Dilok Klaisataporn

Main Thesis & Background

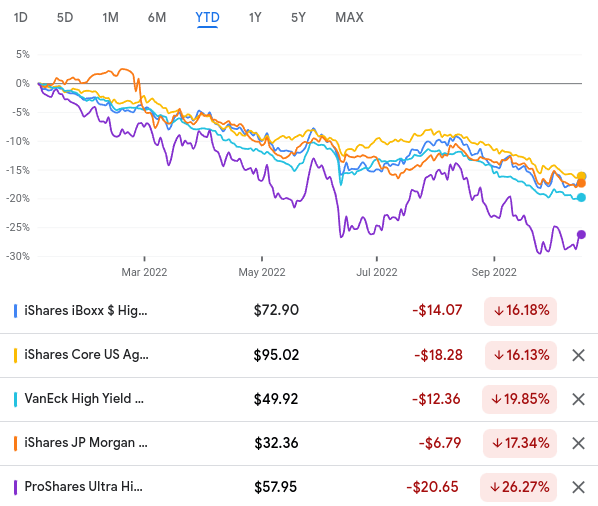

The purpose of this article is to discuss the state of the high yield credit and bond markets – both domestic and foreign. The reason for this is that fixed-income markets have been under immense pressure on a year-to-date basis. This was fairly predictable in a sense because investors anticipated the Fed to begin an aggressive interest rate hiking cycle. However, very few could have predicted how sharp the drawdowns in this space have been. Passive index funds have taken it on the chin while leveraged plays in this space have fallen even harder. For a sample of performance, see the graph below:

YTD Performance (Various Credit/Bond Funds) (Google Finance)

(The graphic shows YTD performance of the iShares Core US Aggregate Bond ETF (AGG), iShares iBoxx $ High Yield Corporate Bond ETF (HYG), iShares JP Morgan EM Local Currency Bond ETF (LEMB), VanEck High Yield Muni ETF (HYD), and ProShares Ultra High Yield (UJB)

As you can see, the market has punished broad-based bond funds, high yield credit, muni debt, and leveraged plays alike. The simple notion would be that avoiding the debt markets since year, perhaps with the exception of floating rate debt, would have been the right move.

With this in mind, should investors be thinking about high yield credit the same way going in to 2023? Personally, I see many of the same headwinds still on the horizon, which will make positive returns difficult to come by. Yet, the market is very forward looking. It is very possible that the Fed’s rate hike path will be less aggressive in 2023 and give the debt markets a welcome reprieve from what they have experienced this year. Balance sheets and default rates are also supportive – if you look in the right places. This “push – pull” mentality is what led me to want to write this review, and I will cover the macro-forces that are making this sector challenging in detail below.

Let’s Start With The Problem Overseas

To begin the review I will capture one of the primary forces rattling credit markets in 2022. This has been the Fed interest rate cycle, which is impacting credit across the board. The more obvious effect is that bond and loan prices (assuming fixed-rate debt) will decline as yields go up – and that is exactly what has been happening. The other effect is that the dollar has been rising consistently. While other central banks like the Bank of England and the Bank of Canada have also been on the rate hike path, the Fed here in the U.S. has been one of the most aggressive. The result has been a USD rise than has been straight up since 2022 got underway:

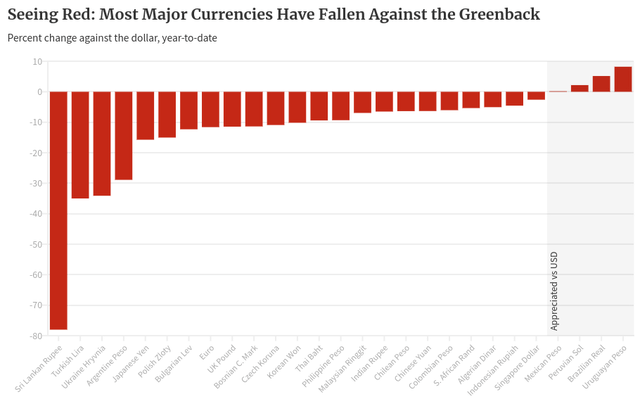

While this has posed challenges in the U.S., it also has implications elsewhere. While the dollar’s rise can be problematic for nations around the globe, those in particular who are hurt the most are emerging markets (EMS). These economies are more sensitive to currency fluctuations because their home currencies are not as stable and/or in demand as major developed currencies like the Euro, Yen, or British Pound. The result has been a sharp loss in value for many currencies in the emerging world, with only a handful of EM currencies actually rising in value against USD this year:

