VTT Studio/iStock via Getty Images

The kind of precipitous drop that Zevia PBC (NYSE:ZVIA) has experienced over the past year is not uncommon among small stocks of a similar caliber. What matters is whether the business or its prospects have changed fundamentally. In Zevia’s case, they have not.

The company does seem to be having a hard time controlling its operational expenses. But at least part of it is a temporary side effect of becoming public. The balance should be taken care of by greater cost discipline.

One year after the IPO, with new management at the helm, Zevia is entering a new phase of evolution, one that ought to initiate long awaited profitability. If it maintains its strong growth momentum, it should be able to carve out a solid chunk of the high-growth natural sugar free carbonated drink market.

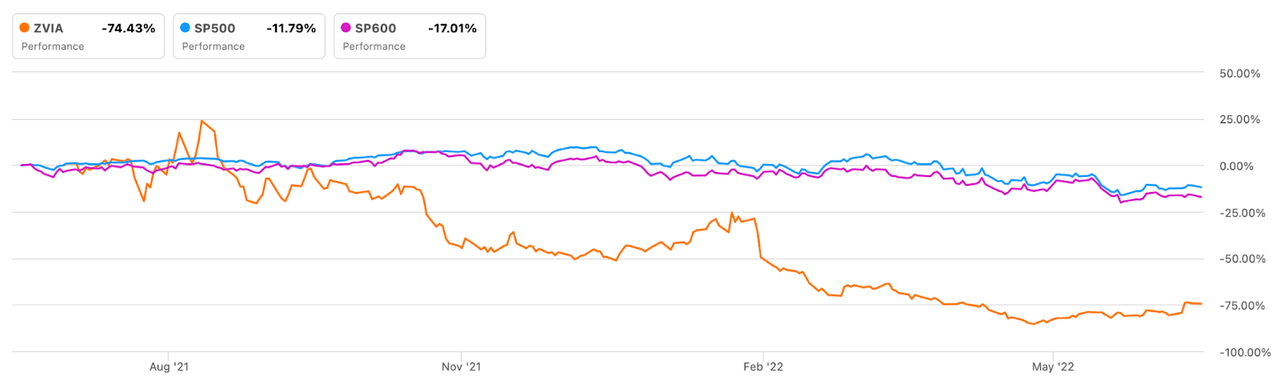

Price Return vs S&P 500 and S&P 600

Seeking Alpha

Zevia started with a share price of $14 in July 2021. Since then, the stock took a nosedive, losing more than 70% in value, now at ¼ of the IPO price. In contrast, the S&P SmallCap 600 fell less dramatically, 17% in the past year.

Performance

From the first year of operations in 2008 to the latest fiscal year of 2021, Zevia’s top line grew 47% on a compounded basis. Year-over-year growth has moderated lately, 29% in 2020 and 26% in 2021, but it is still significantly higher than the median in Consumer Staples. The company maintains a solid gross margin in the mid-40’s, with the long-term target above 50%.

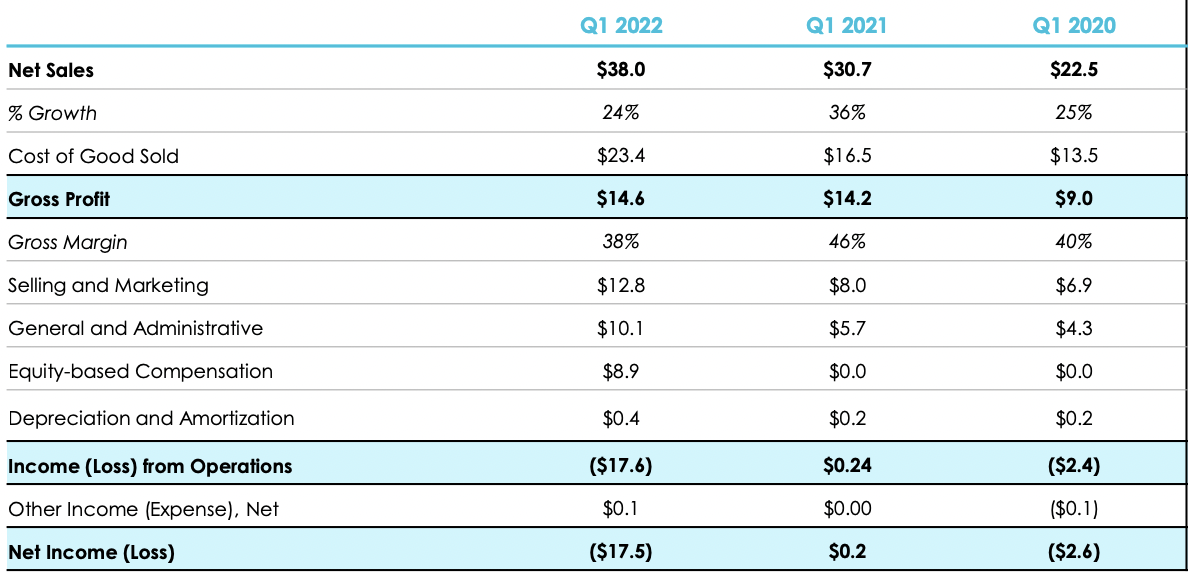

Profit & Loss Statement, in millions

Zevia

The signs of cost related strains were obvious to see in the latest Q1 results. Production costs shot up by 42% – way more than the rate at which net sales grew – which was largely explained by rising aluminum and co-pack manufacturing costs. Aluminum prices, for one, have since eased considerably as output stabilizes.

