jiefeng jiang

II-VI Inc. (NASDAQ:IIVI) reported Q4 EPS of $0.98, $0.04 better than analyst estimates of $0.94. Revenue for the quarter came in at $887 million versus the consensus estimate of $859.56 million. Supply constraints impacted F4Q22 sales by $8.6 million.

II-VI guided Q1 2023 ending September 30, 2022 is revenue of $1.3B to $1.4 billion vs. consensus of $1.25 billion and earnings per diluted share on a non-GAAP basis of $0.77 to $0.90 vs. consensus of $0.85. – Seeking Alpha’s news on earnings (here)

This is a follow-up to my article on II-VI from Aug. 23 (here).

Upbeat Call

I didn’t listen to the earnings call, to be frank, but read the transcripts. More remarkable than the positive data metrics and outlook, which I’ll discuss below, was the incredibly upbeat commentary from all participants. This was a switch from some previous earnings calls when IIVI was belabored by COVID and supply chain headwinds.

For example, CEO Dr. Chuck Mattera established the tone in his opening remarks:

“FY22 was truly extraordinary in every conceivable way, starting with our financial results.

In the face of these headwinds, our global team rose to the occasion every day with extraordinary effort and care for our employees and achieved an incredible success. There is an undeniable plumb line running directly from the Finisar acquisition and our collective long and deep history of dedicating ourselves to excellence, including as reflected in the results we report today.”

Deep Dive Into Segments

The enthusiasm of IIVI management is a clarion call that problematic headwinds in the past year, although still present is one form or another, are or soon will be alleviated, unlike gloomy guidance from other CEOs at recent earnings calls that negatively impacted investor response. Since Micron’s (MU) earnings call on June 30, 2022, technology stocks have sputtered due to slowing sales of consumer electronics products, weak guidance, and plans for capex cuts.

I discussed this in a July 1, 2022, Seeking Alpha article entitled “Why Are Tech Stocks Selling Off And What Is The Outlook?”

This optimism is particularly important because about 70% of acquired Coherent’s total business is tied to the macro factors, and the U.S. has recorded two successive quarters of negative GDP growth.

Data Center Business

II-VI noted that as the cloud and hyperscale data center market transitions to 25 and 50 terabits per second, the demand for its 800G transceivers is picking up. Datacom sales to hyperscale datacenters and supercomputing customers were strong with a 14% YoY growth. Shipments to hyperscalers of the company’s higher data rate transceivers at 200G and beyond were 4X higher than in fiscal year 2021 and drove the majority of the growth of our datacom business in fiscal year 2022.

Amazon (AMZN) is dominant position in the cloud-computing market, particularly in the Infrastructure as a Service (IaaS) space under its Amazon Web Services (AWS), which is one of its high-margin generating businesses. According to the company AWS powers hundreds of thousands of businesses in 190 countries around the world, with data center locations in the U.S., Europe, Brazil, Singapore, Japan, and Australia.

I wrote about Amazon in a May 6, 2022, SA article “What Chip And Cloud Strength Mean For Micron Technology,” so I refer readers to that article.

Strong Q1 2022 cloud results from U.S. hyperscalers (Microsoft (MSFT), Amazon, and Google Cloud (GOOG) (GOOGL)) continue to show high growth, which will translate to strong capex and semiconductor consumption.

- Amazon’s AWS (cloud) sales amounted to US$18 billion (+37% YoY) in 1Q22.

- Microsoft Intelligent Cloud’s 1Q22 sales reached US$19.1 billion (+26% YoY), with Azure (cloud platform) sales rallying 46% YoY.

- Google Cloud’s 1Q22 sales amounted to US$5.8 billion (+44% YoY).

