jetcityimage

As the stock market is negatively impacted by uncertainty, economic instability and a general downturn in consumer spending, there may be an opportunity to buy temporarily undervalued stocks in companies associated with reliability, consistency and resilience for long term investment. I believe one such company is Alimentation Couche-Tard Inc., (OTCPK:ANCUF) or (OTCPK:ANCTF), a global market leader in convenience merchandise and fuel. With over a decade long track record performance on key company fundamentals, twice proven recession resilient in the past, while continuously growing through M&As and organic growth initiatives. This financial year, the company has performed positively on the top and bottom line irrespective of the suspension of its stores in Russia, shortage of staff due to the ongoing impact of COVID-19 and variants, and increased operational expenses due to inflation. ANCUF produced positive cashflow and net profits all whilst heavily investing into rebranding, loyalty programs, business automation and electric energy solutions. Lastly management has what they say to be an achievable goal to reach $ 5.1 billion in EBITDA by 2023. Although cautious that a company cannot be guaranteed recession proof, the market is highly competitive, and big economic players such as Walmart (WMT) have entered the space, I do believe investors may want to take a bullish stance on this company based on its historic performance and future strategic outlook.

Introduction

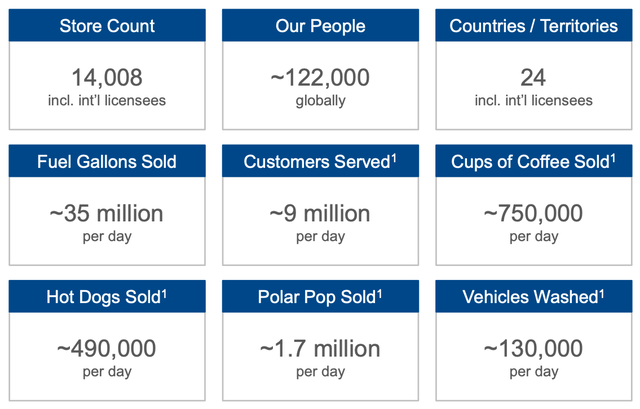

ANCUF is a Canadian company that was established 42 years ago as a single convenience store. The founder and current chairman of the board of directors, Alain Bouchard, has seen it grow to over 14,000 stores, of which 10,700 offer fuel, and across borders to 24 different countries, employing over 122,000 people worldwide. The company revenue is generated from two main income streams, namely merchandise and services, and road transport fuel. Fuel accounts for 72% of the revenue, whilst merchandise and services make up for 51% of gross profit. The company wants to create customer loyalty by selling time and convenience. 80% of what has been purchased in store is consumed within one hour.

Company in Numbers (Alimentation Couche-Tard Investor Presentation 2022)

The company works on a decentralized business model allowing for localized knowledge, goods, services and pricing to meet the consumer demand across the various and diverse regions.

Since 2015 it has worked on unifying its convenient stores and fuel pumps under the umbrella name Circle K, a company acquired by ANCUF in 2003. The brand power not only allows for better consumer recognition but additional scaled retailer benefits such as better access to fuel supply, reduced credit card expenses, and pushback on suppliers to control gross margins.

Circle K Umbrella Brand Company Benefits (Alimentation Couche-Tard Investor Presentation 2022)

Additionally, a small but growingly significant part of the business focuses on sustainable energy, primarily in Scandinavia, the company is supplying electric charging units to its consumers. In Europe there are now a total of 1100 and there is a 24-month plan to launch these throughout Northern America in regions where there is a consumer demand.

Circle K Electric Charging Units (The Copenhagen Post)

Valuation

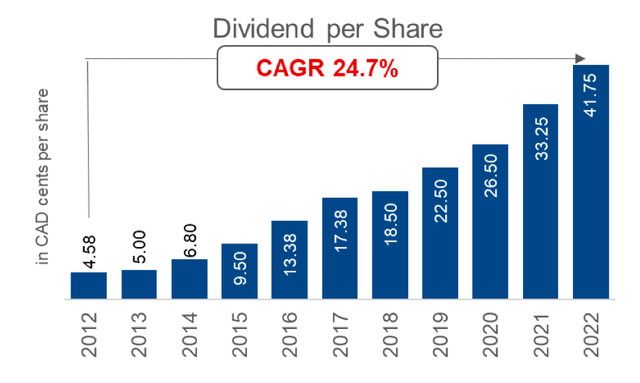

The long history of clear cut numbers speak for itself. The company has consistently been profitable since its IPO in 1986. Since 2012 the company has had an EBITDA CAGR of around 20% and has rewarded shareholders accordingly. All this while the company’s P/E ratio is currently 16.15, well under the general market P/E, indicating that it is undervalued.

Dividends per share since 2012 (Alimentation Couche Tard Investor Presentation)

If we look at overall revenue in the most recent financial report, under difficult circumstances the company has delivered impressive numbers. We see a 34.3% increase from Q4 last year at $16.4 billion. If we compare this fiscal year to the previous one we see an increase of 37.3% by $17 billion. The revenue growth is due to a number of factors, namely the increase of average fuel prices, the increase in fuel demand, the contribution from acquisitions that have been made, organic growth from merchandising and service sales and the positive outcome of foreign currency operations converting into US dollars.

Total merchandising and service revenues increased by 18% to $3.8 billion. If we break this down into regions we can see that revenue increased by 2.3% in the States, an increase of 6.2% in Europe and a small increase of 0.1% in Canada to last year for the same Q1. If we compare this to the gross margin in the same period, we also see increases all around, 1.3% increase in the States, giving us a margin of 33%, a 0.2% increase in Europe, giving us a margin of 38.3% and a 1.4% increase in Canada giving us a margin of 32.4%. This is also in line with the companies localized price promotion initiatives driven by data analytics to offer the best value for money specific to the consumers in the different regions. The company decreased in net earnings between Q4 2022 and the same period in the previous year which was at $563.9 million.

