cemagraphics

It’s been about 3.5 months since I wrote my latest cautious note about Innoviva Inc. (NASDAQ:INVA), and in that time the shares have cratered an additional 20.5% against a loss of about 6.8% for the S&P 500. Much has happened since I last wrote about the business, so I thought I’d review the name again. For instance, they have made another acquisition, and they have reported earnings. I did well trading this stock in the past, so it’s time to review the name. After all, a stock trading at $12.40 is, by definition, less risky than the same stock when it’s trading at $15.60. Finally, I never tire of writing about big bank analyst mistakes, and Innoviva gives me the opportunity to do just that.

Welcome to the thesis statement paragraph of the article. I’ve already hinted that this article is going to be filled with even more bragging than usual, so I can understand why you’d want to a way to glean the highlights of my thinking so you can then leave the article before being exposed to too much Doyle mojo. I think there are risks here, and I think the negative relationship between revenue and net income remain a perennial problem. That written, I’d be happy to buy this business at the right price, as I think the firm has a fairly decent moat, and I think there’s potential in the most recent acquisitions. The problem for me is that the shares aren’t objectively cheap enough. Thankfully the options market offers an alternative, and so I’ll be selling puts this week. This concludes my thesis statement. If you read on from here, that’s on you. I don’t want to read any complaints in the comments section about my self aggrandizement or the fact that I spell words like “flavour” properly or similar.

Update

Before getting into the financial analysis, recently the company presented at the Morgan Stanley 20th Annual Global Healthcare Conference, and I think that deserves commentary. Feel free to listen to that presentation yourselves, obviously, but if you choose to subject yourselves to this, I would recommend wearing headphones and setting the speed to 0.75x normal because the audio quality is similar to what you’d expect to hear if the conference were broadcast from inside of a deflated basketball.

In case you don’t want to subject yourself to this experience, I’ll offer you what I consider to be the highlights from the presentation for your enjoyment and edification:

- The company expects to remain cash flow positive, and they’ve made some efforts to clean up the capital structure. In particular, they issued a $250 million convertible note that was used to pay off debt due this coming January. They took a loss of about $20.6 million to extinguish this debt.

- The outlook for Relvar/Breo and Anoro both look good. Even when the royalty streams for these products eventually run dry, the reality is that it’s challenging to get new products approved and onto the market. Thus, there’s a likely moat around these for some time to come.

- With the acquisition of Entasis and La Jolla, the company seems to be moving toward acquiring operating assets as opposed to royalty assets. The Morgan Stanley analyst noted the distinction between these two types of assets, and the challenges associated with moving from one type of asset to the other.

- The company believes that the acquisitions will be cash flow positive in relatively short order. La Jolla is cash flow positive as of now. While Entasis is pre-market, it’ll be possible to leverage the La Jolla hospital channel to sell into also.

So, according to the company, the financial position has improved somewhat, and we’re going to review that claim below. I think the Morgan Stanley analyst is correct in suggesting that there’s risk associated with a royalty company buying operating companies. It’s generally also the case that even acquisitions that look good on paper have a nasty tendency to fail. Anyway, those were what I consider to be the highlights of the call, and I would urge you to listen to all 23 minutes of it if you’re so inclined.

Financial Snapshot

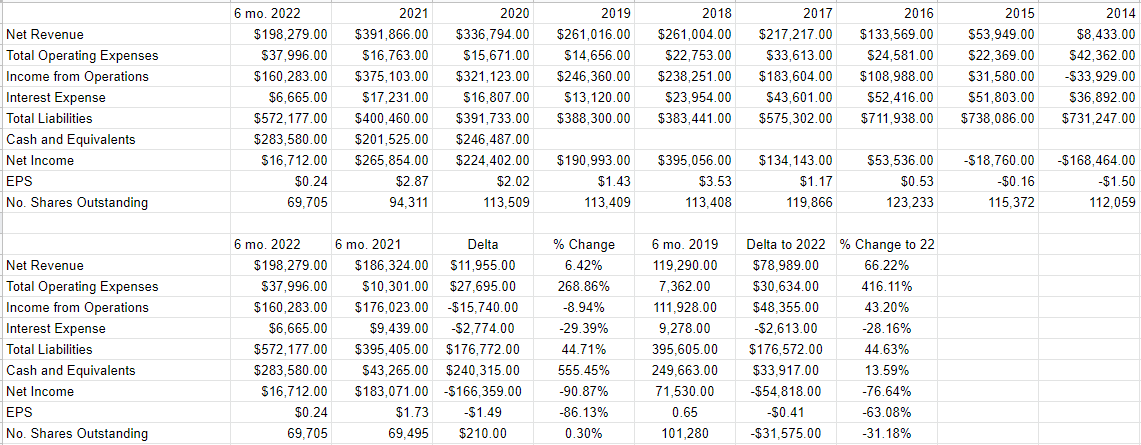

The most recent period continues a long, somewhat depressing trend at this firm, namely the disconnect between revenue and net income. Relative to the same period in 2021, the top line has grown about 6.4% but net income has plummeted by more than 90%. This happened in spite of a nice 29% reduction in interest expense. The chief culprits were the $19.6 million increase in R&D expenses, $8 million increase in G&A expenses, and a $20.6 million loss on debt extinguishment. The last of these won’t recur, obviously, but I think investors would be wise to gird themselves for the risk of a permanently higher cost structure here.

