Erikona/iStock Unreleased via Getty Images

PayPal (NASDAQ:PYPL)’s setup is attractive: The stock is trading at a very reasonable P/E ratio after a year-long downward revaluation and the global payments company will continue to grow its total annual payment volume going forward. Additionally, PayPal is expanding its services, especially in the buy now pay later segment, which helps merchants increase sales and conversions. For PayPal, an expansion of BNPL services could translate to much needed profit growth going forward!

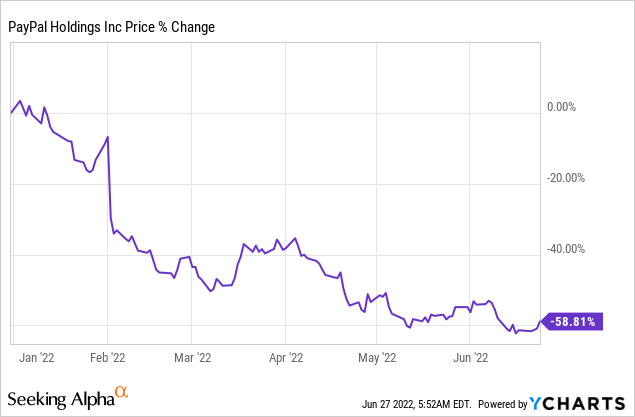

Reduced guidance still weighing on PayPal’s valuation

PayPal’s shares revalued lower even before PayPal announced a massive cut to its FY 2022 guidance. I discussed the change in guidance in “Epic Recovery Ahead”. Year to date, PayPal’s shares have declined a massive 59%.

PayPal is expanding its offering in the BNPL segment

As a global payments company, PayPal has an opportunity to aggressively expand its service offering in the hot buy now pay later segment. BNPL products allow customers to break up a purchase price over multiple installments meaning they can purchase products that fall outside of their budgets. PayPal entered the BNPL market in 2020 with its ‘Pay in 4’ product which allowed customers to pay for purchases in four equal payments. BNPL products are an attractive category because credit products increase merchants’ payment volumes and conversions.

Just two weeks ago, PayPal announced that it is expanding its BNPL services by introducing ‘PayPal Pay Monthly’, which is an expansion of PayPal’s existing buy now pay later product. PayPal Pay Monthly gives customers the flexibility to purchase products with a value between $199-$10,000 and spread the cost over a 6-24 month payment period. Monthly payments begin one month after the purchase has been completed with interest rates ranging from 0%-29.99%.

According to PayPal, 22M PayPal customers used the firm’s buy now pay later products in FY 2021. Considering that PayPal’s ecosystem includes an active account base of 426M, PayPal has serious penetration potential in the BNPL segment going forward and the firm could easily double the amount of customers that use one of its buy now pay later products.

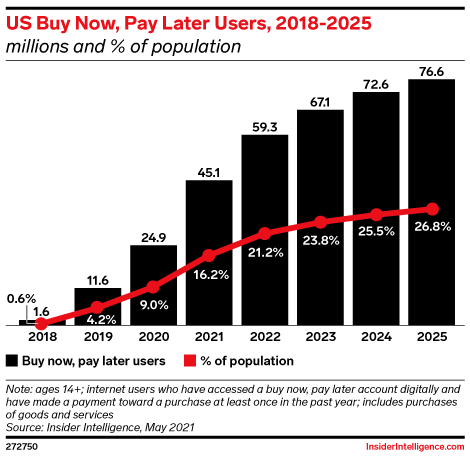

The single biggest driver of BNPL adoption is e-Commerce growth. Projections from eMarketer call for a massive rise in BNPL adoption until FY 2025, creating a huge opportunity for growth for PayPal.

