Chip Somodevilla/Getty Images News

Meta Platforms (NASDAQ:META) sunk after reporting second quarter earnings that confirmed the fears of Wall Street: winter is coming. While there were many positives in the report, this is an environment with excessively negative sentiment towards tech stocks, even if they have strong balance sheets and are buying back stock. While META’s growth trajectory is likely to remain volatile in the near term, I remain confident that management can right the ship and bring back growth once the economy stabilizes. META is the best risk-reward opportunity in the market today.

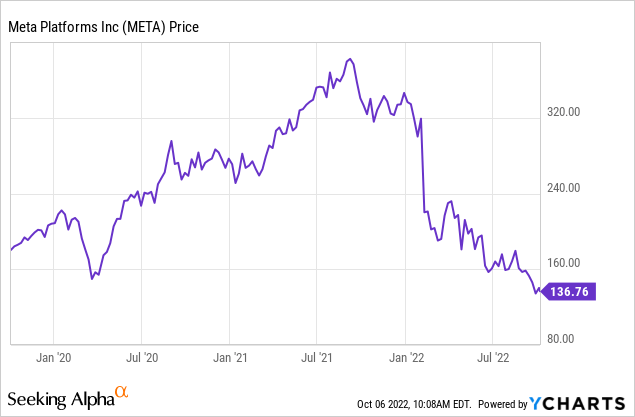

META Stock Price

META has crashed like it was an unprofitable bubble stock. After peaking around $384 per share, the stock is trading below $137 per share.

I last covered META in July when I rated it a strong buy on account of the strong balance sheet and cash flow generation. That thesis still holds even as the company adds stagnating growth to that list of headwinds.

META Stock Key Metrics

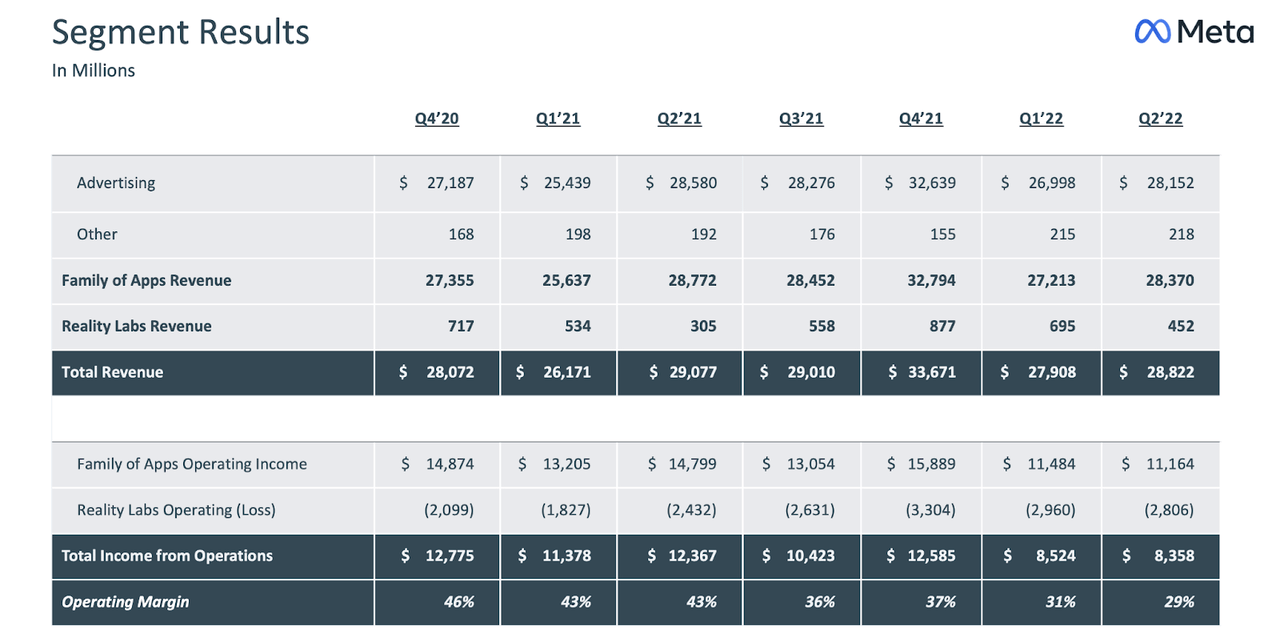

The latest quarter saw the company’s first ever year over year decline in revenues. Operating margin also contracted from 43% to 29%.

