Cavan Images

Earnings of First BanCorp (NYSE:FBP) will likely continue to surge in the remainder of 2022 and full-year 2023. Economic strength in Puerto Rico will drive loan growth, which will, in turn, play a pivotal role in earnings growth. Further, the net interest income will likely continue to benefit from rising interest rates. Overall, I’m expecting First BanCorp to report earnings of $1.58 per share in 2022, up 20% year-over-year. Compared to my last report on the company, I’ve slightly increased my earnings estimate as I’ve tweaked upwards my net interest margin estimate. For 2023, I’m expecting the company to report earnings of $1.64 per share, up 4% year-over-year. The year-end target price is quite close to the current market price. Therefore, I’m downgrading First BanCorp to a hold rating.

Strong Regional Economy Bodes Well for Loan Growth

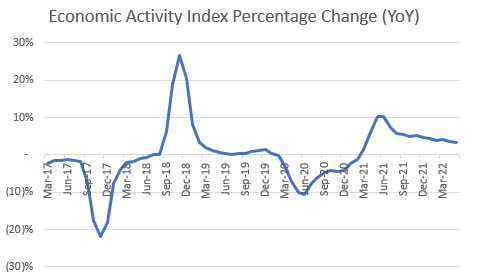

First BanCorp’s loan growth improved to 0.7% in the second quarter of 2022 from 0.5% in the first quarter of the year. Further acceleration in the loan growth rate is likely in the third quarter partly because of Puerto Rico’s rapidly strengthening economy. The Economic Development Bank for Puerto Rico’s economic activity index shows that the Puerto Rican economy has improved sharply so far this year.

Economic Development Bank for Puerto Rico

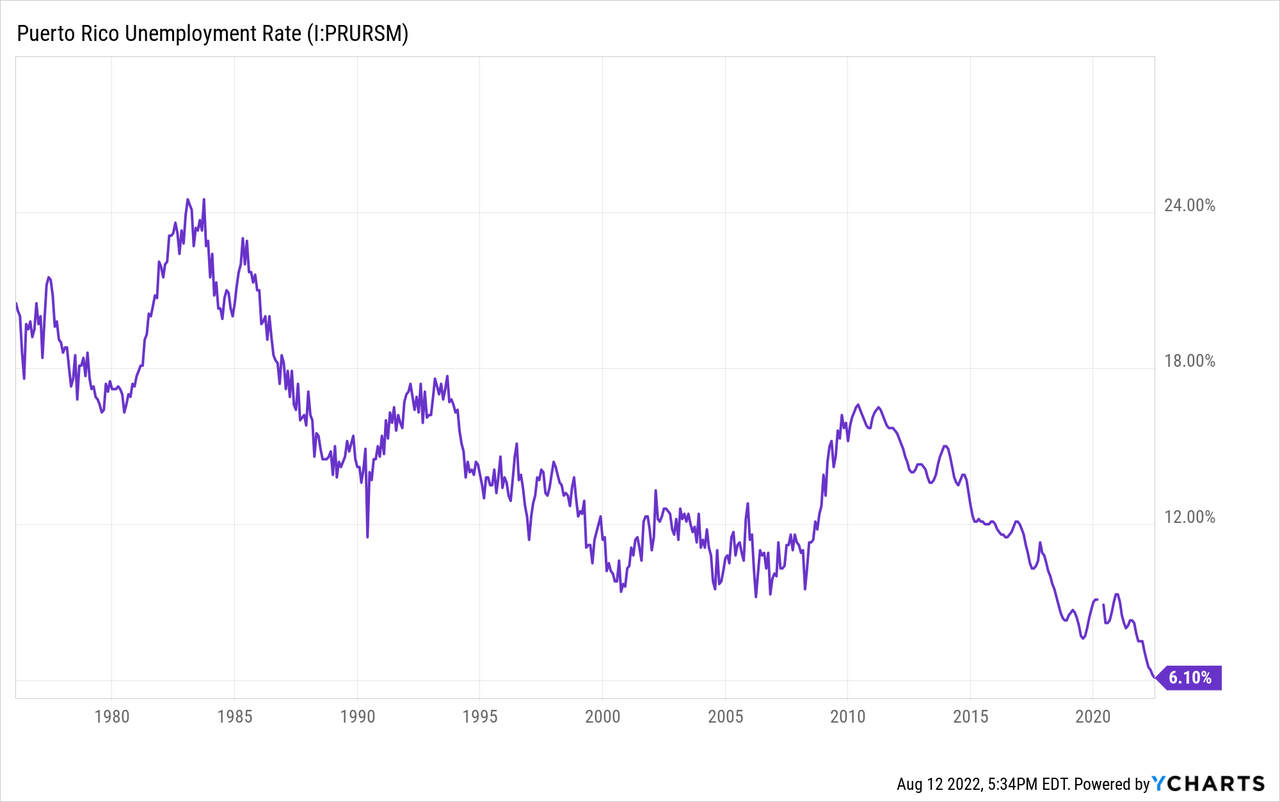

Puerto Rico’s continuously plunging unemployment rate provides further proof of economic strength.

