PeopleImages/iStock via Getty Images

Investment Thesis

CommScope (NASDAQ:COMM), a provider of enterprise scale communications solutions is now teaming up with Microsoft (NASDAQ:MSFT) to expand IoT capabilities with a cloud platform. What does this mean? It means that CommScope can continue to sell its communications hardware to clients, and it now has Azure Cloud support to drive advancements in usability, data aggregation, and efficiency. This is important as more and more manufacturers and businesses leverage smart devices, automation, and wireless features. While beneficial for both parties, I believe CommScope, which has had a lull in performance of late, will benefit the most. Therefore, I believe there is a strong argument for a turnaround play in COMM, and residual bullish implications for Microsoft’s Azure revenues.

‘We see a tremendous opportunity to transform workforce efficiency by making it easy to deploy and develop private wireless that can underpin agile factories,’ said Shriraj Gaglani, GM for Azure for Operators at Microsoft. ‘We collaborated with CommScope to implement use cases that increase worker and production line efficiency, and to help incubate and inspire industry 4.0 transformations.’

CommScope Website

CommScope Summary

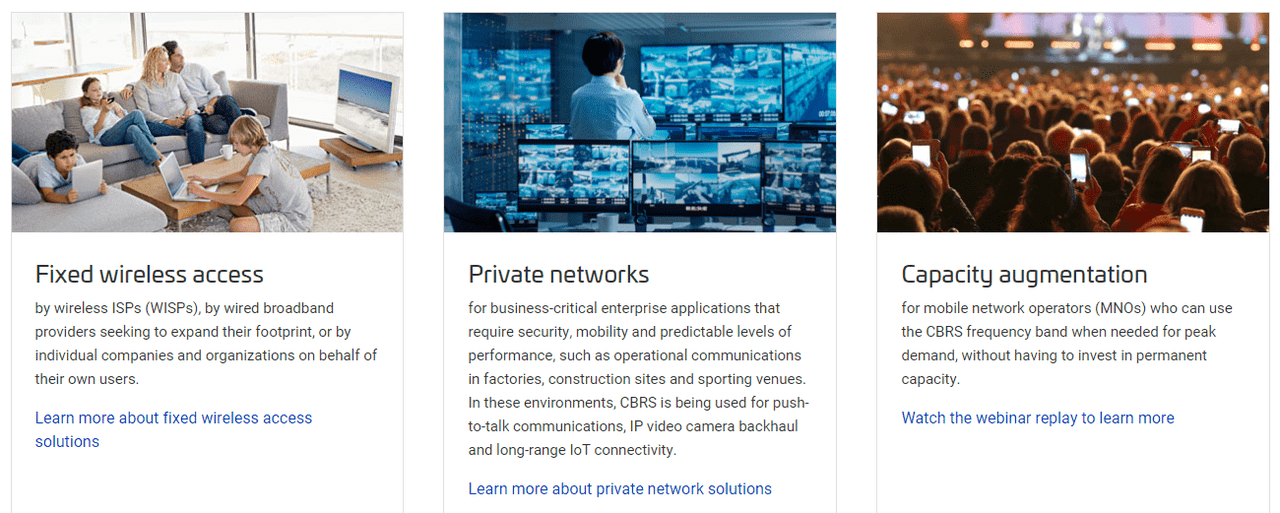

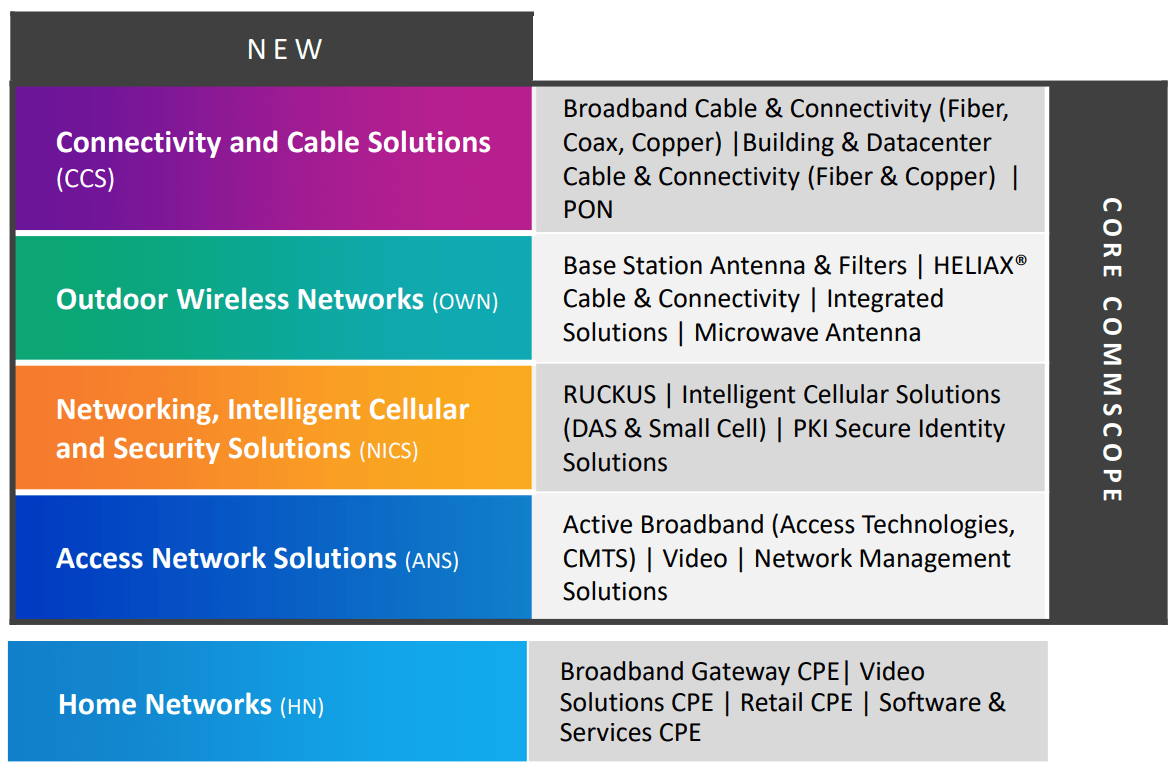

It is important to consider CommScope as a hardware producer. Many of their products revolve around modems, antennas, cable management, etc., with the goal of advanced digitalization of facilities or areas. Importantly, the company allows clients to gain their own wireless networks to have fast communication between staff, devices, and customers. The company used to be heavily exposed to housing and consumer applications, but has recently shifted more towards enterprise internet-of-things (IoT) applications. With that came the Microsoft partnership to drive higher margin access network solutions. Oracle (ORCL) presents the importance of IoT applications:

By means of low-cost computing, the cloud, big data, analytics, and mobile technologies, physical things can share and collect data with minimal human intervention. In this hyperconnected world, digital systems can record, monitor, and adjust each interaction between connected things. The physical world meets the digital world-and they cooperate.

For CommScope, this means a renewed focus on industrial applications in order to aid in the automation revolution. However, legacy clientele are also digitizing, and case studies include public and university level educational facilities, sporting and event facilities around the world, and commercial real estate. The current featured case study is CommScope’s work in leveraging advanced communications solutions at a new Nestle headquarters in Sao Paulo, Brazil. Remember, COMM does the hardware, so financially, they will not see the same returns as a SaaS provider.

