jetcityimage

Coca-Cola (NYSE:KO) is one of the best known brands in the world, and I think it has a capable management team. However, many stocks and the entire market in general, is getting re-rated in terms of valuation. Unfortunately, I see a number of reasons why this stock has been declining, and why it appears poised to make new 52-week lows. I buy Coca-Cola products, and I would be happy to buy this stock, but after analyzing it, I do think better buying opportunities are coming. Here’s why:

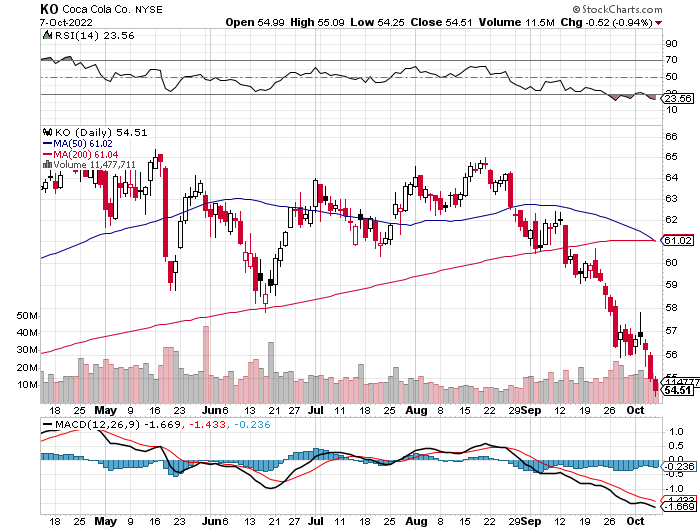

The Chart:

As the chart below shows, Coca-Cola shares have been in a downtrend and it’s even oversold, so it might get a bounce. However, overall, the downtrend appears poised to continue. This stock has dropped below the key support levels of the 50 and 200-day moving averages and it has even broken below the June lows. With the stock now trading at about $54 per share, it seems likely for it to hit and possibly break through the 52-week lows of $52.28. Obviously, this chart shows that the price action and technicals of this stock are bearish, but there are a number of fundamental reasons that appear to be driving these shares lower as well.

StockCharts.com

The Dividend Is No Longer Compelling:

As a dividend, Coca-Cola pays out $1.76 per share and this provides a yield of about 3.13%. While this was good and even generous when we were living in a zero interest rate policy world, it is no longer compelling. Due to aggressive rate hikes by the Federal Reserve in just the past few months, it’s now possible to earn around 4% in US Treasury bonds. It is also possible to earn around 5% in short term investment grade corporate bonds. These are significantly higher yields, and they do not involve taking on the downside risk that comes with investing in a single stock.

The company is expected to earn about $2.50 per share for 2022. With the dividend at $1.76 per share, this shows a fairly high payout ratio, which could limit dividend increase in the future. At current levels, Coca-Cola’s dividend is considerably lower than other potentially safer options for income investors and due to the high payout ratio, it is not likely to offer much growth.

The Surge In The U.S. Dollar Is A Major Headwind:

The U.S. Dollar has surged in the past couple of months, and this is going to cause major headwinds for U.S. based companies that are big exporters, and significant revenues from overseas. Coca-Cola derives about 34% of its revenues from the United States, and a whopping 66% from international sources. The surge in the U.S. Dollar has really accelerated in the past several weeks, so I believe it is going to impact the Q3 results which are due on October 25th and more importantly, I expect it to impact Q4 guidance in a negative way. The company is expected to earn 63 cents per share for Q3, so a miss on that or weak guidance could be what sparks a test of the 52-week lows.

The Macro View Also Shows Major Headwinds For Coca-Cola:

Many investors seem to view Coca-Cola as being recession-resistant, but many consumers will cut back on soft drinks, or switch to less expensive generic brands. In addition, Coca-Cola is likely to be impacted by a potential slowdown in sales to restaurants and other institutional sales. It is already clear that an increasing number of companies are announcing layoffs, and consumer confidence has been dropping. All of this could lead to fewer consumers going out to eat at restaurants, as well as reduced attendance to sporting events and concerts.

The other macro issue is rising inflation which means Coca-Cola could be seeing rising input costs, however this appears to have cooled off in recent weeks, although costs still appear higher now than they were 6 or 12 months ago.

A Huge Tax Dispute That Could Cost Coca-Cola An Estimated $13 Billion:

Coca-Cola is involved in a multi-billion dollar tax dispute with the Internal Revenue Service which could impact the share price, if a negative ruling is issued. This case is based on “Transfer Pricing”, which is when a company with overseas subsidiaries is used to manipulate profits by charging that subsidiary more or (usually) less than they normally would. For example, if a corporation in the USA has a subsidiary in another country that has a more favorable tax rate, it could sell products to that subsidiary at a low price, which would reduce profits in the USA and transfer these profits to a more tax-friendly locale. In the case with Coca-Cola, the Internal Revenue Service is suggesting that Coca-Cola was undercharging its subsidiaries in a number of countries including Chile, Costa Rica, Mexico, Ireland, Brazil, etc., which led to an underpayment of taxes in the USA.

According to some industry professionals, an estimated $13 billion could be owed by Coca-Cola if the Internal Revenue Service prevails. Issues like this can take a long time to play out and Coca-Cola might be able to appeal a negative ruling, however, this could ultimately be a very expensive battle and lead to losses for Coca-Cola and its shareholders. According to the latest financial reports from Coca-Cola, it has about $9.6 billion in cash on the balance sheet, and nearly $38 billion in long term debt. This shows that a negative ruling on this potentially $13 billion tax issue could have a very negative impact.

In Conclusion:

Coca-Cola shares are now less than $4 away from making a new 52-week low. With the bear market ongoing, and headwinds like the strong dollar and an aggressive Federal Reserve still hiking rates, the downturn in these shares is likely to continue. The stock could also gap down at some point, if an unfavorable ruling is announced in the tax dispute. Coca-Cola also carries a significant amount of debt on the balance sheet, and for obvious reasons, cash-rich companies tend to fare much better during a recession. All of these factors and potential downside risks lead me to believe that investors will have a chance to buy Coca-Cola shares at far more attractive levels in the coming months.

Based on all these headwinds and the fact that bonds and other investments can provide a yield of 4%, I feel investors should wait until this stock offers at least a 4% yield as well. With the current dividend of $1.76 per share, if the shares drop to $45, it would then provide a yield of about 4%, and that is when I would start buying. It’s worth noting that during the pandemic lows, this stock went down to about $36 per share, so $45 is hardly unrealistic, especially if the Federal Reserve is too aggressive and/or if geopolitical issues spiral further downward. Finally, I would add that this stock regularly traded in the $40 range before the pandemic, and we are seeing so many stocks go back to their pre-pandemic levels. In fact, a number of analysts and investors think all the major market indexes are heading back to their respective pre-pandemic levels.

Be the first to comment