Igor Borisenko

ICD Is Due For A Rise

I covered Independence Contract Drilling’s (NYSE:ICD) strategies in my previous article, where I discussed why its management believed demand for the pad-optimal super-spec rigs in some US basins would increase. In 2022, based on the current contracts, rigs re-rating, and additional rigs that will come through in Q4 and into 2023, its operating margin will likely improve further. More than a third of its backlog extends into 2023 at an average day rate that is higher than the current rate in the market. Upgrading 200-series rigs to 300-series specifications will accelerate margin expansion while minimizing the capex rise.

On the other hand, relatively few operators require rigs with such high specifications. However, complex rig systems like ICD’s 300-series rigs will see demand rising with contiguous acreage and more pad-optimal drilling. Negative cash flow is concerning, though. The stock is relatively undervalued versus its peers. At the current price, I would suggest investors buy the stock.

Outlook And Rig Strategy

ICD looks to strike short-term deals because its management believes shorter-term contracts are in the early stages of the current energy market upcycle. Its 300-series rigs are already earning higher margins in the current environment. It will continue to hold a balanced portfolio approach in its contracting strategy but with a higher share of near-term contracts.

Before the Q2 earnings results, 60% of ICD’s 24 marketed rigs met the 300 series specification. Currently, it has added two more marketed rigs. 96% of its 26 rigs would now be marketed with 300 series specifications. Upgrading 200-series rigs to 300-series specifications will accelerate margin expansion because it will strengthen its competitiveness in the market. The conversion of the two 200-series rigs is scheduled for Q3 and early Q4. Each conversion would cost the company $650K.

Product Mix Change And Day Rate Improvement

The company’s focus on short-term pad-to-pad contracts and operating the 300 series rigs have yielded positive results. Spot rates are in the low-to-mid-30Ks. For the 18th rig, the contract duration has increased to one year in Haynesville. It has also signed a few other contracts for six months. Because 300 series rigs are in the shortest supply, their prices command a premium. From Q2 2020 to Q2 2022, its average number of 300 series rigs increased from three to eight. By 2022, it will reach ten, and more will be available for reactivation in 2023.

However, fewer operators require rigs with such high specifications today. But I expect, with contiguous acreage and more pad-optimal drilling, such complex rig systems will see demand rising. With a steady backlog and rig reactivation, the company will likely enter 2023 with a firm foot.

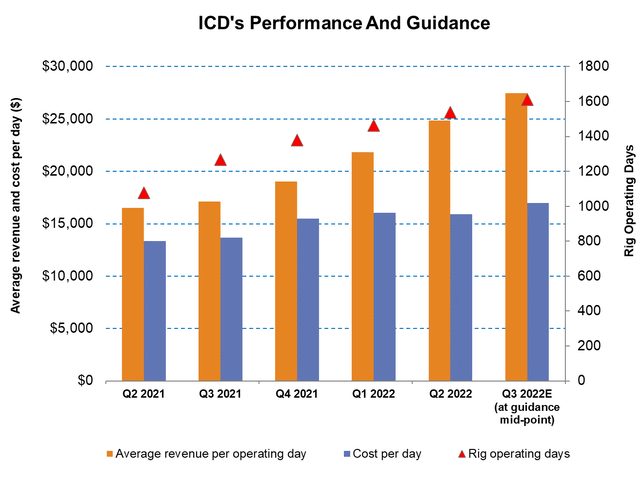

The Q3 Forecast

In Q3 2022, rig operating days can increase by 5% compared to Q2, while the average revenue per operating day can move up by 10%. The cost per day can increase by 7%. This would lead to a ~15% rise in average rig margin per operating day in Q3. In Q4, the operating margin per day can improve further (by 14%). I think spot market pricing and operating costs will remain stable, which, along with higher revenues, can raise its margin expectation.

The margin outlook is based on the contracts it has on hand and the re-rating of a significant number of rigs in Q3 and 2023. So, with the addition of the 300-series rigs (following the upgrade), the company expects the margin expansion to continue in 2023.

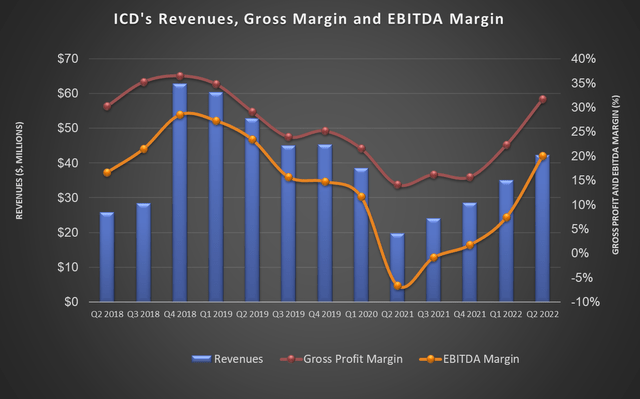

Analyzing The Q2 Drivers

From Q1 2022 to Q2 2022, the company’s revenue per day increased by 5%, while cost per day decreased marginally (by 1%). A continued market share gain of the 300 series rigs, improved marketing strategies, and establishment of a presence in Haynesville contributed favorably to a 56% jump in the average rig margin.

