hatchapong

Visa (NYSE:V), along with chief rival Mastercard (MA), are key barometers of the global economy. Their business model is to take a tiny fee from millions upon millions of credit and debit card transactions. In effect, they serve as a fractional global tax on commerce.

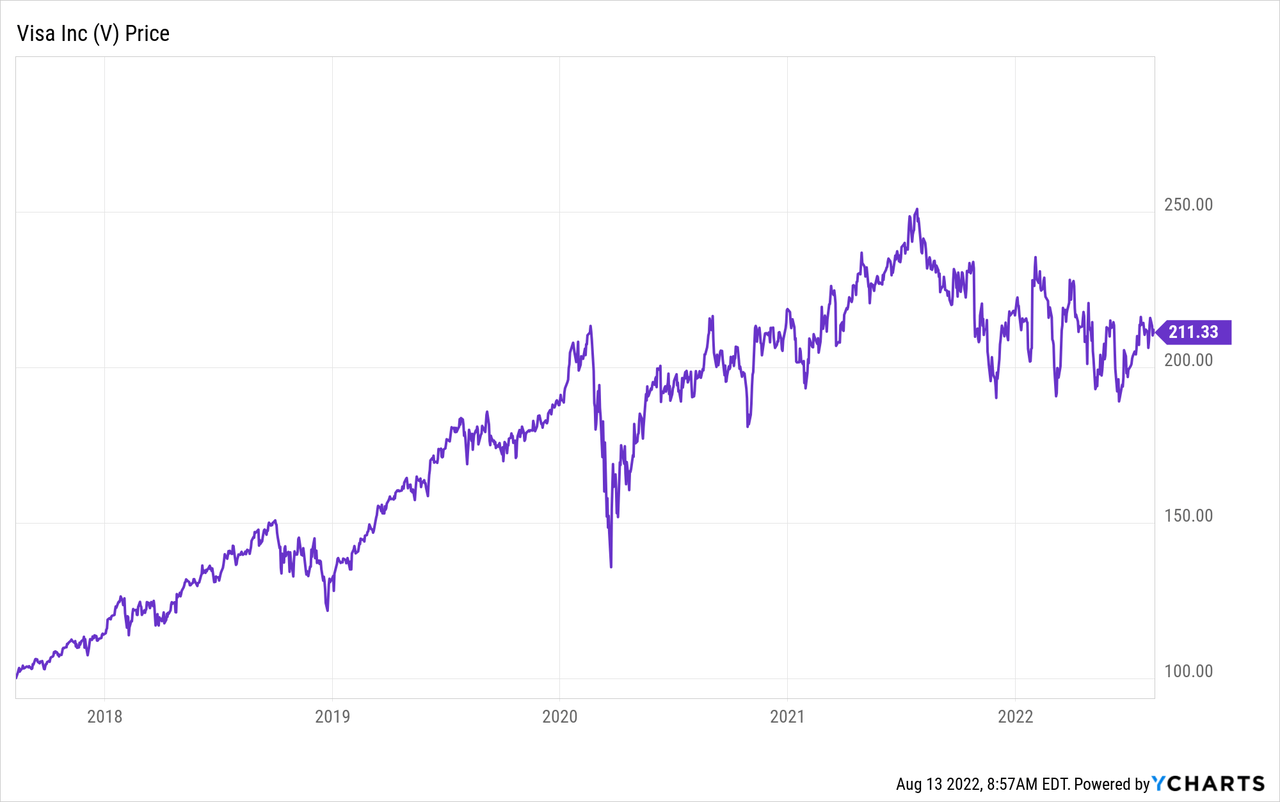

So when that commerce came to a halt in 2020, shares of Visa sold off and took a fair while to recover:

Visa shares did manage fresh all-time highs in 2021, but have since slipped right back to where they were in early 2020 prior to the onset of Covid-19.

What explains the slower comeback in Visa stock as opposed to so many other companies linked to economic reopening?

A big piece of that is due to Visa’s multiple tiers of transaction fees. Visa charges very low fees on most domestic purchases. For international purchases, however, Visa can get a bigger piece of the pie. These cross-border transactions, particularly if they involve currency exchange, give Visa a much better margin profile.

For obvious reasons, while Visa’s overall transaction volume didn’t fall too much during the pandemic, the share of its lucrative cross-border activity plunged. This led to a considerable overhang on earnings. As this clears up with international travel roaring back to life, Visa’s earnings should return to their normal and steady upward trajectory.