Foreign Currencies Dropping Against The Dollar (World Bank)

This has posed a challenge around the world and I think it bears watching because the Fed is on a path to continue raising rates for at least the next two quarters. EMs are typically very reliant on foreign investment and foreign capital, both of which can come under pressure when USD gains in value (the logic being those investment dollars will flow elsewhere).

There are other concerns as well. For the most part, when the USD rises we often see developing countries tighten their own monetary policy to head off further depreciation of their local currency. This can, in turn, send bond prices even lower. The other negative from an investor standpoint is this new rising rate environment will limit economic growth and challenge balance sheets. The worst case scenario would be this environment leading to higher levels of distressed debt and credit going into default.

The broader takeaway is a rising dollar is a major headwind for EMs. Local currencies come under intense pressure and that puts those local governments in a tight spot. If they do not take action, the local currency will keep on falling in value. This exacerbates inflation and also raises the cost of servicing USD-denominated debt. That is money that has to be pulled from somewhere, often resulting in budget gaps elsewhere.

What this means to me is that most investors are probably best off avoiding EM debt at this time. This is relevant because EM debt is often considered comparable to junk debt in developed markets because it is correlated to higher yields and lower credit quality. So many “high yield” funds, especially those that are actively managed, hold some percentage of EM debt. If one understands the risks and wants exposure to this arena anyway, I would recommend being very selective. Look to nations that are less reliant on Europe given the ongoing military and energy crises there. Consider nations that primarily export commodities (i.e Chile), as they have seen their currencies depreciate less than average and have benefiting from rising commodity prices in 2022. Other strategies would be to keep this exposure to a small percentage of total assets under management because if inflation stays hot in 2023 and the Fed remains hawkish, more pain is on the way for EM.

Amount Of Distressed Debt Is On The Rise

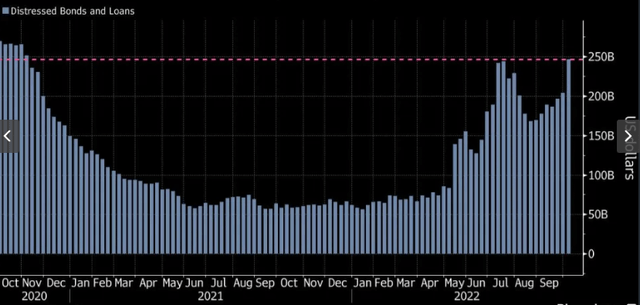

I will now dig into some concerns I have closer to home. While debt in the U.S. is seen as less risky than much of the debt that comes from overseas, that has not stopped the marked losses that have occurred this year. Much of this has been due simply to rising rates pressuring bond values. But the other side of the concern has been broader concern about economic conditions. If we see a recession (or perhaps are already in one), then high yield debt can fall out of favor. The logic is the same as what was said above – as conditions worsen then delinquent and default debt will often rise in volume.

So far, that has not yet been the case. Investment grade debt has been losing value but remaining solid from a credit perspective. High yield debt has also managed to remain current – for now. But while headline default figures are low, there is trouble brewing under the surface.

For example, risky debt is beginning to pile up. The amount of USD-denominated corporate bonds and loans trading at distressed levels rose to almost $247 billion in early October. This represents a 21% jump from the end of September:

Distressed Debt (America) (Yahoo Finance)

This is a troubling metric to say the least. It suggests that more defaults could be on the way. If economic conditions improve and corporate earnings surprise to the upside, this volume of distressed debt could decline and/or not turn into a larger problem.

