undefined undefined

I first wrote about ZimVie Inc. (NASDAQ:ZIMV) a few weeks ago, noting that the stock screened cheap, trading at just 7.3x adjusted P/E. At the time, I thought the risk/reward was decent.

While ZimVie still screens attractive with an adjusted P/E of 9.1x, the disappointing second quarter results have reduced my confidence in management’s execution. Until the company can meet its own guidance and deliver results close to what was envisioned on the February Investor Day, I would recommend investors step to the sidelines.

Quick Company Background

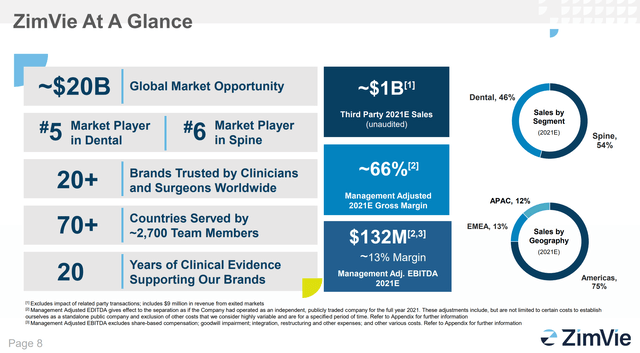

For those not familiar, ZimVie Inc. was spun out of Zimmer Biomet Holdings Inc. (ZBH) in March of this year. It comprises the non-core Dental and Spine businesses of Zimmer Biomet. The spin-out ZimVie is a leading player in the dental implants and spine markets, with combined total addressable market (“TAM”) of $20 billion. ZimVie is the #5 player in the dental market and #6 player in spine market, respectively (Figure 1).

Figure 1 – ZimVie overview (ZimVie Investor Day presentation)

Zimmer Biomet wanted to focus on its faster growing orthopedic franchise, and saw an opportunity to spin out the lower growth businesses to shareholders.

The combined ZimVie businesses have approximately $1 billion in run-rate revenues, split roughly equally between dental and spine. ZimVie is a market leader in the dental biomaterials sub-segment and the plan is to use the leadership position in biomaterials to cross-sell dental implants and digital solutions. In the spine market, ZimVie does not have leadership position in any sub-segment, although it does have interesting new products such as the Tether system to treat childhood scoliosis and the Mobi-C device to treat degenerative disc disease.

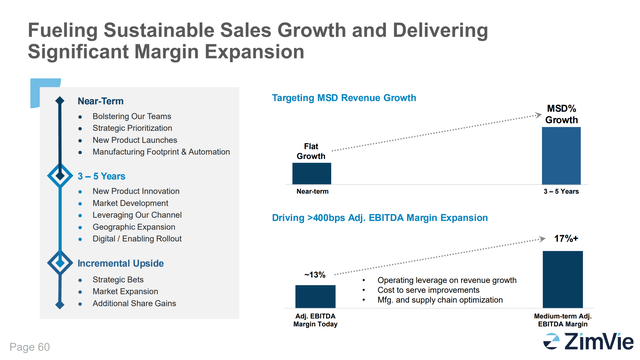

At the Investor Day in February, management was fairly upbeat with a plan to stabilize the businesses in the near-term with a goal to deliver mid-single-digit (“MSD”) growth in the medium term, along with margin expansion (Figure 2).

Figure 2 – Investor Day goals (ZimVie Investor Day presentation)

ZimVie’s initial quarterly report in May supported this view, with the company delivering revenues of $236 million and non-GAAP EPS of $0.50 a share, both ahead of consensus.

Second Quarter Was A Disappointment

However, for Q2/2022, ZimVie delivered a disappointing report. Consolidated revenues were $233 million and net loss was $9 million or diluted EPS of ($0.33) per share. On an adjusted basis, ZimVie reported adjusted net income of $18 million and adjusted EPS of $0.67.