2022 Q2 Presentation

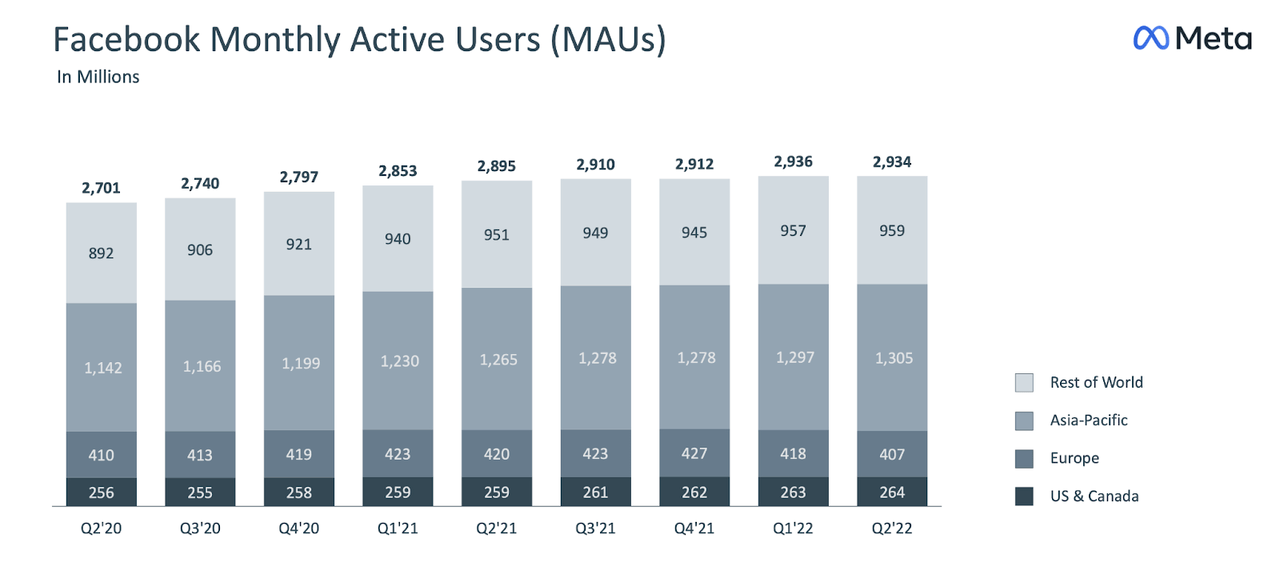

In a normal market environment, investors would focus on what drove the weakness and look to the long term, but this is no normal environment. META noted last quarter that Reels (the company’s answer to competitor TikTok) made up 20% of the time spent on Instagram and noted in the conference call that this time increased by 30%. META experienced a similar monetization weakness in the past when it unveiled stories – these new features have historically generated lower monetization rates in the beginning. META also noted weakness in Europe due to the Russia-Ukraine war. Indeed, it was the decline in the European monthly active users (‘MAUs’) that led to the overall decline in MAUs.

2022 Q2 Presentation

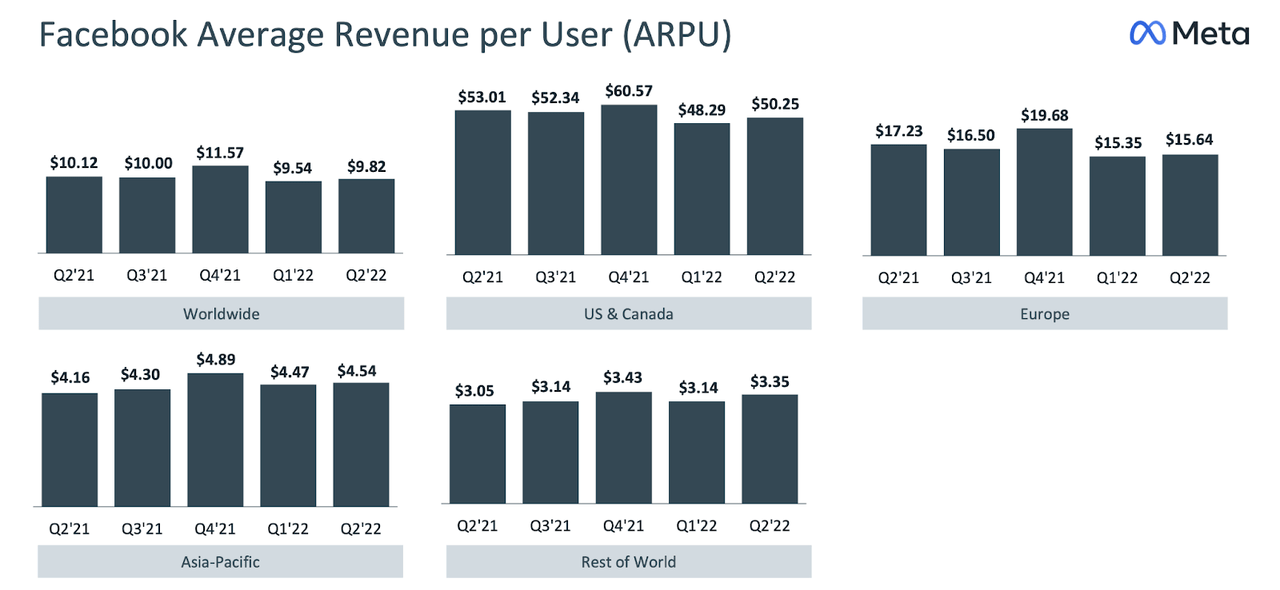

META saw average revenue per user (‘ARPU’) dip slightly to $50.25 in the quarter.

