sandsun/iStock Editorial via Getty Images

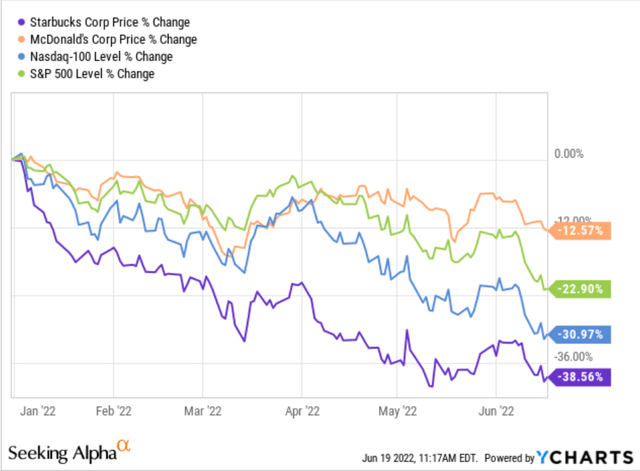

Because of the recent stock market rout collapsing shares of Starbucks (NASDAQ:SBUX) by nearly 40%, this opened up a great opportunity for prospective buyers. Due to the significant drop in price, it has cooled down its valuation drastically, as they remain to pay a substantial dividend, which has compelling as a potential a long position. On the other hand, McDonald’s Corporation (NYSE:MCD) has greatly outperformed the broader market in the 2022 bear market, making its valuation unattractive compared to its beat-down peers within the restaurant industry. Because of McDonald’s sub-par growth and valuation comparisons, I would open a short position on MCD.

Starbucks Corporation has been trading at a very attractive historical valuation due to the bear market we have recently entered. Several issues such as supply chain disruptions, inflation, and the increase in commodity pricing of coffee beans linger; however, Starbucks continues to demonstrate its robust growth, sturdy dividend yield, and an impressive generation of free cash flows. Moreover, the emergence of Howard Schultz as the CEO should reassure investors, given his strong track performance at Starbucks.

Contrarily, McDonald’s Corporation, in my opinion, appears to be overvalued compared to its sector. Its expensive price is solely because of the stock’s considerable outperformance in the past year, leading to inflated multiples and a modest dividend yield that hasn’t grown much. McDonald’s stock has not been hit as hard this year as investors see it as a safe haven in the restaurant space compared to the likes of faster growers like Starbucks. Valuations have not cooled down to historical averages, forward growth expectations are not worth the risk factors, and it still carries a premium to own the stock.

In this pair trade thesis, I will use valuation metrics like P/E ratio, EV/EBITDA, and various growth numbers/prospects to compare Starbucks and McDonald’s. I believe that now is an amazing time to go long on Starbucks stock after its huge correction, and I’ll share why I think it’s fundamentally sound compared to McDonald’s, as I feel MCD is due for a decline and a short position would perform well.

Why is Now the Time to Buy the Dip and Go Long on SBUX?

When looking at the historical trends of Starbucks, it is clear that the 2022 bear market has offered a fantastic opportunity to purchase shares. As investors have flocked towards safer value plays in 2022, growth names in the restaurant industry like SBUX and Chipotle Mexican Grill (CMG) have had constant downwards pressure. Starbucks stock has given up over a third of its market value this year, and I think now is the time to move money back into this name at a discount.

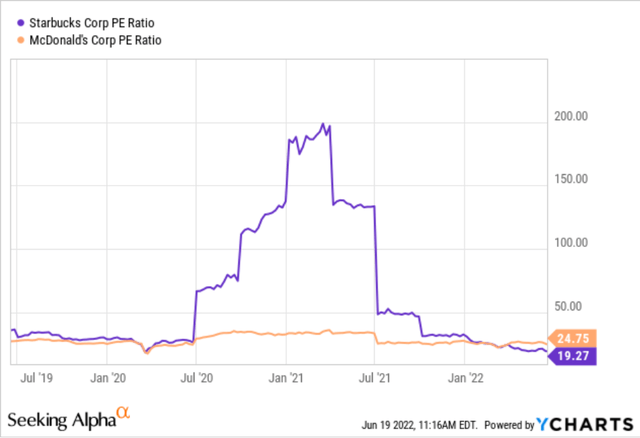

For the most part, Starbucks has carried around a P/E ratio of the mid-20s to the low-30s for the last decade, aside from a few instances. However, because of the recent downside in the market and Starbucks posting consistent earnings numbers, it now holds a multiple of 19.27x. From a YTD perspective, SBUX is down over 38%, which has outpaced the broader-based declines in the S&P 500 and the Nasdaq-100. Given this collapse in share price, it has opened up a ton of dip-buying opportunities for prospective investors looking to catch the bottom on SBUX.

