Introduction

CarGurus, Inc. (NASDAQ:CARG) announced their fourth quarter results on February 13, 2020.

During the conference call, management provided a FY2020 revenue guidance to be between $664 – $676 million. The lowered guidance is due to the company’s decision to reduce ad load to improve user experience and enhance marketplace subscriptions.

Mr. Market was merciless and the stock dropped more than 25% on the next trading day. CARG dropped to an all time low and is currently oversold with an RSI of 31 (source: Finviz).

In my opinion, the FY2019 results were positive and despite short term concerns over the modified guidance for 2020, it has longer term advantages to grow the core business of the company. This article aims to explain the opportunity in CARG’s significant drop.

Image Source: Q4 presentation

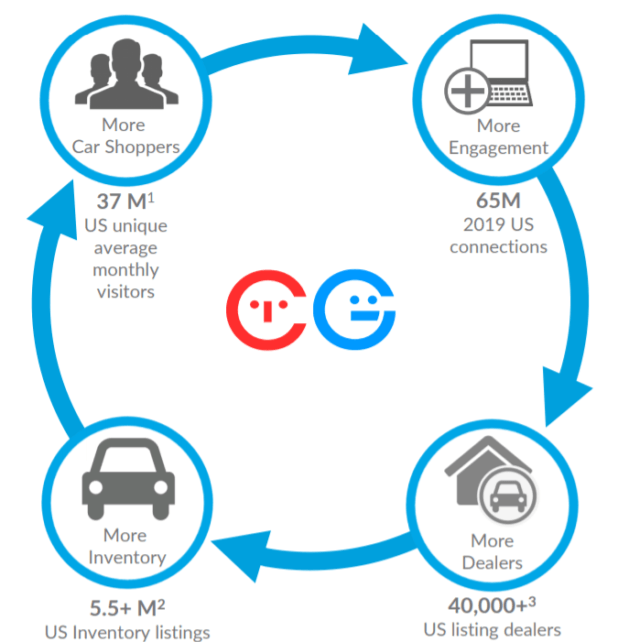

CarGurus is an auto marketplace service with a network of over 40,000 US dealers. The company has almost 3 times more traffic than its nearest competitor.

Source: CarGurus investor presentation

During January 2020, CarGurus announced the acquisition of AutoList.With over 1.3 million monthly visitors to its website and 400,000 mobile app based visitors per month, this acquisition is a good move to fuel CarGurus growth.

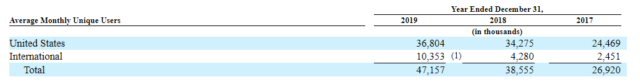

The company’s main competitive advantage is the traffic to its website, measured as Average Monthly Unique Users. In the US, we see a 7.3% growth in traffic. The acquisition of AutoList will add to this traffic in 2020.

International traffic has grown 142% YoY, mainly fueled by the acquisition of PistonHeads in late 2018. During the time of the acquisition, it was measured that PistonHeads had over 5 million average unique monthly visitors in 2018.

Due to Autolist being smaller than PistonHeads, CarGurus expects the integration to be shorter and easier.

Decision to remove ads

In an effort to improve the consumer experience, increase conversion, drive more leads to dealers and generate greater marketplace subscription revenue over time. While this decision certainly means forgoing short term transactional advertising revenue, we know this decision is in the best interest of both consumers and dealers and supports a healthier subscription business for CarGurus over the long-term. This impact is most evident in our first quarter guidance as we expect muted advertising revenue will yield relatively flat sequential total revenue growth from Q4, 2019 to Q1, 2020.

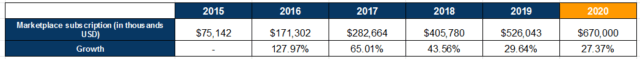

Advertising revenue represents only 10% of CARG’s revenue mix. The big piece comes from Marketplace subscriptions, which the company aims to increase through reduced ads.

Looking at FY2020 guidance, if we mute the advertising revenue and use the revenue guidance as the marketplace subscription revenue, we can see approx 27% YoY growth in marketplace subscriptions. This is good growth in my opinion.

