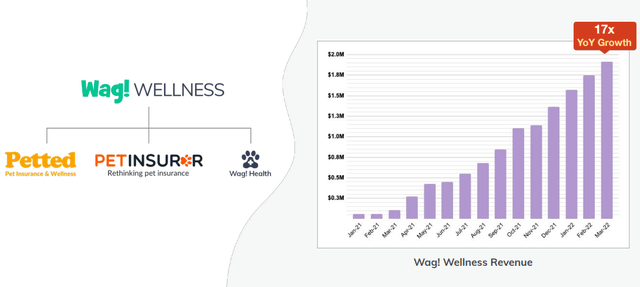

It is crucial to evaluate the engagement of customers and their potential value for PET. If we look at the growth of premium licenses, at a fee of $9.99 per month, year on year went up from 34% to 50%. It is also a very positive sign for increased engagement in the application. Customers making use of multiple services has risen to 58%. The number of bookings increased by 124% if we compare it to the same period one year ago. At the end of Q1 2022, there were 387,000 platform participants. Below we can see the impact of the wellness services on PET’s revenues increasing since 2021.

Wag! Wellness Revenue By month (Investor Presentation 2022)

The graph shows that the company struggled during the COVID-19 year as the demand for its services was reduced due to lockdowns and an increase in remote work opportunities. The additional services have had a significant revenue boost since going live in 2021.

Monthly Revenue Trend (Investor Presentation 2022)

The management team has also improved its forecast for the entire year, expecting revenue in the range of $49 million and EBITDA around a loss of $8 million.

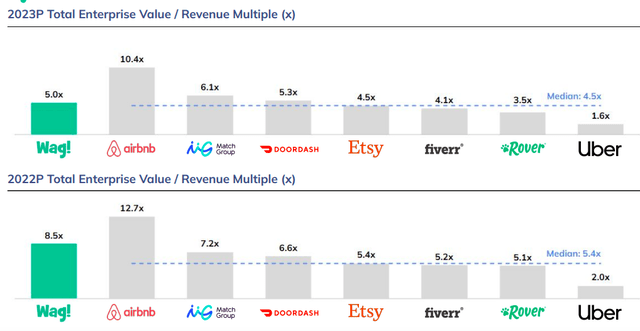

Since going public, news has been optimistic about the stock’s performance. There are not many analysts that have made recommendation reviews. However, one Wall Street analyst recommends PET as a ‘Strong Buy’. PET has a small market cap of $187.34 million and is unprofitable. By doing a relative valuation between comparable public companies that have been in the online consumer marketplaces for a more extended period, we can see PET has a relatively high but improving valuation if we consider the forward-looking ratio. These companies are recognisable internet brands with solid user growth, robust big data and analytics infrastructures, and mobile presence and are highly disruptive in traditional industries.

Relative Valuation (Investor Presentation 2022)

Risks

PET is a young unprofitable company with some operational mishaps in its short-lived history. The concept is new to the market, and there are many competing alternative applications that customers can choose to use. Similar to the platforms mentioned above that connect users, outside of making the connection, PET has little control of what happens once the interaction moves offline. There has been some bad publicity recently about dead dogs and injured walkers that have made people cautious of the website’s security. As this is a disruptive platform, general uncertainty about trying or accepting new concepts and negative information can impact even more.

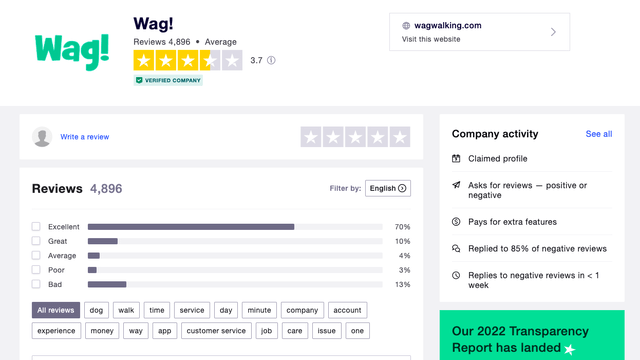

Furthermore, there have been security breaches in the past. For online companies, it is critical to keep up to date with consumer data protection as the company grows and takes on more confidential information. Lastly, customer opinions are essential to maintaining a strong brand and online reputation. The image below gives us a general impression of customer satisfaction regarding the site. Over the last few months, the reviews have been trending towards negative, which is something to be cautious of.

Final Thoughts

PET has just put its paws into the public market space, and we are yet to see if it can handle the stock market better than competitor Rover. However, it has entered the field with strong Q2 financial results, a business plan involving services in pet wellness which has been increasing in monthly revenue and a management team that is confident in a solid financial year-end. For these reasons, I believe investors may want to take a bullish stance on this company.

Be the first to comment