bingfengwu

“There things cannot be long hidden: the sun, the moon and the truth….: Buddha

We are now days away from the 2Q22 earnings release of Las Vegas Sands (NYSE:LVS). The continuing China zero tolerance policy lockdowns are essentially starving Macau revenues to inconsequential levels, providing little basis upon which to project future earnings springing out of covid recovery.

That is why its timely to caution investors not to make too much this coming week as to whether LVS reports a miss, a meet, or a beat. Such numbers are, of course, part of the standard metrics from which the market has judged the values of given stocks.

But that metric world is dramatically diminished in its applied value systems when you have a horrific conflation of macroeconomic events further exacerbated by a pandemic still holding share values hostage. Its surely a witches brew facing the Asian gaming sector.

On top of inflation, recession, labor and supply chain shortages, plus the insidious, impact of an endless chain of pandemic variants spooking world economies, we have the Beijing government fumbling its way into what could be a historic setback in its long bull run of economic progress.

So given this colossal mess, how are investors best guided to decide whether to buy, sell or hold the shares of LVS when the earnings release hits the market? We do have analysts estimates which clearly represent a certain level of educated guesswork. But on balance they don’t present coherent proof that the forecasts ahead are indicative of better or worse times ahead for the global gaming giant.

LVS For the record:

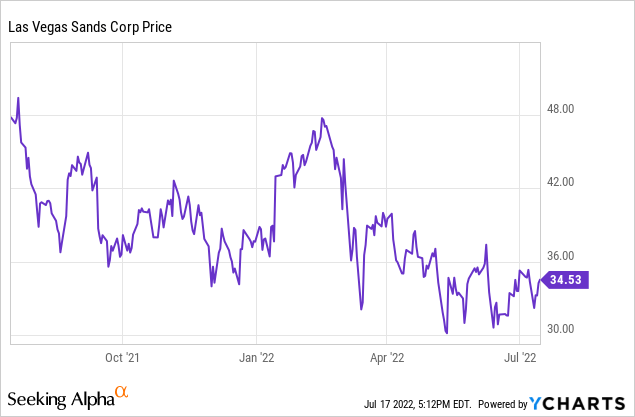

Price at writing: $34.33

52- week range: $28.88 to $49.63

Market cap: $26.3b

Beta: 1.25 – indicative of not many believers or non-believers in the stock these days. Totally understandable if you inhabit that segment of Mr. Market I call drive-by investors who bet on the flow of news week to week, quarter to quarter totally unimpressed by the gut level value of the businesses behind the stock. As followers of this space know, I have been bullish on LVS through the maelstrom of events connected to the pandemic and other headwinds for over two years.

But as I guided my own bullish scenarios viewed from my own perspective of 35 years in the casino business, knowing LVS management’s strengths and weaknesses, I clearly realized that Mr. Market activists saw me as pom pom twirler number one on the stock. It has recovered upside momentum here and there since I began my bullish outlooks but overall it has tanked. And the imminent release of 2Q22 earnings are likely to keep the stock dead pooled in its current limbo no matter what they show. I will take no vindication in an earnings beat.

I will not nod my head and whisper I TOLD YOU SO, if they meet or beat. That’s because my ongoing rationale in these parlous times for the sector is this: I base my assessments not on the questionable knee jerk reactions of the drive-by investors but on the answers to these gut level questions:

- Is this a good business with a positive future based on the long term embrace by consumers of its product?

- Is this a well-managed business? Is it managed by professionals who bring the unique blend of street smarts and solid numeracy instincts to their strategies and cost/ returns decisions?

- Under most foreseeable circumstances, is the core liquidity and solvency under duress to be safely assumed?

- Does management recognize the difference between real opportunity and delusional expectations?

- Over time, the answers to these questions on LVS, to me, make a highly positive case to be a long term holder of the shares, no matter the gusting tailwinds that buffer its progress. And fewer headwinds in gaming history have ever come close to the disaster currently promulgated by the Beijing policies.

I am not alone in these views. Venerated Buffett partner Charlie Munger is on the public record as believing such metrics as EBITDA and EPS are pure B/S in many circumstances. His reasoning springs from a similar viewpoint as my own, namely the answers to similar questions to those I posed above. I do not of course pretend to bring anywhere near the prophetic heft to my own opinions as Mr. Munger or his partner.

But nobody has a franchise on common sense in investing. Given the run of many comments I get on my SA articles I can attest to a significant repository of wisdom of this crowd on many investing issues. The trolls, of course, are released out of their caves once in a while, but overall there is a soundness to an approach to investing that has proven to produce the most returns over time for those willing to embrace it.

The outlook for LVS as a business

LVS archives

Above: Expansion of Marina Bay Sands property in Singapore moving ahead to a 2026 opening. Capex going full speed ahead.

Price at writing: $34.53

52 week range: $28,88-$49.63

Market cap: $26.3b

Analyst earnings estimate 2Q22: ($0.22), 11.5% YoY

Revenue: $954.5m down 18.6% y/y largely related to the continuing China covid lockdowns by Beijing.

Consensus EPS for 2Q22 is 22.73% lower.