Operating expenses also increased, partly due to tight shipping capacity, but also because of higher staff compensation and compliance costs since going public. But the biggest factor leading to an outsized net loss of $17.5m for the past quarter (compared to net income of $0.2m a year ago) was equity-based compensation. As a non-recurring item, however, it is expected to decline after the IPO lock-up expires in January 2022.

Moving forward, unit economics should show some improvement after the successive price hikes from Q2 (6% in core soda packages) and Q3 (10% across all packages). The management seems confident that such actions will be well-taken by consumers given competitive original pricing and strong velocity measures. At the same time, better marketing effectiveness should support cost optimization.

While profitability is still not in the near-term scenario (even if quarterly gross margins were to improve), a definite forte of Zevia is a strong balance sheet which provides support for its growth ambitions. Prior to IPO, it had raised a total of $236m over 5 funding rounds; its cash balance as of 31 March stood at $59m, giving it a cash runway of 2.8 years. The company carries no debt but has a line of credit for up to $30m.

Industry

The carbonated soft drink market generated $136b in the U.S. and $333b globally in the year to June 2022. The expected CAGR to 2026 is 6.3%, most of which will be accounted for by emerging economies. In mature markets, the activity is shifting toward more mindful growth driven by health-conscious consumers and regulators.

Consumers in the U.S. want both less sugar in their diets and less artificial sweeteners in their drinks. Among natural alternatives, stevia and monk fruit offer the same sweetness but without the harmful effects. Stevia is by far the more popular ingredient, and by focusing exclusively on stevia Zevia has been able to ride this sentiment. The challenge is that the space is getting crowded as large manufacturers pouring resources into R&D on zero calorie drinks without the synthetic stuff. The competition may force Zevia to keep spending big in order to grow.

A definite upside is the fact that all of Zevia’s beverages are sold under a single brand which makes it easily recognizable, thus stretching marketing dollars further. The company claims to have ranked first among carbonated soft drink brands in the NaturalEnhanced channel according to SPINS; it was, additionally, the number one carbonated soft drink brand on Amazon (AMZN) in both 2000 and 2021 based on dollar sales, according to Stackline.

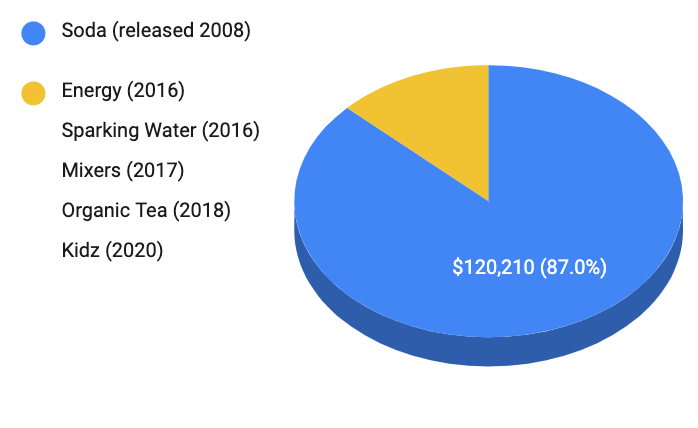

Product Sales as Percentage of Net Sales, 2021

Zevia, author

Zevia products are sold in more than 31,000 retail locations in the U.S. and Canada and also online (13% of net sales in 2021). Wider omnichannel distribution directly to retailers is a key focus for growth, particularly given the high concentration risk, with the largest ten customers currently accounting for three-quarters of net sales.

Competition

As a premium natural soda brand, Zevia successfully differentiates itself by pricing lower than comparable offerings and being more affordable than 65% of all non-alcoholic ready to drink beverages. In that way, it is making healthier substitutes to refined sugar more accessible to the masses.

|

Zero calorie drink, 12 oz cans, pack of 24 |

Lowest price / fl oz |

|

Coca-Cola: Coke Zero |

$0.07 |

|

Pepsi: Zero Sugar |

$0.09 |

|

Zevia: Soda, Cola |

$0.11 |

|

Celsius: Energy drink, Sparking Cola |

$0.17 |

|

National Beverage Corporation: La Croix Cola |

$2.57 |

Source: Amazon.com as of 13 July 2022.

Below I look at some of the notable companies in the U.S. health drinks market in terms of growth and efficiency indicators versus Zevia’s.