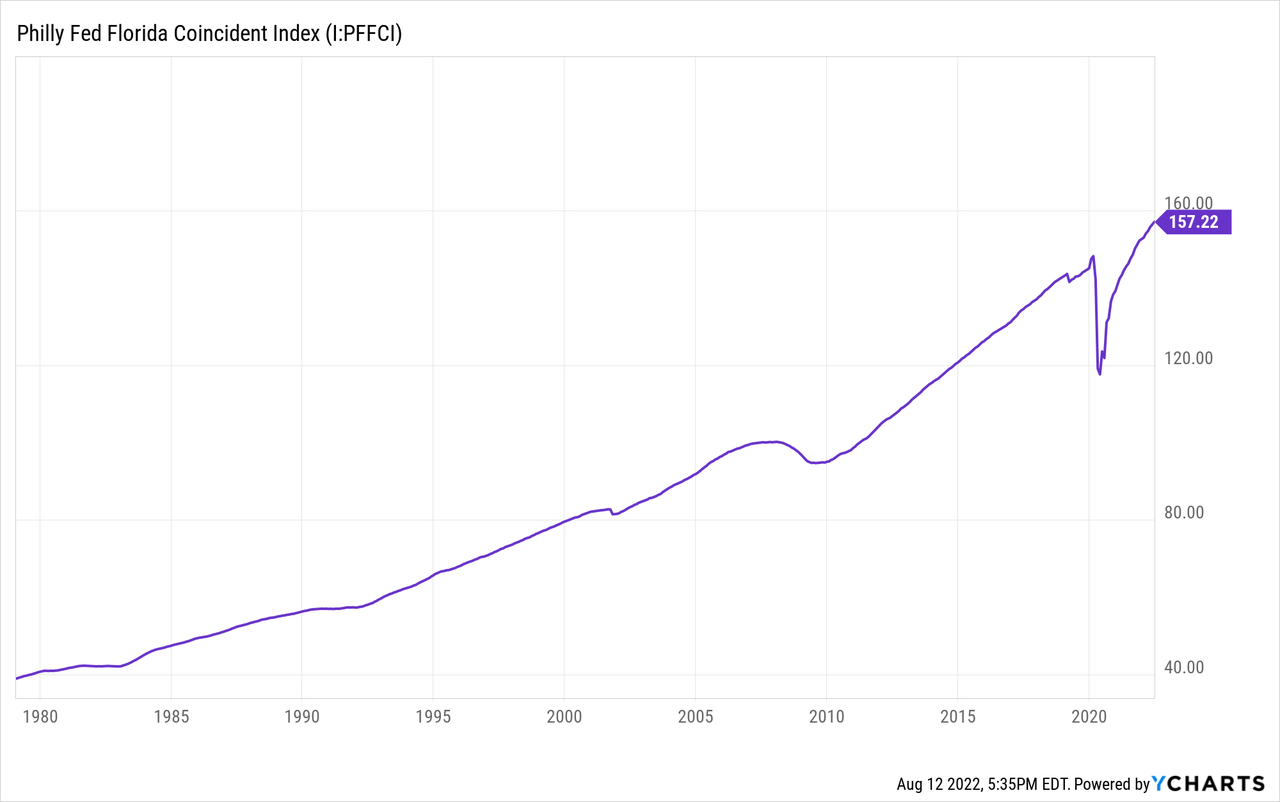

First Bancorp also has some presence in Florida, which is another rapidly improving market. The state’s unemployment was just 2.8% in June, which is much better than the national average. Further, the state’s coincident index has recovered sharply, which bodes well for loan growth.

First BanCorp’s ongoing investments in technology should also bear fruit soon. While economic factors will help increase the market size, technological advancements will help First BanCorp gain market share. As mentioned in the earnings presentation, First BanCorp plans to increase its capital projects-related expenses in the second half of 2022. As these projects have been ongoing for some time, they should not take too long to bear fruit. I’m expecting benefits to accrue in the second half of this year.

