gesrey

The idea of generating passive income has been a captivating strategy for many investors. In fact, some investors won’t allocate capital toward individual equities unless it generates a dividend. Other investors go further down the rabbit hole and will only invest in companies or funds that not only generate a dividend but have sequentially increased the dividend over a specific amount of time. To some, the idea of collecting dividends is alluring but to others collecting dividends and getting an annual raise to do nothing is even better.

Whether you’re a seasoned income investor or just getting started in dividend investing, there are several approaches to accomplish the goals of generating consistent income with annual increases. You can do the research and create a portfolio of individual equities that have a track record of providing dividends with annual increases, look at the Dividend Aristocrat list, and build a portfolio from only companies that have a minimum of 25 years of increasing their dividends, or you can invest in an exchange-traded fund (ETF) that does the work for you. It depends on how hands-on you would like to be but in 2022, you can pretty much find an ETF that meets your investment criteria.

The iShares Core Dividend Growth ETF (NYSEARCA:DGRO) has been recommended to me several times in the comment section of previous articles. Some readers have recommended DGRO to be an addition to my Dividend Harvesting portfolio series on Seeking Alpha. When I have written articles about other dividend ETFs, such as the Vanguard High Dividend Yield ETF (VYM), some have indicated that I should consider DGRO. Being invested in several ETFs dedicated toward dividends, I wanted to look into DGRO and see if it could be an addition or even a replacement for one of my current funds.

The iShares Core Dividend Growth ETF

DGRO is exactly what the name indicates; an ETF focused on dividend growth. DGRO tracks the US Dividend Growth Index from Morningstar, which is a dividend dollar-weighted index that seeks to measure the performance of US companies selected based on a consistent history of growing dividends. For a company to be eligible for the US Dividend Growth Index from Morningstar, the individual company must pay a qualified dividend, have a minimum of 5 consecutive years of annual dividend growth, and their earnings payout ratio must be less than 75%. Companies in the top decile based on dividend yield are excluded prior to conducting screens for dividend growth and payout ratios. The index includes small, medium, and large capitalization companies. DGRO’s investment parameters include investing at least 80% of its assets in the component securities of its Underlying Index and in investments that have economic characteristics that are substantially identical to the component securities of its Underlying Index. With the additional 20%, DGRO has the ability to allocate capital toward futures, options and swap contracts, cash and cash equivalents, including shares of money market funds.

