NicoElNino/iStock via Getty Images

Investment Thesis

Exela Technologies (NASDAQ:XELA) is a relatively small company that aspires to be a leader in the field of business process automation (“BPA”). Right now, looking at how the company is described in Gartner’s report, it achieved some success but is nowhere near the status of a ‘market leader’.

Financially, it is inferior to its closest competitors in all the top to bottom line items. It is also financially very leveraged in debt. Although the debt amount is declining significantly in the last 3 quarters, it is unclear whether this declining trend will persist in the long run.

The product of ‘DrySign’ has made notable expansion outside of the US market. However, looking at the current size of its user base, it still pales in comparison to other alternative products.

The company is currently undervalued but without a clear track record of maintaining and growing its profitability to greater heights, this undervalued status should not be regarded as a buy signal.

Company Overview

XELA prides itself as a leader in BPA. Through its digital transformation solutions, it helps customers enhance quality, productivity, and end-user experience.

From the company’s latest annual report, we understand it operates through three segments:

- Information & Transaction Processing Solutions (“ITPS”) – this segment comprises 74.9% of the company’s revenue

- Healthcare Solutions (“HS”) – this segment comprises 18.7% of the company’s revenue

- Legal & Loss Prevention Services (“LLPS”) – this segment comprises 6.4% of the company’s revenues.

While the company provides services to a global customer base, more than 80% of its revenue comes from the United States.

Unclear Competitive Advantage

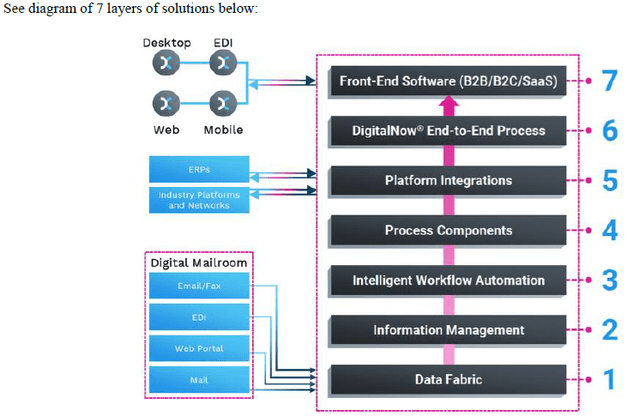

The company described its BPA solution as a 7-layer framework in this diagram.

7 Layers of Solution (Company Annual Report)

Basically, the company is trying to provide a whole suite of automation at “all levels” of a typical company’s operations:

- Layers 1 and 2 handle the heavy lifting of “data crunching”, with the results ready to be used by the higher levels of automation.

- Layers 3 and 4 automate the day-to-day workflow and processes that would otherwise have to be done manually by people.

- Layer 5 connects different platforms of a company to work together synergistically to enhance overall productivity. Without this layer, the different platforms will be working in silos.

- Layers 6 and 7 appear to be empowering business users to execute business processes using multiple front-end digital channels as opposed to having to follow written instructions manually.

Such BPA services are also provided by many other companies. In the company’s latest annual report, XELA prides itself on having gone the extra mile to deploy many employees to work on-site at customers’ premises:

“Approximately 3,200 of our employees currently work at customers in an on-site capacity. We believe this on-site presence is a competitive differentiator and a valuable asset as we pursue future growth opportunities.”

In my opinion, they appear to be taking on the role of “IT Consulting”, which means the company will have to compete with other consulting firms like Accenture (ACN), which is the largest consulting firm in the world.

It is unclear how the company will fare in the long run against these competitors.

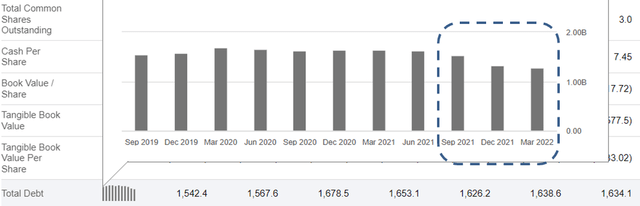

Tapering of Debt

XELA is highly leveraged. Its total debt of 1,276M is currently 15 times its EBITDA of 83.9M.

The silver lining is that over the last 3 quarters, XELA has managed to reduce its debt substantially.

Investors need to monitor whether this debt reduction trend can persist. In my opinion, ideally, in the long run, the debt should be reduced to no more than 3 times its EBITDA.

Prospect of DrySign

‘DrySign’ is a proprietary eSignature platform that was launched in 2020 to the public in the United States. Subsequently, it has expanded its release to the Indian, UK, and the Philippines market.

As part of the company’s BPA solution stack, DrySign has “4,000 customers across a variety of industries, including over 60% of the Fortune 100”, according to the latest annual report. This does not appear so impressive given that alternatives like Adobe (ADBE) Cloud has 26M subscribers and DocuSign (DOCU) has 1M customers.

