Sunshine Seeds

A Quick Take On Sedibelo Resources Limited

Sedibelo Resources Limited (SED) has filed to raise an undisclosed amount in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm operates as a producer and future processor of platinum group metals in South Africa.

SED appears well positioned in the world’s primary mining location amid growing demand for platinum group metals and related processing.

I’ll provide a final opinion when we learn more IPO details from management.

Sedibelo Overview

St. Peter Port, Guernsey-based Sedibelo was founded to develop the Pilanesberg Platinum Mine [PPM] in the Bushveld Complex that produces platinum, palladium and rhodium in large percentages of global production.

Management is headed by Chief Executive Officer Erich Clarke, who has been with the firm since 2015 when he joined the firm as CFO and was previously CEO of the Contract Mining and Plant Rental division of Imperial / Eqstra group.

The company is also expanding the PPM mine as well as developing a greenfield Mphahlele Project.

Management believes these two projects are both shallower and higher grade quality, with its existing infrastructure combining to make them potentially ‘very capital efficient.’

SED is also developing metals processing capabilities with operation expected by 2025.

Sedibelo has booked fair market value investment of $2.5 billion as of March 31, 2022 from investors including Bakgatla, IDC, NGPMR, Gemfields Resources, Pallinghurst EMG African Queen, AMCI ConsMin, Smedvig G.P., RPM and Telok Ayer Street VI Limited.

Sedibelo – Monetization

Currently, the company sells its ore products via commodities markets. Once it begins operations of its processing facility, it will be able to sell processed and refined metals products, both from its own mining efforts and from third-parties.

In 2020, the Bushveld Complex produced an estimated ‘70%, 34% and 78% of global platinum, palladium and rhodium production…respectively.’

Administrative and General expenses as a percentage of total revenue have risen as revenues have decreased, as the figures below indicate:

|

Administrative and General |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Three Mos. Ended March 31, 2022 |

15.4% |

|

2021 |

12.2% |

|

2020 |

8.1% |

(Source – SEC)

The Administrative and General efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Administrative and General spend, dropped to negative (5.2x) in the most recent reporting period, as shown in the table below:

|

Administrative and General |

Efficiency Rate |

|

Period |

Multiple |

|

Three Mos. Ended March 31, 2022 |

-5.2 |

|

2021 |

-0.4 |

(Source – SEC)

Sedibelo’s Market & Competition

According to a 2020 market research report by Grand View Research, the global market for platinum was an estimated $6.5 billion in 2019 and is forecast to reach $9.6 billion by 2027.

This represents a forecast CAGR of 5.0% from 2020 to 2027.

The main drivers for this expected growth are strong growth in demand from industrial applications which require platinum as a catalytic agent during manufacturing.

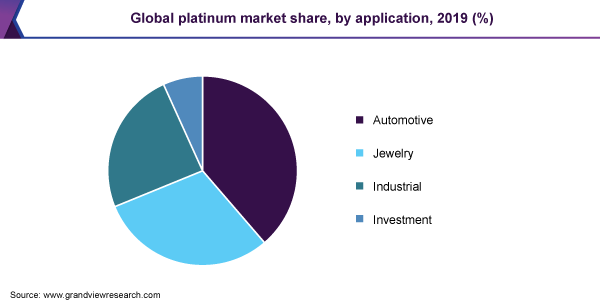

Also, the automotive industry is a key consumer of platinum metals in the worldwide market, followed by jewelry, industrial and for investment purposes, as the chart shows below:

Global Platinum Market (Grand View Research)

By region, the Asia Pacific area accounted for the highest market share, at 49% in 2019, and is expected to remain in a leading market share position through 2027, followed by the European region and then N. America.

Major competitive or other industry participants include:

-

Vale SA

-

Asahi Holdings

-

African Rainbow Minerals

-

Eastern Platinum

-

Eurasia Mining PLC

-

Anglo American Platinum Ltd.

-

Implats Platinum Ltd.

-

Sibanye-Stillwater

-

Norilsk Nickel

-

Northam Platinum Ltd.

Sedibelo Resources Limited Financial Performance

The company’s recent financial results can be summarized as follows:

-

Dropping topline revenue

-

Reduced gross profit and variable gross margin

-

Lowered operating profit

-

Reduced cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2022 |

$ 53,063,000 |

-44.6% |

|

2021 |

$ 265,520,000 |

-4.3% |

|

2020 |

$ 277,572,000 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2022 |

$ 16,468,000 |

-68.3% |

|

2021 |

$ 81,268,000 |

-33.0% |

|

2020 |

$ 121,359,000 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Three Mos. Ended March 31, 2022 |

31.03% |

|

|

2021 |

30.61% |

|

|

2020 |

43.72% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Three Mos. Ended March 31, 2022 |

$ 5,572,000 |

10.5% |

|

2021 |

$ 51,173,000 |

19.3% |

|

2020 |

$ 100,544,000 |

36.2% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Three Mos. Ended March 31, 2022 |

$ 3,195,000 |

6.0% |

|

2021 |

$ 33,172,000 |

62.5% |

|

2020 |

$ 196,194,000 |

369.7% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Three Mos. Ended March 31, 2022 |

$ 10,808,000 |

|

|

2021 |

$ 120,107,000 |

|

|

2020 |

$ 52,798,000 |

|

(Source – SEC)

As of March 31, 2022, Sedibelo had $152.3 million in cash and $88 million in total liabilities.

Free cash flow during the twelve months ended March 31, 2022, was $54.6 million.

Sedibelo Resources Limited IPO Details

Sedibelo intends to raise an undisclosed amount in gross proceeds from an IPO of its ordinary shares.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management did not disclose its proposed use of proceeds in the initial F-1 filing.

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, the firm is subject to a number of legal proceedings and the potential for a reduction of its mineral rights in administrative proceedings. Management said that it ‘determined that the risk of loss with respect to all of our legal proceedings was less than probable.’ So, it did not record any loss provisions.

The listed bookrunners of the IPO are Evercore ISI, JPMorgan and RBC Capital Markets.

Commentary About Sedibelo’s IPO

SED is seeking U.S. capital market investment likely to continue its mining development efforts and related buildout of its processing capabilities.

The company’s financials have produced decreased topline revenue, lowered gross profit and variable gross margin, reduced operating profit and less cash flow from operations.

Free cash flow for the twelve months ended March 31, 2022, was $54.6 million.

Administrative and General expenses as a percentage of total revenue have risen as revenues have decreased; its Administrative and General efficiency multiple was negative (5.2x) in the most recent reporting period.

The firm currently plans to pay no dividends and intends to retain future earnings to reinvest back into the business.

SED’s CapEx Ratio is 3.24, which indicates it is spending significantly on capital expenditures as a percentage of its operating cash flow.

The market opportunity for platinum group metals is large and expected to grow considerably in the coming years as major industries use more of the metal in their manufacturing processes.

Evercore ISI is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (68.0%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is the highly variable price of its commodity complex of metals.

However, the firm appears well positioned in the world’s primary mining location amid growing demand for platinum group metals and related processing.

I’ll provide a final opinion when we learn more IPO details from management.

Expected IPO Pricing Date: To be announced.

Be the first to comment