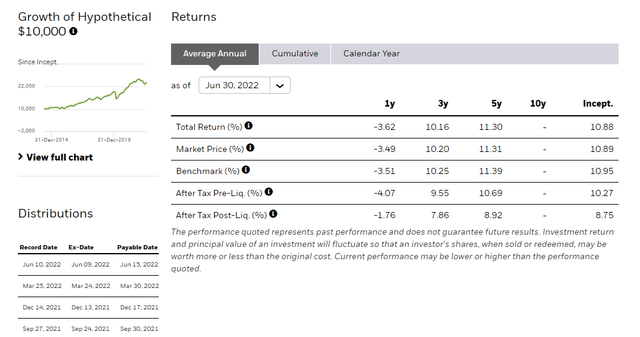

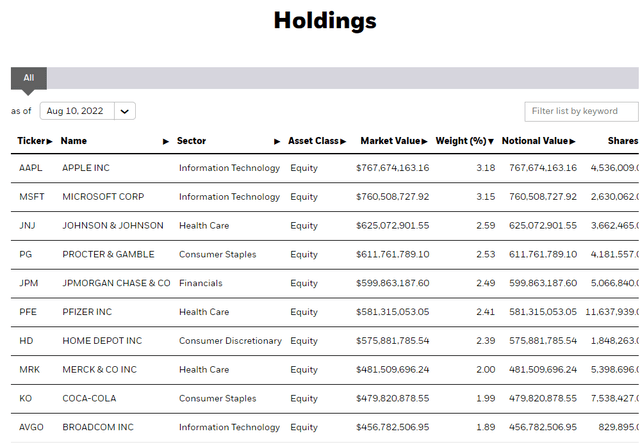

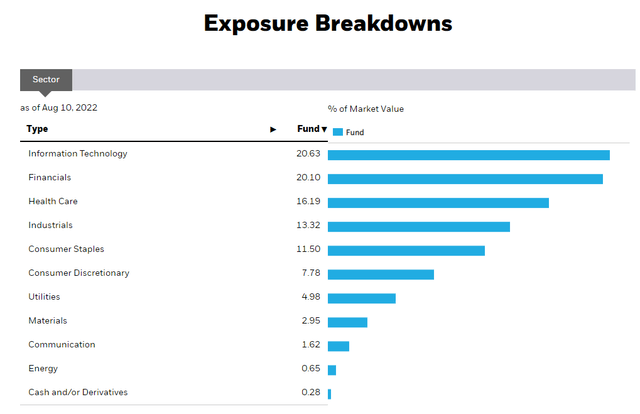

DGRO is a large ETF with $24.11 billion of net assets. DGRO was created on 6/10/14 and pays a quarterly dividend. DGRO has a large diversification across 414 companies with a focus on information technology and financials. iShares charges its investors a 0.08% management fee with no additional upcharges, putting its total expense ratio at 0.08%. DGRO pays an annual dividend of $1.05, which is a 2.03% yield with a 5-year average dividend growth rate of 9.19% and 7 consecutive years of annual dividend growth. Throughout DGRO’s top ten holdings, you will find many of the most well-known companies, from Apple (AAPL) to Microsoft (MSFT). DGRO’s largest holding is AAPL at 3.18% of its assets, and its largest investment sector is information technology which accounts for 20.63% of the fund.

What I like and what I don’t like about DGRO

There are positive and negative aspects to DGRO, in my opinion. I’ll start with the positives. DGRO is a large fund that provides a solid mixture of companies throughout the market. I find it to be more of a hybrid fund than a dividend growth fund, as 6.33% of its assets are tied to AAPL and Microsoft. I like its focus on dividend growth and that the expense ratio is less than pennies on the dollar. For every $10,000 invested, you would pay $8 in management fees. I am a big fan of diversification as too many investors become consumed with a specific investment which many times becomes an overwhelming portion of their portfolio. DGRO has done a fantastic job at spreading its assets out, and its largest position, AAPL is only 3.18% of the portfolio, and its largest sector (Information Technology) represents 20.63% of the portfolio.

While I think DGRO is a good fund, there are several aspects I don’t like, which could be a deal breaker for my personal investment purposes. First, the yield is very low for a dividend fund. I could invest in an S&P index fund such as the SPDR S&P 500 Trust (SPY) and generate a 1.43% yield. DGRO is currently yielding 2.03%, so I am not generating that much more from the annual dividend than a standard index fund. If you’re looking for income, DGRO would generate $2,003 on every $100,000 vs. $1,430 from SPY, and that’s not necessarily appealing to me. Next, I don’t like the fact that DGRO excludes the companies in the top decile based on dividend yield, As a dividend growth fund, I would be looking to maximize both my yield and dividend growth and would want companies such as Realty Income (O), Altria Group (MO), Enterprise Products Partners (EPD), and Verizon (VZ) to be part of the fund. The other perplexing aspect is that DGRO can write call options on 20% of the fund’s assets, yet the yield is just a hair above 2%. Looking at funds such as the Amplify CWP Enhanced Dividend Income ETF (DIVO), which I previously wrote an article on, looks much more compelling from a dividend standpoint. It’s just shocking that a fund with over $1 billion in assets that have the ability to write covered calls on 20% of its portfolio is only generating a 2.03% yield.

DGRO’s performance and dividend compared to other dividend-focused ETFs

The proof is in the numbers, so I want to see how DGRO has performed compared to SPY (a standard index fund) and some dividend-focused funds. Since DGRO is focused on dividend growth, I want to make sure I have at least 2 other funds with similar focuses. I will be comparing DGRO to the following funds:

Vanguard Dividend Appreciation ETF (VIG)

Schwab U.S. Dividend Equity ETF (SCHD)

ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

Amplify CWP Enhanced Dividend Income ETF (DIVO)

SPDR S&P 500 ETF (SPY)

|

Ticker |

Share Price |

Dividend |

Dividend Yield |

|

DIVO |

35.82 |

1.76 |

4.91% |

|

SCHD |

76.5 |

2.82 |

3.69% |

|

DGRO |

51.81 |

1.05 |

2.03% |

|

NOBL |

93.17 |

1.79 |

1.92% |

|

VIG |

156.59 |

2.86 |

1.83% |

|

SPY |

422.65 |

6.01 |

1.42% |

From a dividend perspective, DGRO is slightly above the other dividend growth-focused funds but significantly below SCHD. While SCHD isn’t considered a dividend growth fund, it has provided 9 years of dividend increases. If my main focus was dividend growth and yield, I would go with SCHD over DGRO.