Indeed, I started buying Visa stock in late 2021 with this thesis. So far, shares are just flat since then, though that’s not a terrible overall result given the market’s struggles in 2022. The payments sector in particular has been a mess lately, with stocks like PayPal (PYPL) and Block (SQ) getting hammered. So Visa’s performance isn’t too bad compared with its industry peers.

Still, I expected better when I entered the position, given that global travel is recovering rapidly, as expected. So how do things look heading toward 2023? I have little reason to doubt my initial thesis and believe shares deserve to trade considerably higher, both in the near-term and five years from now.

Visa Key Stock Metrics

While Visa’s stock price hasn’t come surging back toward the highs yet, its earnings are moving sharply in the right direction.

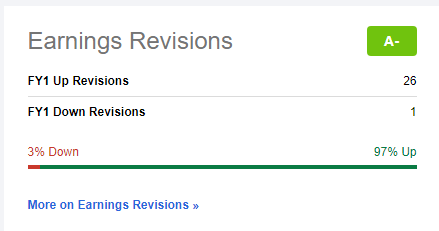

Powered by both strong transaction activity in general and a pickup in international commerce, Visa has reported strong numbers so far in 2022. As a result, out of the professional analysts that cover the company, 26 have raised their earnings estimates on Visa recently with only one analyst trimming their outlook:

Visa earnings revisions (Seeking Alpha)

It’s always interesting when analyst sentiment moves sharply in one direction and yet the stock price doesn’t react. While the company’s fundamental outlook is improving, the stock price hasn’t reflected that, or at least not yet. Therein lies the opportunity.