2022 Q2 Presentation

The company ended the quarter with $40.49 billion of cash and investments versus no debt. At recent prices, that makes up over 9% of the market cap. The company repurchased $5.08 billion of stock in the quarter – outpacing the $4.6 billion in free cash flow. This is the type of business that can easily sustain at least 1.5x debt to EBITDA, implying an additional $75 billion in debt capacity available to fund aggressive share repurchases. I emphasize that this would be in addition to the $40 billion of net cash on the balance sheet and $30 billion in annual net income.

META expects the third quarter to see up to $28.5 billion of revenues, reflecting the ongoing headwinds. That would be a decline from the $29.0 billion of revenue in the prior year’s quarter. META did note that the following quarter would be hit 6% by currency headwinds. Adding in the $259 million currency tailwind in the prior year’s quarter, the outlook suggests 5% year over year growth.

Is META Stock A Buy, Sell, Or Hold?

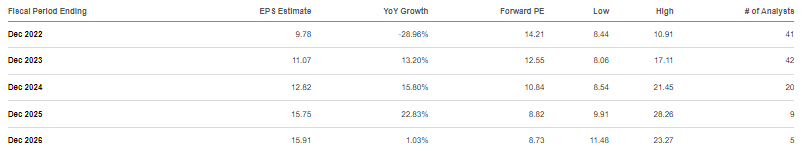

With the slowing growth, the emergence of TikTok, and the iOS data privacy changes, one can be forgiven for thinking that META has all the makings of a value trap. Wall Street can often be near-sighted and that includes looking backwards as well. Investors seem to be forgetting that this is a company that grew its revenues by 22x over the past nine years. The company is being hit all at once from all directions which will undoubtedly impact the near term financial outlook. But META deserves the benefit of the doubt as its platforms remain highly relevant in today’s society. Consensus estimates look too conservative. Analysts expect modest earnings growth over the next five years.

Seeking Alpha

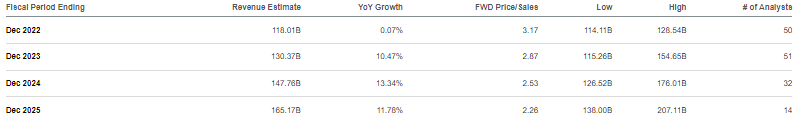

META is expected to return to double-digit revenue growth starting next year.

Seeking Alpha

I expect META to beat on those estimates handily as it eventually works through the iOS changes and eventually realizes returns on its metaverse investments. Regarding the deteriorating profit margins, one must take into context the current market environment. This is a market in which stocks like META are punished for investing heavily in future growth because it brings down operating profits. In reality, one must take into account the impact that these investments will have on future profit growth. If META is unable to realize returns in its metaverse investments, then the roughly $10 billion in associated annual expenses would have all been for nothing. But this is the type of company that you don’t want to bet against given their long history of innovation. META is trading at 14x forward earnings. But that includes a roughly 30% impact from its metaverse investments. If we exclude metaverse losses and assign zero value to that segment, then META is trading at around 11x forward earnings. That valuation is even lower if one assigns positive value to the metaverse segment. I expect META to return to 15% to 20% earnings growth eventually. At that point, I could see the stock trading at a 1.5x price to earnings growth ratio (‘PEG ratio’), leading to a valuation of around 25x earnings – implying around 125% potential upside from multiple expansion alone. As META continues returning all of free cash flow to shareholders through share repurchases, I can see that PEG ratio jumping to the 2x range to fall in-line with other consistent shareholder yield machines like Microsoft (MSFT) and others. It isn’t every day that you get to buy the stock of a dominant tech platform for a low single-digit multiple of earnings. That kind of opportunity only occurs when few are recommending the stock, but to me the low valuations only help to increase my conviction in the name.

What are key risks? It is possible that the iOS changes have permanently impaired the growth story, or that market saturation has been reached and growth will be far slower than consensus estimates. It is also possible that the metaverse proves to be a waste of time and money, with CEO Zuckerberg not realizing this until too much capital has already been invested. The company is generating sufficient cash flow even after metaverse investments, but there is no guarantee that management continues to repurchase shares here.

I have discussed my market outlook for subscribers of Best of Breed Growth Stocks including my view that a diversified basket of beaten-down tech stocks can perform strongly from here. META offers the rare combination of strong free cash flows, undervaluation, and secular growth – making it a core position in my portfolio.

Be the first to comment