inbj

Very few tech companies have been able to prove that they have an extended shelf life, and unfortunately, it seems that eBay (NASDAQ:EBAY) is not one of them. The internet auction site, one of the earliest internet crazes to spring out of Silicon Valley, saw a brief resurgence during the pandemic when online shopping (particularly for collectibles) spiked. But now in the post-pandemic era, eBay is struggling with a sharp deceleration in marketplace results as well as re-affirming its place in a world dominated by Amazon (AMZN).

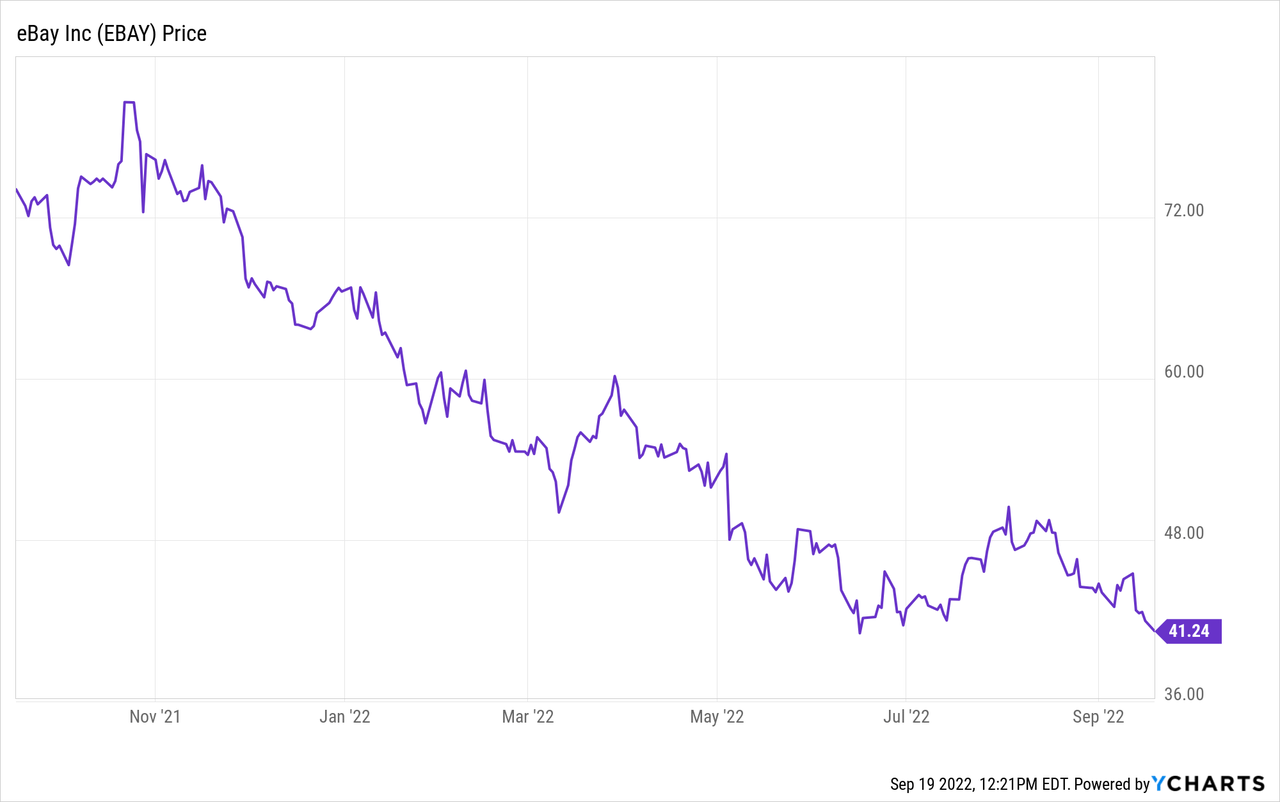

Year to date, shares of eBay have lost 40% of their value. Though a value stock on paper, trading at less than a <10x forward P/E ratio based on Wall Street’s $4.41 EPS consensus for next year, I think eBay will struggle to gain ground from here and may even see more pain ahead.

I remain neutral on eBay. I think the company’s valuation and year-to-date slide protect it from substantial further downside; however, there are a lot of risks that investors need to be mindful of:

- The return of brick-and-mortar stores seems to be impacting e-commerce much more than expected. eBay’s relentless deceleration in both revenue and GM trends is a reflection of much weaker macro trends than the company initially expected entering into the year.