In case you’re worried that I’m drawing a comparison between 2022 and a uniquely profitable year, fret no further, dear readers. During the presentation with Morgan Stanley, the company referenced the huge impact of the Covid pandemic, so I thought it’d be interesting to compare the current state to the pre-Covid state. When compared to the same period in 2019, revenue in 2022 is 66.2% higher, and net income is 76% lower. This is a perennial problem that I’ve been droning on about for years at this point.

That said, about a month and a half after I put out my “avoid” recommendation on this stock, Goldman Sachs joined the party with a $16 price target, which represented an 8.7% upside from the then price of $14.72. Sadly the shares have gone the other way, obviously, but sooner or later Goldman’s relative optimism may pay off, so it may be worth buying the shares at the right price.

Innoviva Financials (Innoviva investor relations)

The Stock

Welcome to the section of the article where I point out yet again what I consider to be screamingly obvious, namely that “the business” is quite a different thing from “the stock.” If you read my stuff regularly for some reason, this isn’t a shock to you. I feel a need to point this out because one of the more pernicious old adages that float around investing circles is that “we don’t buy stocks, we buy businesses.” No, we absolutely do not “buy businesses.” We very much buy “stocks”, and they are affected by forces that are in addition to the ups and downs of the firm. For instance, a stock may move up or down in price because of what an analyst has recently written about the business. Now, as the Goldman experience I wrote about above proves, this may not mean very much, but analyst activity is something. Also, the stock is very definitely affected by our collective views about the overall market, and stocks as an asset class. For example, given that the S&P has dropped about 6% since I wrote about this, a reasonable argument could be made to suggest that 30% of the drop in price is caused by people eschewing the “stock” asset class.

It may be tiresome that your stock gets buffeted around by forces having very little to do with the company, but in my experience, this creates tremendous opportunity also. The only way to consistently make money trading stocks is to spot discrepancies between the crowd’s view about a given company and subsequent results. This is the approach I’ve taken with Innoviva and it’s worked out pretty well. We want to go long a stock when the crowd becomes overly pessimistic, and we want to avoid stocks when the crowd becomes overly sanguine. This approach causes investors to miss out on some great gains in the short run, but I think it preserves the purchasing power of your capital over time, and that’s really the name of the game in my view.