But the risk here is that if the economy continues on a slow or negative growth path, that volume is almost certain to rise. If this leads to defaults, the value of high yield debt is going to fall and distributions are going to be cut. This again means that investors need to be very selective on where they put their cash at the moment. This means taking an active approach and perhaps avoiding the sectors that are most at risk right now (i.e. retail, health care, sub-sectors within real estate, etc.).

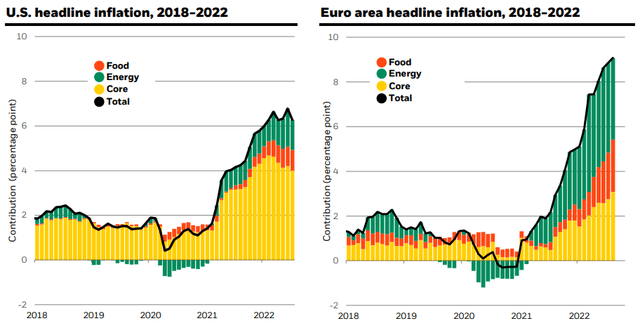

Inflation Remains A Global Problem

My final word of caution relates to the biggest thorn in the side of the market as a whole in 2022 – inflation. While the higher interest rate environment is pressuring equity and debt markets alike, the root cause of the higher rates is inflation. Central banks around the world are being forced to raise interest rates in an attempt to limit inflation’s rise. So far the effect has been muted.

The concern here is that if inflation remains red hot as it has been, then central banks like the Fed will continue on a hawkish path. If so, it is difficult to see a climate where bonds and credit markets post positive returns. This hurts high yield and IG debt alike. While investors are cautiously optimistic right now that inflation may be peaking in the U.S., the same cannot be said for other developed markets. Europe has seen inflation push higher than it has on our side of the pond, and the energy crisis expected this winter is likely to keep inflation stickier on the continent there than elsewhere in the world:

Inflation In The U.S. & Europe (BlackRock)

The conclusion I draw here is that the inflation headwind is as relevant as ever. While that story could change as we push towards 2023, readers should not be ignoring this risk. We need to be prudent on our outlooks for inflation in the short-term, and plan for further volatility in credit markets.

There Are Reasons To Be Optimistic

Through this review I have certainly struck a more negative tone. But I started off by saying this is a “push-pull” environment. That means there have to be some positive attributes to balance out the negative – and there are.

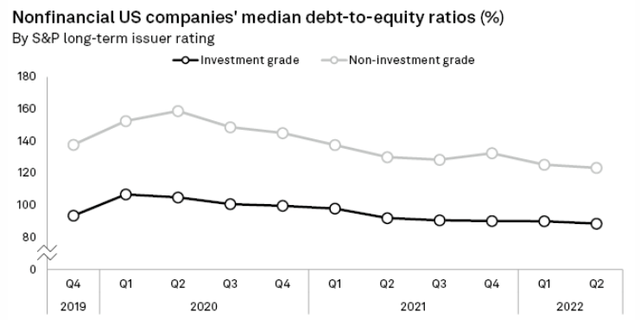

The first is that corporate balance sheets have been improving, on average. During the past two years of ultra-low interest rates, companies stocked up on low yielding debt. This allowed them to raise cash, and they are now reducing those cash stockpiles by paying down debt. This is a net positive for cash-rich companies when debt matures in a rising rate environment. If they needed the cash, they would have to refinance at higher rates, increasing their borrowing costs. But they have been paying down this debt instead, which is prudent management in my view. As a result, debt ratios are now significantly lower than the pre-pandemic level across both IG and non-IG sectors:

Debt – Equity Ratios (S&P Global)

The takeaway is this is broadly good for debt-holders and investors. On average, corporate America is in a relatively health position. This means income streams should be resilient.