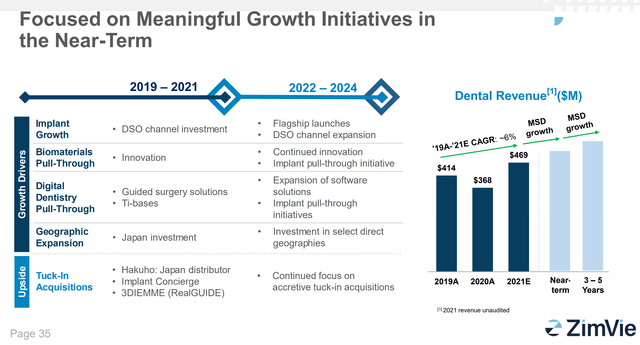

Revenues in the two segments were both disappointing. The dental segment saw constant currency growth of 2.9%, lower than the MSD long-term growth rate that management was guiding to at the Investor Day (Figure 3). Combined with currency headwinds, Dental revenues actually declined 1.8% YoY to $118 million.

Figure 3 – ZimVie expectations for the Dental Business (ZimVie Investor Day Presentation Feb 2022)

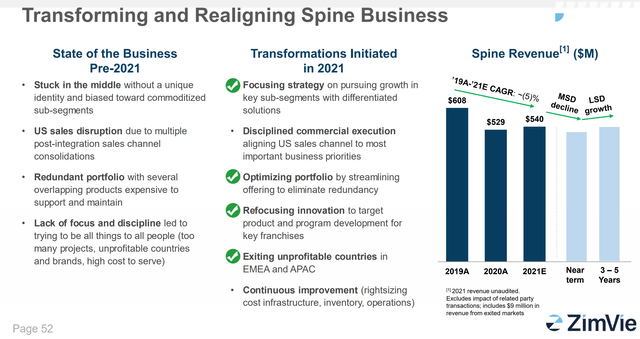

The spine segment saw revenues of $115 million, an almost 20% YoY decline (17.8% YoY decline in constant currency). ZimVie had been guiding to MSD declines in the short-term before reaccelerating to Low-Single-Digit (“LSD”) growth rates long-term (Figure 4). A large double-digit decline is certainly concerning and raises concerns that management does not have a good handle on customer demand.

Figure 4 – ZimVie expectations for the Spine Business (ZimVie Investor Day Presentation Feb 2022)

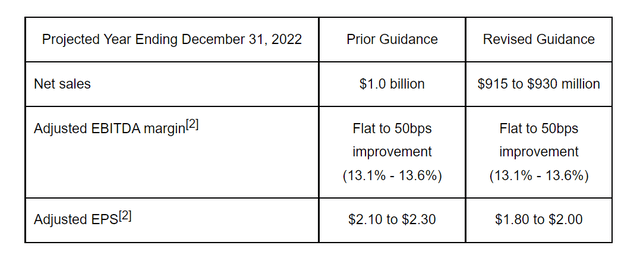

Finally, the company reduced its full-year guidance that was only issued a few months earlier in May (Figure 5). From $1.0 billion in revenues, ZimVie is now expecting $915 – 930 million in revenues, with roughly half the reduction due to currency headwinds. Also, from $2.20 in adjusted EPS (midpoint of guidance), the company is now expecting $1.90. What changed so drastically in a matter of months?

Figure 5 – ZimVie revised guidance (ZimVie Q2/2022 press release)

Guidance May Still Be Optimistic

With respect to the guidance, CEO Vafa Jamali made some comments on the earnings call that I believe could still be optimistic. I have highlighted the important sentences:

Vafa Jamali

Yes. So, let me provide a little bit of just color on how we are thinking about the balance of the year, and I will break it up between dental and spine. So, on the dental business, we guided mid-single digits to high-single digits. We expect to be at the lower end of the range. The way I think about it is if Q3 sequentially is our lower quarter for dental, and so what we expect to see is a kind of a modest decline in Q3 due to seasonality and then Q4 is typically our strongest quarter. And seasonality for dental will largely be roughly the same as it was, say, in 2019. On the spine side of things, we expect the balance of the year to be in the low-single digit decline [note: CEO later corrected himself and said low double-digit]. Again, Q4 is the stronger of the two remaining quarters because of seasonality, but we still expect Q3 to be impacted by seasonality in spine.

For the dental business, the CEO is expecting a modest decline in the coming third quarter, and then a “strong” fourth quarter to bring the full-year to MSD growth. Given the business is currently tracking at less than MSD growth rates, a lot of faith has been built into the fourth quarter.

On the spine business, the CEO is expecting the decline to decelerate from almost 20% YoY to a low double-digit decline, again building a lot of expectations for a large Q4.

It is hard for analysts to put too much faith in management guidance two quarters in the future when they had to severely lower the full year guidance after only 3 months.