Revenue Growth

|

Company |

2020 |

2021 |

TTM |

|

Zevia |

28.6% ($110.0m) |

25.6% ($138.2m) |

23% |

|

Reed’s |

23.0% ($41.6m) |

19.2% ($49.6m) |

11.2% |

|

National Beverage Corp |

7.2% ($1,072m) |

6.1% ($1,138m) |

4.4% |

|

Vita Coco |

9.4% ($283.9m) |

22.2% ($379.5m) |

19.9% |

|

Celsius |

74.0% ($130.7m) |

140.1% ($314.3m) |

111.9% |

Source: Seeking Alpha.

Zevia holds a respectable position among peers in terms of revenue growth, but Celsius Holdings (CELH) is the runaway leader. The latter’s achievement may have to do with its commitment to the fast-growing energy drinks segment and specifically the niche of natural zero calorie energy drinks. Although Zevia does carry an energy drink within its portfolio, the overall feel of the brand is one of more casual, than functional, consumption.

Gross Profit Margin

|

Company |

2020 |

2021 |

TTM |

|

Zevia |

44.9% |

44.3% |

42.4% |

|

Reed’s |

30.7% |

27.4% |

25.5% |

|

National Beverage Corp |

39.3% |

36.7% |

36.7% |

|

Vita Coco |

33.8% |

29.8% |

27.0% |

|

Celsius |

46.7% |

40.8% |

40.6% |

Source: Seeking Alpha.

Zevia enjoys one of the highest gross profit margins across its peers. This is quite an accomplishment seeing that it offers one of the lowest prices per ounce versus other natural drink producers. A major reason is the business’s asset light model which relies on outsourced manufacturing and distribution.

SGA Expenses as Percentage of Sales

|

Company |

2020 |

2021 |

TTM |

|

Zevia |

44.9% |

44.3% |

42.4% |

|

Reed’s |

51.4% |

59.0% |

57.0% |

|

National Beverage Corp |

18.1% |

18.5% |

18.5% |

|

Vita Coco |

23.4% |

21.9% |

22.4% |

|

Celsius |

40.6% |

42.1% |

39.3% |

Source: Seeking Alpha.

While production costs seem manageable even for smaller companies, where the benefits of economies of scale really kick in is in selling and marketing efforts. Bigger players manage well with lower SGA expenses on a relative basis, compared to smaller upstarts. This may have to do with the highly competitive nature of the industry, on the one hand, and a desire for rapid growth, on the other.

The Vita Coco Company (COCO) stands out here, as it is able to grow at a respectable pace whilst maintaining costs low. It has positioned itself in a unique drink segment (coconut water), whilst Zevia and Celsius both sell products with lots of alternatives, which requires greater spending to capture and maintain market share.

PBC and B Corp

I personally see a big boon in the fact that Zevia takes a cohesive approach to promoting its values-based mission. The holding company is both a public benefit corporation (PBC) in the state of Delaware (since March 2021), meaning its charter formally articulates the social and environmental goals of the business, and a certified B Corp (since June 2021) with an impact score of 82. There is some evidence that B Corps tend to grow faster than comparable non-certified CPG brands.

Public health is the main angle as far as public benefits are concerned, given the elimination of regular sugar and artificial ingredients. All of Zevia’s beverages carry the Non-GMO Project label, while the teas are additionally USDA Organic and Fair Trade. Another area where Zevia stands out is environmental sustainability: it has not produced a single plastic bottle since inception, opting instead for aluminum cans that have a higher recycling rate and value.

Valuation

As of 14 July, ZVIA lost about 75% of its one-year value. But the more recent trend is positive: over the last month, the stock has gained 33%. Its trailing twelve months EV/Sales and Price/Sales are both lower than the sector medians, 0.33 versus 1.82 for the former and 1.02 versus 1.18 for the latter. Against these measures, Zevia looks like a bargain compared to fast growing Celsius (9.12 and 13.55).

Forward estimates are often too unreliable in cases such as this and especially at times like this. Yet one source puts Zevia’s “Fair P/S Ratio” at 4.2 based on forecasts of future growth, profit margins and risk factors.

Risks

Zevia is highly reliant on a few raw materials that it uses throughout its product portfolio. Stevia is the sole sweetener whose supply could become disrupted, while aluminum is the only packaging material exposed to inflationary pressures and energy volatility. If price actions are not sufficient to make up for any upward movement in key materials, margins would suffer and profitability be delayed longer. There is also no guarantee that subsequent price increases will be well tolerated by consumers.

Conclusion

Although ZVIA fell significantly, the business is growing fine and its margins compare positively to those of similar companies. Despite the recent rally, the stock can still be purchased at a huge discount to the original IPO price and to the sector/industry’s median valuation. The management expects to maintain the growth rate and improve the margins, primarily through price increases and cost optimization.

The next two quarters (when higher net sales are expected due to seasonality) will be pivotal for the longer-term outlook. Maintaining a double digit growth rate in a mature market is going to be no easy feat. But because Zevia is banking on the future of the industry – in which more and more consumers will choose naturally sweetened drinks with fewer or no artificial ingredients – the company just might pull it off.

Be the first to comment