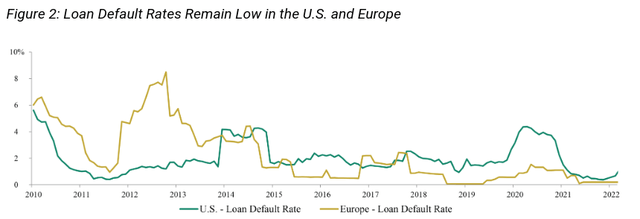

Not surprisingly, this has also led to an environment with historically low default rates, despite the all the challenging macro-headwinds:

Loan Default Rates (OakTree Capital)

I take this as support for at least some positioning to credit. Well, rising distressed debt levels could pressure both of the attributes mentioned, the reality is that right now the average company is in a healthy position and defaults have not been materialized. This continues to warrant some caution in the form of staying away from the debt from companies most at risk. In this light I would go with an actively managed fund by managers you trust, or remaining in passive index funds that avoid the riskiest rated assets.

Opportunity If Inflation Has Peaked

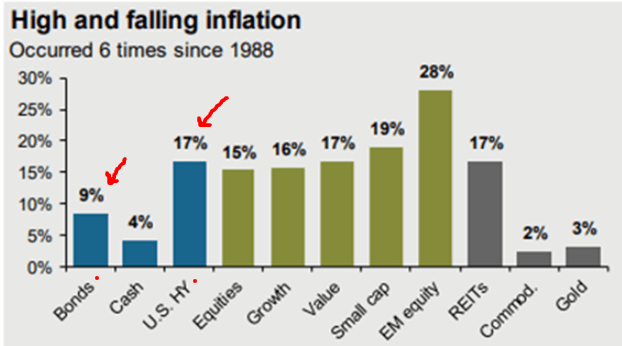

The next attribute to consider is historical performance. As we know, inflation and higher rates have been a net negative for bonds and credit. But there is a possible path to a brighter future. History suggests that if inflation remains high, but begins to fall, U.S. high yield credit in particular could be set up for a nice run. Bonds as a whole too often experience strong gains in this scenario:

Annualized Returns When Inflation Is High, But Falling (JPMorgan Asset Management)

This graphic shows that risk-on in general performs well once inflation starts to fall, even if it remains relatively high. This means that bonds and high-yield credit could partake in a broad-based rally and support the idea that using these sectors for diversification continues to have merit going forward.

Yield Curve Inversion Suggests Caution

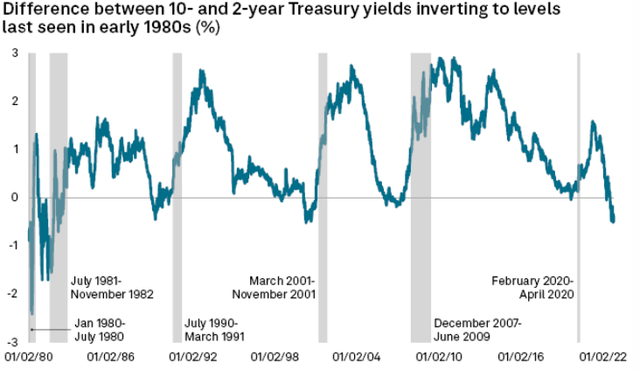

My last point is to remain vigilant and within your risk tolerance in this market. While there are signs that point to brighter days ahead, other signs suggest we could see more pain. For example, the yield curve has inverted to a level that suggest investors are anticipating a recession. If that is the case, junk debt in particular will also certainly get less valuable:

Yield Curve Inversion (Federal Reserve)

I view this as a reason to avoid getting too bullish on those heavily leveraged CEFs that are popular to play these spaces. As the yield curve inverts, the cost of paying for that leverage increases and the opportunities to earn higher yields on assets with longer date maturities dwindles. With this backdrop, leveraged CEFs could continue their under-performance, and readers need to evaluate this risk closely before initiating or adding to positions.

Bottom-line

High yield credit has been a big loser in 2022. This story has some chance of turning around in 2023, but only under the right circumstances. Inflation has to at least peak, and ideally fall, prompting central banks to pump the brakes a bit. Further, while defaults have been low, the amount of distressed debt has been piling up. This means credit conditions could become a lot worse if we start to see a prolonged recession. Finally, the rise of the dollar does not impact everyone equally. This disproportionately hurts EMs, and investors will want to avoid the debt from countries most at risk of a strong USD. Ultimately, I hope this review provides readers with enough information to make informed decisions on their credit investments as we wrap up 2022.

Be the first to comment