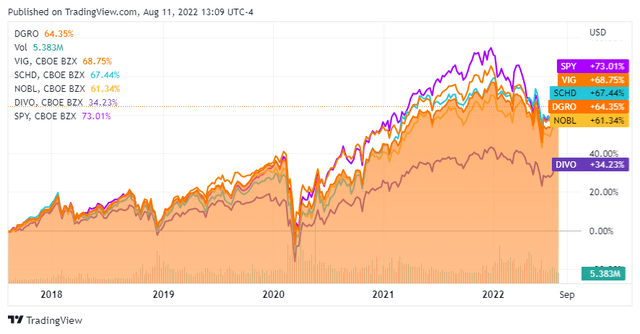

I am going to compare these funds performances over a 5-year, 1-year, YTD, and 1-month time period.

Over the previous 5-years SPY has appreciated by 73.01%, while VIG and SCHD both outperformed DGRO. DGRO came in at 64.35%, while SCHD appreciated by 67.44% and VIG appreciated by 68.75%.

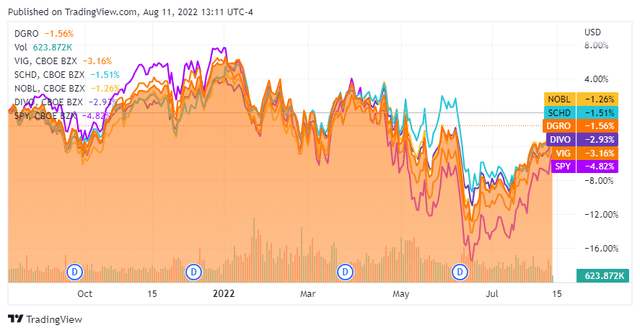

Over the past year, DGRO has declined by -1.56%, which is less than SPY’s -4.82% and right behind SCHD and NOBL.

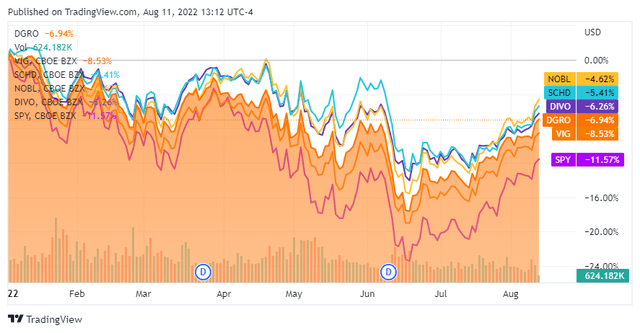

Looking at these funds from a YTD perspective, DGRO is within a respectable range compared to the other dividend funds. DGRO declined by -6.94%, while NOBL declined by -4.62%, and SCHD declined by -5.41%.

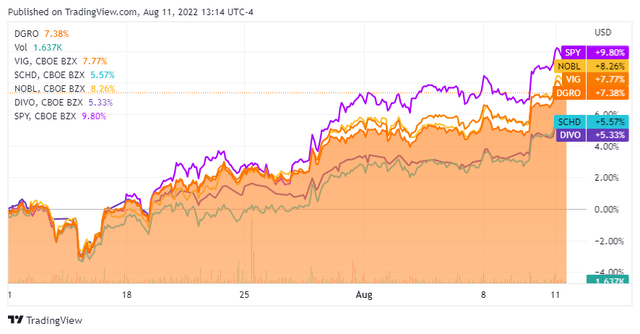

Over the past month, the markets have been rebounding, and SPY has climbed 9.8%. DGRO isn’t that far behind at 7.38%, but VIG and NOBL have both appreciated more than DGRO in this period.

After looking at performance in these time periods, I would also select SCHD over DGRO if I was going to pick a fund based on appreciation, dividend growth, and yield.

Conclusion

DGRO is a solid dividend growth ETF, but it doesn’t earn a spot in my portfolio. I am turned off by their exclusion of high-yielding companies and their ability to generate a larger yield while 20% of their assets can be utilized for options. DGRO’s 2.03% yield is too low for me on a dividend-focused fund when I can get 1.42% from a standard S&P index fund and more capital appreciation. I really want to get around a 3% yield from a dividend-focused ETF, and it’s hard to make DGRO a real consideration when SCHD has a 3.69% yield, 9 years of dividend growth, and has outperformed DGRO over the past 5-years from an appreciation aspect. I am agnostic toward DGRO as it doesn’t make a case for me to allocate capital toward it.

Be the first to comment