CommScope Website CommScope Presentation

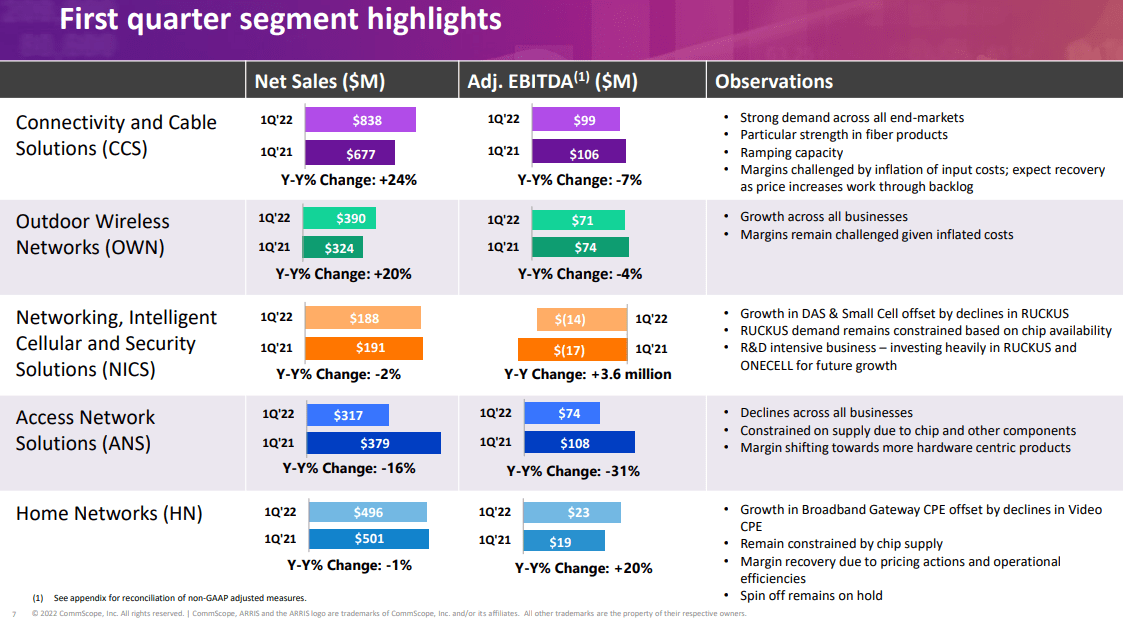

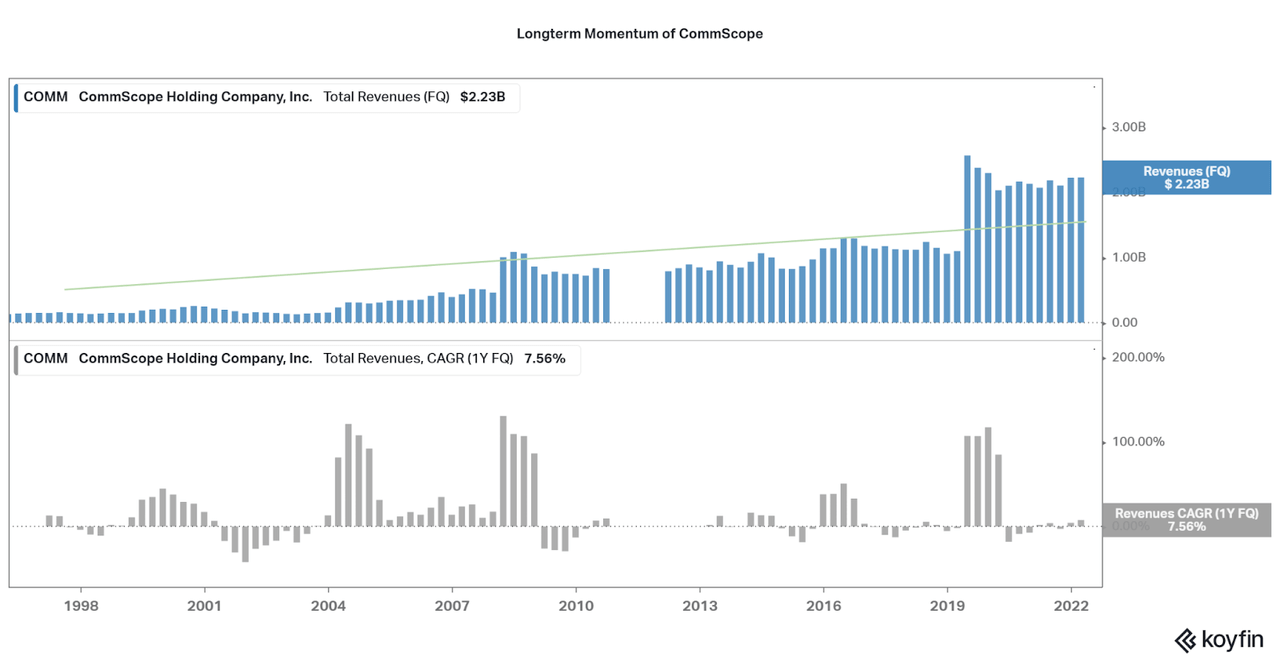

As development projects were put on the back burner due to the pandemic, CommScope has seen weak growth over the past few years. However, it seems that growth of sales is returning, although supply chain issues are preventing a full return. Therefore, one can expect an improvement in the financials over the next year or so as the company can obtain the necessary hardware components. I am sure that some investors enjoy a good turnaround play, and I believe that CommScope offers that. However, as I will now highlight, there are a few risks to consider, especially when you can also invest in Microsoft to gain exposure to IoT as well.