Beyond North America, Starbucks does not have a massive international presence like McDonald’s. While there are some downsides to this, in socioeconomic conditions seen recently, this has been favorable for Starbucks. Starbucks hasn’t had to worry nearly as much as McDonald’s with Russia’s warmongering behavior, which has been a blemish on MCD’s performance this year. In the most recent earnings call, interim CEO Howard Schultz stated that the “challenges have been amplified by record demand for Starbucks coffee in our U.S. stores that has accelerated with the lifting of COVID restrictions.” Because the second largest country it operates in is China, Starbucks has had to deal with the extensive lockdowns in that region. However, with COVID cases on a worldwide downturn as of late, Schultz has shared that operations are looking much brighter there.

McDonald’s Inflated Valuation Could Mean Trouble for the Stock

Due to recent headwinds in the market, Starbucks has been a name that has garnered significant attention from dividend growth investors. Now that the P/E ratio has calmed to 19.27x because of their consistent revenue and earnings growth, many people searching for a solid dividend play with good growth have stumbled upon SBUX. Traditionally, Starbucks has had a P/E ratio in the high-20s, so this is a significant drop that many investors must consider.

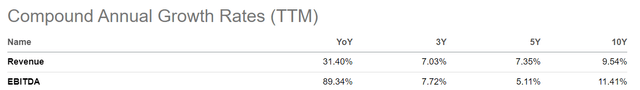

The company and management have done a great job combatting the constant worldwide inflation in the past year. Starbucks has grown its revenues significantly, posting 31.40% revenue growth YoY and a 5-year CAGR of 7.35%. Both of these numbers are greatly affected by the pandemic that significantly impacted sales in the restaurant industry for all of 2020 and 2021. So, forward revenue projections are noteworthy, and analysts project Starbucks to grow revenues by 14.82%, which is an astounding number. Next, Starbucks has also outpaced McDonald’s in the EBITDA category, presenting a sturdy 11.41% CAGR over a 10-year time frame.

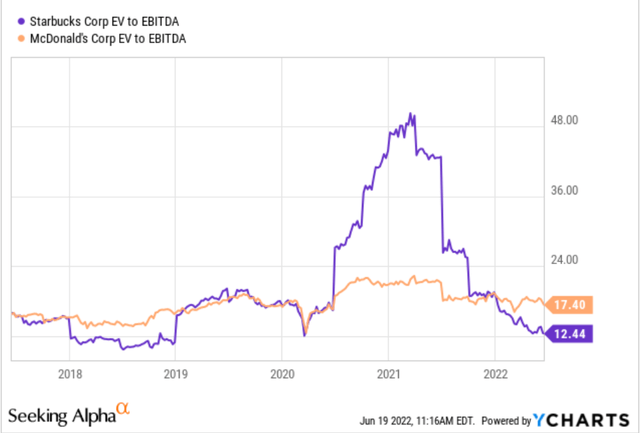

Another metric in which Starbucks seems to look very undervalued in compared to McDonald’s is their EV/EBITDA ratio. This ratio represents a company’s enterprise value to the company’s earnings before interest, taxes, depreciation, and amortization are accounted for. EV/EBITDA is found by dividing a company’s enterprise value by its EBITDA. EBITDA is commonly used for the purpose of focusing on the profits that come from a company’s primary operating functions rather than accounting practices.

A company’s enterprise value is the market value plus the total debt the company currently holds. Both Starbucks and McDonald’s take on similar amounts of debt to fund their business models, with the former having about 23% of their enterprise value comprising of debt and the latter holding around 22%.