Source: FY2019 Form 10K

If CarGurus continues to increase traffic, then advertising could be enabled in the future if the company seeks to increase revenues. I believe the absence of advertising revenue does not hurt the long term growth path of the company.

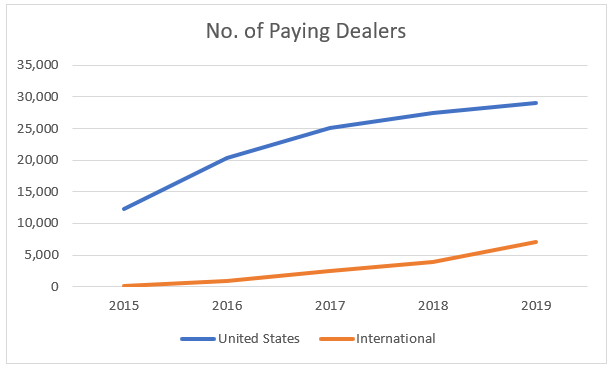

Growth in No. of Paying Dealers

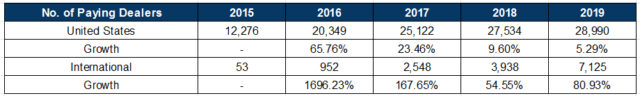

Paying Dealers constitutes the core of CarGurus’ business.

Source: Company Form 10K’s

While there is some truth to the slowdown in growth of paying dealers within the US, we can expect international growth to be high for the next few years. I anticipate slow organic growth in paying domestic dealers coupled with tuck-in acquisitions (similar to AutoList).

Paying international dealers growth is very strong (fueled by the acquisition of piston heads) and I expect this trend to continue for the foreseeable future.

Source: Company Form 10K’s

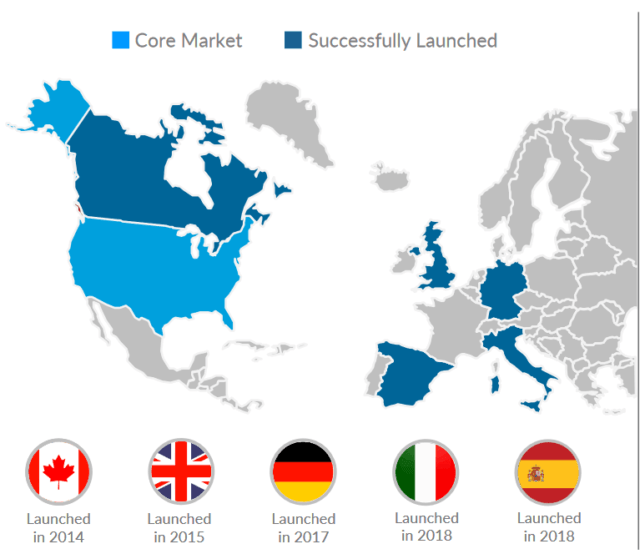

International Growth Opportunities

Car Shopping is being simplified through digital methods and the opportunity is wide open globally. With successful international launches in UK, Canada, Germany, Italy and Spain, there is a lot of opportunity to grow these markets and expand into new ones.

Source: Investor Presentation

The automotive market is struggling in developing countries such as India and China. This may present a good opportunity to CarGurus to enter these markets through acquisition of a major auto listing company in these countries.

Healthy Balance Sheet

With a total debt (Short term and Long term) of $68 million and cash (includes cash equivalents) balance of $172 million (source: WSJ), CarGurus has a healthy balance sheet and is well positioned to make quick acquisitions to maintain its leadership in web traffic and paying dealer count.

Conclusion

I believe there has been some irrational panic post the Q4 conference call due to the company’s lowered revenue guidance for FY2020. Looking into the details, the company’s decision to remove advertising from their platform creates short term concerns over reduced revenues. However, this appears to be in-line with the long term growth story of the company. Further, international growth is just beginning for CarGurus and the company’s healthy balance sheet puts them in a good position to dominate overseas markets through timely acquisitions.

In my opinion, CARG is a good investment for investors with a 1-2 year investment horizon.

Disclosure: I am/we are long CARG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment