vm

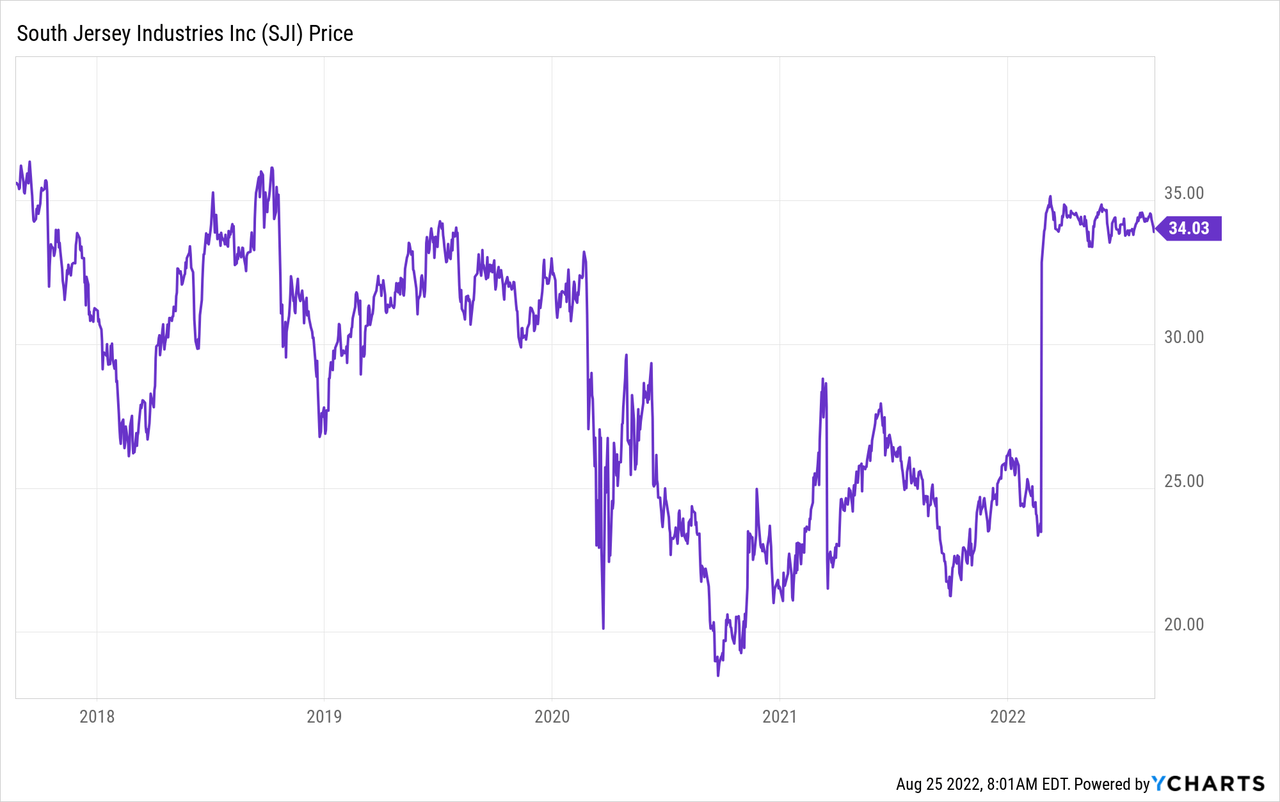

South Jersey Industries, Inc. (NYSE:SJI) is a small utility with a market cap of ~$3 billion, primarily serving New Jersey customers. The company has a merger agreement with IFF – Infrastructure Investments Fund to be taken private at $36 per share.