Because Starbucks and McDonald’s are in the same sector (consumer discretionary) and industry (restaurant), the EV/EBITDA metric is an excellent ratio for comparison. Both companies have ratios above the sector averages; however, their multiples are around par within the restaurant industry. Similarly, EV/EBITDA and P/E ratios convey a cheaper valuation if the multiple is lower, and corporations can be seen as overvalued with high multiples. Pictured above, you can see that SBUX’s EV/EBITDA ratio is trading much lower than their 5-year average, and it is trending down to the troughs seen in 2018-2019. However, MCD’s multiple of 17.4x is much higher than Starbucks, which is around average for McDonald’s in the last five years.

This metric is an excellent pairing with the P/E ratio because it accounts for factors not used in the price-to-earnings ratio. The enterprise value, in some cases, can paint a more accurate picture because it illustrates equity and debt within a company. So ultimately, both of these valuation ratios are a great way to compare companies like SBUX and MCD that are within the same industries.

McDonald’s Lagging Dividend Growth

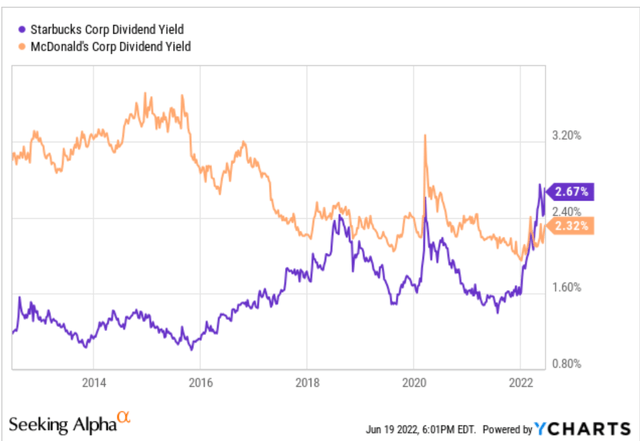

While both companies pay out pretty sturdy dividends, Starbucks has finally outpaced McDonald’s with its 2.67% dividend. MCD offers a 2.32% dividend, which is not much lower than its counterpart. However, they also do not have the same revenue and earnings growth numbers in the last decade. Starbucks’ dividend is another significant reason investors should consider buying the stock, especially in the macro-environment we are in now. With lingering inflation worldwide, the solid 2.67% dividend could offer moderate protection from rising prices, and there is no sign that Starbucks will stop growing its dividend over time.

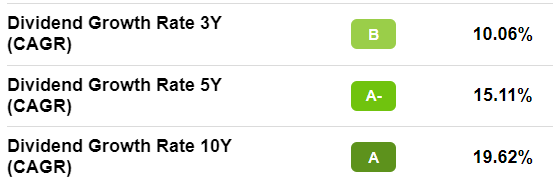

As I said earlier, investors in Starbucks shouldn’t question if their dividend will get cut or stop rising in the future because as the company grows its earnings, they continue to grow its dividend in harmony. Starbucks has had an astonishing 19.62% Dividend CAGR for the last decade, levels above its sector average of 10.42%. Its dividend growth rate has slowed over the previous few years, but it still has moved in the positive direction towards an all-time high for the stock.

Dividend CAGR SBUX (Seeking Alpha)

On the other hand, McDonald’s is nowhere near its peak dividend yield, as it paid out over 4.5% during the financial crisis and around 3.2% during the COVID-19 outbreak. McDonald’s is paying out a smaller yield than SBUX of 2.32%, which is still very substantial, but about 13% lower than Starbucks’ yearly dividend. If McDonald’s wants to catch up to Starbucks, they would need to allocate more of their earnings to dividends rather than retaining them, which could slow their stagnant growth even more.

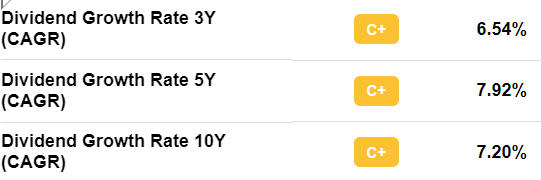

Dividend CAGR MCD (Seeking Alpha)

Pictured above is MCD’s CAGR for their dividend yield, and it is much more modest than the double-digit growth seen at SBUX. Although both yields have risen since the start of 2022, Starbucks offers more of an attractive buying opportunity, being down around 40% YTD and offering a sturdier dividend.

