da-kuk

Overview

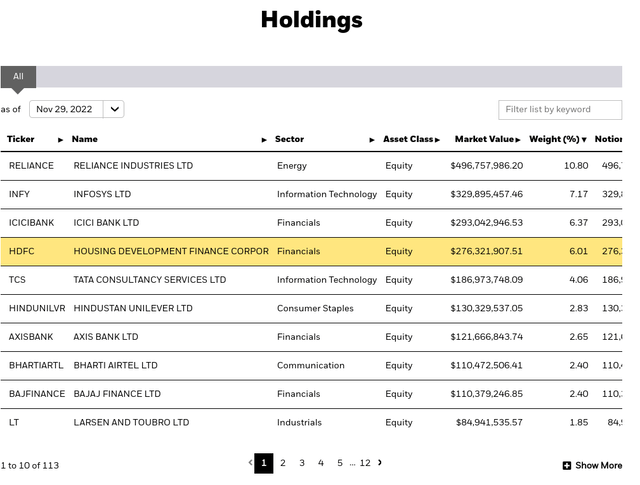

The iShares MSCI India ETF (BATS:INDA) provides exposure to large and mid-sized companies in India. As of 29th November 2022, the INDA exchange-traded fund (“ETF”) was invested in 108 different holdings, which includes popular names such as Reliance Industries and Infosys.

The fund has an expense ratio of 0.65% per annum (3rd cheapest among similar ETFs). Franklin Templeton provides a similar exchange-traded fund with a cheaper expense ratio of 0.19% per annum.

Fund Performance

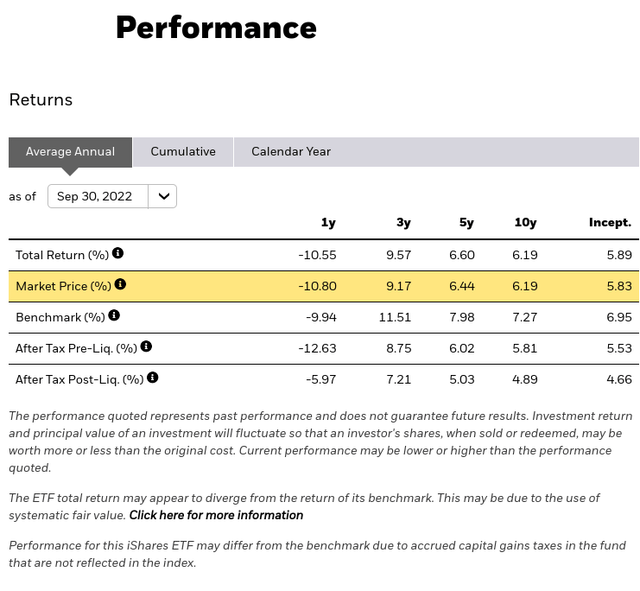

The INDA fund has returned 5.89% per annum since its inception in 2012. The fund has not been able to track its benchmark index (MSCI India) closely, which returned 6.95% per annum.

Overall, the return has been quite poor compared with the S&P 500 (SP500) average return of 11.88% per annum. Investors have not been compensated for the higher risk involved with an investment in an emerging market.

The fund’s performance can be seen below:

Portfolio

The INDA fund is heavily weighted towards the Financials, Information Technology and Energy sectors, which represent more than 50% of exposures.

On the other hand, it has very low exposure to Real Estate, which is less than 1% of the total portfolio.

The fund’s top 10 holdings include the following:

Reliance Industries is the top holding of the fund with a 10.80% weight. It is the crown jewel in the Indian stock market. The company is led by Mukesh Ambani, a popular Indian billionaire, and is one of the most profitable companies in India.

Comparison between ETF providers

The iShares MSCI India ETF is managed by BlackRock, Inc. (BLK), which is one of the largest asset managers in the world. BlackRock is known for providing better liquidity than other asset managers due to higher assets under management and, therefore, higher trading volume in its ETFs.

Liquidity is an important factor to consider when investing in an overseas fund because in a stress scenario it can be difficult to cash out at a good price if there is insufficient liquidity.

On the other hand, Franklin Templeton offers a cheaper alternative to the INDA fund. As a specialist in the emerging markets sector, Franklin Templeton is a good alternative to the INDA fund when considering expense ratios.

Outlook for the Indian Economy

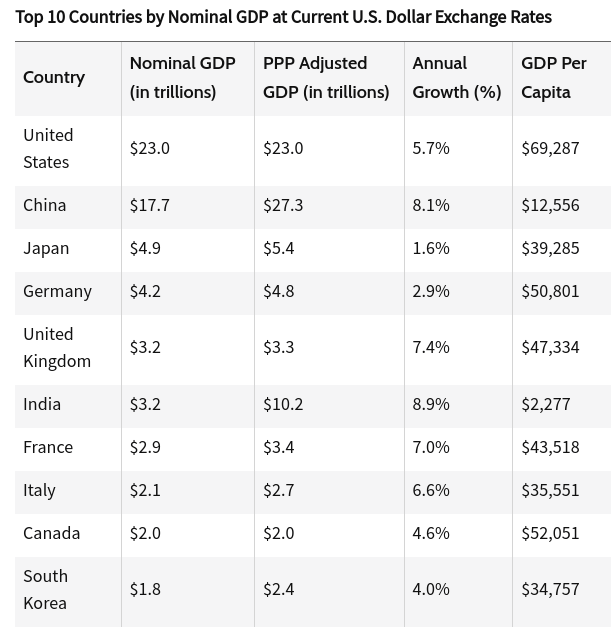

S&P Global and Morgan Stanley have recently published forecasts suggesting that India is set to become the world’s third-largest economy (ranked by nominal GDP) by the end of the decade, overtaking Japan, Germany and the UK.

Investopedia

The expectation is that India will double its nominal GDP from the current $3.2 trillion to $8.5 trillion over the next 10 years.

These projections are underpinned by the shift from global companies looking to move their manufacturing operations from China to India.

A combination of geopolitical risks between the West and China and the ongoing supply chain risks from China’s zero-Covid policy has made India a destination of choice for global companies trying to reduce the risk of disruption to their supply chains.

Companies like Apple (AAPL), Samsung (OTCPK:SSNLF, OTCPK:SSNNF), and Google (GOOG, GOOGL) have been slowly moving their manufacturing operation to India, which has been offering generous incentives to attract foreign investment.

For example, the Indian government announced that it would fund 50% of project costs for a range of semiconductor fabrication plants. This is in addition to $40 billion of incentives unveiled in December 2021 to make India a global hub for electronics production.

The offshoring of manufacturing operations to India should help boost investment, job creation, and exports in the country. A combination of factors which will help support sustained growth in the country’s GDP.

Conclusion

China has been wildly successful after liberalizing foreign trade and investment at the end of 1970s. The GDP annual growth rate in China averaged 9.05% per annum from 1989 to 2022.

I believe that India should be on people’s radar, as it might be the next big thing after China’s success story.

If you enjoyed the article, please subscribe to receive my latest articles.

Be the first to comment