SBTheGreenMan/iStock via Getty Images

What Is The Jackson Hole Symposium?

Each year, roughly 120 academics, global central bankers, and journalists meet in the resort town of Jackson Hole, Wyoming. The event is held by the Kansas City Fed and is called the Jackson Hole Economic Symposium. The conference is little known by the general public, but big money investors watch the event like a hawk for clues on how the Federal Reserve will influence the markets and the economy. Fed chair Jerome Powell is scheduled to give a speech Friday morning that will outline his plan to bring down inflation. This speech will be especially closely watched because of the violent swings in inflation and interest rates that have tormented the global economy since the start of the coronavirus pandemic. Jackson Hole has some potential political implications as well, with Bank of England Governor Andrew Bailey attending, but European Central Bank President Christine Lagarde not attending.

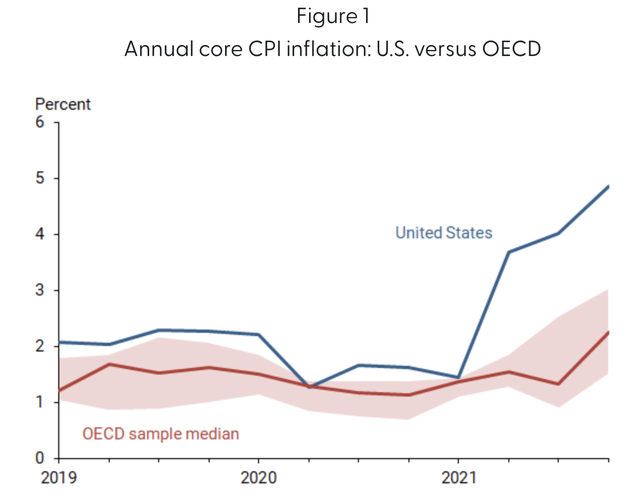

The conference started out in Missouri in 1978, then moved to Vail, Colorado, and was moved to Jackson Hole in 1982 because former Fed chair Paul Volcker loved to fish and the late-summer fly fishing is better further north. Jackson Hole isn’t just a fishing town though – Jackson Hole and wider Teton County are notable for having grown into one of the wealthiest places in America and for having the highest income inequality in America. The irony is thick here – in every press conference Powell has vowed to protect the middle class from inflation, but his policies have so far spectacularly failed to do so, with inflation over the last 12 months at 8.5% annualized after running at 7.0% for 2021. Some of this is due to spiking energy prices, but as you’ll see in a bit, core inflation in the US has been much higher than our OECD peers.

What Is The Agenda For Jackson Hole This Year?

The Fed rolled the dice on ultra-loose pandemic-era policies, but those policies blew up in their face, with many Americans facing widespread shortages for the first time in their lives and core US inflation among the highest in the developed world. The official theme of this year’s meeting is “Reassessing Constraints on the Economy and Policy,” which translates to me and other observers as a euphemism for “We Messed Up, How Do We Get Back on Track?”

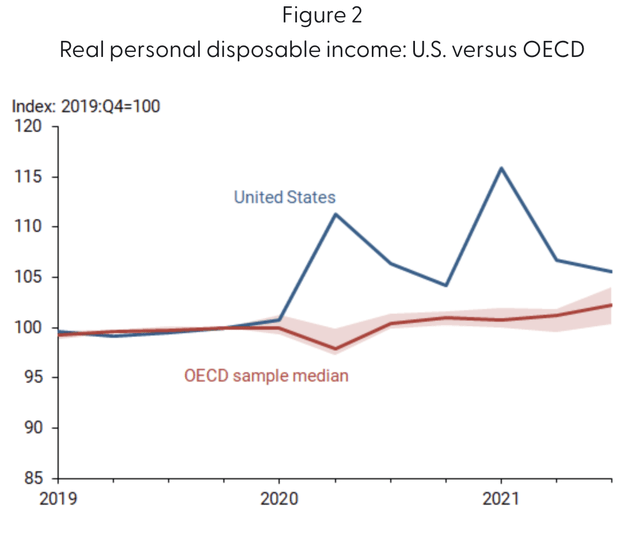

This isn’t rocket science. In 2020 and 2021, Congress handed out way too much stimulus, driving cash incomes higher despite the economy shrinking.

