Scott Olson/Getty Images News

Investment Thesis

It is evident that McDonald’s Corporation’s (NYSE:MCD) golden arches have been bringing in massive amounts of “gold” during the past two years, as proof that its products are resilient against the pandemic. Therefore, we are not surprised by its 3Y price total return of 28.9%, further boosted by the growth in its dividend payout.

Given the consensus estimates for MCD’s continued revenue and net income growth over the next two years, the company may also be inflation-proof and recession-proof, thereby ensuring its continued stock price appreciation and valuation growth during the bear market. Therefore, long-term investors would be insulated from the potential recession, given the stock’s long runway for growth moving ahead.

Nonetheless, precisely due to the baked-in premium, the MCD stock is also trading at elevated valuations, above its 50-day moving average. Therefore, investors with lower risk tolerance may choose to wait for more of a buffer of safety, since the stock is also starting to show signs of weakness since January 2022. We shall see.

MCD Has Had A Monster FY2021 With Long Runway For Growth Ahead

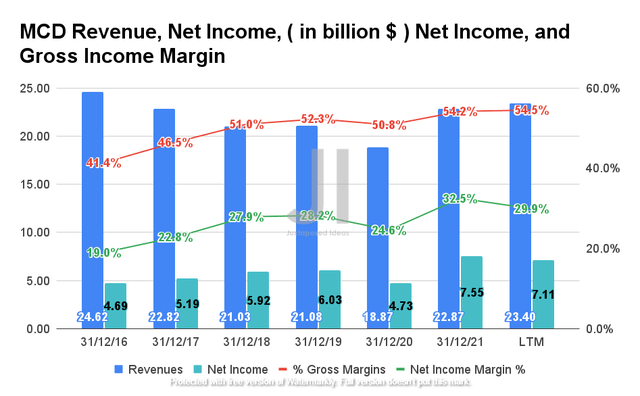

Despite the relatively in-line revenue growth, it is apparent that MCD has been growing its profitability over the past five years. As a result, the company reported revenues of $23.4B and gross margins of 54.5%, representing an excellent increase of 11% and 2.2 percentage points from FY2019 levels, respectively. In addition, MCD also improved its net income profitability, from net income of $6.03B and margins of 28.2% in FY2019 to net income of $7.11B and margins of 29.9% in the LTM. Therefore, this points to its excellent management, despite the global supply chain issues crippling other major industries, such as the semiconductor chips, shipping and logistics, and automotive.

MCD Cash/ Equivalents, FCF, and FCF Margins

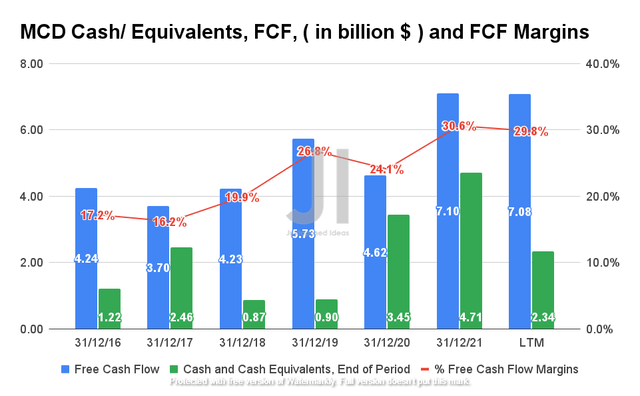

In the past few years, MCD has been generating robust Free Cash Flow (FCF), with the exception of FY2020. Though we must highlight that it is impressive that the company still managed to report a more than decent FCF of $4.62B and an FCF margin of 24.1% during the heights of the COVID-19 pandemic. In the LTM, MCD also reported a massive FCF of $7.08B with FCF margins of 29.8%, representing excellent improvement by 23.5% and 3 percentage points from FY2019 levels, respectively.

MCD Operating Expense

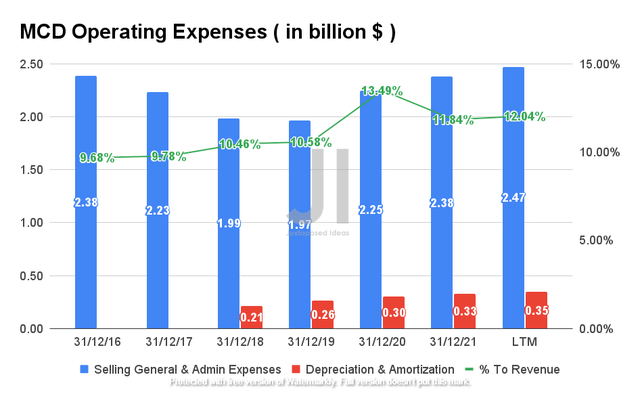

Nonetheless, it is evident that MCD has also been expanding its operational expenses to a total of $2.82B in the LTM, representing an increase of 26.4% from FY2019 levels. As a result, the company reported increased operating expenses with regard to its proportionately growing revenue, accounting for 12.04% of its revenue in the LTM.

