Justin Sullivan

The Intro

While it may be more exciting to bet on industries of the future, and burn money on stocks like Tesla (TSLA) and Nvidia (NVDA), outsized returns usually come from unloved industries with cheap cash flows. When it comes to selecting sectors, famed investor Peter Lynch had some advice:

“I’m always on the lookout for great companies in lousy industries. A great industry that’s growing fast, such as computers or medical technology, attracts too much attention and too many competitors.”

This leads us to the lousy industry of mall retailers. Amid the sell-off, we believe the market is coughing up long-term returns of 15% and 16% per annum in stocks like American Eagle Outfitters (NYSE:AEO) and Foot Locker (NYSE:FL).

The Fears Are Overblown

Many fear that e-commerce will wipe out the sales of Foot Locker and American Eagle. But, to us, this thesis doesn’t make any sense. Nobody likes ordering multiple pairs of shoes online, and having to constantly ship them back and forth when they don’t fit just right. The average person tries on a number of shoes when they visit Foot Locker, likewise with American Eagle’s clothing. And, in the case of American Eagle, consumers are shopping for the company’s merchandise online. The company’s online sales are skyrocketing. American Eagle’s 2021 annual report said:

“Compared to the pre-pandemic fiscal year 2019 base, store revenue increased 3% and digital revenue increased 46%.”

While Nike (NKE) is moving to selling more online, the business is not economically practical unless Nike charges a shipping fee. The company is reportedly charging an $8 shipping fee, and it can take anywhere from 1 day to 6 weeks to receive your order.

We recently visited a Foot Locker mall outlet, and business was booming. The Foot Locker staff was fantastic, and we bought some cheap pairs of Nike sandals. The company is now selling a range of brands from adidas (OTCQX:ADDYY) to Converse to Nike, and has increased its apparel offerings. The brands and consumer mind share of American Eagle and Foot Locker allow them to enjoy industry leading profitability. They should also gain market share in the event of industry consolidation.

Why The Dividends Are Sustainable

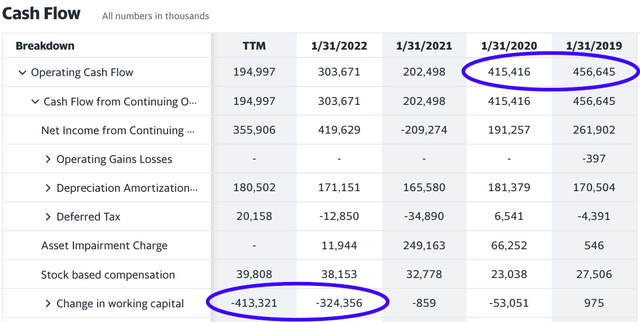

American Eagle and Foot Locker have negative free cash flow over a trailing 12-month period. Meanwhile, they have enormous net incomes. So what’s going on here? Well, let’s take a look at American Eagle’s cash flow statement:

AEO’s Cash Flow From Operating Activities (Yahoo Finance)

Here comes some boring accounting talk, but the gist of it is that Net Income is a better representation of these companies’ true earnings power. What’s going on is American Eagle and Foot Locker spent a lot of cash purchasing inventory over the past year, which shows up as a “Change In Working Capital.” This reduces their cash flow in the short term, but that inventory should come off the shelves in the years ahead. As that happens, the cash flow will come gushing back in. If you add back this change in working capital, you’ll see that American Eagle’s free cash flow is much the same as its net income, around $350 million. And, the company’s only paying out $121 million in dividends, giving you huge dividend coverage.

In the meantime, American Eagle and Footlocker have strong balance sheets, with working capital representing about 25% of their market caps. They have loads of excess cash to pay dividends and buy back shares.

