Alina Lyssenko

I predict future happiness for Americans, if they can prevent the government from wasting the labors of the people under the pretense of taking care of them. ― Thomas Jefferson

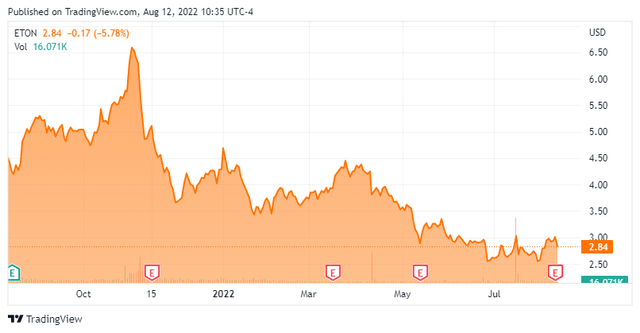

It has been almost a year since our last piece on Eton Pharmaceuticals (NASDAQ:ETON). The stock shot up soon after that article was posted but has been in pullback mode since. The company posted second quarter results earlier this week. Given that it seems a good to revisit this small cap name. An analysis follows below.

Company Overview

Eton Pharmaceuticals is a commercial-stage biopharmaceutical concern based in Illinois. The company is focused on improving the formula, delivery, and/or safety of approved drugs employing the 505(B)(2) regulatory pathway. The stock currently trades just below three bucks a shares and sports and approximate market capitalization of $75 million. The company is in the early stages of commercialization with several products and has several more than could potentially launch over the next year.

May Company Presentation

The company breaks down its focus to two main areas. There are royalty products. These are products that are handled by partners with established salesforces for which Eton will get paid milestone payouts as well as royalties on sales. There are Orphan Drug Products which Eton will sell under its own label and have the greatest potential to impact margins and earnings. The company has recently launched two drugs in that category.

May Company Presentation

The first of which is Carglumic Acid tablets. If the company eventually meets its market share goals, this could be roughly a $15 million product annually.

May Company Presentation

Alkindi Sprinkle as described above is a much bigger potential opportunity and leadership believes this product could eventually do $100 million in annual sales. The product is ‘co-promoted‘ by Tolmar Pharmaceuticals through their 60 plus sales reps.

The company had a Hospital Products division that was gearing up for several commercial launches. However, in late June, Eton sold the rights and interests in Biorphen, Rezipres and Cysteine Hydrochloride products in that division to a subsidiary of Dr. Reddy’s Laboratories (RDY). This deal came with a $5 million upfront payment as well as potential additional payments of up to $45 million, based on the achievement of certain event-based and sales-based milestones. This allows Eton to focus solely on its rare disease product portfolio.

Second Quarter Results

The company posted second quarter numbers on August 11th. Eton had a GAAP loss for the quarter of six cents a share. The consensus was projecting a slight profit for the quarter. Revenues did rise over 140% on a year-over-year basis to $7.4 million, which was slightly below expectations. It should be noted most of revenues was for milestone payments including the $5 million payment netted for the disposal of the assets in its Hospital Product division. Carglumic Acid sales saw 100% sequential growth and Alkindi Sprinkle sales were up 34% from the first quarter of this year, but both are coming off very low numbers as they are at the beginning of commercial launch phase.

Zonisade was approved in July and will be marketed by Azurity Pharmaceuticals. During the quarter, Eton made good progress addressing FDA concerns about its marketing application for dehydrated alcohol injection. The company expects to resubmit the application for the product later this year. Approval and launch should occur in 2023. With approval, Eton would one of only 2 suppliers in this approximate $80 million annual market due to the orphan drug exclusivity protections.

Management also continue to progress the development of its ZENEO® hydrocortisone autoinjector. A marketing application for this product should be filed with the FDA in 2023.

Analyst Commentary & Balance Sheet

The company ended the second quarter with $17 million in cash and marketable securities on the balance sheet after posting a net loss of $1.6 million in the second quarter. The company also is entitled to receive an additional $5 million milestone payment upon the launch of the recently approved Zonisade™ product. Approximately five percent of the outstanding float in Eton Pharmaceuticals is currently held short. There also has been no insider activity in the shares so far in 2022.

Several months ago JonesTrading reissued a Buy rating with a $10 price target on ETON. This week, H.C. Wainwright did the same with a $9 price target. That is the only analyst firm activity I can find on this stock so far in 2022.

Verdict

The one analyst firm that has posted projections, has the company losing 39 cents a share on flat revenues of $21.5 million in FY2022. For Y2023, that loss is expected to narrow to 8 cents a shares as sales rise to $37 million.

The company has launched a couple of key products since we last visited. The balance sheet seems in good shape given the low cash burn rate at Eton, the upcoming $5 million payout for the recent Zonisade approval, and potentially $45 million from its agreement around its Hospital Product division.

That said, its key commercial launches are in the very early stage and there is little in the way analyst coverage or projections around the company. The company is complicated but potentially compelling ‘sum of the parts’ story given its only $75 million and several products on the market. Therefore, the shares seem to merit a small ‘watch item‘ holding while investors get more visibility around Eton’s sales ramp in the coming quarters.

If you can convince people that freedom is injustice, they will then believe that slavery is freedom. ― Stefan Molyneux

Be the first to comment