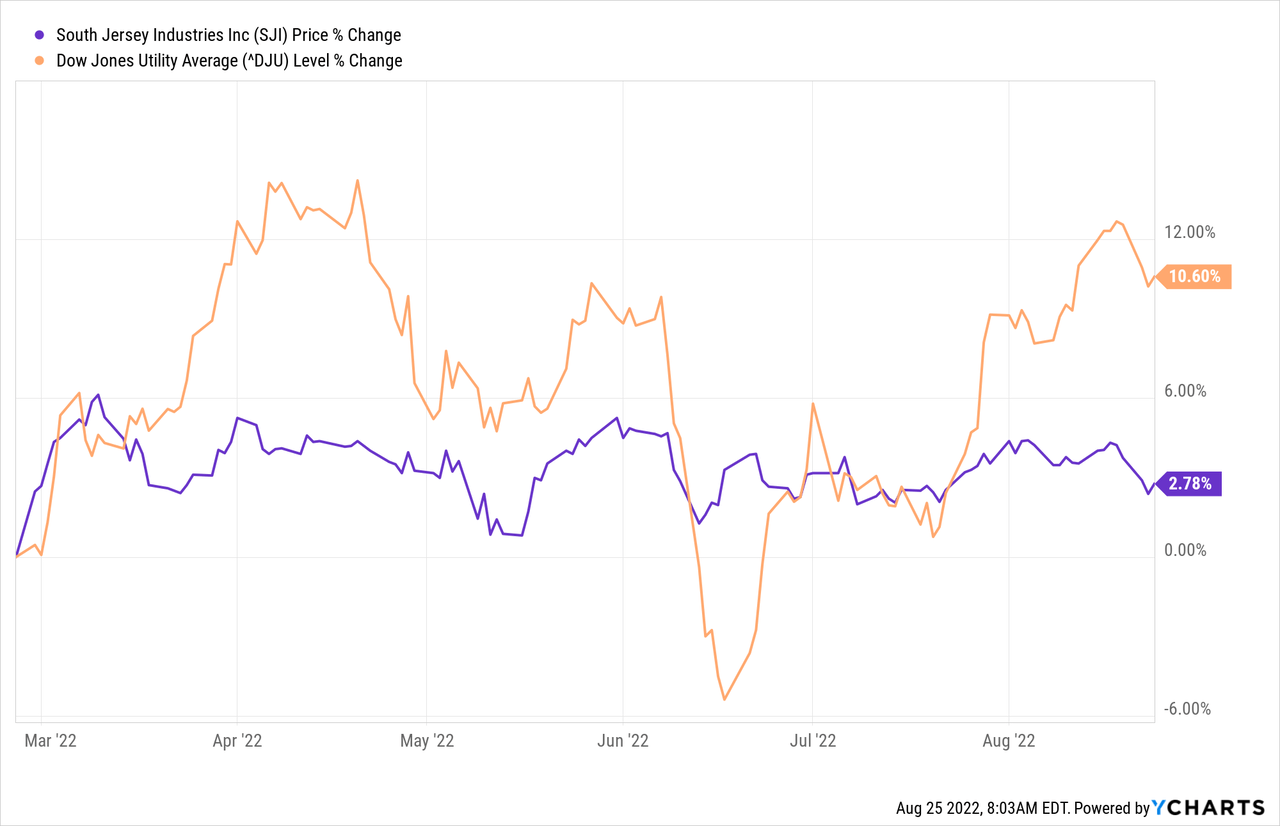

Since the announcement date, the utility index is up about 10.6%:

But SJI is still trading around ~$34 per share. While this deal is awaiting approval, shareholders also receive dividends at quarterly intervals. On closing, shareholders get a smaller stub dividend to make up for the time held between the last dividend and the finalization of the deal. From November, the dividend ticks up ever so slightly (to $0.3193), as agreed upon in the M&A agreement.

The spread of around ~5.5% stood out to me among pending deals. However, I quickly discovered why the spread is on the juicy side. My broker isn’t exactly generous in providing margin to hold this stock. More importantly, it is a utility. Utilities are kind of notorious for regulatory intervention. The distinct regulatory path can take a long time and suddenly “out of nowhere” block a deal. This deal isn’t out of the woods yet.

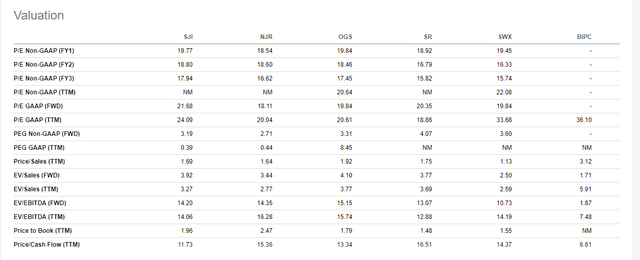

However, a few things are mitigating my concerns about this deal. First off, this buyout happened at a fairly opportunistic time. That’s clear from the longer time graph, when looking at the recovery in the utility exchange-traded fund (“ETF”) since the deal date, but also because of valuations for a peer group. I pulled up Seeking Alpha’s valuations for a set of peers:

small-cap utility peer group valuations (Seeking Alpha)

The valuation for SJI doesn’t look particularly rich even when it’s trading with most of its merger premium included.

Second, IFF is a financial buyer with a very long-term holding period as opposed to a strategic buyer. The board discussed the challenges associated with utility acquisitions several times during negotiations. This is a quote from the merger agreement (emphasis added):

IIF’s indication of interest noted that IIF is a long-term owner which does not require a realization event after a pre-defined hold period and that IIF has historically provided ongoing financing to support long-term capital requirements, which characteristics make it a desirable owner of public utilities by applicable regulators. IIF also indicated that it was able to fund the transaction with equity fully funded by IIF and that IIF would provide the Company with an equity commitment agreement to such effect in connection with the execution of a definitive merger agreement. IIF also noted it would obtain committed bridge financing in an amount necessary to cover a back-stop of any existing financing arrangements with change-of-control provisions and transaction costs.

IIF didn’t just talk but also walked the walk as it agreed to a $255 million termination fee. That’s not an insignificant amount on a $3 billion market cap utility and comes to $2 of value per share in case of a deal break.

If I take in all the above, I’m inclined to believe the market may somewhat overestimate the risk of a deal break. In addition, the break price could potentially be around ~$28 instead of $24.

Conclusion

Utility deals tend to be treacherous affairs. They can take longer than expected and get derailed after you’ve been holding for quite a while. But you pick up dividends as you wait here worth $0.3193 per quarter per share. That’s like 3.5%+ on an annualized basis. The spread is a juicy 5.5% (roughly $2 per share) and it could potentially close before yearend.

Admittedly, a delay to Q1 2023 would not be that surprising. There has been an early August 8-K update that the deal is on track to close Q4 2022. If the deal breaks, the losses could very well amount to something like $8 to $12 per share. All things considered, I think this is a reasonably attractive risk/reward and like this as an addition to my portfolio.

Be the first to comment