Incredibly Cheap

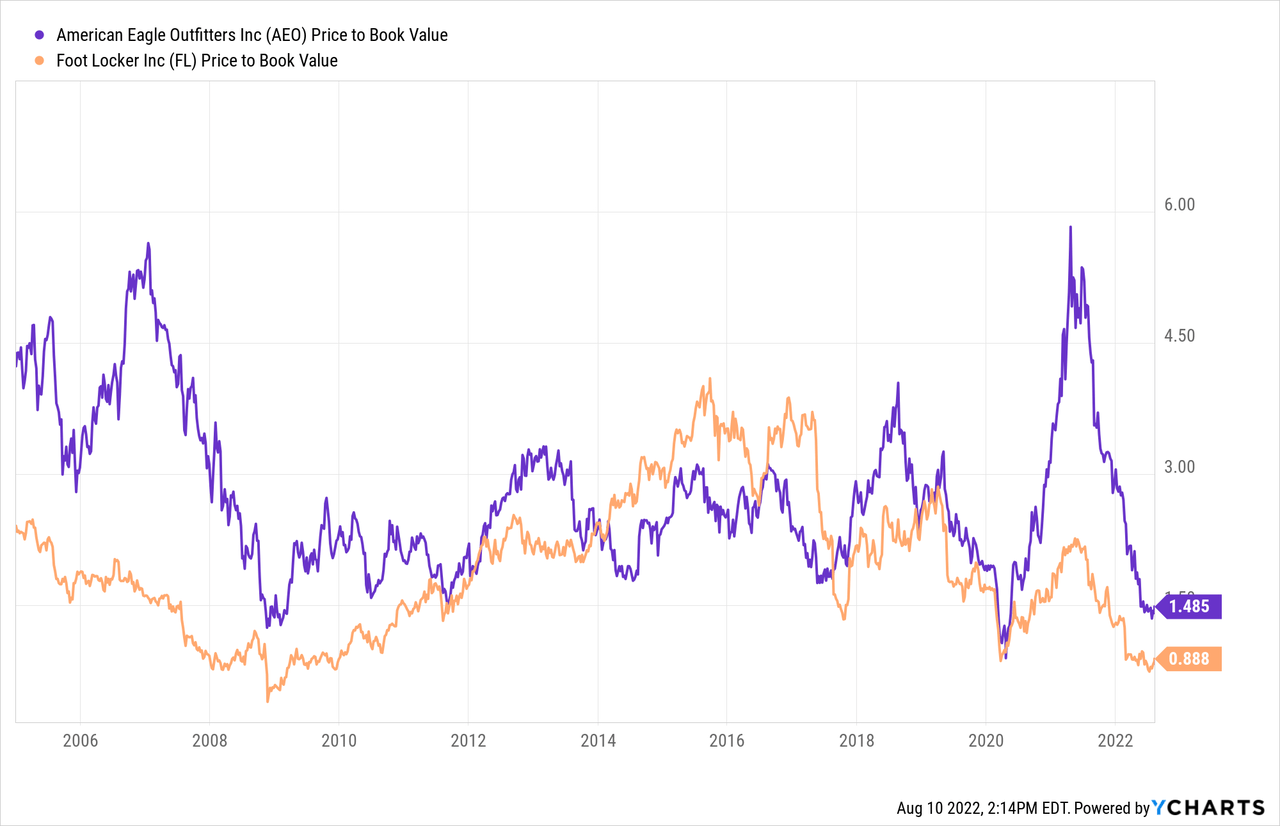

The price to book ratio of these corporations has come down markedly over time, which greatly reduces the risk of investing. In fact, Foot Locker is trading at 0.88x book value and American Eagle is trading near historic lows. With some reversion to the mean, you could get an easy double on these stocks:

