Tero Vesalainen

Oh Snap!

Shares of Snap (NYSE:SNAP) are down ~38% as the social media company reported disappointing 2Q22 top-line growth and pulled its 3Q22 guidance on a challenging macro outlook. In May 2022, Snap already warned investors of a deteriorating outlook by slashing its Q2 revenue guide to the low end of 20%-25% YoY growth (below +27% consensus then). Just when everyone thought second quarter earnings had been re-risked, yesterday Snap reported Q2 revenue growth of just 13% YoY growth against +15.5% consensus, which gave investors enough reasons to ditch the recent rally.

Q2 results worse than feared

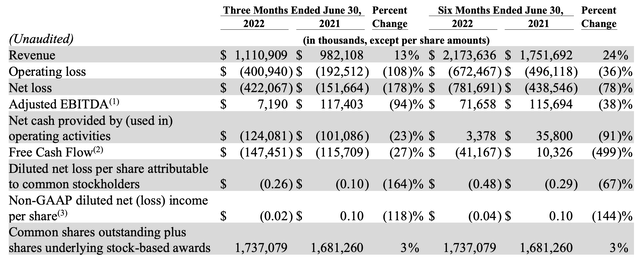

In 2Q22, Snap delivered revenue of $1.1 billion, up 4.5% QoQ vs. +27.5% QoQ in 2Q21. Management highlighted a deteriorating macro backdrop causing advertisers to pull their digital ad spend rather quickly as inflationary pressures and higher cost of capital eat into profits. Digital advertising campaigns are easy to turn on/off, and auction-driven direct response [DR] advertising are especially susceptible to budget cuts. This as a result had a swift impact on Snap’s business as marketers were able to make downward adjustments quickly. Interestingly, CEO Evan Spiegel was on the conference call, but did not speak at all during the Q&A.

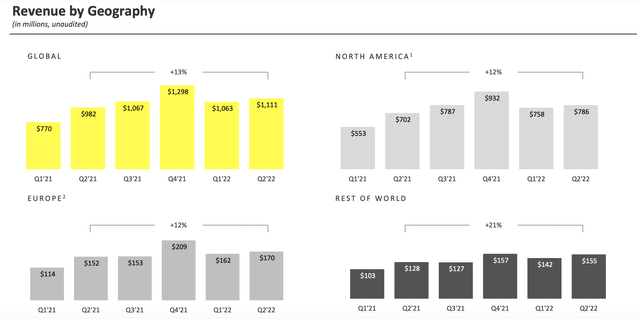

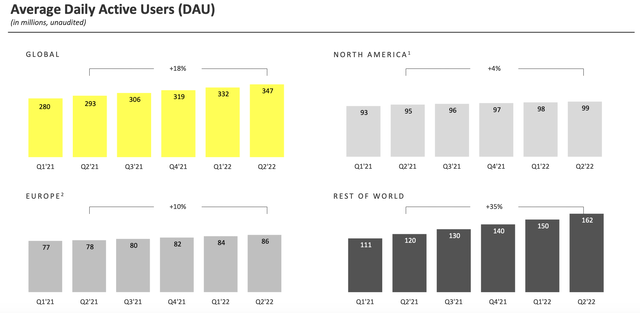

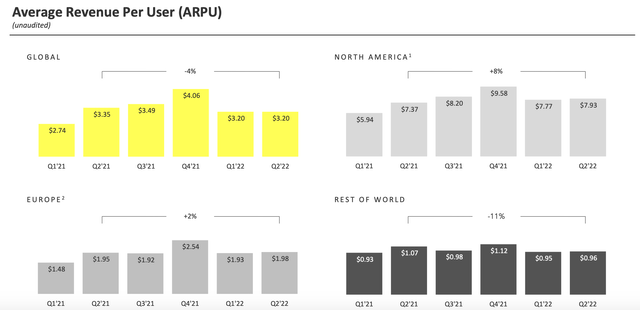

Despite an 18% increase in DAU (daily active users) and management’s upbeat comment on content engagement (time spent on Spotlight content up 59% YoY), revenue wasn’t able to keep up with user growth. Digging further, we can see that Rest of World revenue growth (+21% YoY) outperformed North America (+12%) and Europe (+12%). RoW DAU growth was also relatively strong (+35% YoY) against +4% in NA and +10% in Europe.

However, as a key revenue driver, overall ARPU growth of -4% YoY was underwhelming, with RoW ARPU (-11% YoY) contributing most of the downside against NA (+8%) and Europe (+2%).