But free money isn’t free. So now we’re paying for it with inflation much higher than our peers.

This isn’t mainly the Fed’s fault since Congress dished out this money. But it’s the Fed’s job to fix it.

One of the core ideas of central banking is that you’re supposed to be independent of politics, so if Congress tries to spend money without raising taxes to pay for it, then interest rates rise from all the debt they have to sell and act as a natural check on inflation and deficit spending. This didn’t happen in 2021 for a variety of reasons that are likely to be debated in the coming decades. Instead, the Fed bowed to politics and bought pretty much all of the debt that the Treasury issued. Chaos ensued.

To fix the mess that we’re in, the Fed funds rate probably needs to be close to the rate of core inflation (price inflation excluding commodities), otherwise, it’s not a “neutral” rate. The free money is now gone, and core inflation is close to 6% by CPI and close to 5% by the Fed’s preferred measure of core PCE. It’s hard to see a scenario where a rate of 3% magically fixes inflation. 4% might do it if the Fed shrinks its balance sheet aggressively, or they might need to do a bit more. The market is not yet pricing this. Moreover, the Fed’s balance sheet is far too big, and they likely need to ramp up their quantitative tightening (QT) program to shrink the amount of debt they hold on their balance sheet.

Why The Smart Money Cares About The Fed So Much

To this point, the single most important thing to the smart money is whether the Fed is going to double down on its easy money policies or jack up interest rates to stop inflation. The Fed funds rate is the single most important price in the financial markets because professional investors can either lend cash at the rate if the Fed wants conditions tighter or can borrow at the rate if the Fed wants conditions looser. This also is known as the risk-free rate of return.

If you think the Fed is willing to cause a recession to restore price stability, cash is king, and you should be selling the S&P 500 (SPY) and/or holding cash. Because of the large loans required by consumers, the most interest rate-sensitive sectors of the market are housing (ITB) and automakers like Ford (F), General Motors (GM), and Toyota (TM). If you think the Fed is bluffing and is going to turn around and cut rates, then you probably want to buy long-duration bonds (TLT), the Nasdaq (QQQ), and maybe Bitcoin (BTC-USD).

There’s an old adage on Wall Street that says never to fight the Fed. Indeed, twice in the last 25 years, cash rates have been over 5% (1999-2000 and 2007), and in both cases, investors could sell near the top and make risk-free money in Treasuries. And when the Fed cuts rates dramatically in 2002, 2008, and 2020, it’s been time to buy, or even to press further by borrowing money at cheap rates during periods of lower volatility. The Fed always repeats that the results of monetary policy are long and variable, so using Fed policy to guide you isn’t that useful for forecasting where stocks will be in a couple of months. But for forecasting where stocks will be in a couple of years, the Fed is of paramount importance to you as an investor. The Fed can be your best friend or worst enemy as an investor, and knowing the difference can make your financial life a heck of a lot easier.

What Will The Fed Do?

What the Fed will do going forward is up for debate, but what they need to do to restore price stability isn’t complicated. If the Fed wants to get inflation under control:

1. The Fed needs to keep hiking rates to 4% or more.

2. And it needs to aggressively shrink its balance sheet, probably at a quicker pace than is currently planned. I’d favor more QT and fewer rate hikes if they want to try to pull off a soft-ish landing.

