coldsnowstorm

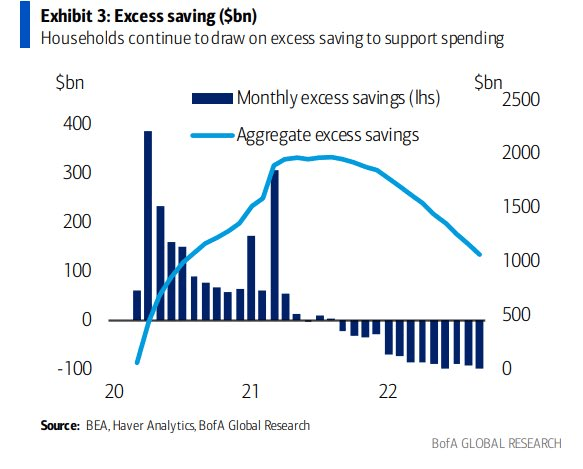

Companies tied to the consumer are in a tough spot right now, with dwindling savings balances on Main Street and the prospect of shrinking loan growth should a recession strike in 2023. We’ve heard mixed results from firms in the industry so far this earnings season, and one small outfit with exposure to low-end consumers reported a revenue beat last week but also increased FY22 loss guidance. Let’s weigh the risks and upside potential of this name.

Consumers’ Coffers Constraining

BofA Global Research

According to Bank of America Global Research, Bread Financial (NYSE:BFH) is a financial services company providing simple, personalized payment, lending, and saving solutions. Bread offers a comprehensive suite of products, including private label and co-brand credit cards, installment lending, and buy now, pay later (split-pay).

The Ohio-based $1.8 billion market cap Consumer Finance industry company within the Financials sector trades at a low 2.6 trailing 12-month price-to-earnings ratio and pays a 2.3% dividend yield, according to The Wall Street Journal.

Bread’s new executive team continues to work on improving operations and the balance sheet. The focus is on growing earnings, but a significant risk is the firm’s exposure to subprime consumers compared to its industry. Thus, downside economic risks pose particular peril to BFH right now.

Investors should closely monitor the trend of loan losses and defaults. Moreover, weakening loan growth could pressure earnings in the coming quarters. Not surprisingly, the company reported a jump in delinquencies and net charge-offs in its quarterly report last week.

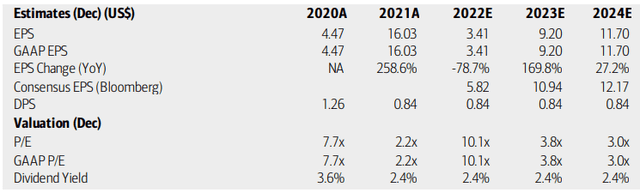

On valuation, analysts at BofA see earnings falling big in 2022, but on the 2-year stack, the EPS drop is not as huge. Looking ahead, per-share profits are expected to rebound dramatically in 2023 before steadying in 2024. The Bloomberg consensus forecast is slightly more optimistic than BofA’s expectation. Dividends are expected to remain at $0.84 per share in the coming quarters, however.

Finally, both the operating and GAAP P/Es are exceptionally cheap. With consumer finance companies, though, I like to look at the price-to-book ratio. That metric also suggests the stock is cheap, but a poor growth outlook is the reason.

Bread Financial: Earnings, Valuation, Dividend Forecasts

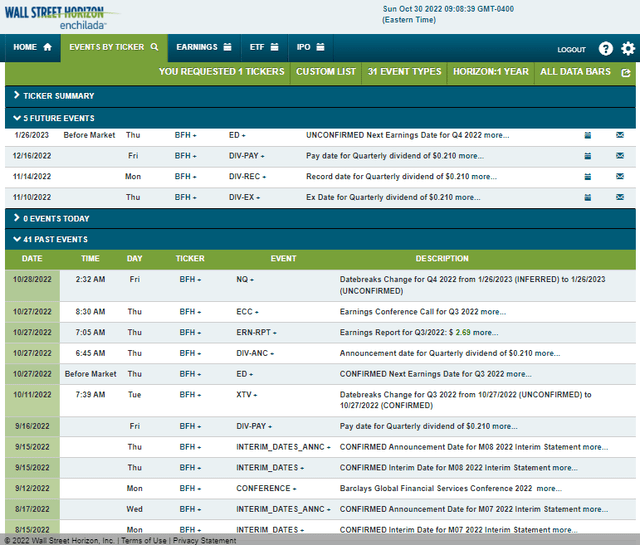

Looking ahead, corporate event data provided by Wall Street Horizon show a rather quiet period upcoming. There’s a dividend ex-date of Thursday, Nov. 10 before its next earnings report unconfirmed for Thursday, Jan. 26 before market open.

Corporate Event Calendar

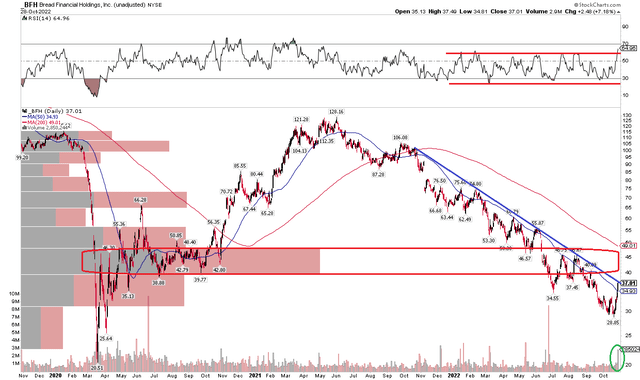

The Technical Take

BFH has bounced hugely off its October low. Following a top-line beat last week, the stock soared on big volume to $37 from under $29 just a couple of weeks ago. Shares rallied above the 50-day moving average, though the longer-term 200-day moving average is way up at $49 and remains sharply negatively sloped – a bearish sign. There is also a downtrend resistance line from a year ago that comes into play at current levels. Moreover, I notice a significant amount of shares traded in the $39 to $48 range, which should prove to be bearish overhead supply.

On the bullish side, along with the volume spike, the RSI indicator finally broke out above the notoriously bearish 20 to 60 range.

Putting it all together, I see more bearish than bullish risks here. If you’re long, I would use the recent jump as an opportunity to take profits.

BFH: Some Positive Signs, But Shares Remain In A Downtrend

The Bottom Line

BFH stock has an intriguing valuation, but earnings volatility and questionable growth over the next year, given macro risks, make me wary. Also, the technical chart puts the burden of proof on the bulls. I’m a hold on the stock for these mixed signals. Much depends on how the consumer fares during this tough economic stretch.

Be the first to comment