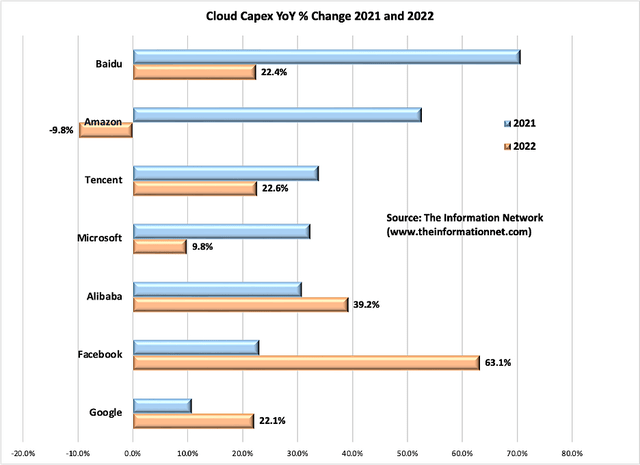

In Chart 1, I show my forecast for YoY percent change in Cloud Capex spend of the top hyperscaler companies in 2021 and 2022. These include Baidu (BIDU), Amazon, Tencent (OTCPK:TCEHY), Microsoft, Alibaba (BABA), Meta (META), and Google.

Capex spend grew at a CAGR of 34.8% between 2019 and 2021, according to our report entitled “Hot ICs: A Market Analysis of Artificial Intelligence (“AI”), 5G, Automotive, and Memory Chips.”

Chart 1

3D Sensing

On May 5, 2021, we learned that Apple (AAPL) awarded $410M from its Advanced Manufacturing Fund for II-VI to create additional capacity and accelerate delivery of future iPhone components.

The article further notes that “today’s award builds on an initial $390 million awarded from Apple’s Advanced Manufacturing Fund in 2017,” which was actually awarded to Finistar prior to its acquisition by II-VI in 2019.

Finisar had invested close to $100 million in a new 6″ wafer VCSEL (short for Light Detection and Ranging) production fab and planned to have the new facility qualified by Apple by the end of 2018.

VCSELs are processed on 6″ diameter (150 mm) GaAs wafers and cost about $10,000/wafer at modest volumes. With a usable area of ~ 15,000 mm², this translates to ~$0.6/mm². They are used in smartphones by Apple and Samsung (OTC:SSNLF), each of which have integrated ToF (time of flight) functions in their respective products, such as iPhone and iPad Pro.

VCSELs from suppliers II-VI or Lumentum (LITE) are combined with a sensor and VCSEL driver to make up the LiDAR product used in the Mac or iPhones.

Importantly, II-VI has been progressing in taking share from LITE. In its recent F4Q22 earnings call, LITE indicated:

“We expect smartphone 3D sensing revenue in fiscal ’23 to be reduced by approximately 40% to 50% from last year’s run rate, starting from our first fiscal quarter. As such, we expect first quarter industrial and consumer revenue to be up only modestly from the prior quarter.”

That suggests to me that II-VI is primary beneficiary of run rate loss at LITE. Indeed, II-VI’s CEO Mattra noted in the recent earnings call:

“We expect continued sequential growth from the consumer market due to both, meaningful share gains in the sensing market, including 3D sensing.”

Silicon Carbide

Silicon carbide substrate shipments II-VI grew 23% in Q4 over the same period last year. II-VI’s engagements with customers in the U.S. and Asia are expanding rapidly. II-VI also reported its first automotive qualified MOSFET devices.

In my Aug. 23, 2022, Seeking Alpha article entitled “Analysis Of II-VI’s SiC Wafer Agreement With Infineon Technologies,” I reported that SiC devices are competing for around 80% of the power electronics at the heart of the powertrain in electric vehicles, including the main traction inverter that converts direct current stored in the car’s battery pack into alternating current and feeds it to the electric motor turning the wheels.

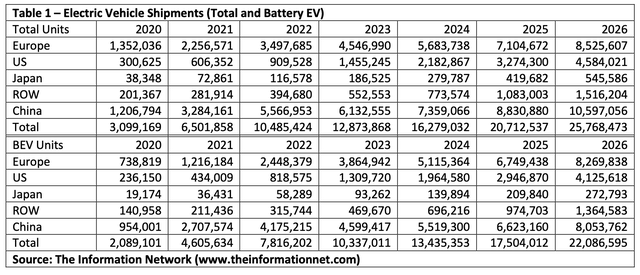

According to our report entitled “Global and China EV Batteries and Materials: Technology, Trends and Market Forecasts,”the EV market will grow significantly between 2020 and 2026.