Otherwise, there’s a significant risk that inflation is never going away. July CPI came in a bit better than expected, but keep in mind that July CPI was the result of a rapid tightening of financial conditions in June. This meant that the dollar was stronger (bringing prices down), the Nasdaq was tanking (another source of free money), interest rates (especially mortgage rates) were up, and pressure was building on money-losing zombie companies that have refinanced their debt over and over again. Then everyone started betting on the Fed to turn around and bail out falling stocks. Financial conditions rapidly loosened in July, with skyrocketing stock prices, a weaker dollar, lower rates, and a renewed boom in meme stocks.

This sets the conditions for an upside surprise to the August CPI numbers on Sept. 13. To this point, this was what happened in the 1970s, inflation would come down a bit, and then the Fed would loosen up and cut rates, and inflation would surge again. To avoid this, the Fed needs to keep rates high for years, not months.

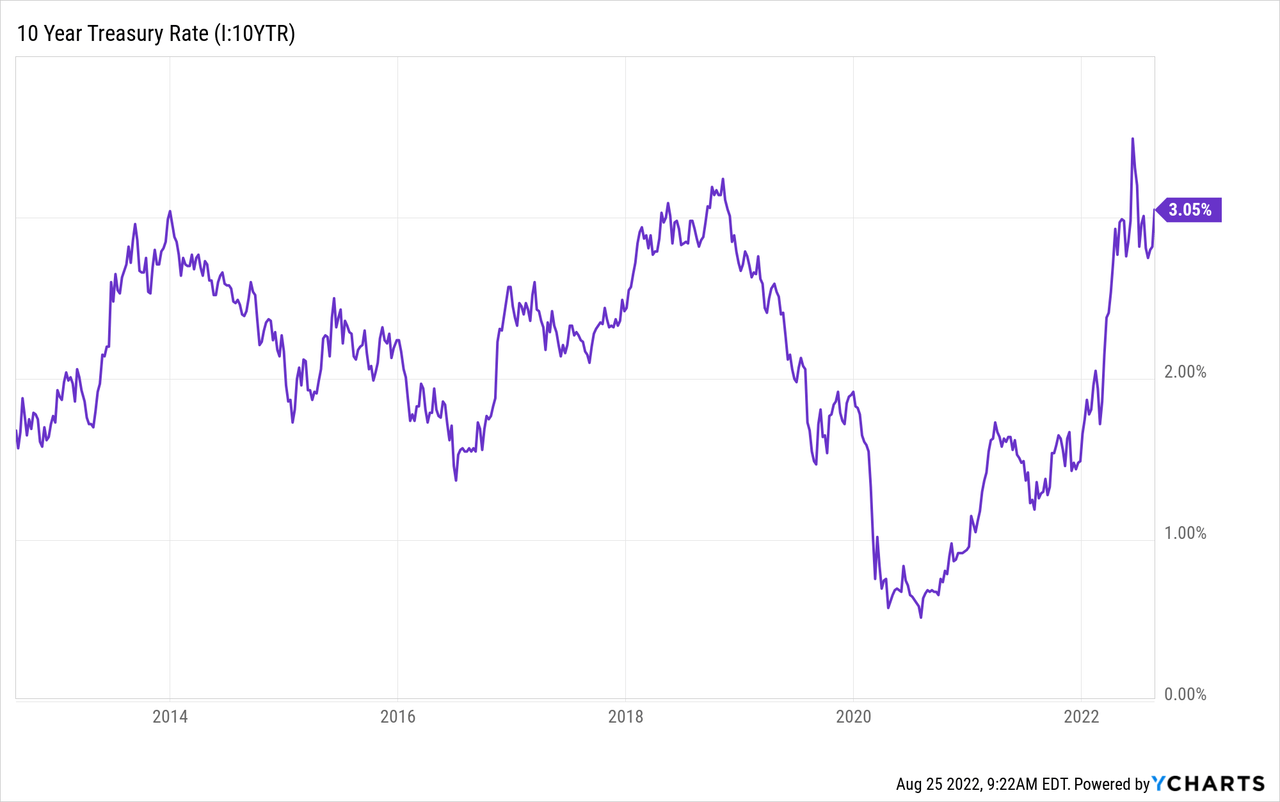

The Fed doesn’t directly control stock prices, so the best measure of whether what they’re doing is working is to look at current and forecasted cash rates, the 10-year yield, and inflation breakevens set by the price of inflation-protected Treasuries (TIP). The 10-year yield is creeping back up again after traders pounded the Treasury market with bets on a recession, briefly knocking it down to below the rate of inflation.