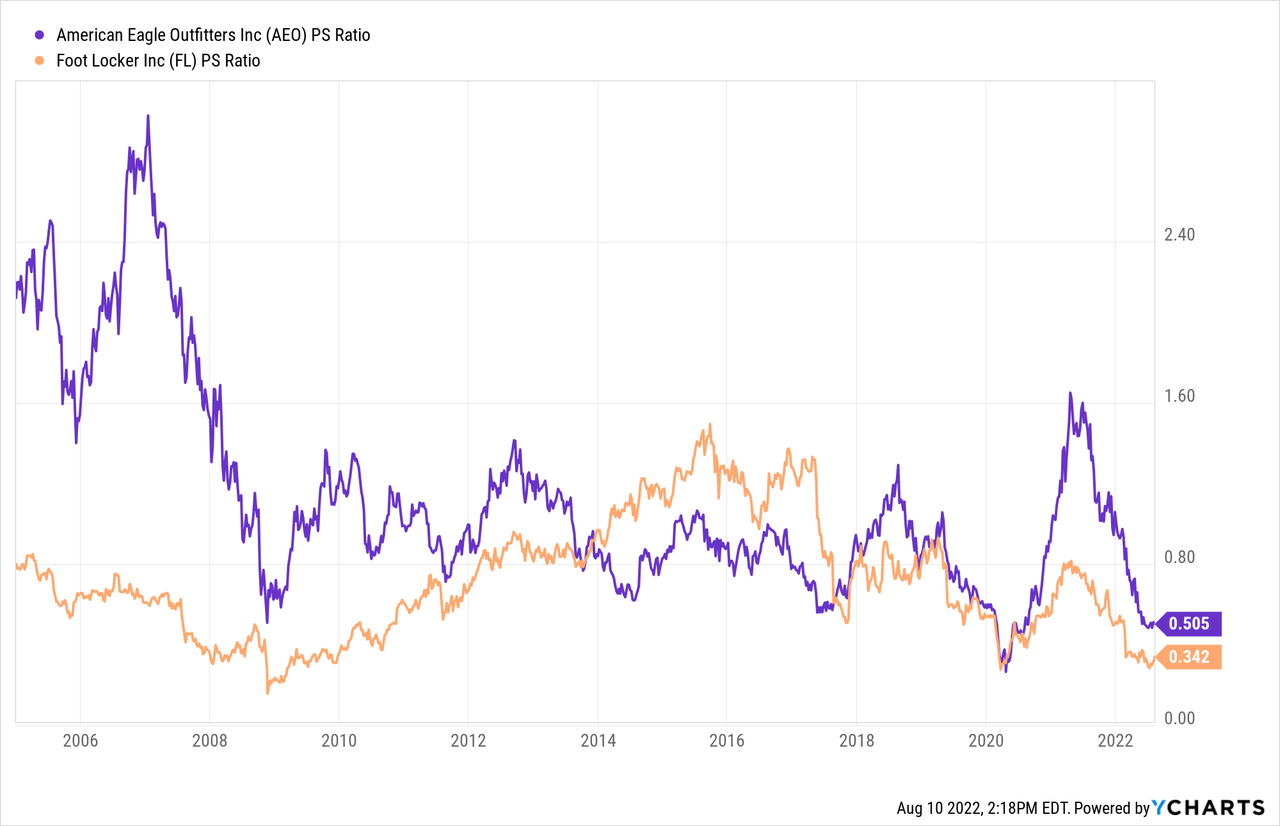

Price to sales tells a similar story:

If we compare these businesses to the S&P 500, we see just how cheap they are:

| S&P 500 (SPY) | American Eagle | Foot Locker | |

| Price to Earnings | 21.2 | 7.0 | 3.8 |

|

Price to Book |

4.2 | 1.5 | 0.9 |

|

Price to Sales |

2.6 | 0.5 | 0.3 |

| CAPE Ratio | 31.5 | 12.1 | 5.6 |

This valuation gap is bordering on the edge of insanity, in our humble opinion. If you want to sell us FL or AEO to buy the S&P 500, we’ll take that bet all day.