CommScope

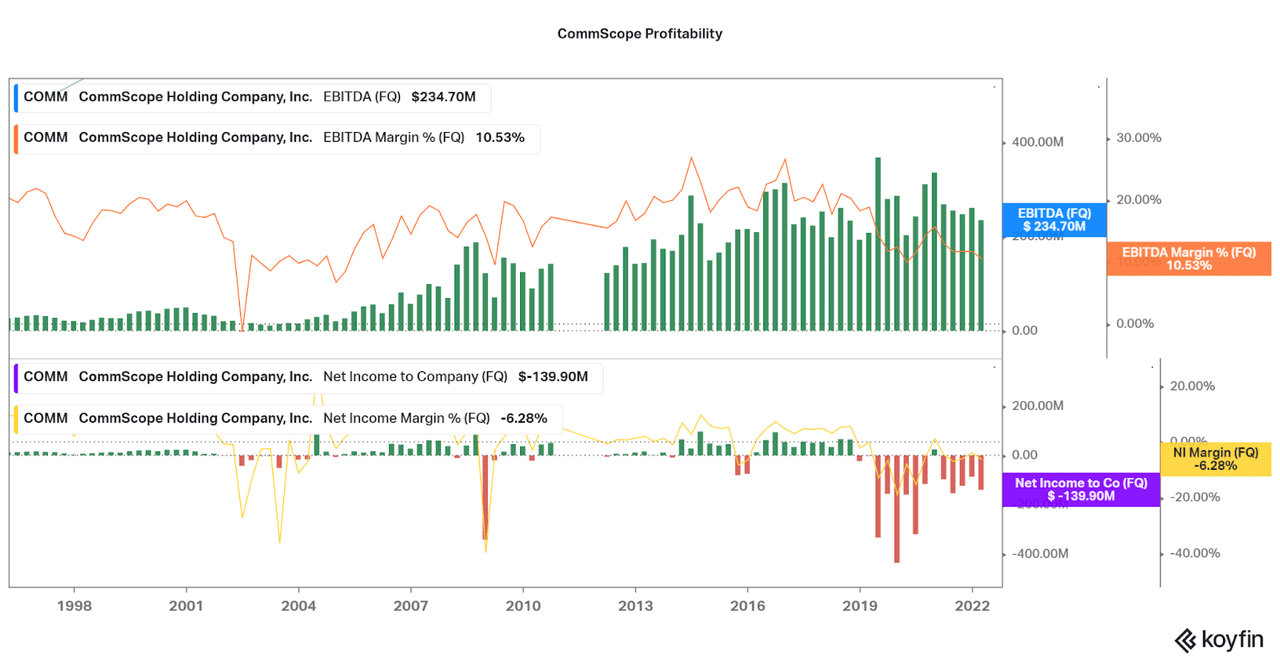

First, CommScope has always offered hardware lever financial performance. This means that growth is cyclical, and margins are low. Further, CommScope has had to find growth through acquisitions, and this has weakened the balance sheet significantly. However, the pandemic exacerbated the weakness, and one would hope that a return to normal form would offer more safety. While the financial terms of the Microsoft partnership are unknown, I expect to see slight improvements as the collaboration moves forward. First, look for revenue growth to return positive, above the current 7% YoY rate. Then, watch for operational synergies and high margin sales to increase profit margins. So far, the downward trend in EBITDA margin seems to be flattening out, but net income remains a risk point.