Considering these factors, I’m expecting the loan portfolio to grow by 2.7% in 2022 and 3.0% in 2023. Compared to my last report on First BanCorp, I haven’t changed my loan growth estimate much.

Equity Book Value to Face Further Pressure

First BanCorp’s tangible book value per share plunged to $7.8 by the end of June 2022 from $10.07 at the end of 2021. Most of the decline was attributable to unrealized losses on the securities portfolio racked up due to rising interest rates. As the fed funds rate was increased by 75 basis points in July, and I’m expecting another 75 basis points hike in the remainder of the year, the equity book value will face further pressure in the second half of 2022. However, retained earnings will support book value per share going forward. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||

| Financial Position | ||||||||

| Net Loans | 8,705 | 8,887 | 11,442 | 10,827 | 11,120 | 11,457 | ||

| Growth of Net Loans | 0.6% | 2.1% | 28.8% | (5.4)% | 2.7% | 3.0% | ||

| Other Earning Assets | 2,140 | 2,398 | 4,926 | 6,658 | 6,631 | 6,765 | ||

| Deposits | 8,995 | 9,348 | 15,317 | 17,785 | 17,398 | 17,749 | ||

| Borrowings and Sub-Debt | 1,074 | 854 | 924 | 684 | 590 | 601 | ||

| Common equity | 2,009 | 2,192 | 2,239 | 2,102 | 1,662 | 1,889 | ||

| Book Value Per Share ($) | 9.3 | 10.1 | 10.3 | 9.9 | 8.5 | 9.7 | ||

| Tangible BVPS ($) | 9.3 | 9.9 | 9.9 | 9.6 | 8.2 | 9.3 | ||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||

Revising Upwards the Margin Estimate

First BanCorp’s net interest margin has expanded by around 40 basis points in the first half of 2022, which is more than what I previously expected. This expansion is also greater than what was implied by the management’s interest rate simulation model. According to the results of the simulation model given in the latest 10-Q filing, a 200 basis points hike in interest rates can boost the net interest income by only 3.11% over twelve months.

Due to the first half’s good performance, I’ve decided to revise upwards my margin estimate for 2022. I’m now expecting the margin to grow by 26 basis points in the second half of 2022, and then by a further 10 basis points in the first quarter of 2023. The rise in 2023 will be due to a lagged effect of the monetary tightening in 2022. I’m not expecting the rate-hike cycle to continue beyond 2022.

Improvement in Asset Quality to Keep Provisioning Below Historical Average

First BanCorp has rapidly improved its portfolio’s asset quality over the last 12 months. Nonaccrual loans declined to 0.88% of total loans by the end of June 2022 from 1.60% of total loans at the end of June 2021, as mentioned in the earnings release. The company has also released its reserves during the same interval but at a lower rate. Consequently, the coverage has improved.

Allowances made up 2.25% of total loans, while nonaccrual loans made up 0.88% of total loans at the end of June 2022. Due to the high coverage, I believe First BanCorp will not need to increase provisioning amid heightened interest rates and possibilities of a recession. In my opinion, provisioning will likely continue at the second quarter’s level through the end of 2023. Overall, I’m expecting the provision expense to make up around 0.36% of total loans (annualized) in the second half of 2022 and full-year 2023. In comparison, the net provision expense averaged 0.74% of total loans in the last five years.

Expecting Earnings to Grow by 20%

The anticipated loan additions and margin expansion will drive earnings in the remainder of 2022 and 2023. On the other hand, higher provision expense, net of reversals, will restrict earnings growth. Moreover, operating expenses will surge in the year ahead as the management is planning to increase its capital projects-related expenses. The management elaborated in the conference call that it expects to incur higher professional fees and technology costs on the ongoing projects. Further, the management expects a normalization of vacancy levels, which will lift salary expenses. Overall, the management expects the efficiency rate to increase towards the 50% mark from 47.7% in the second quarter of 2022.

