xavierarnau

Significant Stock Price and Dividend Upside

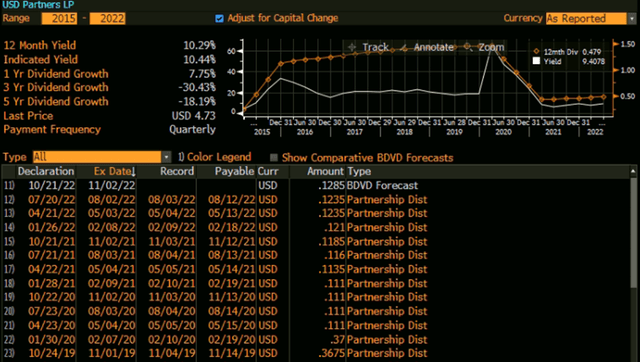

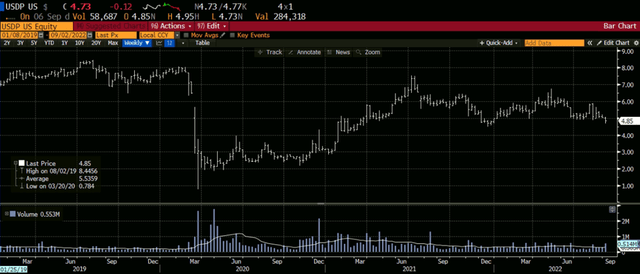

USD Partners (NYSE:USDP) is a Master Limited Partnership that provides transport and logistic services for crude oil, biofuels and energy-related products in the US and Canada. After COVID-19 hit in early 2020, USD Partners cut its distribution sharply. This also resulted in a nearly -55% fall in the stock price from its 2019 high of $11.75. In the last five quarters however, distributions have again been inching up. This we think will continue over the next couple of years.

Additionally, with limited exposure to commodity prices, and long-term take-or-pay contracts with investment grade customers, the business has a very stable revenue stream. This combined with its attractive valuations, likelihood of an increase in distributions and improving balance sheet makes the stock an attractive investment opportunity. We see potential for the stock to return to its pre-COVID levels of $8.00 as these catalysts play out.

Bloomberg

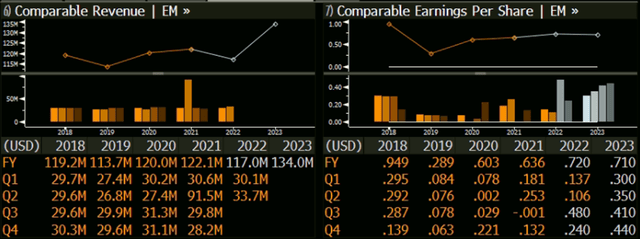

The stock currently trades at a P/E of 6.6x/6.4x for 2022/2023 with a dividend (partnership distribution) yield of 10.4%/11.8% for 2022/2023. FCF yield for the stock stands at 27.4% and 31.9% in 2022 and 2023, respectively.

Bloomberg

We value the stock at a very conservative P/E of 10x on our 2023 EPS estimate of $0.81. This brings us to a target price $8.00, a 70% upside from the CMP.

Weak 2Q Results, But Outlook Favorable

USD Partners announced a weak set of 2Q22 results recently. The company has also recast its 2Q21 results following the acquisition of Hardisty South. 2Q22 revenue was down 63.0% YoY largely due to lower revenues from terminalling services. This was because of lower revenue at Hardisty South which had seen higher revenues in 2Q21 on account of an early contract cancellation payment. Lower contracted volumes at the Stroud Terminal reduced sales too. The end of a customer contract in September 2021 also lowered storage revenue at the Casper Terminal. Adjusted EBITDA and distributable cash flows were down 29% YoY. Net income fell 44.7% YoY as lower revenue and higher interest costs hit performance.

Bloomberg

Contracts representing 26% of the combined Hardisty Terminals capacity expired as of June 2022. This is in addition to the remaining contracted capacity at the Stroud Terminal which also ended in June 2022. Management continues to work toward renewing, replacing or extending its agreements at these two terminals and given the current scenario, expects that they should have the opportunity to do so in the second half of 2022/early 2023.

For 2Q22 USD Partners has a distribution per share of $0.1235, which is flat from the prior quarter. The company also has closed the acquisition of the Hardisty South Terminal and completed simplifying its partnership structure.

Risk Factors

Cut in distributions – USD Partners has been increasing its distributions over the past one year, and this is expected to continue looking ahead. However, if this doesn’t materialize and distributions fall going forward, USD Partners stock price could be hit, as it was during the COVID period in 2020.

Contract terminations – The company operates mainly through long-term contracts with its customers. Non-renewal of contracts and/or any loss of customers will impact the company’s financial performance.

Worsening margins – While USD Partners does not take any commodity risk, in the current inflationary environment, a worsening of margins could clearly impact financial performance.

Economic downturn – USD Partners distributions and revenues could be negatively impacted in a recessionary economy.

Conclusion – Yield plus Capital Appreciation

USD Partners offers investors with an attractive distribution yield that we expect will only increase from here. With a stable business, growth opportunities from the recent acquisition of Hardisty South terminal assets, and strong free cash flow generation, we believe the downside to the stock is limited. The stock is already down nearly 55% from its 2019 highs and offers investors with a good entry point. The stock trades at relatively inexpensive valuations of 6.6x/6.4xP/E for 2022/2023. Importantly, we estimate dividend (partnership distribution) yield of 10.4%/11.8% for 2022/2023. We have a target price of $8.00 for USD Partners which implies an upside potential of 70%.

Be the first to comment