MCD Long-Term Debt, Interest Expense, Net PPE, and Capex

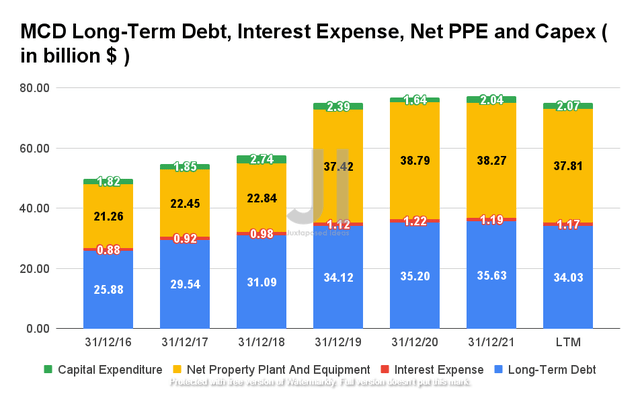

MCD also grew its net PPE to $37.81B and therefore, long-term debt to $34.03B in the LTM, representing an increase of 65.5% and 9.4% from FY2018 levels, respectively. As a result, the company had to spend $1.17B to service its interest expenses in the LTM, representing an increase of 19.3% from FY2018 levels, though it also reported reduced capital expenditure by 24.4% at the same time. Nonetheless, we are not overly concerned about its growing expenses of $6.06B in the LTM, given its robust net income/FCF profitability and cash and equivalents.

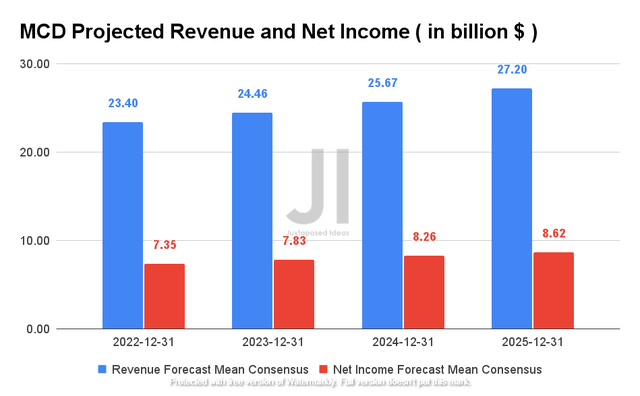

MCD Projected Revenue and Net Income

Over the next four years, MCD is expected to report revenue growth at a CAGR of 4.43% and net income at a CAGR of 3.42%. The company is also expected to sustain a robust net income margin of over 31% through FY2025.

For FY2022, consensus estimates that MCD would report revenues of $23.4B and net income of $7.35B, representing YoY growth of 2.3% and a decline of -2.5%, respectively. However, it is important to note that given the heights of the COVID-19 pandemic in FY2020 and the outlier growth in FY2021, the company’s projected net income in FY2022 still represents an impressive CAGR of 6.88% in the past three years. Therefore, we are of the opinion that MCD has a long runway for growth and stock price/ valuation appreciation moving forward.

MCD Is Still An Excellent Dividend Stock

MCD 10Y Share Price (adjusted) and Dividend Yield

MCD has had a discernible long-term stock price uptrend over the last ten years, discounting the brief dip during the heights of the COVID-19 pandemic in 2020. Though the stock had a notable decline in its dividend yield from 4.2% in 2015 to 2.2% in 2022, its dividend payout has been increasing at a CAGR of 7.17% in the past seven years, from $0.85 to $1.38. The fact that the company increased its payout by 3.2% consecutively, and by 6.9% during the pandemic, also highlights the fact it is a serious dividend stock for a long-term hold.

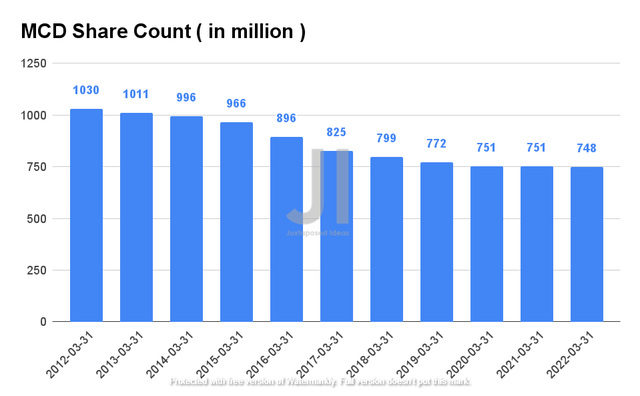

MCD Share Count

With its long-term share buyback programs in the past ten years and future programs worth $15B, it is evident that any long-term MCD shareholders have been, and will be, massively rewarded moving forward. Therefore, the stock remains a solid pick for long-term investors looking for consistent growth, steady dividend payouts, and regular share buyback programs.

So, Is MCD Stock A Buy, Sell, or Hold?

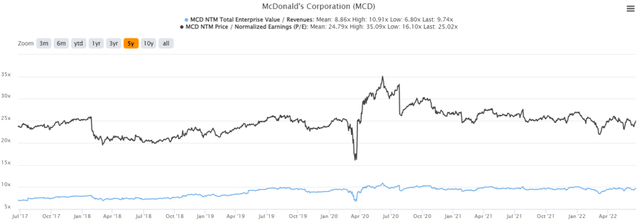

MCD 5Y EV/Revenue and P/E Valuations

MCD is currently trading at an EV/NTM Revenue of 9.74x and NTM P/E of 25.02x, slightly more elevated than its 5Y mean of 8.86x and 24.79x, respectively. The stock is also trading at $247.90, down 8.5% from its 52 weeks high of $271.15 though at a premium of 13.8% from its 52 weeks low of $217.68.

MCD 5Y Stock Price

As evident from the chart, MCD has had a strong uptrend in the past five years, with an excellent 5Y price total return of 81.7%, given its average dividend yield of 2.19%. Nonetheless, with the obvious baked-in premium, the stock only has a 13.8% upside to the consensus estimates price target of $282.11. Since MCD is also trading near its 50-day moving average of $245.66, we encourage investors to wait for a deeper retracement to a safer price target of $210, before adding more exposure to their portfolio.

Therefore, we rate MCD stock as a Hold for now.

Be the first to comment