DmitriiSimakov/iStock via Getty Images

It’s been about 8 ½ months since I wrote my latest cautious piece about John Wiley & Sons Inc. (NYSE:WLY) (NYSE:WLYB), and in that time the shares have fallen about 29.8% against a loss of 18.4% for the S&P 500. Given that I’ve written short puts against this name for a while now, I’m obviously comfortable owning the name at the right price, and so I want to explore whether or not we’re near that level today. After all, a stock trading at a price of $38.87 is, by definition, a less risky investment than that same stock when it’s trading at $56.21. I’ll determine whether or not I want to buy at current levels by looking at the most recent financial performance, focusing primarily on the dividend. I’m also going to review the valuation, as I’m of the view that an investor’s future returns are largely a function of the price paid for a given stock. Finally, I’m chomping at the bit to write about my options trades on this stock for two reasons. First, doing so gives me an opportunity to brag, and I’ll never pass up such an opportunity. A distant second motivation for writing about options is to introduce investors to the risk reducing, yield enhancing potential of these. If you’re not yet familiar with what short puts can do for you, I would recommend you make yourself so.

It’s time, yet again, for the “thesis statement.” I provide this paragraph as a service to my busy readers who want to understand the flavor of my thesis before deciding whether or not it’s worth their time to dive into the entire article. This is one of the many ways that I try to make your lives as pleasant as possible. You’re welcome. I think the most recent financial performance here was fairly bad, and I think the company itself is doing the financial equivalent of “battening down the hatches,” and that’s never a great sign, in my view. The capital structure has deteriorated fairly substantially, and that’s also troublesome in my view. Worst of all, I’ve reviewed the dividend and I think it’s barely sustainable at best. At the very least, I’ve concluded that the company can maintain the dividend, or continue its habit of acquiring, but it can’t do both. Against this backdrop, the shares are cheaper, but they’re not cheap enough in my view. I think there’s a very real chance that the dividend will be cut, and I think that will have a very obvious impact on the stock price. I’d need the shares to trade at a very, very significant discount before buying. Finally, I offer some of the specifics of the risk reducing, yield enhancing potential of put options. I’ve sold these as a way to generate decent (sometimes very decent) premia while reducing the risk of my stock exposures. If you’re not yet familiar with these tools, I highly recommend them.

Financial Snapshot

I want to focus most of my time here to the dividend because I think it’s most relevant to investors. The dividend is itself supported by what goes on in the business at large, though, so I feel a need to offer at least some commentary on financial results more broadly.

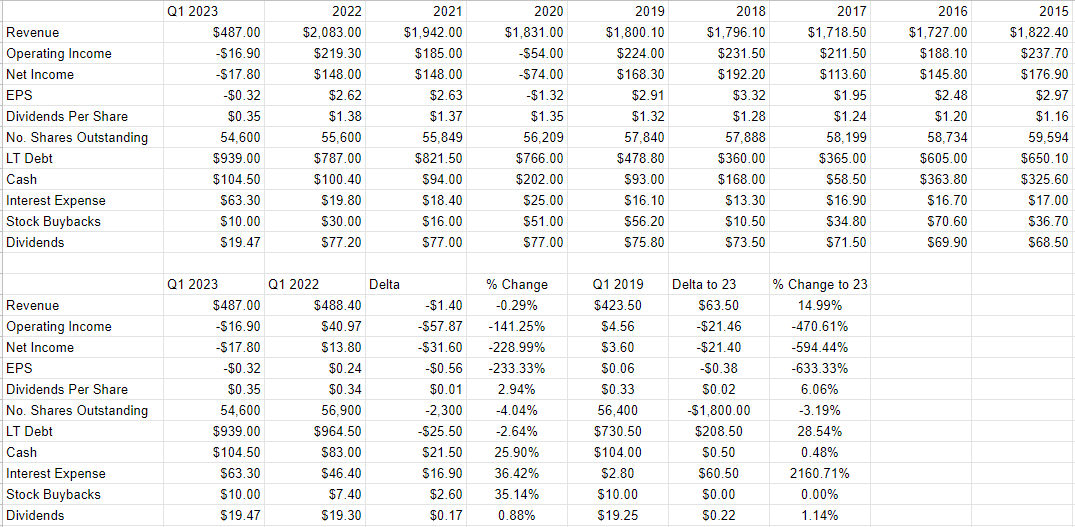

I’d characterize the most recent financial quarter as being “mixed to generally bad.” On the one hand, we saw sales rise nicely relative to the pre-pandemic period, up fully 15% against the first quarter of 2019, they were down slightly (by .3%) relative to the previous year. Additionally, net income was fairly bad over the most recent quarter, given that the company posted a $17.8 million loss for the first three months of the year. In fairness, this was largely driven by a $22.4 million restructuring charge, but even if we apply some magic thinking and add this back, net income would have come in at $4.64 million for the quarter, which would be down 66% against the previous year. Also, I think the restructuring expense suggests the company is girding for a slowdown in the business. They took the charge because they shuttered some real estate, and paid $12.1 million in severance charges. I think this offers a clue that the company itself is in the mood to conserve resources as much as possible.