Additionally, 2022 has already seen the completion and opening of 133 new stores and 58 more under construction. There was an acquisition of four company operated stores, totaling the number of companies to 74. This acquisition was paid in cash. The ability to sell 44 sites, in which the company gained $15.6 million. This shows that the cashflow is sufficient to invest and continue its growth. It had a positive operational cashflow of $3.94 billion.

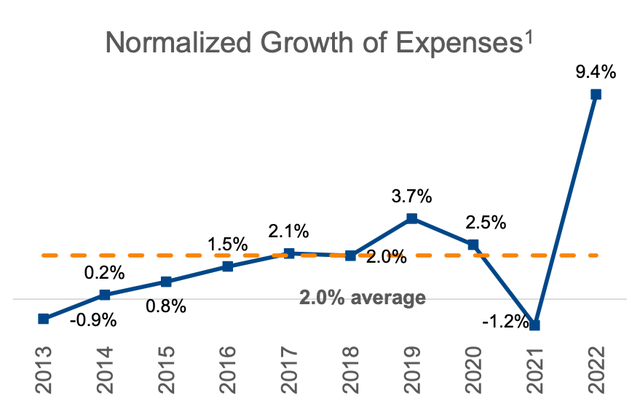

The expenditure looks relatively high compared to the years impacted by COVID pandemic in which expenses where unusually low. High operational expenditure is connected to COVID, workforce wage inflation and own brand fuel marketing.

Expenses since 2013 (Alimentation Couche Tard Investor Presentation 2022)

The company is dealing with a 3.4% wage inflation. There is a lot of pressure on expenses such as high fuel prices that are pushing up supply chain costs. As the company is starting to focus more of its energy on organic growth initiatives, naturally costs will occur connected to the data collection and workforce requirements. Lastly the rebranding of its fuel to Circle K Fuel is a large investment but costly to put in the required changes. The company mentions that operational expenses may reduce in the longer run through self checkout which has already been launched in 2500 stores, automation process on the backend for stores known as Easy Office and an automatic payment system to be rolled out that will allow for customers to smart pay.

Risks

Although ANCUF has a proven reliable business model, there are risks we need to take into consideration. Firstly, the company is fully dependent on third party suppliers for its fuel and merchandise products and services. Although it is one of the larger convenience stores and therefore has better negotiating power. As seen with the economic and political pressures on fuel supply, the cost and supply available can heavily fluctuate, impacting the companies ability to service consumers and ultimately its performance. The Ukraine crisis resulted in the suspension of 38 of its stores in Russia, consequently $56.2 million in depreciation, amortization and impairment costs.

As mentioned previously, increased inflation has had a big impact on operational expenses. One issue is the cost of staffing, in addition to an already shortage of staff. Although small scale implementation of automated systems are present in some markets, the majority of the Circle K convenience locations rely on adequate staffing to fulfil the customers needs. Consumer habits are also already changing with inflation, the company has seen a reduction in the purchase of fuel, and changing to cheaper brand options for cigarettes and beer.

Lastly the industry is highly competitive and the number and type of companies competing is constantly changing. For many of the goods sold conveniently, there is a low barrier to enter, competitors can vary from other convenience store chains, to gas station operators, to small and large food retailers, although ANCUF is one of the largest players and has consolidated business through many acquisitions worldwide over the years. There are large competitors such as Walmart, who have aggressively entered into fuel and convenience, competing with similar budget friendly loyalty programs across its umbrella brand offering, especially an in issue in the States.

Growth and Final Thoughts

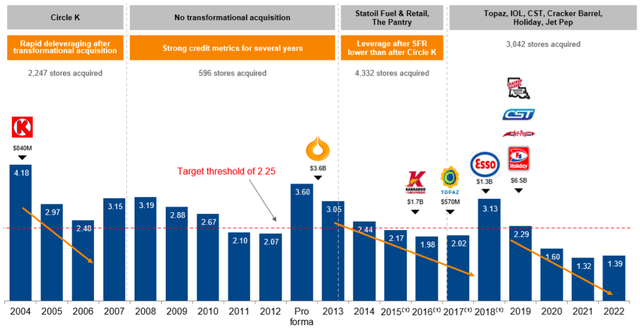

Over the years growth has been dominated by mergers and acquisitions. The lifecycle we find the company in and the focus is now on accelerating internal growth by providing consumers with more offerings. One example is the fresh food fast initiative which is available in 4000 stores.

Acquisitions over the years with Leverage Ratio (Alimentation Couche Tard Investor Presentation 2022)

The company has already made significant progress with alternative energy solutions in Europe, and specifically in Scandinavia with its e-mobility offerings. The goal is over the next 24 months to launch this offering across locations in the USA and Canada where there is sufficient consumer demand.

Big investments have been made into smart checkout technologies to reduce the cost of operations over the long run and overcome staffing shortage issues that have been a dominant issue, especially since the pandemic. Furthermore, data analytics are identifying the possibilities on rapid delivery and where this can be used to increase organic growth for the company.

ANCUF is present in all but three of the states in the States, it is market leader across many regions in Europe. It has a track record of generating value for its shareholders since 2012 and has ambitious growth plans for the future of the company. If anything the downward turn in the stock market is giving investors the chance to grab this stock at a value well below its estimated target value. For this reason, I believe investors may want to take a bullish stance on this company.

Be the first to comment