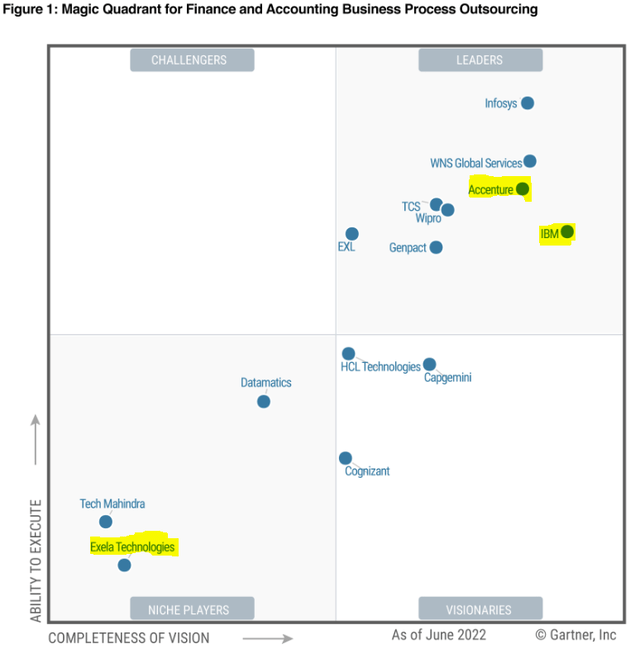

Niche Player in 2022 Gartner Magic Quadrant

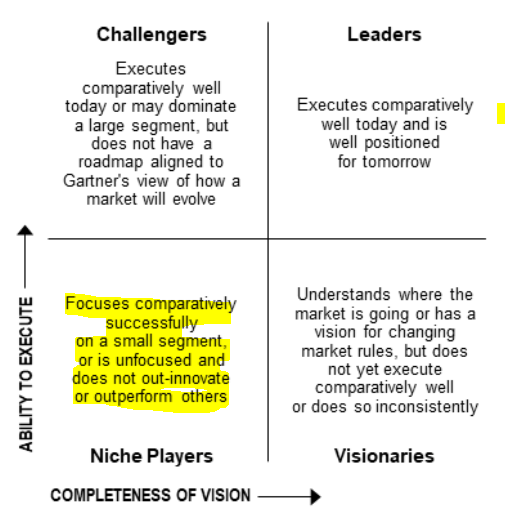

XELA was recently named a niche player in the 2022 Gartner Magic Quadrant. According to Gartner, this is how a “niche player” is defined:

Gartner Magic Quadrant (Gartner)

Based on this definition, companies should aim to be located towards the upper right corner of the quadrant to become clear market leaders in the industry. Right now, this spot is occupied by well-known leaders like IBM (IBM) and Accenture.

Company Named a Niche Player (Exela Technologies)

In my opinion, as a “niche player”, XELA still has a lot of work to do to become one of the market leaders.

Competitors

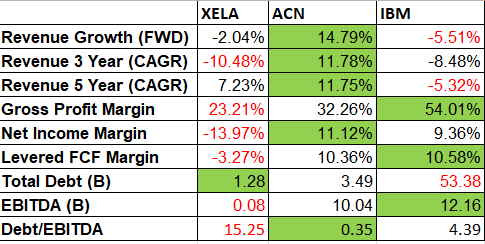

We will compare the financial profile of XELA with the market leaders of Accenture and IBM.

Financial Comparison (Seeking Alpha)

We can understand that:

- ACN has a very clear advantage in terms of top-line growth. The top-line revenue of XELA and IBM has declined over the last few years.

- Although IBM has not been growing in terms of top-line revenue, it is still positive in the bottom lines of gross and net margins. As an established market leader, it might be able to sustain a few years of low to no growth. XELA, as a “niche player”, needs to demonstrate that it is nimble enough to rise above the competition from these market leaders. Right now, we are not observing these in its bottom line margins.

- XELA is the only player in the comparison list that is negative in free cash flow while the other 2 players are already cash positive.

- XELA has the least amount of debt by absolute amount. But this is 15 times its EBITDA, the highest among the comparison list. As mentioned earlier, ideally, I would consider a healthy debt profile to be at most 3 times its EBITDA. Right now, XELA is nowhere near such a healthy debt multiple.

XELA is clearly not profitable in terms of all levels of the gross, net, and free cash flow margins. It is common for a much smaller “niche” player to be unprofitable while it is focused on growing its top-line revenue. However, this is not the case for XELA.

Gartner’s inclusion of XELA in its ‘Gartner Magic Quadrant’ as a ‘niche player’ suggests it displayed some ‘potential’ business quality that might one day translate into some competitive advantage. Right now, we are not seeing this reflected in its financial profile.

Valuation

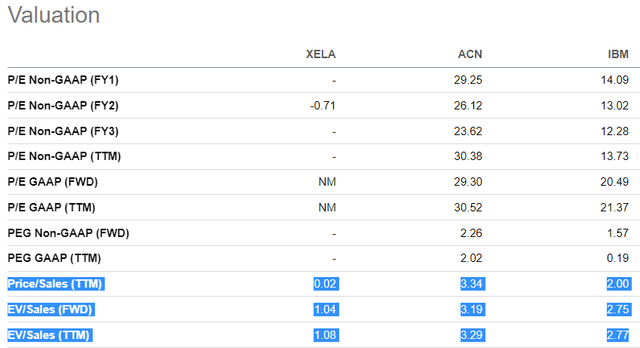

XELA is neither profitable in net income nor cash flow positive. We cannot value it using discounted free cash flow or net income. We will infer from Seeking Alpha’s valuation ratios to understand how it fares with respect to its competitors.

Since it is not profitable, it is more meaningful to look at the ratios that are denominated by top-line ‘Sales’. If we do that, XELA does look undervalued with respect to ACN and IBM.

However, without a proven track record of improving profitability margins, cheap can get cheaper so I will not regard this undervalued status as a buy signal.

Conclusion

XELA is a relatively small ‘niche’ player in the BPA market. It is nowhere near achieving market leadership, in spite of the company claiming to be a ‘leader’ in this segment.

Niche players can rise above the competition of current incumbent leaders. But to do that, XELA needs to demonstrate its ability to grow at a much faster pace than its competitors, at least at the top line revenue. Right now this is not happening yet.

Although the stock price looks undervalued now, long-term investors should hold and observe whether the company’s growth prospect improves significantly before taking a significant position.

Be the first to comment