At the same time the company saw the business generally slow, the capital structure deteriorated fairly dramatically. Over the first three months of this year, long-term debt increased by ~$152 million or 19%. Not only does this increase risk here in my view, I think there’s a good chance that this will at some point impact the dividend.

Dividend Sustainability

As I promised/threatened at the beginning of this section, I’m going to focus on dividend sustainability as I think it’s highly relevant in this case. Dividends have two obvious benefits. First, dividends are supportive of price, meaning that the shares of the payers of sustainable dividend cannot drop below a certain floor before they find a bid. Second, they obviously aid investors in financial planning. For these reasons, I think it’s worth spending a fair bit of time exploring whether or not the dividend is sustainable here. If the company is obliged to cut the dividend at some point, I think we can agree that the effect on the shares would be pretty inevitable and immediate.

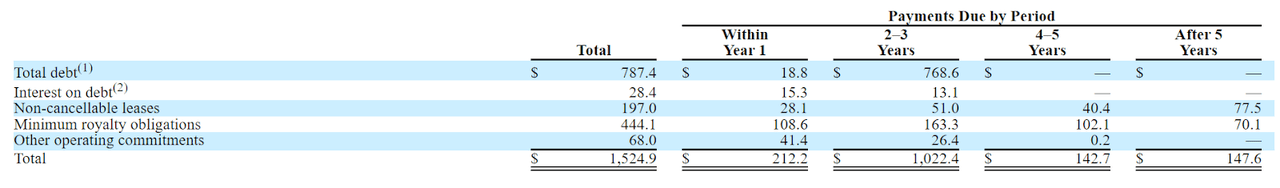

Although I’m as much of a fan of accrual accounting as any other semi-sane finance nerd, when it comes to reviewing the sustainability of dividends, I compare the upcoming contractual uses of cash to the current cash resources and likely future sources of cash. In other words, when it comes to dividends, “cash is king.” I’ll start this exercise by reviewing the upcoming future obligations. I’ve plucked a table that outlines the schedule of future cash obligations and recreated it here for your enjoyment and edification. I do this work so you don’t have to. You’re very welcome.

Anyway, cast your eyes to the third column under the heading “2-3 Years”, and note that within 2 to 3 years (calendar 2024, 2025), the company is “on the hook,” as the young people say, for $1.022 billion. To quote the young people again, that’s a “spicy meatball.” If we venture further into the latest 10-K, we see on page 89 that the annual maturities are just under $205 million in 2024, and $564 million in 2025. Combine this with the fact that interest rates are on the rise, and this could be troublesome for the company. It very well may be the case that John Wiley’s debt will be up for renegotiation at a very inopportune time. Specifically, fully $768 million of this $1.022 billion is debt. At the moment, interest on debt represents about 19% of net income, and about 26% of the money the company spends on dividends. What happens if and when debt becomes more expensive?

John Wiley Contractual Obligations (John Wiley Latest 10-K)

Against these obligations, the company has about $104.5 million in cash on the books. In addition, they generated an average of $329 million in cash from operations over the past three years, while spending about $324 million in CFI activities. Admittedly, the CFI average drops to $122.85 million if the we strip out money spent on acquisitions over the past few years.

Given all of the above, I’m of the view that the company can have acquisitions or a sustainable dividend, but it can’t have both. This may be a hard square for the company to circle, given that they’ve spent $921.6 million on acquisitions over the past six years. To suddenly wean themselves off of acquisitions in order to maintain the current dividend stretches credulity in my view. There are only five more dividend payments between now and 2024, so I think this is an issue of immediate importance to the company. Just because the dividend is only barely covered, and the prospect of a dividend increase is a pipe dream in my view, I’d be willing to buy these shares at the right price, as I think there’s at least some value here.