Koyfin Koyfin

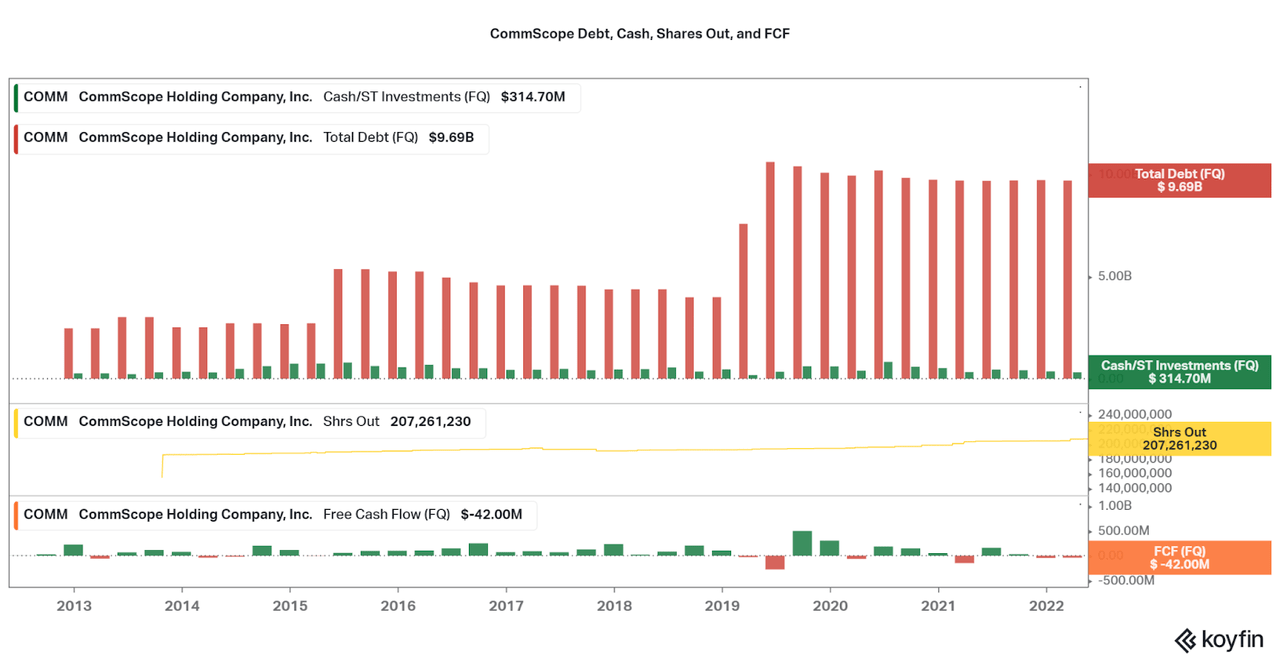

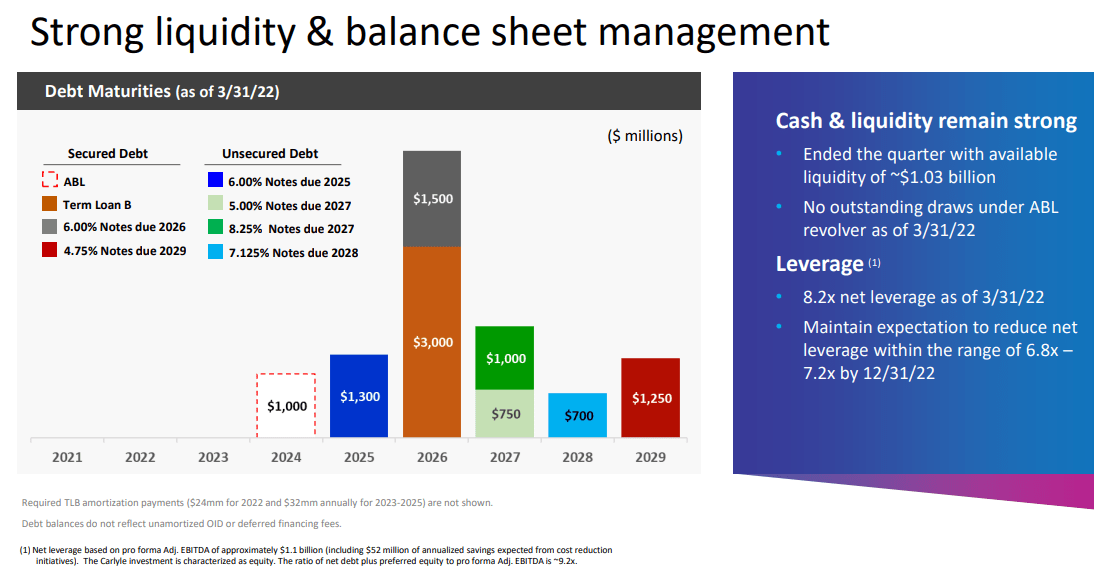

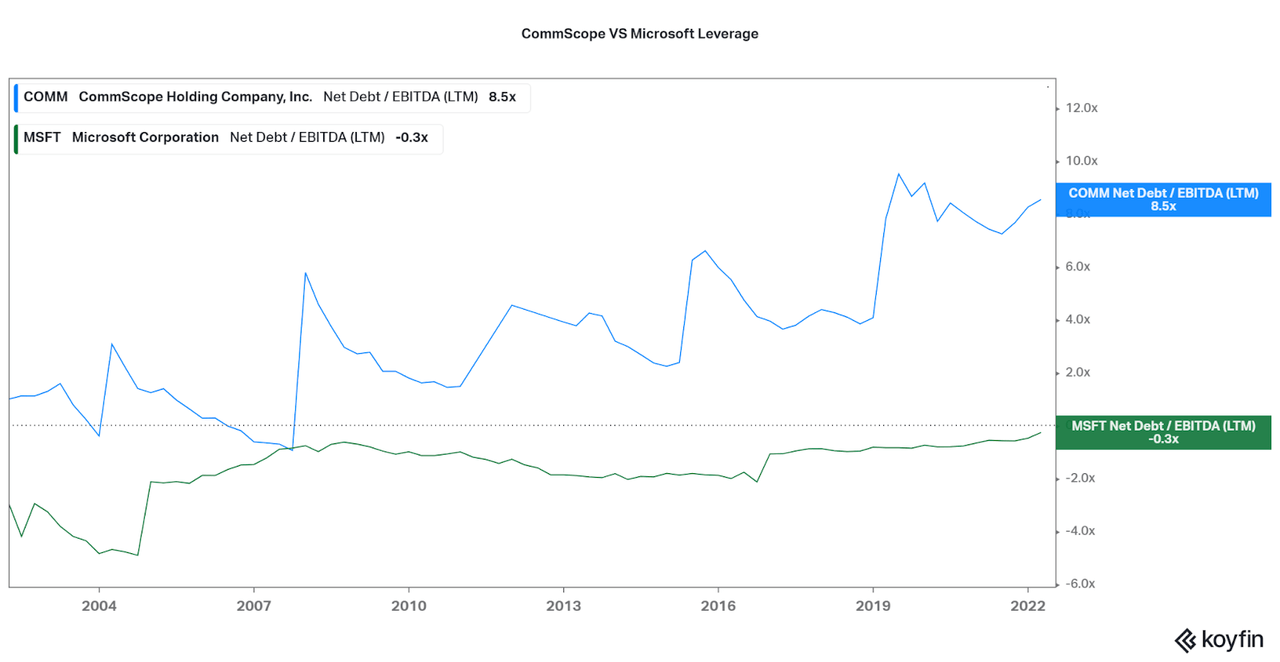

Another major risk point is the extremely leveraged balance sheet. An acquisition of Arris in 2019 came with tremendous amounts of debt and the acquisition only pushed revenues up. Margins have weakened ever since, and the company has decided to shift away from the consumer segment. While management states that their debt is well managed, Moody’s would disagree as they have downgraded the company and maintain a negative outlook.

The negative outlook reflects the uncertainty around the timing of resolution of supply chain challenges, cost pressures and the resulting ability to drive leverage towards 7x. CommScope’s cost cutting plans and expected price increases has the potential to offset some of the pressures in late 2022 and 2023 if the macro environment does not deteriorate.

