gesrey

Co-produced by Austin Rogers

The Democratic tax-and-spend billed titled the “Inflation Reduction Act” (“IRA”) contains many of the same provisions and addresses many of the same priorities as President Joe Biden’s previous “Build Back Better” bill, only in a pared down form that is more palatable to a few key senators.

Like its spiritual predecessor in “Build Back Better,” the IRA (not to be confused with an “individual retirement account”) focuses heavily on achieving climate-related goals through advancing clean/green energy as well as expanding government healthcare spending.

Unlike “Build Back Better,” however, the IRA also focuses on reducing the federal fiscal deficit by raising taxes and decreasing government spending on prescription drugs.

The Congressional Budget Office (as reported by the Committee For A Responsible Federal Budget) estimates that the bill will reduce federal deficit spending by a total of $305 billion through 2031. Approximately 2/3rds of that deficit reduction will come from stronger tax compliance measures (hiring more IRS employees), while the remaining 1/3rd comes from drug price savings.

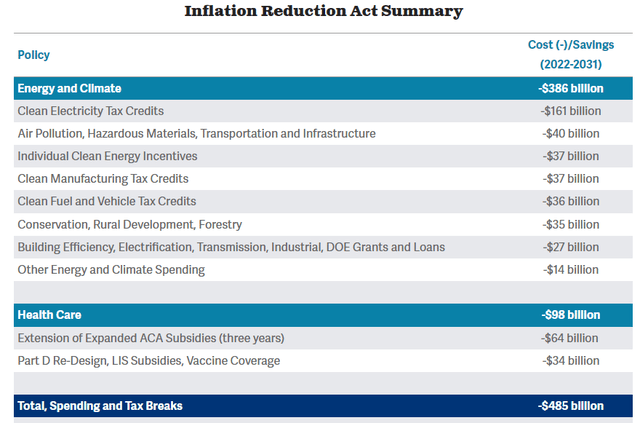

The Committee For A Responsible Federal Budget put together a handy breakdown of the bill’s main points. Here are the spending and tax break line items of the IRA:

Committee For A Responsible Federal Budget

As you can see, the bulk of new spending pertains to climate change and clean energy. This includes expanded tax credits for consumer purchases of electric vehicles, a move that should make Tesla (TSLA) shareholders and drivers alike very happy.

More winners here should be miners and producers of lithium, a crucial material in EV batteries as well as the large-scale battery systems used for utility purposes. Albemarle (ALB) and Lithium Americas (LAC) are two names that come to mind as producers of the rare metal.

The IRA also extends the investment tax credit for production of green power such as wind and solar. This should prove a boon to renewable energy producers like Brookfield Renewable (BEP, BEPC), NextEra Energy Partners (NEP), Clearway Energy (CWEN, CWEN.A), and Atlantica Sustainable Infrastructure (AY).

Moreover, starting in 2025, the criteria to receive these tax credits will be broadened to include other forms of energy production, as long as they are carbon-neutral. Thus, in three years, certain fossil fuels will be eligible to receive tax credits as long as they are able to demonstrate effective carbon capture technology.

These tax credits will remain in place until 2032 or until the US utility sector achieves a 75% reduction in carbon emissions from 2022 levels, whichever comes first. After this, tax credits phase out over multiple years.

Our view is that this rule change, combined with hastening the approval process for oil & gas pipelines and opening up more federal land for drilling, will also prove a boon to midstream energy companies like Enterprise Products Partners (EPD), Energy Transfer (ET), Plains All American (PAA), and others.

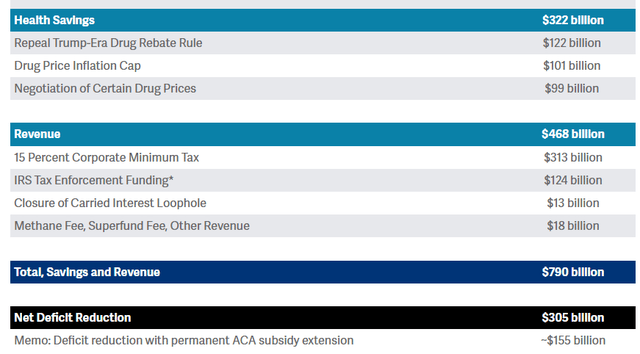

Now, what about the other side of the ledger – the savings side? Here’s the CRFB’s breakdown of how the CBO expects money to flow into the government’s coffers:

Committee For A Responsible Federal Budget

The largest single line item on the revenue side of the bill is the new 15% minimum corporate tax, which prevents big corporations like Amazon (AMZN) from racking up enough deductions to avoid paying any taxes at all (or at least very little).

