Drew Angerer

Jerome Powell, Chairman of the Board of Governors of the Federal Reserve System, is the focus of the investment community right now.

Mr. Powell knows that.

Yesterday, Mr. Powell gave a speech at the annual Federal Reserve conference held in Jackson Hole, Wyoming.

Mr. Powell’s talk was shorter than usual.

Mr. Powell’s talk was more pointed than usual.

And, in his speech, after explaining that the Federal Reserve must combat inflation, Mr. Powell emphasized that

“we must keep at it until the job is done.”

And, to conclude, Mr. Powell closed with this last sentence, reaffirming that

“We will keep at it until the job is done.”

More than anything else right now, Mr. Powell has all the lights on him.

The investment community has its doubts about Mr. Powell. These doubts are about whether or not Mr. Powell can produce a monetary policy that can defeat inflation and whether or not Mr. Powell can stick with this policy, even though it produces a lot of pain, long enough to actually bring inflation down somewhere around the Fed’s target rate of inflation, 2.0 percent.

Movements in the stock market this year have reflected this wavering attitude concerning Mr. Powell’s ability and Mr. Powell’s ability to stick with the job.

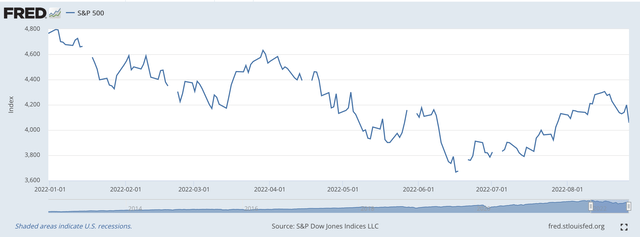

Take a look at market performance this year.

S&P 500 Stock Index (Federal Reserve)

The S&P 500 Stock Index has trended downward for most of this year. On January 3, 2022, the S&P hit a new historical high for the index. But, after that, the direction has been down.

That is, except when investors had doubts about what the Fed was doing, what the Fed was going to do, and whether or not the Fed would stick with a strong policy effort to really get inflation down to around 2.0 percent.

Colby Smith and Eric Platt get the front page, the lead article in the Saturday/Sunday Financial Times:

“War Is Declared!”

The Initial Reaction

Investors reacted, I believe, in the way that Mr. Powell was hoping.

Stock prices collapsed.

The Dow Jones Industrial Average dropped by more than 1,000 points. The S&P 500 Stock Index fell by 137 points. And, the NASDAQ index declined by almost 500 points.

We read in the Wall Street Journal.

“In a highly anticipated speech, Mr. Powell said the Fed must continue raising interest rates and keep them high until inflation is under control.”

“His comments disappointed investors who had hoped inflation had peaked and the Fed would shift from raising rates to lowering them something next year.”

The hope has always been that the rise in inflation was at or was near its peak and would be declining soon. Investors were hoping that all the supply chain problems or other dislocations coming from the spread of the Covid-19 pandemic were in the process of reversing themselves.

For much of 2021, Mr. Powell seemed to feel this way as well and presented a narrative that supported this outlook.

Now, Mr. Powell even says that the Fed should have begun raising its policy rate of interest earlier than it did. In this respect, Mr. Powell and the Fed are “behind the curve” when it comes to raising its policy rate of interest, and they admit to this fault.

Mr. Powell even alluded to the possibility that the Fed, at its September meeting of the FOMC, will approve another 75-basis point rise in the range it sets for its policy rate of interest. The rise in the range at the last two FOMC meetings has been 75 basis points.

Back To The Stock Market

It appears that part of Mr. Powell’s effort on Friday was to convince investors that he, and the Fed, were seriously “in the game” and were very intent upon pressing on the monetary brakes until it appeared as if the inflation rate was collapsing toward the Fed’s 2.0 percent target.

Stock prices should continue to decline.

Inflation has a long way to drop before it gets back to 2.0 percent.

Furthermore, as I have been arguing in recent months, there are so many markets or sectors of the economy that are in various states of dislocation that it is hard to make a case that the U.S. economy will settle down anytime soon.

And, there is still lots and lots of cash floating around that can cause problems here or there. That is one of the problems connected with the Federal Reserve injecting trillions of dollars into the financial system. The Federal Reserve now has to overcome all the liquidity that it spread around to prevent a downside disaster.

The stock market?

Well, the stock market, for at least the last decade, has followed the saying, “ride with the Fed.”

Consequently, stock prices went up and up as the Federal Reserve pumped more and more money into the financial system.

Now, we are on the other side and the Fed is in a position where it can do very little to continue the support of the stock prices.

The Fed cannot produce a restrictive monetary stance and still act to “err on the side of monetary ease.”

This just cannot be done when the Federal Reserve seriously sets out to combat inflation.

And, this, I think, is exactly the position Mr. Powell finds himself in, and, in the speech at Jackson Hole, Mr. Powell wants to establish the attitude that the Fed is tightening up on monetary policy and will not ease up until the Fed’s target rate of inflation is achieved.

Stock prices should be expected to fall.

Be the first to comment