The number of ICD’s rigs operating on short-term contracts will re-price 1x-2x in 2H 2022. It also estimates that ~36% of its backlog will have an average day rate of $32,000 per day in 2023, which is higher than the current day rate. So, I think its operating margin will improve in the coming quarters.

Cash Flows And Liquidity

In 1H 2022, ICD’s cash flow from operations (or CFO) turned marginally positive compared to a negative CFO a year ago, led by a revenue increase. However, capex exceeded CFO, so free cash flow (or FCF) remained negative in 1H 2022. Although the day rate and margins expansion will improve CFO, new rig addition and upgrades will keep pushing capex, leaving FCF under pressure.

As of June 30, ICD’s debt-to-equity stood at 0.58x. This is much lower than the average of peers (NBR, HP, PTEN). Its liquidity was $21 million on June 30. During 1H 2022, it received $157.5 million in proceeds from borrowings under the convertible debt while it repaid a term loan. The liquidity sources would allow for two new rig reactivations in 2022 and six more in 2023.

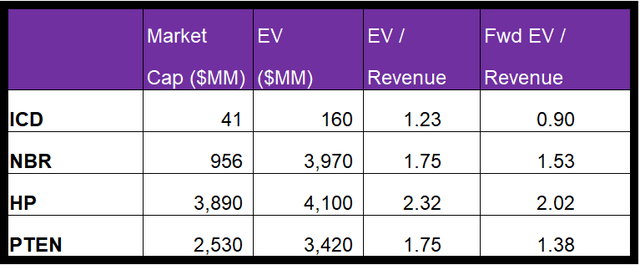

What Does The Relative Valuation Imply?

Its current EV/Revenue multiple (1.2x) to the forward EV/Revenue multiple (0.9x) contraction is steeper than its peers’ (NBR, HP, and PTEN) average fall, implying a higher revenue growth. This, in turn, typically reflects in a higher EV/Revenue multiple. However, the stock’s current multiple is lower than its peers (1.9x). I think the stock is undervalued versus its peers at the current level.

Target Price And Analyst Rating

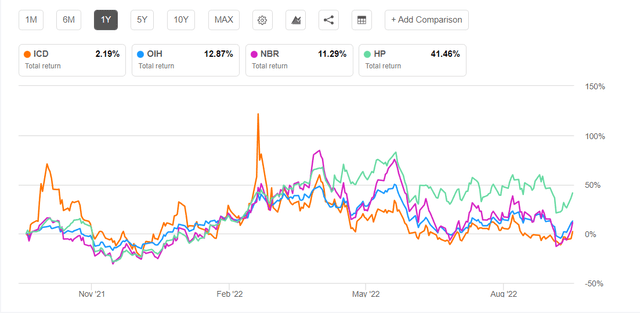

During the past 90- days, a Wall-street analyst rated ICD a “Buy” (“Strong Buy”). None rated it a “Hold” or “Sell.” The consensus target price is $7.0, which yields ~115% returns at the current price.

Why I Upgraded ICD?

My previous article about ICD was moderately bullish. While contract re-pricing and increasing the day rate would boost the operating margin, I was somewhat concerned about the short-term nature of the contracts. Running on spot rates, in my opinion, was less reliable than having longer-term or term contracts for rates, allowing for margin and cash flow stability. I wrote:

The primary challenges for ICD are intense competition and supply chain issues as the economy recovers from the pandemic. Because all of its contracts are due for re-pricing after October, its entire fleet can re-rate at current market day rates by Q4. Many contract drillers are not reactivating the legacy drilling rigs owing to low day rates and unprofitable contractual terms.

After Q2, I see some of the factors are still in play (e.g., the prevalence of spot rate), but the management is confident enough to plan precisely for rig additions in 2022 and multiple rig reactivations in 2023. The contract duration, at least for some, will increase. Relative valuation-wise, the stock is at a more attractive level. So, I’ve upgraded ICD to a “buy.”

What’s The Take On ICD?

In 2022, ICD plans to market most of its rigs with 300-series specifications, while upgrading 200-series rigs to 300-series specifications will accelerate margin expansion. Its average number of 300 series rigs increased from three in 2020 to ten by 2022. It can add six more through reactivation in 2023.

The primary challenge for ICD is the intense competition. Also, relatively few operators require rigs with such high specifications. However, the situation is due for a change, while more pad-optimal drilling requires complex rigs. Negative cash flow is a mild concern, too. The VanEck Vectors Oil Services ETF (OIH) has outperformed ICD over the previous year. With relative valuation placing the stock at an attractive place, returns from buying the stock should be a handful.

Be the first to comment