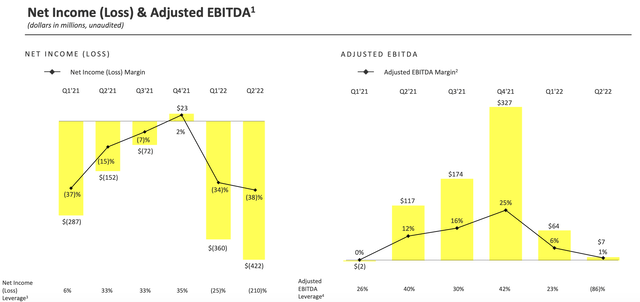

In a rising rate environment where investors care about profits today vs. tomorrow, Snap’s bottom-line results were a disaster to say the least. In Q2, Snap’s net losses widened from $152 million in 2Q21 to $422 million. Adj. EBITDA, a popular metric amongst non-profitable, high-growth tech companies, was only 1% for Q2 vs. 12% last year. Considering free cash flow was a negative $124 million in the quarter, I’m not sure a $500 million buyback program is a wise decision. Evidently, there’s a lot to be done on the expense side of the business as Snap expects to materially slow down the pace of hiring. Soon enough, it’s likely that a hiring freeze will turn into layoffs just like what we’ve seen at other tech companies like Twitter (TWTR) and Netflix (NFLX).

No visibility on Q3

Looking toward Q3, Snap believed DAU will be able to reach roughly 360 million but decided not to provide any guidance on the revenue side. Management noted that revenue growth is flat thus far in Q3. If this continues to be the case throughout the current quarter, Snap will deliver revenue slightly above $1 billion for Q3. Prior to Q2 earnings, the Street was looking for full year 2022 revenue of $5.2 billion, implying that revenue growth must exceed 50% in Q4 to achieve this target.

Of course, this is no longer a realistic scenario and analysts were quick enough to bring down 2022 revenue estimate to $4.65 billion now, looking for roughly 1% and 3.4% of top-line growth in Q3 and Q4, respectively. While 2023 consensus estimates on Seeking Alpha call for revenue of $6 billion (+30% YoY), sell-side analysts have already begun cutting their estimates.

Going forward, Snap expects to navigate the impact of IDFA by investing in 1P solutions and integrating with 3P solutions for its DR business. The goal is to optimize estimated conversions so that any gap between 1P and 3P results can be addressed to build trust amongst advertisers. Snap also seeks to diversify its revenue sources with Spotlight, Camera, AR and Snapchat+. Spotlight (short-form videos) will extend monetization testing in 2H22. The new Snapchat+ subscription plan costs $3.99/month and will allow users to use exclusive features, but doesn’t remove ads on the platform.

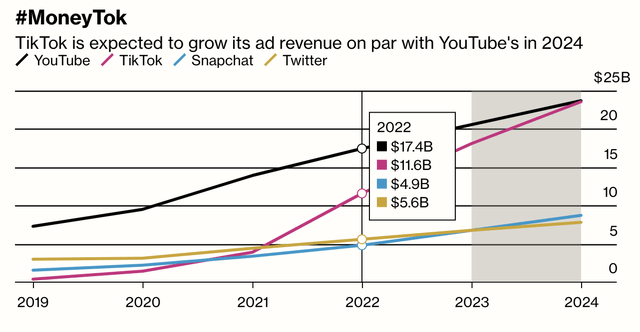

While Snap’s outlook may have certain implications for the broader digital advertising industry, competition was also a factor considering TikTok is another highly popular app amongst teenagers. Per eMarketer, TikTok’s revenue is estimated to reach almost $12 billion in 2022, up threefold from 2021. The phenomenal growth of TikTok clearly shows advertisers have been allocating budgets to the short-form video app, indicating share gains in incremental ad spend vs. Snap that share similar user demographics.

Conclusion

Snap’s Q2 results were highly disappointing and the company’s outlook is clouded by many challenges. Despite management pointing to macro factors, Snap’s problem may not be entirely representative of the advertising space due to the company’s size, experimental nature in the marketing budget, and competitors like TikTok gaining significant traction. The company’s path to profitability remains highly questionable, and investors have few reasons to stick around as top-line growth has hit a wall. The stock is falling ~38% as of writing, potentially giving short-sellers enough reasons to cover, leading to conditions for a short-term bounce. However, the fundamental prospects are the same regardless of where share prices go tomorrow. For now, I’d best recommend avoiding the stock and look for buying opportunities elsewhere. In digital advertising, my top picks are still Google parent Alphabet (GOOG) (GOOGL) (analysis here) and The Trade Desk (TTD) (here).

Be the first to comment