Overall, I’m expecting First BanCorp to report earnings of $1.58 per share for 2022, up 20% year-over-year. For 2023, I’m expecting the company to report earnings of $1.64 per share, up 4% year-over-year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||

| Income Statement | ||||||||

| Net interest income | 525 | 567 | 600 | 730 | 797 | 871 | ||

| Provision for loan losses | 59 | 40 | 171 | (66) | 16 | 40 | ||

| Non-interest income | 82 | 91 | 111 | 121 | 126 | 138 | ||

| Non-interest expense | 358 | 378 | 424 | 489 | 448 | 490 | ||

| Net income – Common Sh. | 199 | 164 | 100 | 277 | 308 | 321 | ||

| EPS – Diluted ($) | 0.92 | 0.76 | 0.46 | 1.31 | 1.58 | 1.64 | ||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||

In my last report on First BanCorp, I estimated earnings of $1.49 per share for 2022. I’ve increased my earnings estimate because I’ve revised upwards my net interest margin estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Downgrading to a Hold Rating

First BanCorp is offering a dividend yield of 3.0% at the current quarterly dividend rate of $0.12 per share. The earnings and dividend estimates suggest a payout ratio of 29% for 2023, which is the same as the three-year average. Therefore, I’m not expecting an increase in the dividend level. (Side note: I took a three-year average only instead of five years because FBP resumed dividends in late 2018.)

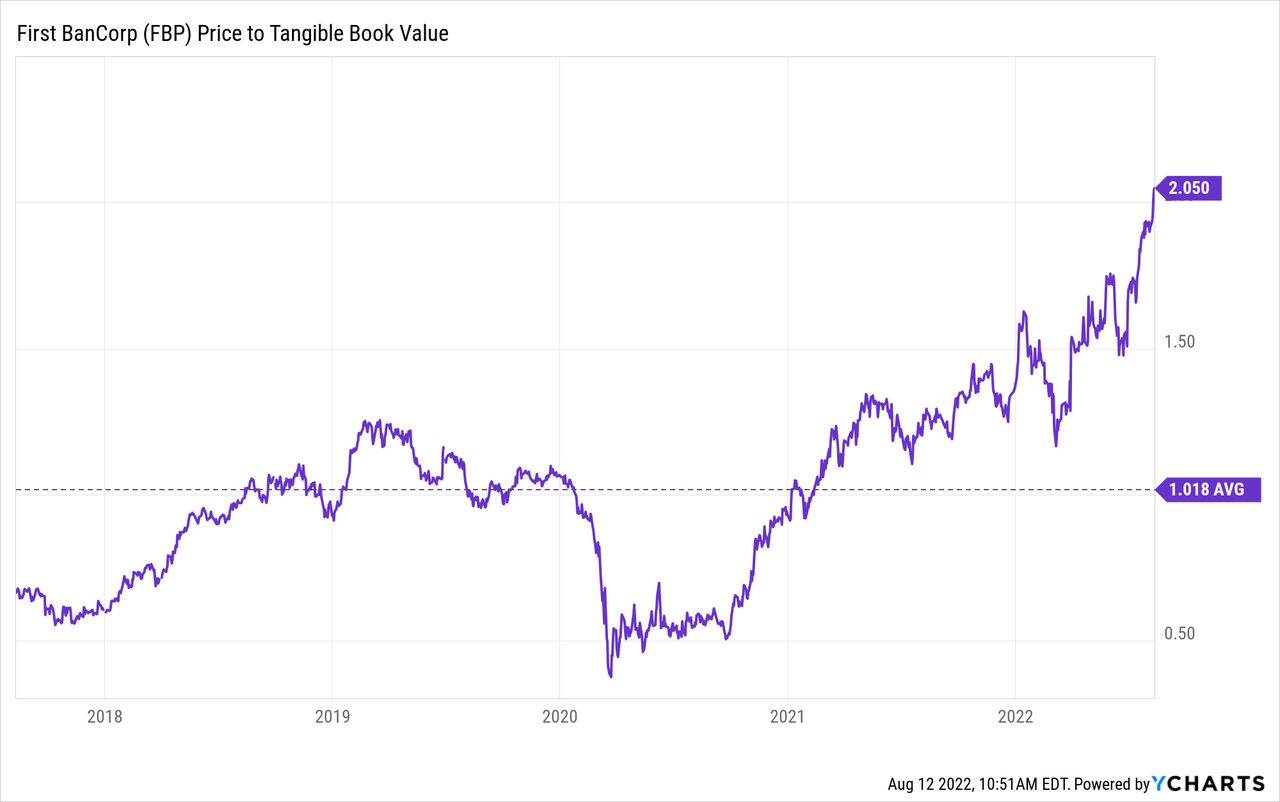

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First BanCorp. The stock has traded at an average P/TB ratio of 1.02x in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $8.2 gives a target price of $8.3 for the end of 2022. This price target implies a 48.6% downside from the August 12 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.82x | 0.92x | 1.02x | 1.12x | 1.22x |

