StockByM/iStock via Getty Images

An area of the global stock market that has provided surprisingly strong alpha in the last few months is the Eurozone. Among its largest nations is Germany. The iShares MSCI Germany ETF (NYSEARCA:EWG) is a popular way to get exposure to the German market in dollar terms.

According to iShares, EWG is an ETF holding mid and large-sized equities in Germany. It is an efficient way to express a single-country view at a low cost. EWG sports an expense ratio of 0.50%, which is not cheap by today’s standards, but the security is highly liquid with a median 30-day bid/ask spread of just five basis points. It also has a history of trading very close to its NAV. Daily volume is more than five million shares.

EWG holds 61 stocks and boasts a dividend yield of 3.01% (30-day SEC yield), well above the dividend rate on the broad U.S. market. The trailing 12-month dividend rate is even higher at 5.44% – a better gauge of the fund’s true yield. Its volatility is about on par with the S&P 500 at 25.4%. What I really like about EWG right now is its exceptionally low price-to-earnings ratio of 11.4 as of November 8, per iShares.

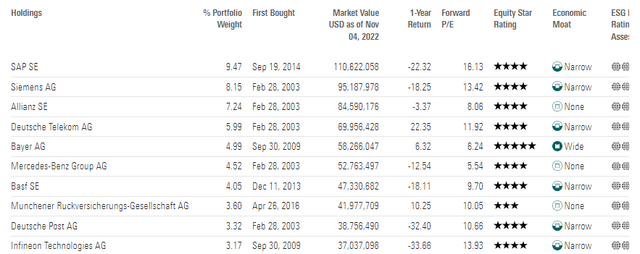

EWG is a concentrated ETF with more than 30% of the assets in its top four holdings: SAP (SAP), Siemens (SIE), Allianz (ALV), and Deutsche Telecom (DTE), so be sure to track events with those key companies.

EWG Top 10 Holdings: P/Es Under 16, High-Rated Stocks

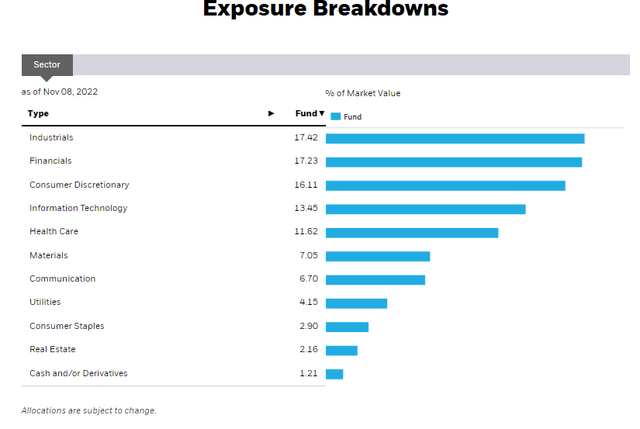

Sector-wise, you get a value flavor when holding EWG, but also exposure to some stalwart growth names. Together, Industrials and Financials are more than one-third of EWG while the TMT sectors make up more than 35%, too. What makes EWG different from domestic equity ETFs is that the valuations on its tech/media/telecom holdings are generally lower than what you would find among mega-cap U.S. tech. P/E ratios across the top 10 holdings are under 17.

EWG: Value Exposure And Blue-Chip TMT

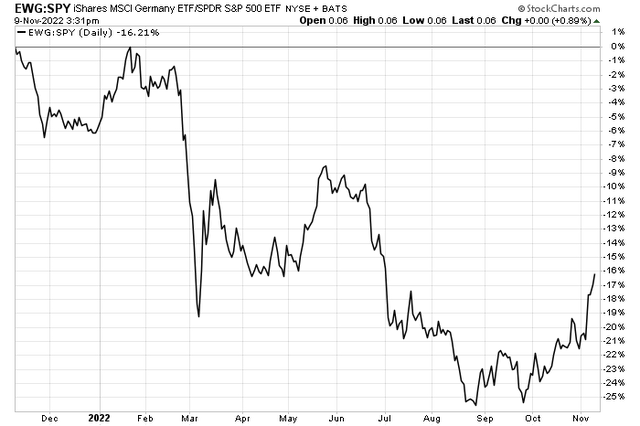

With a good valuation and exposure to value and cyclical sectors, let’s dive into the price action. This is where I see opportunities. Notice in the chart below that relative strength in EWG vs. SPY is at the best level since early July. The latest jump comes as the U.S. dollar has pulled back, and the euro has climbed back above parity. Expect more strength into year-end if the euro firms further. I could see the EWG vs. SPY chart climb back to its May-June highs before long.

EWG Vs. SPY Relative Chart: Fresh 4-Month Highs

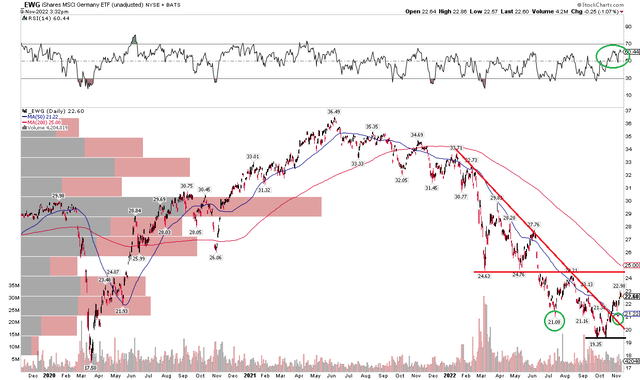

As for the absolute chart of EWG, I see a few interesting features suggesting a near-term bottom is in. First, notice how shares formed a bullish double-bottom reversal pattern just above $19. EWG then rallied nearly 20% to a high just shy of $23 earlier this week. Weakness after the U.S. midterms and amid the FTX debacle are more like sideshows for EWG, in my opinion. I expect EWG to rally to resistance in the $24 to $25 range soon – that coincides with where the falling 200-day moving average will come into play. A move above $25 would warrant potential upside to $29 to $30 (where there is high volume-by-price). Finally, the daily RSI indicator has finally broken out of the bearish 20-60 zone.

EWG Bottoming, Still Work To Do

A major tailwind for EWG is an apparent break of the downtrend in EURUSD. While the move could always fail, the bears seem to have lost their grip on the euro.

Currency Check In

The Bottom Line

I like the valuation of and yield on EWG right now. The fund has finally made a bullish turn and has tailwinds from a euro that appears to be basing. I think being long here outright or against SPY makes sense into year-end.

Be the first to comment