The IRA also seeks to raise revenue by capping drug prices and removing drug rebates. And then there’s the ability of Medicare to “negotiate” drug prices. Of course, Medicare is such a massive buyer of prescription drugs in the US economy as to make the word “negotiate” a bit of a misnomer. As explained by Slate:

The bill’s medical cost savings come primarily from a provision that requires pharmaceutical and biotechnology companies to accept steep price cuts for a handful of prescription drugs purchased through Medicare.

The penalty for refusal to accept Medicare’s price cut demands will be a 1,900% excise tax. End of negotiation.

Then again, this provision of the bill comes far from making pharmaceutical stocks, or drug development specifically, unprofitable. Hence why drugmaker stocks have largely held their ground.

But there is a component of the IRA bill that has so far received little attention compared to the headline provisions, and it could hugely benefit dividend investors.

The 1% Stock Buyback Tax

At the last minute, Democrats inserted into the IRA a measure to tax public companies buying back their own stock. A 1% excise tax will be levied on all share repurchases, effective January 1st, 2023.

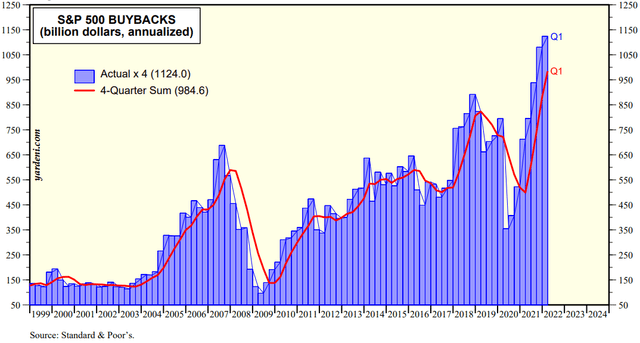

While 1% may not sound like much, it adds up. This is especially true considering the fact that buybacks have become a more and more popular method of returning cash to shareholders in recent years.

For the twelve months ending in Q1 2022, stock buybacks for S&P 500 (SPY) companies alone reached nearly $1 trillion ($984.6 billion, to be exact). This is a record-breaking number. If it had occurred at a time when the 1% buybacks tax was in place, S&P 500 corporations would have to pay ~$9.85 billion in taxes for those buybacks.

How much exactly will this deter public companies from engaging in buybacks?

Well, Senate Democrats have estimated that the measure should raise about $74 billion in taxes over the next decade, or $7.4 billion per year. That would mark a ~25% reduction in total buybacks from the current level.

So, if public companies do end up spending less money on stock buybacks than they otherwise would, how will that cash be allocated instead? There are multiple possible alternative ways it could be used:

- Investment in capital expenditure and human capital improvements

- Debt reduction

- Increased dividends

While lawmakers would like to see public companies divert cash from buybacks to greater investments in capex and human capital (such as higher wages for workers), corporate capital allocators are likely to continue using the same amount of cash to reward shareholders.

However, to the degree that the new stock buyback tax actually deters stock buybacks, capital allocators are likely to instead use the money to reduce debt and/or increase dividend payouts. Both of these uses of cash would be beneficial to dividend stock investors.

Higher dividend payouts would be beneficial for obvious reasons, but even debt reduction can be beneficial to dividend investors, because debt service has higher seniority than common equity dividends. Thus, lower debt service costs make dividend payments safer, all else being equal.

Moreover, to the degree that this tax code change causes some companies to begin paying a dividend or shift toward a prioritization of dividends over buybacks, it will give dividend investors a wider array of options to choose from.

Our Bottom Line

At High Yield Investor, we are sector-agnostic, meaning that we are willing to look in virtually all corners of the market for high yields and strong returns.

One sector in which we own almost nothing is the information technology sector (VGT), populated by names like Google (GOOG, GOOGL), Meta Platforms (META), Microsoft (MSFT), and Apple (AAPL). It is large- and mega-cap tech stocks like these that have carried out more stock buybacks than any other sector over the last decade.

While we do not expect tech companies to suddenly shift and pour all the money they formerly used for buybacks into dividends, we will be interested to see if any tech companies begin to prioritize dividends over buybacks. If so, it could lead to some interesting opportunities for dividend investors.

On the other hand, one of our favorite sectors has long been energy, especially midstream energy (AMLP, MLPA, MLPX, ENFR), which consists of pipelines, storage facilities, and export facilities. While these kinds of companies rarely engage in buybacks, we expect to continue fishing in this pond for a long time to come, in part because of the benefits we expect them to reap from the Inflation Protection Act.

Finally, the largest sector represented in our portfolio is financial services. This sector engages in the second most stock buybacks, behind only information technology. As such, we will be watching closely to see if the 1% tax on stock buybacks nudges any of our financial services holdings to shift in the direction of dividends instead of share repurchases.

The bottom line is that any tax on stock buybacks is likely to incrementally push capital allocation toward dividends instead of buybacks. If you tax something, you generally get less of it. That’s how it works.

As dividend investors, we believe this change in the tax code can only be good for us.

Be the first to comment