Howard Schultz’s Potential Reemergence as a White Knight for SBUX During the Economic Slump

There has recently been a ton of headwinds and noise around the reemergence of Howard Schultz as interim CEO of Starbucks. Most of this noise is attributed to Schultz’s decision to suspend their share buybacks moving forward and talks of unionization in the labor force. While this noise is justified, investors must note Howard Schultz’s excellent track record as CEO and how he has been a white knight figure at times for the company. Serving as chairman and CEO from 1986 to 2000 and again from 2008 to 2017, he’s a veteran in the space and has proven his worth, growing Starbucks from nothing into over 28,000 stores operating in 77 countries.

The return of Schultz amid the worldwide financial crisis in 2008 arguably saved Starbucks from going bust. Starbucks suffered from a rough economy and its own strategic missteps during the Great Recession, and consumers sought cheaper alternatives at places like McDonald’s. Schultz’s return saw more rampant growth than his previous tenure at the company, and Starbucks demonstrated its potential even in a brutal economy.

In my opinion, his return a couple of months ago is similar to his return in ’08. While the economy is not in complete shambles like the financial crisis, many are projecting high inflation to remain and a recession to strike this year. Schultz’s third return can be another portrayal of his abilities to make Starbucks withstand another economic slowdown and exit it even stronger.

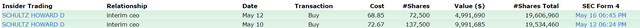

Rare Insider Buying Activity at Starbucks

Howard Schultz’s Insider Buying (FINVIZ)

Another bullish sign at Starbucks is Schultz’s insider buying activity in May of around $15 million worth of shares. Although this might not seem very significant, it is Starbucks’ first insider purchase in nearly four years, and the fact that it has come from Schultz right after his return is another optimistic sign of what is to come. There are several reasons for insiders to sell shares; however, there is solely one reason why an insider would buy shares, they believe the stock is undervalued.

Russia and Its Immense Impact on McDonald’s

About one month ago, McDonald’s announced that they were ceasing operations in Russia which will most definitely adversely affect their business growth. With 850 locations spanning across the country, this decision to exit will especially impact its European presence and reach to consumers in the area. This exit will leave 62,000 workers without jobs; however, they are still getting paid by McDonald’s at the moment, which I highly respect them for. This close cost them $127 million last quarter, a sizable 9% of McDonald’s 2021 revenue.

While this exit is only temporary, there is no telling when Putin will end the war he started. Investors must consider that a substantial portion of McDonald’s sales has halted for the moment, and in my opinion, this shock hasn’t been priced into the stock yet. The stock has chopped back and forth since this announcement, and I wouldn’t be surprised if it corrects to the downside once the Q3 2022 is reported.

Significant Risk Factors for Starbucks and McDonald’s

Lingering inflation continues to be a concern for most countries worldwide, and it is definitely a risk for both Starbucks and McDonald’s moving forward. As the cost of labor and goods goes up, this can significantly hinder the operating margins of both companies moving forward. Starbucks and McDonald’s can raise the price of their product line respectively; however, this can turn away some customers, especially in uncertain economic times.

Schultz’s noted the following on the Q2 earnings call: “… inflationary pressures have outpaced our price increases resulting in several points of margin compression in the short-term and costing us over 200 basis points in the first half of the fiscal year.” Corporations are having trouble combatting the rapid inflation we have seen lately, and it hasn’t gotten any better, given that May’s report was the worst in the U.S. since 1981, coming in at a hot 8.6%.

McDonald’s CFO, Kevin Ozan, recently said the following during their Q1 2022 earnings call: “As expected, our company operating margins were hampered by significant commodity and labor inflation.” Inflation has unfavorably impacted both MCD’s and SBUX’s operating margins significantly. Starbucks shared that its North American operating margin of 17.2% in Q2 2022 contracted by 260 basis points year over year due to inflationary pressures. Commodity and labor inflation has disrupted the restaurant industry in many ways, and most of the management in this industry have projected these issues to hinder their guidance moving forward continuously.

In addition, supply chain woes continue to be an issue, although this risk has calmed down a bit this year. Increased consumer demand and manufacturing slowdowns because of the pandemic over the last two years have led to supply chain bottlenecks hindering the restaurant industry.