eMarketer

PayPal’s biggest advantage is its large ecosystem and significant scale

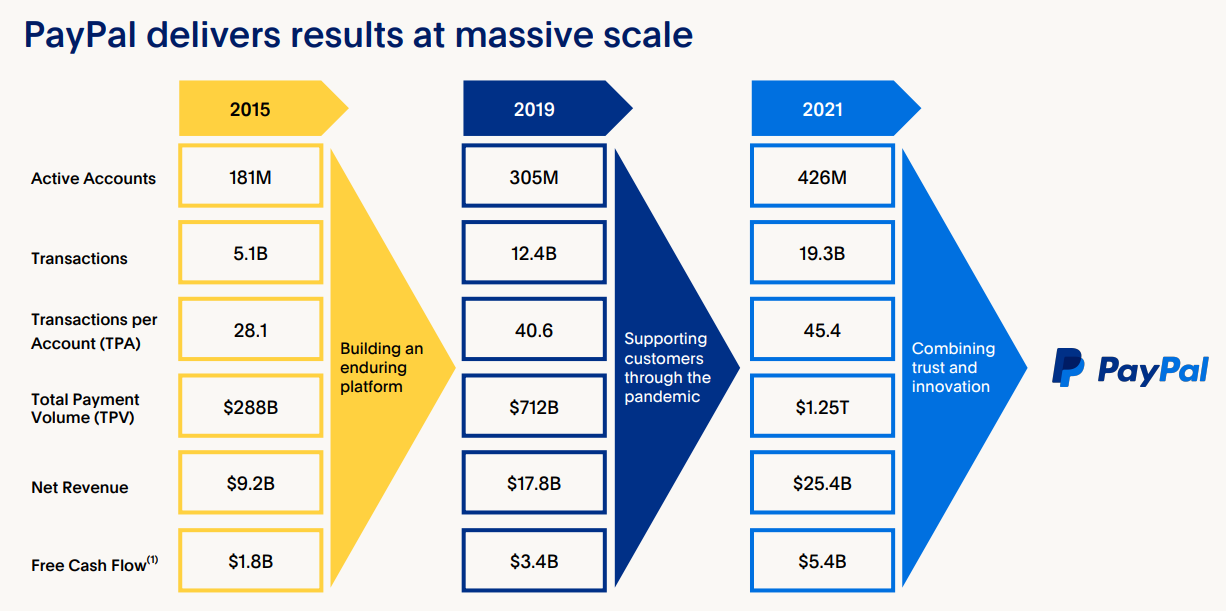

The BNPL market is getting more competitive and not too long ago even technology company Apple (AAPL) moved into the space with its own BNPL product called ‘Apple Pay Later’. Established companies in the industry include Affirm (AFRM), Afterpay and Klarna (KLAR). The biggest advantage for PayPal is that the company already has a large, 426M-strong customer base that is open to online shopping and willing to test out new payment products. PayPal has an annual payment volume of $1.25T, meaning the payment processor already plays an important role in the market for online purchases… which gave PayPal a head-start in the BNPL industry.

The pandemic acted as an accelerant for PayPal’s total payment volume and customer growth: since 2019, PayPal added 121M new active accounts to its payments platform while total payment volume increased 76%, or $538B.

PayPal

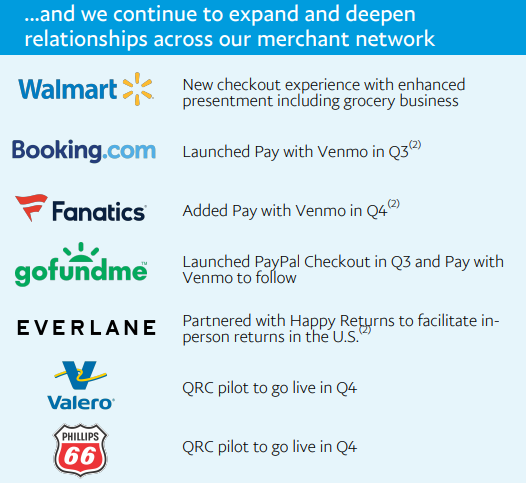

Although growth is slowing, post-pandemic, PayPal has all the necessary key ingredients to scale its BNPL business: It has an engaged customer base and the payment processor is driving payment integrations with many different retailers (including Amazon (AMZN) and Walmart (WMT)) to boost conversions. Going forward, PayPal could sign on new retailers to its payments platform which then offer BNPL services to their customers.

PayPal

PayPal is a bargain

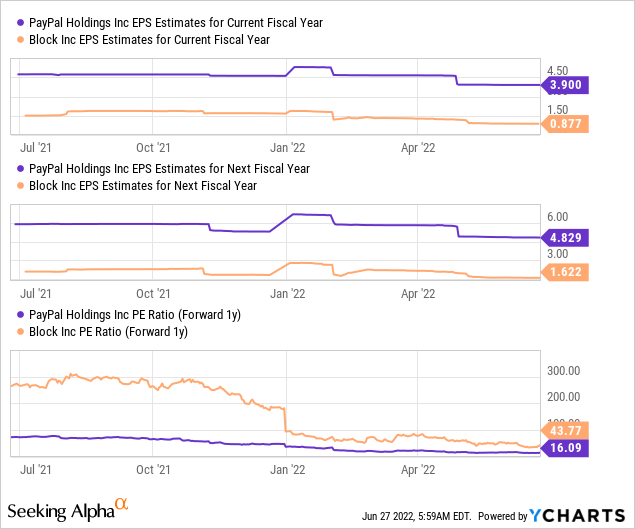

PayPal’s shares are very cheap given the size of the firm’s ecosystem and growth opportunity in the buy now pay later business. PayPal is expected to generate EPS of $4.83 next year which translates to a P/E ratio of 16.1. Block (SQ), a rival payment processing platform, trades at a P/E ratio of 43.8, indicating that PayPal’s growth in the payments industry has become too cheap.

Risks with PayPal

PayPal expects to add 10M new accounts to its ecosystem in FY 2022 while the firm previously assumed it could acquire up to 20M new accounts. The slowdown in account and revenue growth already had repercussions on PayPal’s stock performance in 2021 as well as in 2022, but another downgrade of PayPal’s guidance is not out of the question and would likely result in another down leg for the firm’s shares. Slowing account, revenue and total payment volume growth are the biggest risks for PayPal and its stock right now.

Final thoughts

Global payments company PayPal has an attractive setup: the stock is trading at a very cheap earnings multiplier factor and the firm’s actions regarding the expansion of BNPL services could result in strong customer uptake given the depth of PayPal’s ecosystem, and drive earnings growth going forward. I believe PayPal has a very attractive risk profile right now and with a P/E ratio of 16.1, PayPal’s prospects in the payments industry are undervalued!

Be the first to comment