As shown in Table 1, the total EV market is expected to grow nearly 4X between 2021 and 2026. The total EV market at the top is for BEV (Battery EV) and PHEV (Plug-in Hybrid). Looking at the bottom forecast, BEV units will grow nearly 5X between 2021 and 2026, representing strong growth potential for II-VI’s SiC wafers and chips.

LCD/OLED Laser Business From Coherent

II-VI acquired excimer laser technology from Coherent to make LCD and OLED displays primarily for smartphones and PC displays. These systems are sold by Korea’s AP Systems, which incorporates Coherent’s lasers into an Excimer Laser Anneal (“ELA”) system, which is used to convert amorphous silicon thin films into polycrystalline LTPS (low temperature polysilicon).

Newer technology is to combine LTPS with thin films of IGZO (indium gallium zinc oxide) thin films to form LTPO (low temperature polycrystalline oxide), which are used in the backplane of OLED displays. LTPO is used in Apple’s SmartWatch and Apple’s iPhone 14.

There are three different backplane materials used for displays currently in production: Plasma enhanced chemical vapor deposited (“PECVD”) hydrogenated amorphous silicon (a-Si:H), the amorphous metal oxide indium gallium zinc oxide (“IGZO”), and excimer laser annealed (“ELA”) low temperature polycrystalline silicon (“LTPS”).

Applied Materials’ (AMAT) AKT-PX PECVD equipment deposits LTPS directly on the backside of the display glass. In contrast, AP Systems sells laser anneal equipment that converts a-Si:H into LTPS. a-Si:H is less expensive to deposit than LTPS, but laser-annealed aSi-converted LTPS has better properties than as-deposited LTPS made by AMAT.

According to our report entitled “OLED and LCD Markets: Technology, Directions and Market Analysis,” smartphone shipments in 2022 are expected to fall to 1.46 billion units from 1.57 billion in 2021. Global personal computer shipments should drop 9.5% in 2022. I touched on this above as it related to the poor guidance from Micron.

Currently, displays are in oversupply brought about by the slowdown in consumer electronics products. An oversupply is even worse for LCDs as the migration to OLED displays in smartphones continues.

This oversupply has created a slowdown in equipment sales to make these displays. AMAT’s display segment revenues dropped from $413 million in F3Q 2021 to $333 million in F3Q 2022. Some of that lose is attributed to erosion of market share to II-VI.

Investor Takeaway

II-Vi issued a strong quarter and FY during a period when the company was dealing with significant headwinds coming from the acquisition of Coherent that was held up by Chinese regulators, as well as supply chain, macroeconomic, and geopolitical factors.

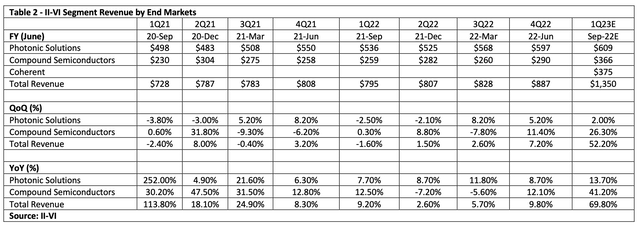

Table 2 shows the company’s revenues by its two segments – Photonic Solutions and Compound Semiconductors. Photonics sales in the June quarter of $597.4 million were up 5.2% sequentially and 8.7% YoY, while Compound Semiconductor sales of $289.6 million were up 11.4% sequentially and 12.1% YoY. For the September quarter, I show estimated revenue of $375 for Coherent, and a growth of 26.3% sequentially and 41.2% YoY for the Compound Semiconductor segment. The Compound Semiconductor backlog was $0.7 billion and the Photonics backlog was $1.6 billion in the past quarter.

Across the board, II-VI demonstrated strong leadership navigating the company through significant and extraordinary headwinds. II-VI registered record backlog, share gain against competitor Lumentum in 3D sensing for Apple business, and supply agreements with leading SiC chip manufacturer Infineon (INFFY) for automobiles enabling II-VI to reach 1 million SiC wafer sales per year by 2027.

On the basis of revenue growth, share gains, and anticipated business expansions, coupled with the Coherent acquisition, I rate II-VI a Buy.

Be the first to comment