Results Continue To Be Adjusted

When I first wrote about ZimVie, I noted the large difference between GAAP and adjusted results:

While these adjustments should be one-time or non-cash, it will be important to monitor the coming quarterly earnings. Persistent differences between GAAP and ‘adjusted’ earnings is a red flag.

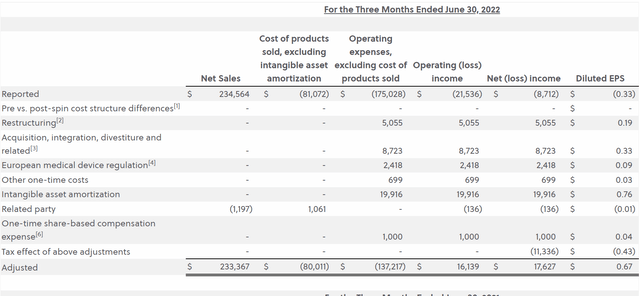

My understanding was that many of these adjustments were due to the spinoff and should be one-time in nature. However, that does not appear to be the case, as ZimVie once again reported large differences between GAAP and adjusted results (Figure 6).

Figure 6 – GAAP vs. Adjusted Q2 earnings (ZimVie Q2/2022 press release)

In particular, why should intangible asset amortization be a constant adjustment? True, it is a non-cash expense, but it reflects the decrease in value of the company’s intangible assets, presumable intellectual property. Don’t patents expire? Shouldn’t that be factored into costs?

Also, the spinoff was completed in early March, and yet there are still lots of “one-time” expenses being charged in Q2. I worry that management will obfuscate deterioration in the core businesses by adjusting for more and more items in the coming quarters.

Valuation Is Cheap On Adjusted Figures

Taking management’s updated guidance as a baseline, ZimVie is currently trading at 9.1x adjusted P/E. While this still screens on the cheap side relative to a market multiple of ~17x, it is no longer as cheap as the 7.3x when I first wrote on ZimVie. Furthermore, results are still heavily adjusted, and I suspect true GAAP earnings to be deeply negative for 2022 (H1/2022 EPS was a loss of $1.32).

Execution Risk Remains Top Of Mind

One of the key risks I highlighted in my previous article was business execution. I noted that this is both CEO Vafa Jamali and CFO Rich Heppenstall’s first stints as top executives of a public company and unfortunately, I was proven right. The poor second quarter execution highlighted management’s inexperience, especially with setting realistic expectations out of the gate.

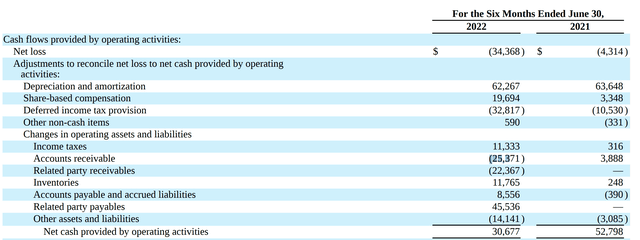

Furthermore, ZimVie remains heavily indebted, with $590 million in long-term debt and lease liabilities. Although the company was able to increase the cash balance by $25 million in the quarter to $130 million, that was mostly on the back of accruals management. Operating cash flows was actually 42% lower YoY for the first half (Figure 7). Without the large $45 million increase in ‘related party payables’, cash flows from operations would have been negative (and this related party payable remains a liability on the balance sheet that will need to be paid in the future).

Figure 7 – ZimVie H1 CFO (ZimVie Q2/2022 10Q report)

Finally, investors should not forget that Zimmer Biomet still holds 19.7% of ZimVie’s stock, and has intentions to use the stock to pay down its own debt (please refer to ZIMV’s Form 10 from February for rationale). As ZimVie’s spinoff was completed on March 1st, I expect ZBH’s SEC Rule 144 hold on ZIMV stock to expire in the coming weeks, potentially putting pressure on the stock.

Conclusion

In conclusion, while ZimVie still screens attractive on an adjusted P/E basis, the disappointing second quarter results have reduced my confidence in management’s execution. I am particularly worried that management had to severely cut their full year guidance only 3 months after publishing it. Until the company can string together a few quarters of positive results (meeting guidance; delivering numbers close to what was envisioned on Investor Day), I would recommend investors step to the sidelines.

Be the first to comment