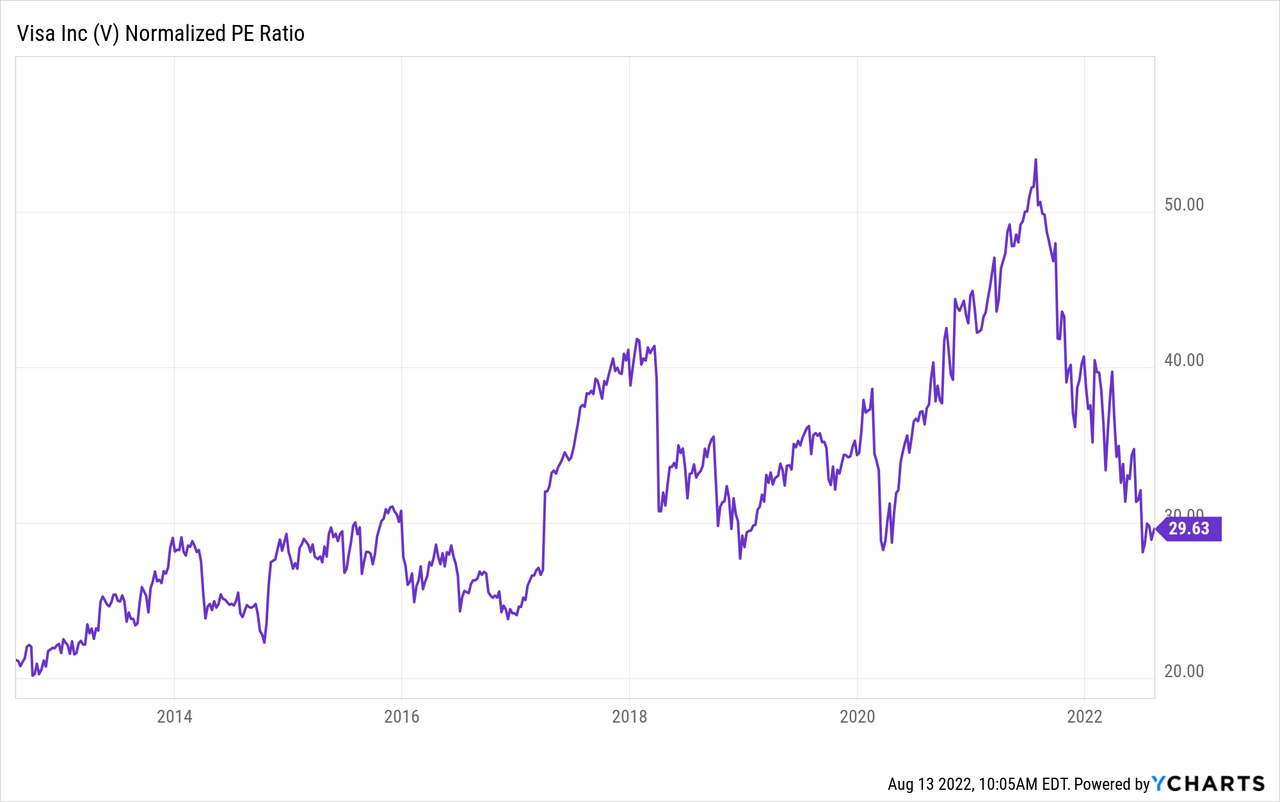

I’d further add that Visa is already trading at a relative discount to its historical valuation even as earnings sentiment is improving. As per Seeking Alpha data, V stock is now at 31x GAAP earnings as opposed to a five-year historical average of 37. And shares trade at 23x EV/EBITDA as opposed to a historical average of 26. Buying at a discount into improving earnings can make for a nice entry point.

Where Will Visa Stock Be In Five Years?

Historically, Visa has traded at a roughly 30-35x P/E multiple. It was closer to 30 in the mid-2010s, and moved higher toward the end of the decade. In any case, the current starting valuation is quite undemanding:

And from this entry point, we can start to think about the future. Visa has historically grown earnings at a high teens rate compounded annually. Will that hold up in a post-pandemic economy? Analysts forecast slightly slower growth, but still see solid double-digit annualized growth ahead:

Visa earnings estimates (Seeking Alpha)

Analysts forecast that Visa’s earnings will rise from $7.43 for the fiscal year ending in September 2022 all the way up to $14.41 for the fiscal year ending in 2027. That’s ever so shy of a straight doubling in five years. As the table shows, following this year’s big recovery with improving international travel, analysts see future growth coming in around 13-14% per year annualized.

Visa shares have historically traded around a median 30x earnings multiple over the past decade, and sometimes got significantly above the figure in recent years. That would seem to be a reasonable baseline for V stock going forward. 30 times earnings of $14/share in 2027 would put the stock at $420, which would be a double versus today’s price.

Using a more conservative 25 times earnings multiple, a level Visa historically has rarely traded below, would put the stock at $350 in 2027.

Is V Stock A Buy, Sell, Or Hold?

Visa checks the right boxes for a long-term buy and hold play. Over time, it is almost inevitably set to continue growing its revenues and earnings as the global economy expands and cards take increasing share from cash, particularly in emerging markets.

The biggest risk that would change my outlook is some competitive force or regulatory change that would cause Visa’s take rate on transactions to fall.

However, most purported threats to Visa’s duopoly just don’t seem credible. For example, we’ve heard about the American government cracking down on credit card fees since the Durbin Amendment in 2010. That limited the amount that the card companies could charge on debit card transactions. However, Visa was able to pull other levers to keep its overall profitability strong despite that obstacle. Debit cards remain exceptionally popular and profitable today.

Senator Durbin continues to talk about going after the card companies’ profits, such as during a Senate speech in May. The card companies’ stocks sell off periodically when we hear of potential new limits or regulations to the industry. However, at the end of the day, it’s really hard to offer a fast, secure, and ubiquitous payments network for less than 20 basis points a transaction. There is little to no evidence that Visa or Mastercard need to be disrupted. They offer a tremendous service at a more than reasonable price.

This has become increasingly apparent over the past few years. We’ve seen an absolute avalanche of venture capital go into FinTech and crypto startups aimed at disrupting payments. Yet crypto’s share of payments transactions remains miniscule. Meanwhile, FinTech firms are reporting large losses, seeing plummeting share prices, and are now facing layoffs and cutbacks.

Visa and Mastercard’s market position comes from scale. They process such a ridiculously large number of payments that they can charge a rock bottom price for each swipe and still earn huge profits. Startup competitors don’t have the scale to compete. And anyone competing on price is likely to run out of funding long before reaching said scale.

As long as Visa’s market position remains as it is today, shares are a buy. The valuation is undemanding at the current price compared to Visa’s historical valuations. There is still some reopening tailwind to benefit the company in the intermediate-term. And longer-term, there’s little reason to think that the company can’t grow earnings at a double-digit clip going forward.

Be the first to comment