Eik Scott/iStock via Getty Images

Intro

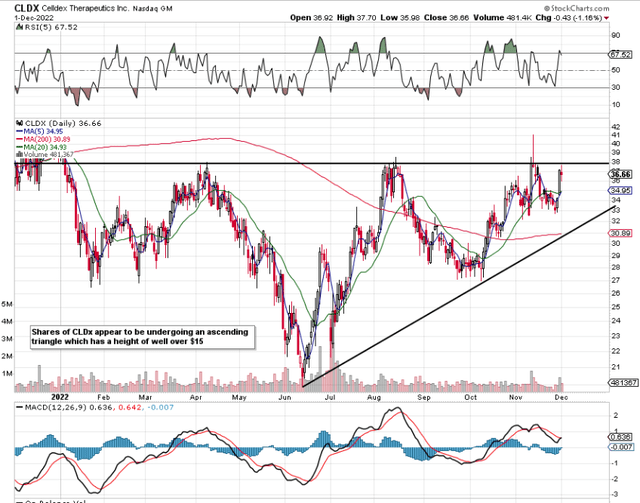

If we pull up a chart of Celldex Therapeutics, Inc. (NASDAQ:CLDX), we can see that we have a potential ascending triangle in play with shares threatening to break out of their bullish formation. No matter where these patterns take place in a technical chart, they have bullish implications as they indicate accumulation. As chartists, we believe that Celldex’s share-price action on the technical chart is the result of every known piece of information on this company at this moment in time. This company, for example, does not have any revenues or earnings to speak of at this moment, but the market believes Celldex fundamentals justify higher prices.

In fact, if indeed an ascending triangle is playing itself out here, shares (when we take the height of the pattern into account) could easily rally well above $50 before all is said and done here. Therefore, from our perspective, we await a breakout above resistance on strong volume before putting capital to work. At that point, we would put a stop as close to the breakout area as possible to minimize downside risk as much as possible. Suffice it to say, we would treat this play as a core trading position and not a long-term hold. Here are some reasons why.

Celldex Ascending Triangle (StockCharts.com)

Huge Dilution & Poor Long-Term Returns

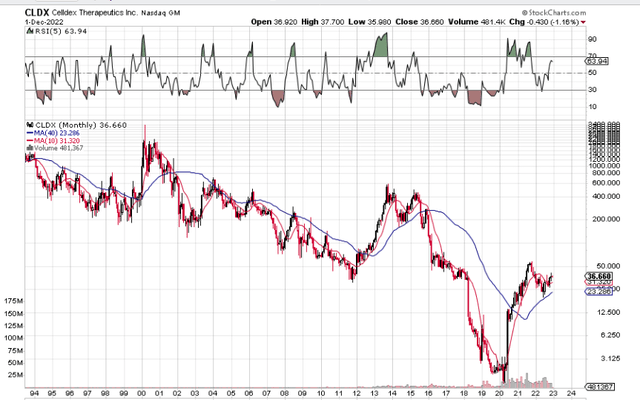

Although we have a short-term opportunity in play in Celldex at present, the long-term chart clearly shows the huge volatility in the share price in past years. This is what happens when late-stage clinical trials get pulled at a moment’s notice. All the hype and enthusiasm evaporate quickly, and the share price tanks as a result. In fact (and which is not seen readily on the chart), management was forced into a reverse split a few years back when shares dropped below $0.50 a share. Suffice it to say, in this industry, nobody can take anything for granted until candidates get through phase three of their respective trials. With a 90% + fail rate, it just makes sense to keep one’s feet on the ground with companies that do not have any proven products, to begin with.

Furthermore, the company’s cash position came in at $323.5 million at the end of Q3, but investors should note where this cash is coming from. A quick look at the trend of the company’s number of shares outstanding over the past 10 years shows that shares outstanding have increased from a mere 3.8 million 10 years ago to over 47 million presently (12x increase).

CLDX Monthly Chart (StockCharts.com)

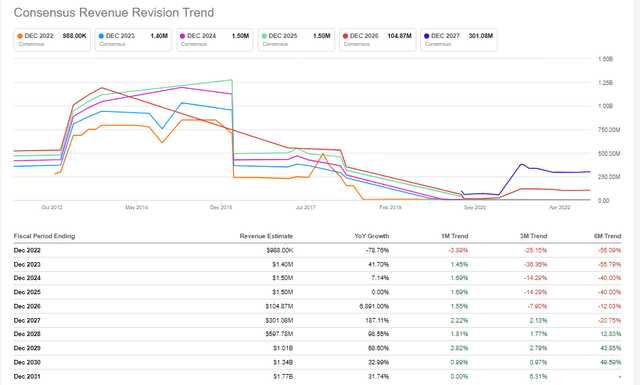

The hype invariably comes from the huge unmet need the drug candidate(s) are targeting. With annual revenues at present hovering around the $1 million mark, analysts who cover this play as we see below are expecting a 100-fold increase by fiscal 2026 followed by a jump to approximately $1+ billion (Another 10-fold increase) by fiscal 2029. These estimates coupled with the knowledge of where shares have traded in past years only whets the appetite even more for all participants alike.

Celldex Forward Looking Sales Revisions (Seeking Alpha)

Barzolvolimab Potential But Odds Remain Thin

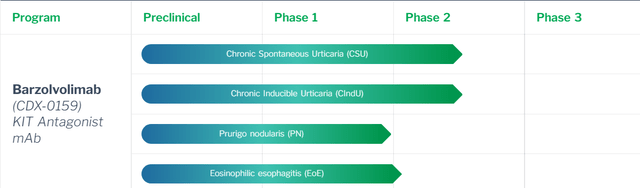

Concerning near-term catalysts which could potentially spike the share price out of the triangle discussed earlier, any positive data from the four Barzolvolimab indications shown below should continue to price shares to the upside. Celldex’s bispecific platform also holds plenty of potential but oncology candidate CDX585 for example is not expected to enter the clinic until later next year. Chronic Spontaneous Urticaria (CSU) and Chronic Inducible Urticaria (CIU) target patients who have hives appearing on their skin from either an allergic reaction (CSU) or from cold or scratching with respect to (CIU).

Suffice it to say, just with respect to these first two Barzolvolimab indications, the opportunity for Celldex is twofold. Firstly, you have a growing population who suffer allergies every year. This is especially apparent in children who have far more allergies on a per capita basis compared to previous generations. Furthermore, approved antihistamines do not provide a solution for patients (Only 1 in 2 responds) when hives appear on the skin. Suffice it to say, if approvals are eventually granted, the fundamentals are very strong in this space.

Barzolvolimab Indications (Pipeline) (Company Website)

Conclusion

To sum up, although we aim to take advantage of the short-term opportunity in Celldex at present, it is prudent to not get drawn into the hype of this biotech play. As the drugs advance, the hype will only continue to increase. This is fine for trading opportunities, but very risky from a long-term position standpoint in Celldex Therapeutics, Inc. We have our eyes peeled for upcoming data on those above-mentioned trials. We look forward to continued coverage.

Be the first to comment