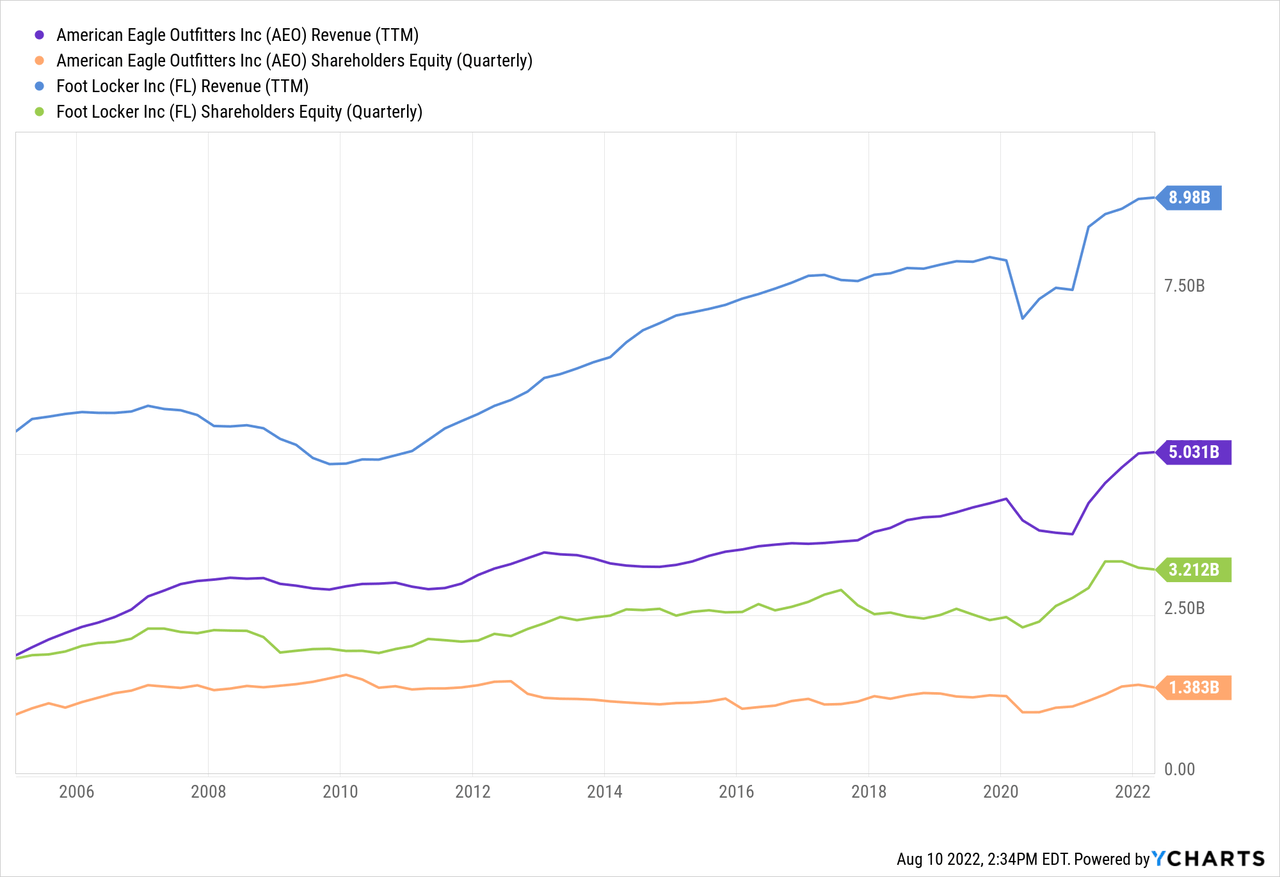

Long-term Returns

As these companies maintain their revenue on the back of strong brands, inflation, and consumer wage growth, we think you’ll get returns of 16% and 15% per annum for Footlocker and American Eagle. This is primarily the result of share buybacks boosting EPS over time. We project next to no revenue and net income growth. We’ve also projected low terminal multiples of 9x and 11x earnings in 2032. For more on the valuation of Foot Locker, check out my article: Foot Locker: A Deep Value Play.

Risks

While e-commerce has been around since the early internet days of 1999, there’s no question that companies like Amazon (AMZN) and Alibaba (BABA) have become more efficient and relevant over the years. Many believe this means secular decline for mall retailers, and it may. But, so far, these companies continue to grow:

American Eagle and Foot Locker have large capital lease liabilities. We’d like to see them completely pay down their long-term debt, as well as continue to close their least profitable stores. The management teams need to keep a clean balance sheet as the industry consolidates.

Net Income for these companies is expected to decline over the next 12 months, which should come as no surprise to investors. S&P Global gave some words of caution on Foot Locker:

Secular changes in the footwear-retailing industry, including the entrance of online players and the existing vendors’ increased focus on building their own DTC channels, have pressured the company’s performance as customers can connect directly with the brand and bypass retailers. Finally, despite the company gradually migrating from the mall, it still remains mostly in malls (about 79 percent of its fleet as of fiscal 2021), which continue to face secular challenges.

Conclusion

We think AEO and FL are an easy double over the next 5 years. We came to this conclusion by analyzing the value propositions and valuations of each business. If Peter Lynch were investing today, he may buy himself some Foot Locker and American Eagle stock. These are strong brands in a lousy industry. As industries consolidate, strong businesses gain share. We encourage you to evaluate the risks for yourself, and consider the potential for outsized returns in these unloved stocks. For us, they’re a “strong buy.”

Be the first to comment