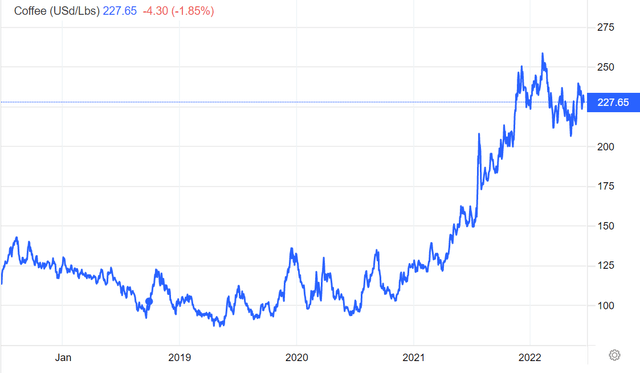

Moreover, rising commodity prices in the form of coffee beans are a risk factor primarily for Starbucks and McDonald’s going forward. Below is the chart of coffee prices in the past five years, and it is clear that a drastic rise in demand for coffee beans in uncertain economic times has driven coffee beans up in price by around 100% in just one year.

If coffee bean prices continue this upwards trend, then Starbucks and McDonald’s will also have to drive the prices up on their coffee which is not a desirable thing for consumers in an inflationary environment.

Unionization has been the talk in the corporate world as of late, and this stands as another risk factor for both Starbucks and McDonald’s. While unions have some pros for workers, they are predominantly unfavorable for a corporation. Because of higher labor costs, poor workplace advancement, increased chances of labor strikes, and frequent lawsuits/arbitrations, unionization in the workforce continues to be a risk for both companies moving forward.

Final Thoughts: A Stellar Opportunity to Long SBUX and Short MCD

Ultimately, after going through a comprehensive analysis of both Starbucks and McDonald’s, using the fundamental analysis I presented, as well as some external factors, I feel that Starbucks stock will significantly outperform McDonald’s moving forward. This is a situation where it mostly comes down to valuations and growth factors moving forward. Starbucks has had a much faster-growing past, and analysts are signaling for continued double-digit sales growth, vastly outpacing the likes of McDonald’s.

Starbucks has much more room to expand its business model as its vast majority of sales (~70%) comprises of locations in North America. International segments for McDonald’s account for about half of their sales, so they have already pushed their outreach near its limits.

Belinda Wong, the chairman of Starbucks in China, stated that the company “remain[s] very optimistic for our future growth in China. Outside of China, the recovery of our international markets gained momentum … achieving record revenue levels in the quarter with revenue growth for the segment outside of China reaching 23%.” The management at Starbucks is extremely optimistic about the business growth strategies they’ve implemented in China, and Schultz even believes in the future that China will grow larger than their American business.

Starbucks has had a rough six months and is trading about 40% lower than its 2021 peak, so now is a great time to buy in if you want some inflation protection from its trusty 2.67% dividend and massive upwards potential given forward revenue and earnings projections. In my opinion, this is one of the best buying opportunities in the market right now to have a long position, as it offers very solid growth on the top and bottom line, an above-average industry dividend, and a proven business model through economic troughs.

Although McDonald’s business model has proven to work greatly in recessions, it is still greatly overvalued within its sector and industry and continues to face inflationary issues that force menu prices to rise. While a recession might be worse for Starbucks than McDonald’s, mainly because of higher menu prices and consumers cutting spending, Starbucks has exceptional financial strength and is in great hands with Schultz.

After assessing various risks, I think that the return of Schultz can potentially be incredible if we enter a recession and a broader-based economic slowdown in the coming months. I believe that SBUX is far more oversold than MCD using fundamental historical data, and if they continue to grow at a pace that they project, their valuation will continue to drop.

Because Starbucks has much more room to expand, given that the vast majority of its sales volume takes place in North America, opening a long position for the next few years is an intelligent idea. As long as they continue to come through with their nearly double-digit CAGR on revenue, earnings, and dividend yield, I see no reason to turn your back on Starbucks stock. However, McDonald’s has struggled to combat labor shortages and costs both domestically and overseas. With inflation worries worldwide, McDonald’s management projects their business to continue to be hindered for at least the next couple of quarters. With slowing sales and earnings growth, foreign exchange troubles in Europe, and exiting a market comprising nearly 10% of their sales makes MCD extremely vulnerable to a stock price correction, and in my opinion, it’s the perfect time to go short.

Be the first to comment