- Capital returns at risk – eBay has driven EPS growth through share buybacks, and rich dividends (currently at a ~2% yield) have kept investors patient. Yet with declining revenue and margins, it’s unclear whether eBay will be able to continue at its current pace.

- Outside of collectibles and other niche categories like auto parts, eBay has no real “wow” factor anymore. Specialized, dedicated e-commerce stores like Chewy (CHWY) have taken over certain categories; and in any category that has no special niche leader, Amazon reigns supreme. It’s unclear whether eBay can continue growing on its collectibles push alone, let alone potentially shrink in the future.

Let’s lean into the collectibles discussion here: in recent quarters, eBay has truly doubled down on its affinity to this category. The company recently launched the eBay Vault – a physical storage location for collectible goods. Right now, eBay is offering free storage for trading cards for up to a year. It is also waiving transfer fees for the remainder of 2022 (intended to be a 3% cut of final sale value when an eBay seller sells a card or other collectible within the eBay Vault to another buyer).

The company also recently spent $295 million to purchase a company called TCGPlayer, another collectibles-focused company.

In other words, eBay is fighting for its relevance by crawling into its niche – but at the end of the day, I think the company is still staffed to support a much larger business than it no longer is. To survive, eBay will have to shrink into a much smaller company – a process that is already playing out in its declining revenue and GMV trends. The company’s cheap valuation (a value trap!) at present is also a reflection of the widespread assumption that eBay will eventually decline.

The bottom line here: While I don’t think eBay will continue to lose much ground from here, neither do I think there are any fundamental catalysts to spark a rebound rally. Staying on the sidelines here is the best move.

Q2 download

Let’s now go through eBay’s latest Q2 results in greater detail. Starting with the top-line trends:

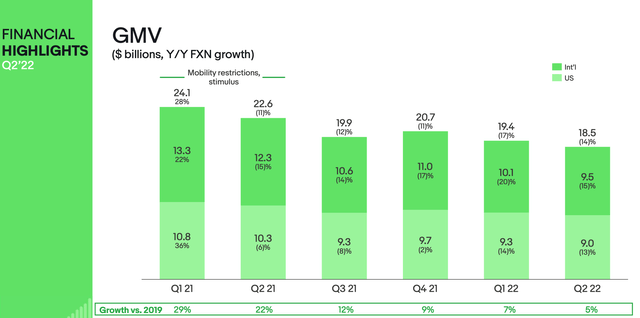

eBay GMV trends (eBay Q2 earnings deck)

eBay’s GMV in the quarter declined -18% y/y to $18.5 billion on an as-reported (spot) basis, decelerating one point to last quarter’s -17% y/y decline. On an FX-neutral basis, GMV shed -14% y/y, driven primarily by losses in the international segment, which contributes to roughly half of overall GMV. Note as well that though U.S. GMV had held up stronger in FY21, the decay domestically is starting to catch up with the rest of the world.

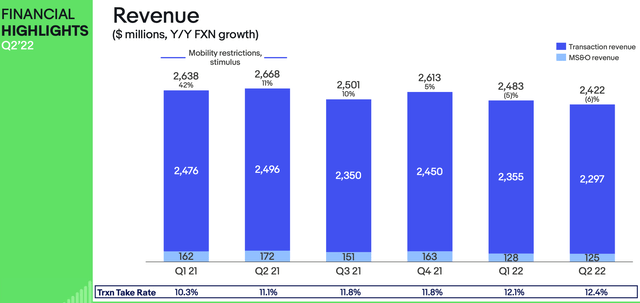

Revenue, too, is sliding downward, though an uptick in transaction take rates is softening the blow to revenue. Revenue declined -9% y/y (-6% on a constant-currency basis) in the quarter to $2.42 billion, beating Wall Street’s $2.36 billion estimate (-11% y/y), though decelerating sharply from last quarter’s -5% y/y decline.

eBay revenue trends (eBay Q2 earnings deck)

As previously discussed, the company has moved to a “focus category” strategy. Per CEO Jamie Iannone’s remarks on the Q2 earnings call:

One of the most important pillars of our long-term plan is our focus category strategy. Investments in trust, product experience and marketing are increasing customer satisfaction, leading to faster volume growth. Last quarter, excluding trading cards, focus category GMV grew 9 points faster than the rest of the platform. Trading cards are lower than last year’s results, but volume remains robust at more than double pre-pandemic levels.

We are seeing significant outperformance in focus categories globally. Although the US is higher than international. The primary reasons for the difference are the timing of launches and category mix by market.

