VITALII BORKOVSKYI/iStock via Getty Images

argenx (NASDAQ:ARGX) continues to execute an exceptional launch of Vyvgart as a treatment for generalized myasthenia gravis. Q3 sales were $131 million, far above the consensus, and a significant increase from $75 million in the previous quarter as strong uptake in the United States continued and as other geographies started to contribute. And Vyvgart’s value proposition should improve in the first half of 2023 if the subcutaneous version receives FDA approval.

And while Vyvgart’s uptake is very important, the key catalyst is on the pipeline side – phase 3 results of Vyvgart in patients with chronic inflammatory demyelinating polyneuropathy (‘CIDP’) are expected in the first quarter of 2023. CIDP is a market opportunity that is at least as large as generalized myasthenia gravis.

Vyvgart continues to outperform

Vyvgart (efgartigimod) net sales increased from $75 million in the second quarter to $131.3 million in the third quarter. U.S. net sales were $124 million, Japan contributed $6 million, and Europe and distribution sales contributed $0.6 million, each. Total revenues of $146.5 million were $29 million above the Street consensus.

Management said on the earnings call that the unmet need was greater than they anticipated and that this has driven the stronger-than-expected launch. Nearly half of patients are IVIg-experienced, and this is an area the company wants to work on because they need to get to earlier lines of therapy to reach all the estimated 17,000 patients in the United States. Perhaps these cautious comments contributed to the earnings day selloff, as this was the only thing you could argue is not as bullish as the rest of the earnings report.

Japan and Germany are five and less than two months into the launch, respectively, but the company expects the ramp in Europe to be more gradual due to the need to secure country-by-country reimbursement, and this is a process that will take several quarters.

argenx has used a Priority Review Voucher to speed up the review of subcutaneous efgartigimod for the treatment of generalized myasthenia gravis and the FDA decision is expected in the first half of 2023. The approval of the subcutaneous version of the drug should help improve the uptake as it will provide patients with a more convenient option to receive the drug.

Overall, my conclusion is the same as in my previous article – Vyvgart is well on its way to meeting or exceeding my annual myasthenia gravis net sales estimate range of $1.5 billion to $2 billion.

Phase 3 results in CIDP patients will kick off a catalyst-rich year for argenx’s pipeline

2022 was very light for argenx’s pipeline in terms of events and catalysts, especially considering the number of ongoing trials and the aggressive pipeline expansion.

That is going to change in 2023 as we will see results from three registrational trials of efgartigimod – CIDP in the first quarter and immune thrombocytopenia (‘ITP’) and pemphigus vulgaris (‘PV’) in the second half of the year. ITP and PV are important, but I believe their combined peak sales potential is below that of CIDP. And, of course, the CIDP trial will be the first to report results.

Success is not guaranteed for any trial, and there is an added layer of uncertainty for efgartigimod in CIDP. Competitor UCB has given up on this indication after rozanolixizumab (which is also an anti-FcRn candidate) failed in a phase 2 trial. However, UCB has not yet published the results, so, we are left to wonder about any efficacy trends of rozanolixizumab, even in light of this failure.

UCB’s failure has not impacted argenx’s conviction or development plans for efgartigimod in CIDP. And the company believes that UCB’s trial was flawed in terms of patient identification and that the biological rationale for efgartigimod in this indication is compelling.

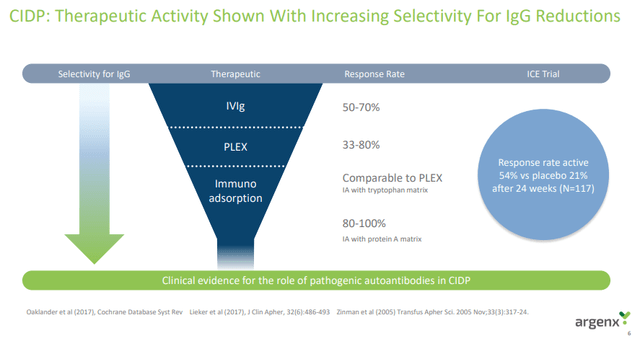

There is also clinical evidence showing a correlation between IgG-lowering effects (efgartigimod’s mechanism of action) of several other therapies and the response rate of CIDP patients.

And since this is a disease that is often misdiagnosed and efgartigimod may not work in a wrongly diagnosed CIDP patient, efgartigimod’s phase 3 trial design has more stringent patient identification criteria and there is an independent committee that will confirm the CIDP diagnosis.

The second layer of protection against failure is the open-label part of the trial where patients receive efgartigimod monotherapy and no placebo. Only patients who respond to efgartigimod in this part of the trial will enter the placebo-controlled phase of the trial.

The open-label phase of the trial was also used as a de-risking event for the trial and argenx was to make a go- or no-go decision based on the response rate in the first 30 patients. And this was defined as a minimum of 14 responders or a nearly 50% response rate. And 50% is not just an arbitrary number because this is roughly in line with the response rate of IVIg in the ICE trial, and this is the bar efgartigimod must beat in order to be competitive in the CIDP market. IVIg’s response rate was 54% in the ICE trial and the placebo response rate was 21%.

In February 2021, argenx announced that efgartigimod exceeded the 14-patient threshold and this triggered the go decision for the rest of the trial, but it has not disclosed the data and we do not know how many patients responded. However, management did say that efgartigimod has “comfortably exceeded” the 14-patient threshold and this provides additional confidence that efgartigimod works well in CIDP patients.

So, the combination of clinical de-risking in the open-label part of the phase 3 trial, the prior data generated by IVIg, and other mechanisms that lower IgGs show a correlation between IgG lowering and response rates in CIDP patients, I believe this trial is likely to report positive data in the first quarter of 2023.

And I should add that while the pipeline is still largely about efgartigimod, ARGX-117 should become more prominent in 2023 as it is expected to report preliminary proof of concept data in multifocal motor neuropathy (‘MMN’) patients and ARGX-119 is expected to enter the clinic and report healthy volunteer data, but value creation with ARGX-119 is unlikely to happen before 2024 as it will take time to generate proof of concept data.

Conclusion

The launch of Vyvgart continues to exceed expectations, and while the launch remains very important, I continue to believe that commercial uptake in gMG is insufficient for significant value creation from current levels. However, there are many additional shots on goal that could drive argenx’s valuation higher in the following years.

Investor attention should soon turn to the pipeline again and the phase 3 results of efgartigimod in CIDP patients in the first quarter of 2023. This is the most important clinical catalyst but not the only one as we should see the results from the second phase 3 trial of efgartigimod in ITP patients and phase 3 results in pemphigus vulgaris patients in the second half of the year, as well as the preliminary clinical data from the proof-of-concept trial of ARGX-117 in MMN patients.

Phase 3 success and approval for the treatment of CIDP and potentially the other two indications would lead to a reacceleration of revenue growth in 2024 and beyond, and there will be more than ten additional shots on goal by 2025 as the company’s target is 15 indications in the clinic or on the market by 2025.

$2.38 billion in cash and equivalents at the end of the third quarter and increasing Vyvgart net sales provide at least several years of runway, and argenx is well-positioned to continue to execute its commercial and development plans.

Be the first to comment