Koyfin CommScope

Comparisons to MSFT

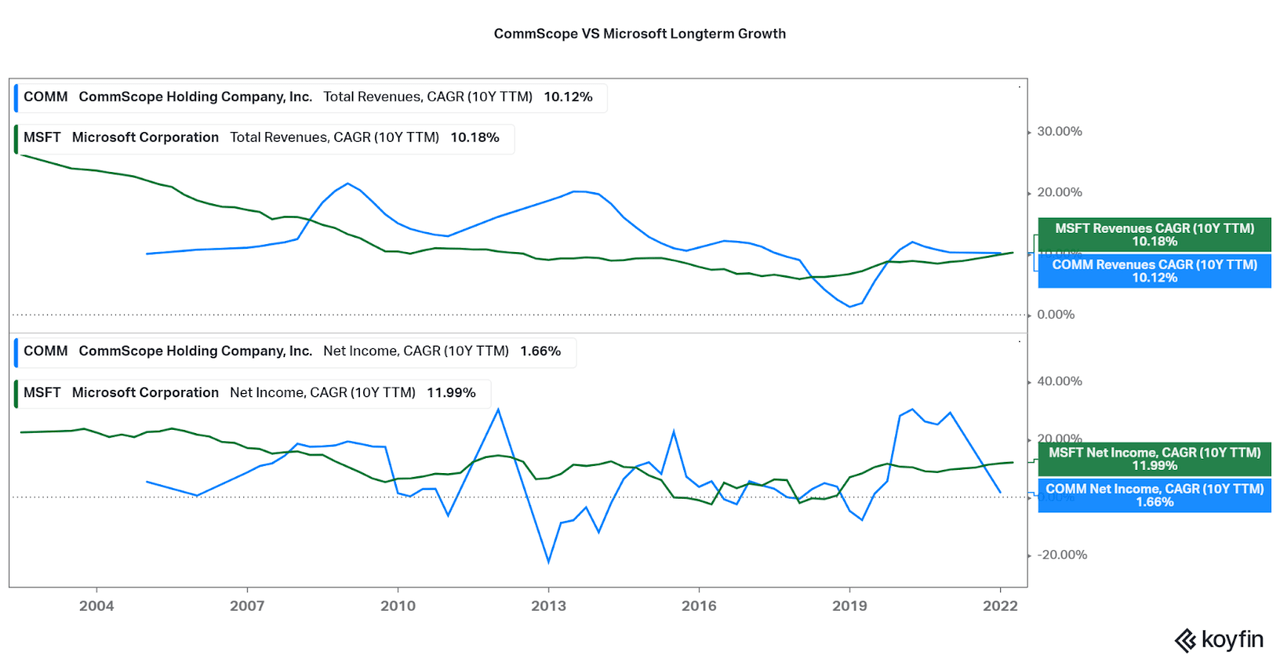

Therefore, unless an investor wants to watch for a bottom and gamble on a turnaround in CommScope, I would recommend considering Microsoft instead. Across the board, MSFT offers substantial, albeit declining revenue and earnings growth. New partnerships, such as with CommScope, and a push towards subscription services via Azure cloud will aid in establishing a forward facing business. This allows investors to not face the same volatility, cyclicality, and risk associated with a company such as CommScope. Just check out the differences in the growth and leverage chart comparisons between the two companies below.