The markets where it’s implemented these changes, customer satisfaction remains at or near best-in-class levels. The vast majority of our enthusiast buyer shop in focus categories and their spending levels remain above $3,000 per year. We continue to see cross-category shopping activity consistent with data we shared during Investor Day in March.”

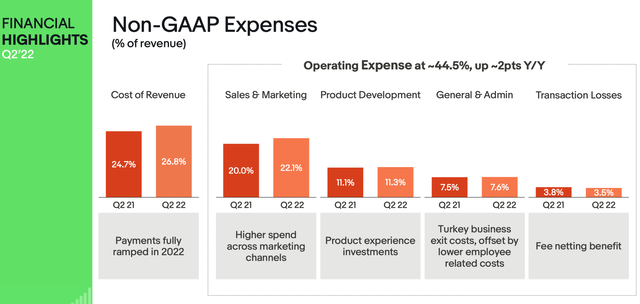

Nevertheless, the overall shrinkage in revenue has led to dis-economies of scale. Operating expenses of 44.5% are two points higher than last year, while gross margins have also pared back by two points as well:

eBay expenses (eBay Q2 earnings deck)

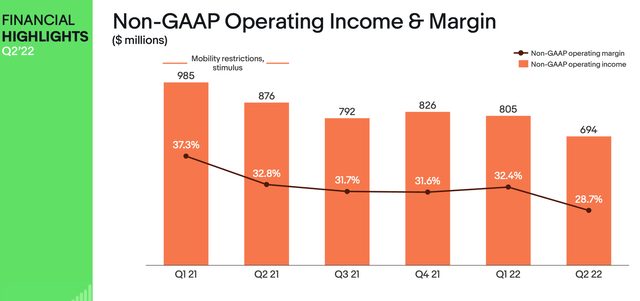

As a result, pro forma operating income declined -21% y/y to $694 million, representing a 28.7% pro forma operating margin – 410bps worse than in the year-ago quarter.

eBay operating margins (eBay Q2 earnings deck)

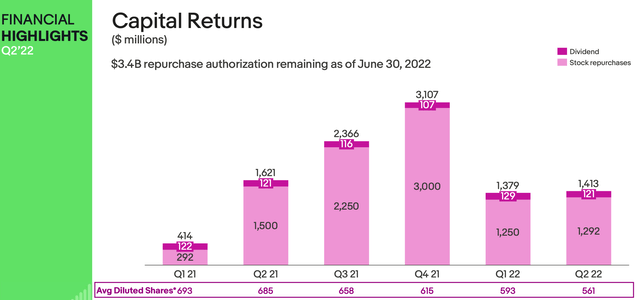

One of the primary concerns here is eBay’s ability to keep up its capital returns program, primarily share repurchases. Over the trailing twelve months, the company has returned a whopping $7.8 billion in total capital returns, of which $473 million came in the form of dividends. These share buybacks, looking backward, were poorly timed as the stock has sunk ~40% year to date:

eBay capital returns (eBay Q2 earnings deck)

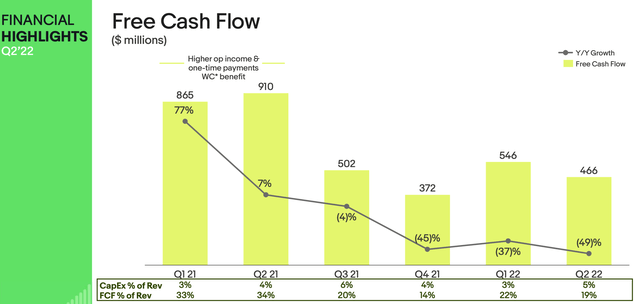

TTM free cash flow, meanwhile, was only $1.9 billion, and as can be seen below, the y/y declines in free cash flow over the past three quarters have been steep.

eBay FCF (eBay Q2 earnings deck)

At these run rates, eBay will have enough firepower to continue its dividend program, but it will take a while to burn through the remainder of its $3.4 billion buyback authorization without tapping into additional debt (and as it stands today, eBay’s $3.4 billion of net debt is already sitting at a 2.5x leverage ratio against adjusted EBITDA, which is just under the company’s target of 3.0x. If EBITDA continues declining, its current net debt levels might already exceed that threshold).

Key takeaways

In my view, there’s little that can be done to reverse eBay’s slow and gradual decline. The company is making the right moves to invest in the categories in which it has proven dominance against Amazon, but the overall end-market size will require eBay to dramatically shrink down its operations. Continue to stay on the sidelines here.

Be the first to comment