TTM:

Revenue: $3.58b

Gross profit: 2.8b

EBITDA: 185m

Diluted EPS: 2.42

We note the above just to put in context what may be coming out this week for 2Q22. No matter what the 2Q22 results, it will neither be a reason to either buy or sell the stock. But it will be a reason in our view, as the company weathers the continuing Asian storm, to HOLD if you own.

LVS Marina Bay Sands, where reason appears to prevail in the Singapore government covid policy, could reach $1b in EBITDA or more in our view for 2022, with revenue exceeding $1b. It’s a flicker in the tunnel slowly expanding to a light for that property. What it suggests to us is that we do not have a structural weakness in the business of LVS but when the covid hostage taking is over, the re-ramp of revenue and profits will be swift and deep.

Alpha spread estimates LVS discounted cash flow value at $45.06 per share or near 30% above its current trade. Again we stress that while this is a reasonable metric, it represents a best guess of how and when LVS will see the re-opening of China and the flood tide of pent up demand that will translate into rapid re-ramping of revenues and by extension profitability.

The balance sheet rationale

The standard metrics we expect are to an extent in a market plagued as it now is, are cosmetic to a degree. The real health of this company is to be found in its ability to sail its ship past the storms now and ahead, into a safe, profitable port.

MRQ:

Cash on hand: $6.43b

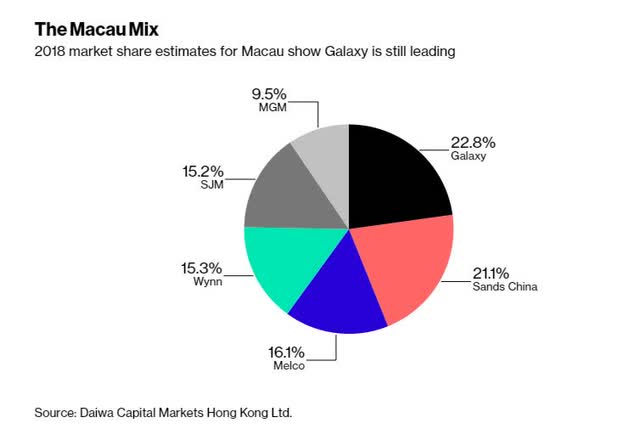

Sector losses are accumulating at a rate of $800m per quarter. LVS has a 21% share of market, so if applied to total losses, assume it is losing $160m per quarter at the minimum. Assuming no prospective raising of travel bans or zero tolerance policies that can be reliably predicted here, we have calculated a burn rate of LVS cash that assumes: Continuing losses in Macau, above $1b in EBITDA for Singapore, and Capex programs in Singapore moving forward as planned. LVS’ current ratio sits at 3.14, getting to edge on the high end of the acceptable spectrum.

LVS long term debt is $14.98b with maturities ahead that suggest the company will not face any draconian need for high cost debt of any kind for at least 18 months. At this point it is fair to raise the question thusly: How do we know that within 18 months Beijing will relent? How do we know that new covid cases will have collapsed to mild sporadic outbreaks or none at all? Clearly we don’t. Our estimate is a mean average we have taken from the judgments of Macau colleagues in the business who deal with covid challenges daily. These are individuals who have pretty good ear to the ground contacts in Beijing.

The 18 months no trouble run rate for LVS cash before having to float new borrowings is based on industry financial executives assessment of a worse to best case set of scenarios for a steady return of travel from key provinces like Guangdong.

How does 2023 look?

Above: 2018 recovery year from 2015 setback. Proof of markets resiliency and LVS leading market share with Galaxy.

We think for 2022, in a base case assumption, that LVS will touch ~$5b in revenue, perhaps a bit more if Singapore recovers at a faster rate than at present. Using that as our beginning, we see 2023 total revenue reaching $10.2b. If these levels are achieved, we see a rapid program of debt reduction put in place to rebuild cash reserves.

The reasoning here in our view is linked to the very real possibility that once covid recovery comes into the cross hairs (or perhaps before) that LVS will announce its move on a third market. As I’ve previously noted, I see Thailand as a major possibility and second to it, metro New York as maybe a meh possibility. Overall, what is important, above all other conjectures that will flush out when earnings are released next week, are the answers to my questions raised in this article.

If you believe the responses are positive, you should feel no peril if earnings miss, even big time, for 2Q22. Nor should you feel ebullient if we see a beat. It is far too early for either metric to mean much. The fate of the entire sector lies with Mother Nature and Beijing’s current fear stricken policies.

Long term, the LVS I see is a $29b company operating in at least 3 Asian nations. I also see a meaningful portion of its 56% family held equity steadily finding its way onto the public markets stimulating trading volume and adding interest among investors who are currently scared off by the pandemic woes facing the company.

Long term In my view, gaming in Asia is a no lose situation, especially now since the long festering fears of many analysts that Macau would not renew the concessions. Or that Beijing would “punish” LVS because the late Sheldon Adelson supported former President Trump. If you understand the new law, even though it’s a 10 year, not 20 year, extension you will have to take away the conviction that Macau is going nowhere and leading peers in the space are a great place to invest long term. Fueling long term fears from short term results bears an illogical premise. LVS is a HOLD.

Be the first to comment