John Wiley Financials (John Wiley investor relations)

The Stock

If you read my stuff regularly you know what time it is. It’s the time where I turn into a bit of a financial “mall cop,” where I remind everyone that a company is distinct from its stock. The company buys and licenses various inputs, adds value to these, and then sells the results at a profit. The stock, on the other hand, is a piece of paper that gets traded around in a public market and is influenced by a great many factors, many of which are only peripherally related to the underlying business. While the stock price is certainly impacted by the company’s recent financial performance, it’s also impacted by the crowd’s ever-changing views about the company’s future financial performance. Some semi-sober writer on this site may start to raise questions about the dividend, which may impact the price of the stock very slightly. The stock price also is potentially impacted by the crowd’s ever-changing perspectives on the relative merits of “stocks” as an asset class. To use John Wiley as an example, the S&P 500, which is admittedly a very concentrated index, lost 18.4% of its value since I wrote about John Wiley back in January, against a loss of 29.8% for this stock. It’s impossible to prove this definitively, but I think it’s reasonable to suggest that part of the loss John Wiley shareholders have suffered over the past nine month is a function of the softness in the overall market. For all of these reasons, the stock is a much more volatile thing than the underlying business. While this is tiresome, it’s potentially profitable. If we can spot the discrepancies between the crowd’s take on a given business, and the assumptions embedded in the price, we can earn a profit. I absolutely hate to brag about it, but I feel a need to remind investors yet again that I’ve used this approach to successfully trade this name among others.

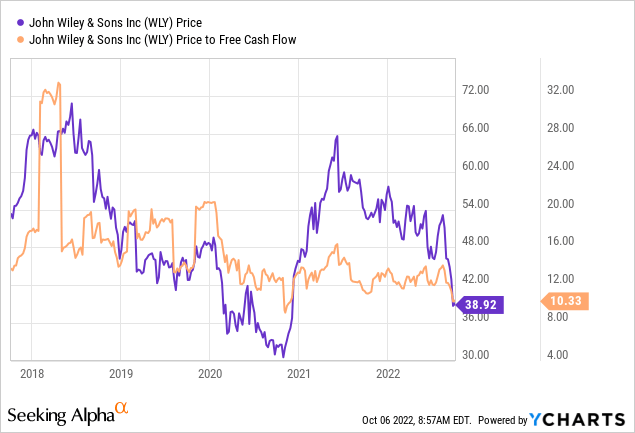

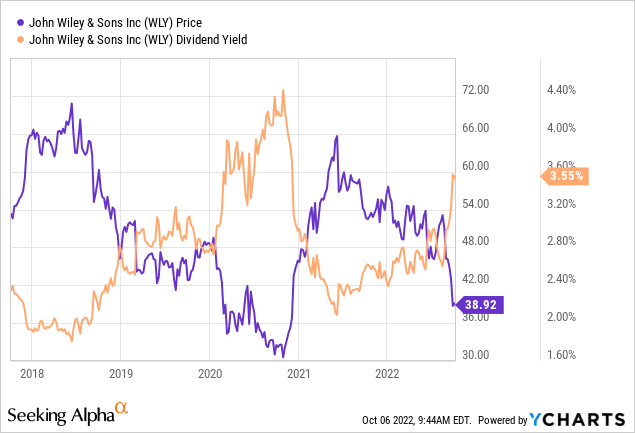

Finally, I should point out that I’ve found that cheaper stocks offer a higher risk-adjusted return, so I like to buy shares when I consider them to be cheap and eschew them when they get expensive. If you’re one of my regular reader/victims you know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive on John Wiley, I characterized my take on their valuation onomatopoeically as “meh.” For example, the shares were trading at a price to free cash flow ratio of about 13.16. The shares are now about 22% cheaper, and are very near the multi year low per the following:

Source: YCharts

While the dividend yield is near multi-year highs, per the following, as I wrote above I’m of the view that this dividend is resting on a fairly shaky foundation, in my view.

Source: YCharts

The shares are cheap, and the dividend is very close to multi-year highs, but they’re not cheap enough in my view. I can’t stop fretting about the impact of a potential dividend cut here. The company is barely able to cover it, and that means that I need to see a very, very deep discount to historical valuations before I’ll buy.

In order to validate (or refute) this view, I want to try to understand what the crowd is currently “assuming” about the future of a given company. If you read me regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to John Wiley at the moment suggests the market is assuming that this company will grow earnings at a rate of ~4% in perpetuity, which I think is actually pretty optimistic. Given that I’m skeptical about the dividend, these shares aren’t cheap enough to get me excited, and for that reason I’m going to continue to pass on them.

Options Summary

I’m not going to be selling any puts on this name anytime soon, as I think there’s a great deal further downside risk from here. That won’t stop me from reminding investors yet again that I made some money by selling what were at the time very deep out of the money put options. Specifically, in January of this year when the shares were trading at $56.20, I sold 10 June puts that were about 28% out of the money (i.e. with a strike of $40) for $.15 each. This brought my total earned from selling puts on John Wiley to $1.30, which is about the same that investors receive from the dividend every year. I earned this income while taking on substantially less risk than shareholders. If you’re not yet considering using these instruments as a way to either generate decent cash yields and/or lock in attractive prices for your equity positions, I would recommend checking them out.

Be the first to comment