RichLegg

Good news is bad news once again.

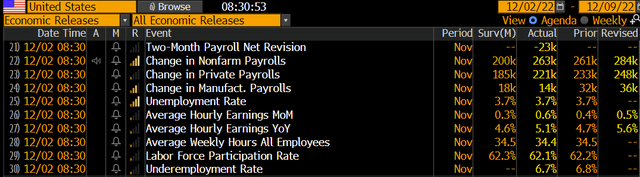

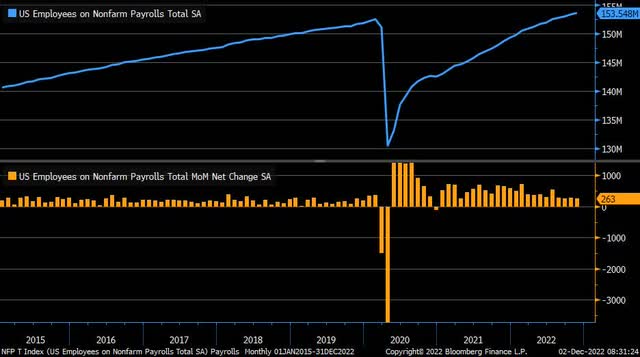

The Labor Department reported a November jobs gain of 263,000 vs. a consensus forecast of +200,000 and a revised 284,000 in October. It was the seventh consecutive headline number beat. Private payrolls increased by 221,000.

Average hourly earnings rose by 0.6%, the highest since October 2021 and well above the 0.3% consensus. Wages year-on-year rose by 5.1% versus a +4.6% expectation. The unemployment rate was unchanged at 3.7%. Average hours worked was 34.4, dropping back 0.1ppt. The labor force participation rate was 62.1, matching July’s trough.

A Massive Monthly Wage Gain Drives Stocks & Bonds Lower

Biggest Average Hourly Earnings Bump Up Since Early 2022

Monthly Job Gains Continue But At A Slowing Pace

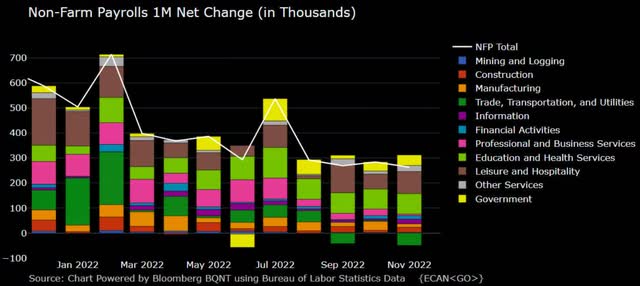

The biggest job gains were seen once again in the Leisure/Hospitality and Education/Health segments. Retail and Trade/Transports featured material job losses despite strong retail sales numbers lately.

Breakout Of November Employment Gains

Stocks sold off hard, about 1.5%, following the hot wage data. This comes after previous signs of cooling inflation and a sharp rally in Treasury securities. Yields rose sharply, some 10 basis points on the 10-year note, immediately after the 8:30 a.m. release, and the U.S. Dollar Index recovered some of its recent losses, up 0.7% post-NFP.

The 2yr-10yr spread inverted further to more than 75 basis points Friday morning. Traders now expect a Fed terminal rate of 4.9%, up about five basis points from Thursday.

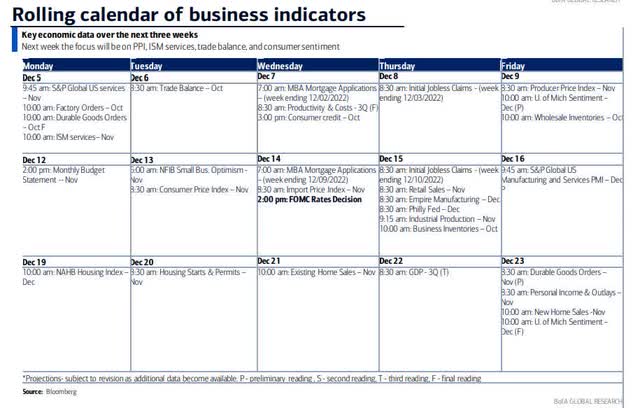

The hot jobs report comes after a strong 17% rally off the October lows on the total U.S. stock market. All eyes will now be on what November CPI prints later this month, which will be released a day before the December 14 Federal Reserve interest rate decision.

Key Data & Events Ahead: CPI & FOMC Mid-Month

Homing in on where stocks could go from here, according to iShares, the Core S&P Total U.S. Stock Market ETF (NYSEARCA:ITOT) tracks the investment results of a broad-based index composed of U.S. equities, from small to large companies. The fund is an effective and efficient way to get exposure to the domestic equity market as it features an expense ratio of just 0.03% with a 30-day median bid/ask spread of 0.01%.

It’s a large fund with more than $41 billion in assets, per iShares, and has average volume above 1.5 million shares. Holding 3,339 stocks as of November 30, 2022, the fund yields 1.6% and features a forward price-to-earnings ratio of 18.2. The Information Technology sector is the biggest part of the total U.S. stock market, currently one-quarter of the fund. Apple (AAPL) and Microsoft (MSFT) make up slightly more than 10% of ITOT.

The Technical Take

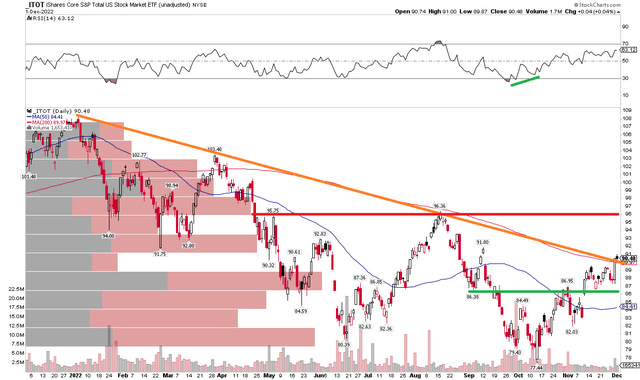

Notice in the technical chart below that ITOT appears to be at a key spot on the chart. The bulls will attempt to take the total U.S. market ETF above its major downtrend resistance line off the all-time high notched in early January. Moreover, ITOT is once again at its falling 200-day moving average – another potential point of selling.

Momentum, meanwhile, is not quite as robust as was seen during the summer rally. What is positive for those hoping for higher prices is strong seasonal trends as the S&P 500 rises in December 75% of the time in data going back to 1950 with an average return of 1.36%, according to data gathered by Bank of America Global Research.

ITOT: Encountering Resistance

The Bottom Line

With the stock market above its 25-year valuation and fears turning from inflation to recession, I see more downside risk than upside potential in domestic equities right now, despite the seasonal tailwind.

Perhaps we have pulled forward much of the holiday cheer, but a 17-plus earnings multiple on large-caps is pricey, particularly now that the Fed might have to keep its foot on the tightening pedal with such hot wage data in the November jobs report.

Be the first to comment