| TBVPS – Dec 2022 ($) | 8.2 | 8.2 | 8.2 | 8.2 | 8.2 |

| Target Price ($) | 6.7 | 7.5 | 8.3 | 9.1 | 10.0 |

| Market Price ($) | 16.2 | 16.2 | 16.2 | 16.2 | 16.2 |

| Upside/(Downside) | (58.7)% | (53.6)% | (48.6)% | (43.5)% | (38.4)% |

| Source: Author’s Estimates |

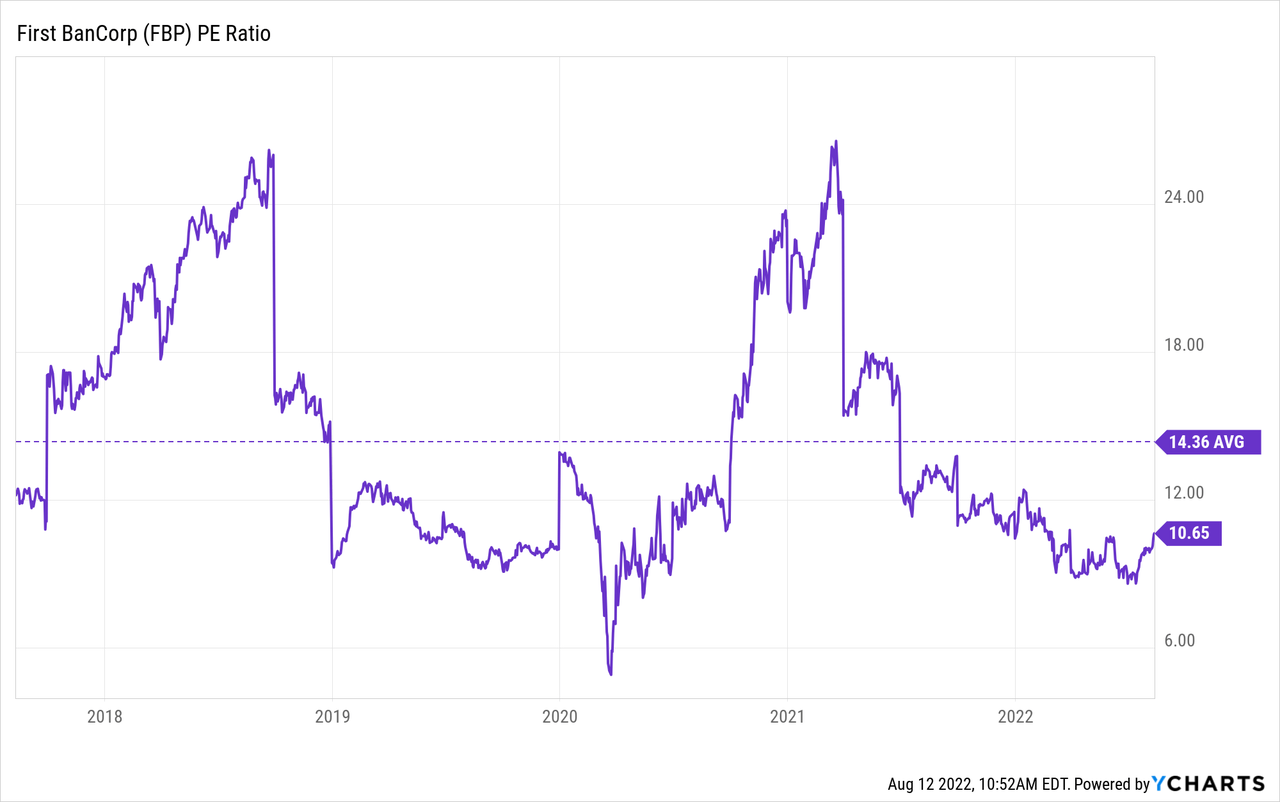

The stock has traded at an average P/E ratio of around 14.4x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $1.58 gives a target price of $22.6 for the end of 2022. This price target implies a 39.9% upside from the August 12 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 12.4x | 13.4x | 14.4x | 15.4x | 16.4x |

| EPS – 2022 ($) | 1.58 | 1.58 | 1.58 | 1.58 | 1.58 |

| Target Price ($) | 19.5 | 21.1 | 22.6 | 24.2 | 25.8 |

| Market Price ($) | 16.2 | 16.2 | 16.2 | 16.2 | 16.2 |

| Upside/(Downside) | 20.4% | 30.1% | 39.9% | 49.6% | 59.3% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $15.5, which implies a 4.3% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 1.5%.

In my last report, I adopted a buy rating on First BanCorp. Since then, the stock price has rallied and crossed the target price. Therefore, I’m now downgrading First BanCorp to a hold rating.

Be the first to comment