Koyfin Koyfin

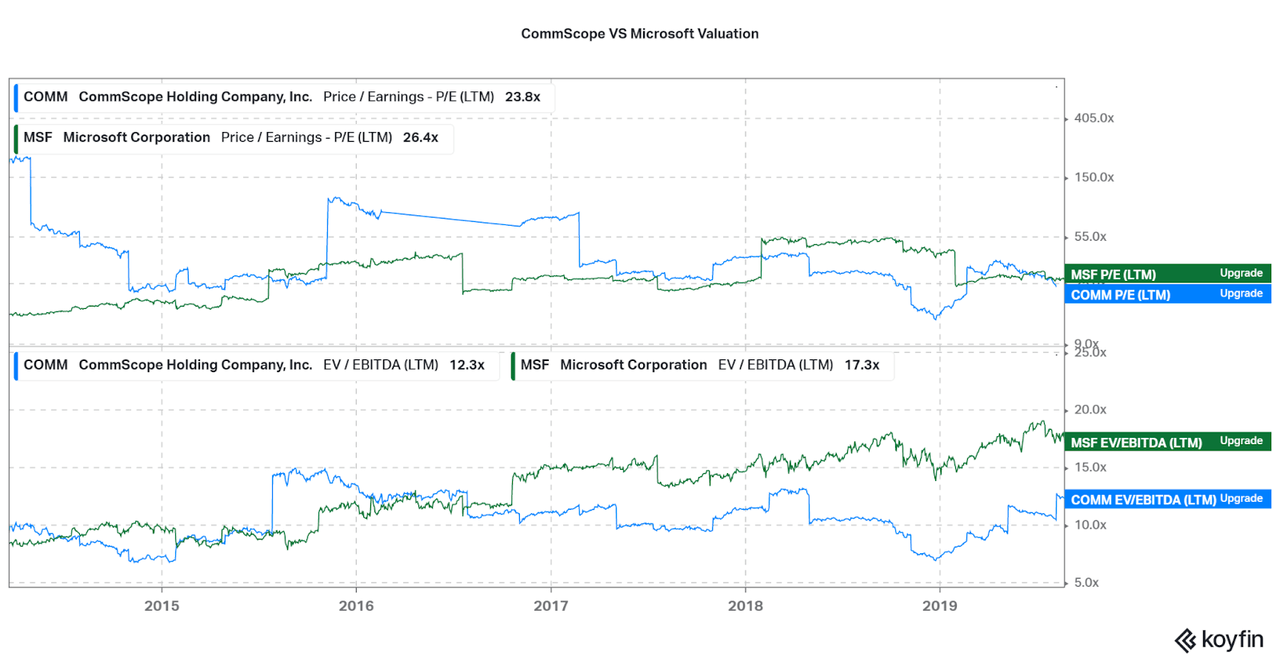

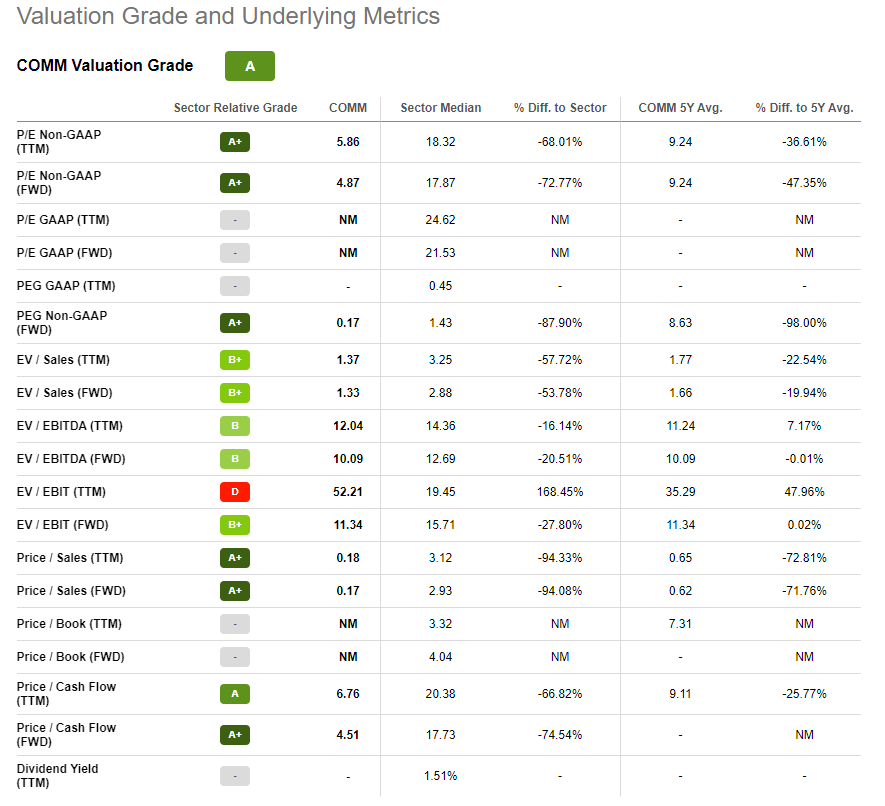

However, sometimes taking the easy way out will not lead to financial outperformance. High risk, high reward, right? This new partnership may be just the catalyst that COMM needs to turn around, depending on how expansive the collaborative nature is. While uncertain to date, we have to also consider the current values of both entities. As shown in the charts below, COMM scope is in fact undervalued when compared to Microsoft. Sure for a good reason, as quality should earn a premium, but COMM is extremely cheap at the moment. Even with the tons of debt, CommScope’s enterprise value metrics remain low when compared to the industry. At a current 0.17x trailing P/S ratio, COMM certainly has a compelling risk/reward profile.

Koyfin Seeking Alpha

Conclusion

While IoT is a growing field, companies such as CommScope are facing headways due to the need to spend on cloud software services. Perhaps a new age of partnerships with cloud providers such as Microsoft will allow for the industry to reestablish strong revenues. While hardware providers will always see cyclicality and low margins, I believe CommScope may have the opportunity to improve their financial position. Any positive improvements at the current share valuation will have tremendous implications to an investor’s returns. Even Moody’s says there may be a chance for this to occur, and they will change their rating accordingly:

Given the negative outlook and high leverage today, an upgrade of CommScope’s ratings in the near term is unlikely. However, an upgrade could occur if the company can sustain core revenue, EBITDA and cash flow growth, leverage is on track to decline to 6x and liquidity remains solid. The ratings could be downgraded if end market outlooks deteriorate, performance weakens, leverage is not on track to improve towards 7x or liquidity deteriorates materially.

Therefore, it is up to COMM’s management being able to leverage this favorable partnership, and not squander the opportunity. I will certainly watching performance over the next few quarters, and may attempt to trade the turnaround. While I would only recommend further research into this for other risk tolerant investors, I feel it is certainly worth consideration. If not, feel comfortable in the fact that Microsoft will continue growing its Azure platform, and more capabilities only create positive outlook.

Thanks for reading.

Be the first to comment