Nominal Treasury Yields

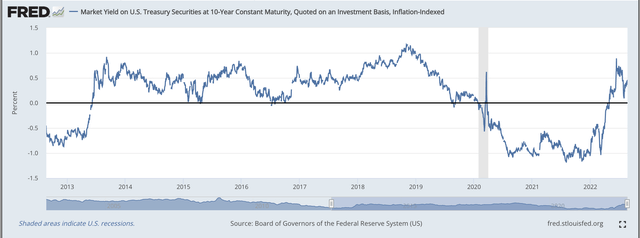

Real yields (vs. 10-year inflation breakeven prices)

10-Year Real Treasury Yield (“FRED”)

The Fed’s massive QE program had Treasury yields returning -1% annually vs. than the expected rate of inflation as late as this winter. Return-free risk! In the 2010s, real rates were generally 0.5% to 1% after the taper tantrum in 2013. But in the 2000s, real rates were more like 2%, which is where they belong in a free market. Inflation expectations are about 2.5% for the next 10 years, so that would imply a fair price for the 10-year yield of 3.5% or higher going forward. The runoff of the Fed’s balance sheet doubles to $95 billion per month on Sept. 1 and the government revenue windfall from 2021 capital gains is gone. This means more supply of Treasuries and higher yields.

The White House is likely to make the Fed’s job even harder with the proposed cancellation of student loans, which is another $300 billion in stimulus not paid for by tax revenue. If you assume an average 10-year repayment and some interest, roughly 1% of the national income goes toward student loans. Former Treasury secretary Larry Summers has been a high-profile critic of student loan forgiveness, saying it will fuel inflation even more. After some research, my guess is this will be struck down by the courts, but blanket student loan forgiveness is not a helpful strategy for getting the economy back on track.

The Fed got way off track in 2021. Its “inflation is transitory” narrative became a meme and is now relegated to the halls of infamy. Everyone makes mistakes, but the question is whether the Fed is going to see through the years-long process of restoring price stability and cleaning up their balance sheet, or whether they’ll try to make do with half measures that will force them to do even more in the end. My guess is that the Fed is willing to be much more aggressive than the market expects, adding to the downside pressure on stocks over the next few months.

People (i.e. voters) really hate inflation, even more so than stocks going down. Thus, there no longer appears to be significant political pressure to monetize government debt, and the negative impact on the middle class has been hammered home by the last 18 months of rapid inflation. My hope is that members of the Fed would strongly prefer not to go down in history as political pawns for a runaway spending Congress. Them doing so would negatively impact the value of the dollar, the future ability of the US government to borrow at reasonable rates, and ultimately the American standard of living.

Bottom Line

Without artificial government support via stimulus and QE, US large-cap stock prices are still about 20% too high, and bond yields are about 50-100 basis points too low. Much of the overvaluation in stocks is concentrated in mega-cap tech stocks like Apple (AAPL), Amazon (AMZN), and Tesla (TSLA). The housing market is similarly messed up. The Fed really can’t win at Jackson Hole, they can only lose (by continuing to deny the full extent of what they need to do to fight inflation until they get pummeled by month after month of hot CPI reports) or draw (by owning up to past mistakes and hiking cash rates to 4% or higher/boosting QT). It’s possible the Fed could get lucky and have some supply chain miracles bring inflation down, but I wouldn’t bet on it. Whatever happens at Jackson Hole, expect some huge bets to come in on the financial markets before, during, and after the event. My guess is that the best-performing asset over the next few months will be cash.

Be the first to comment