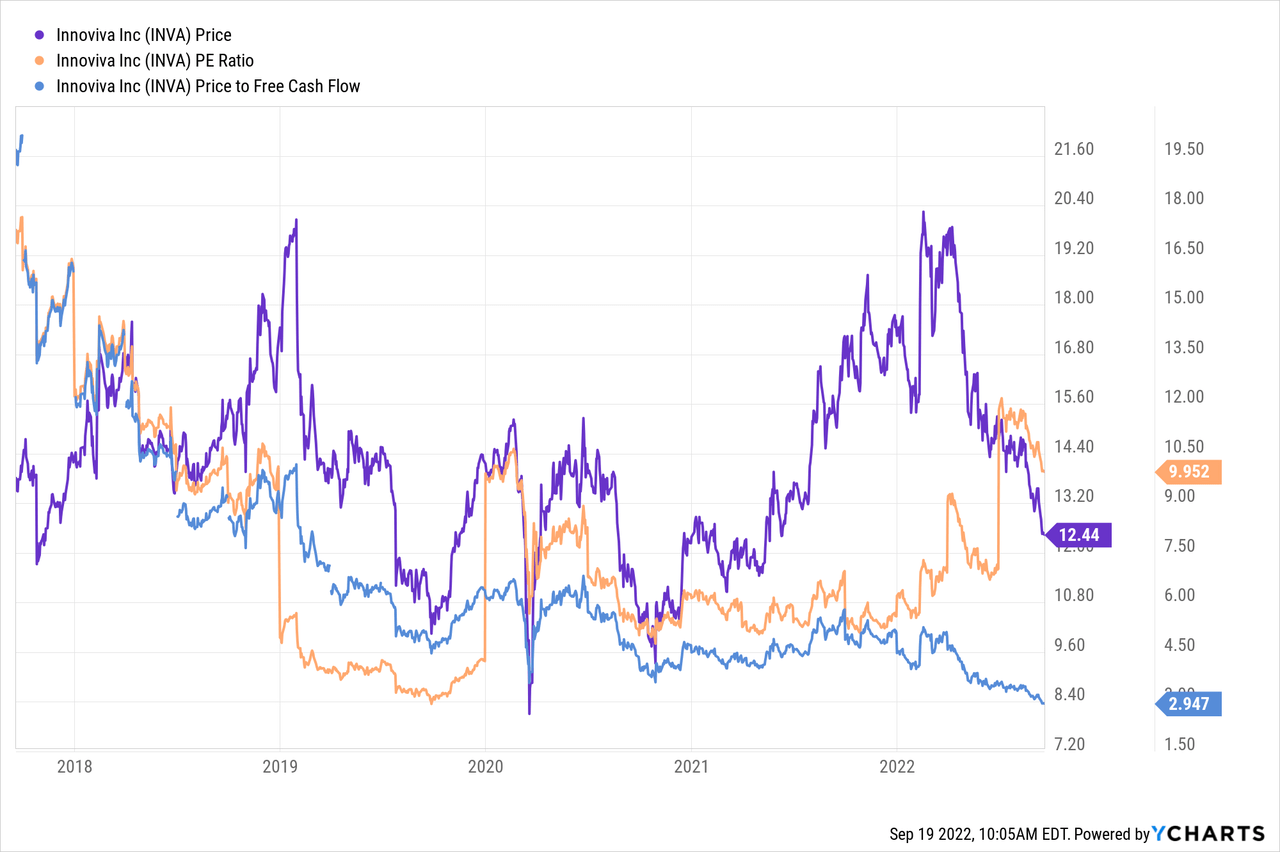

I want to buy when the crowd is particularly pessimistic and I measure pessimism in a few ways, ranging from the simple to the more complex, and I publish some of those measures on this forum. On the simple side, I look at the ratio of price to some measure of economic value like earnings, free cash flow and the like. I want to see a stock trading at a discount to both the overall market and its own history. When last I reviewed Innoviva, I fretted about the fact that price to earnings and price to free cash flow were about 7.2 and 3.6 times respectively. The shares are either 38% more expensive or 17% cheaper depending on how you measure it per the following:

Since the shares are neither unambiguously cheap nor expensive, I’m on the horns of a dilemma. My tendency at the moment is to preserve capital, though I think there’s value here. I can either wait for shares to become more cheaply priced before buying, or I can earn some money today by selling put options on this stock. Those who read my stuff regularly know what I’m inclined to do.

Options As Alternative

In my previous article on this name, I pointed out that fully 13.7% of the $12.06 I had made trading this stock over the years has come from selling put options. I mentioned this for two reasons. First, and most importantly by far, writing about that gives me a chance to brag, and that’s never a bad thing (for me, anyway). Second, it reveals to readers the risk reducing, yield enhancing potential of these wonderful instruments. With that in mind, I recommend selling some more puts today. In particular, I’m a fan of the December Innoviva puts with a strike of $10 which are currently bid at $0.20. I like these because I enjoy the prospect of making 2% in three months. As my regulars know, I consider investments of this sort to be “win-win”, because the outcome is positive no matter what happens. If the shares remain above $10 in price between now and the third Friday of December, I’ll simply pocket the premium. If the shares drop below $10, I’ll be obliged to buy at a net price of $9.80, but I think that’d be a great entry price. It’s also much better than buying at the current market price.

It’s time, once again, to write about risk. It’s all well and good for a stranger on the internet to write about “win-win” trades, but if you’re going to trade these, you need to be made aware of the fact that this investment, like all investments, comes with risk. I consider the risks associated with these instruments to fall into two broad categories: the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. So, I would never advocate that people simply sell puts with the highest premia. In my view, that strategy would lead to disastrous results. So my first bit of advice is to only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay. Take my word on this one, as it’s informed by painful history.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that Innoviva stock price goes parabolic and hits $50 per share between now and the third Friday of December. Obviously my puts will expire worthless, which is a great outcome in some ways. I will not catch any of the upside in the stock price, though. So, short put returns are capped by the premium received. This is emotionally painful for some more hopeful souls than me.

Secondly, it can be emotionally painful when the shares crash below your strike price. So far, whenever this has happened to me, things have worked out well over the long term, because I insist on only ever writing puts at “screaming buy” strike prices. That said, it has been emotionally stressful in the short term on occasion. If you’re going to sell puts, please be aware of this phenomenon.

If you understand these risks, and can tolerate them, I would recommend that you sell puts. I think short puts offer at least some risk adjusted return here, and so we should sell them.

Conclusion

I think the problems at Innoviva linger. There remains a strong disconnect between revenue and net income, and that’s troublesome in my estimation. At the same time, the shares are not extraordinarily cheap, in spite of the risks associated with the recent acquisitions. That written, I think Breo and Anoro do have wide moats, and I’ve been happy owning this business in the past and would do so again at the right price. The only way to gain access to the “right price” is via the options market in my view, which is why I’m selling puts this week.

Be the first to comment