Allkindza

Over the past month, the S&P 500 index has fallen -7.17%, while the Nasdaq has declined by -8.30%. Almost every asset class is in the red, and Real Estate Investment Trusts (REITs) has provided one of the weakest total returns. The 10-year Treasury Note (US10Y) is now sitting at 3.89%, providing a risk-free, high-yield environment for income investors. The market went from a yield-starved investment landscape where investors were actively seeking income-producing opportunities to a point where I bonds and Treasuries became popular in the blink of an eye. Income investors now have choices and can sacrifice yield for risk mitigation and still generate an elevated level of income compared to many equity investments.

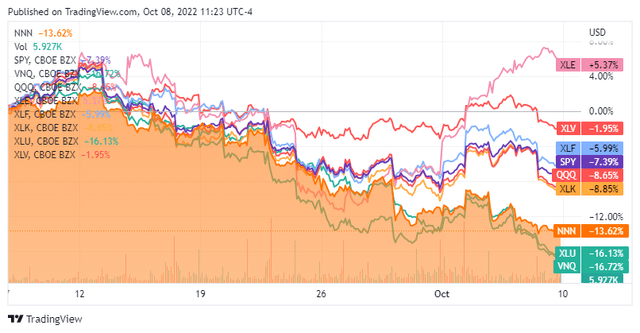

The current landscape has crushed REITs, and the Vanguard Real Estate ETF (VNQ), which many people use to track REITs, has underperformed the Health Care Select Sector SPDR (XLV), Financial Select Sector SPDR ETF (XLF), SPDR S&P 500 Trust ETF (SPY), Invesco QQQ ETF (QQQ), Technology Select Sector SPDR ETF (XLK), Utilities Select Sector SPDR ETF (XLU), and the Energy Select Sector SPDR ETF (XLE). This economic environment won’t last forever, so I went looking through the largest equity REITs to uncover some long-term value opportunities. National Retail Properties (NYSE:NNN) has recently increased its dividend for the 33rd consecutive time, operates a portfolio of real estate that would be difficult to replicate, has an above-average yield to its peers, and trades at a discount to its peers. REITs haven’t been working, but income investors are presented with an opportunity to add shares at a cheaper valuation than in the past, and NNN looks like an opportunity among the rubble.

REITs have been crushed during this economic cycle, but this economic cycle isn’t indefinite.

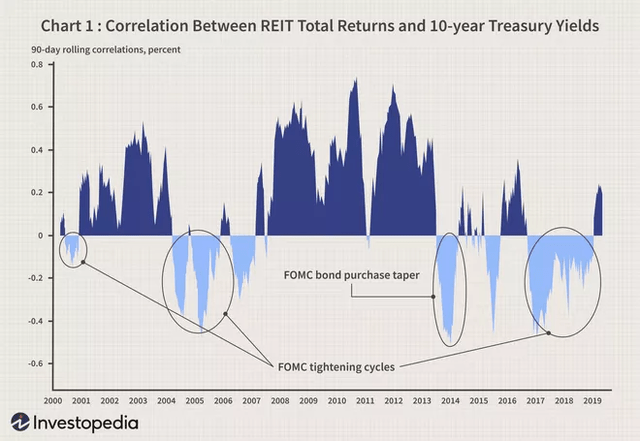

Economic growth is great for many things, including REITs. Typically, during these periods, the value of a REITs underlying assets appreciates, but when the economy slows, and the Fed tightens its monetary policy, REITs tend to lose value. From 2000-2020, there has been a correlation between REITs generating a total negative return to FOMC tightening cycles which push the 10-year yield higher.

REITs are not typically used for trading, or short-term investments, as they are more appealing to long-term investors looking to generate income. From 2000 – 2020, REITs have provided a positive total return after each FOMC tightening cycle. While REITs declined in value during periods of tightening, these cycles haven’t been indefinite, and while some periods last longer than others, they always come to an end.

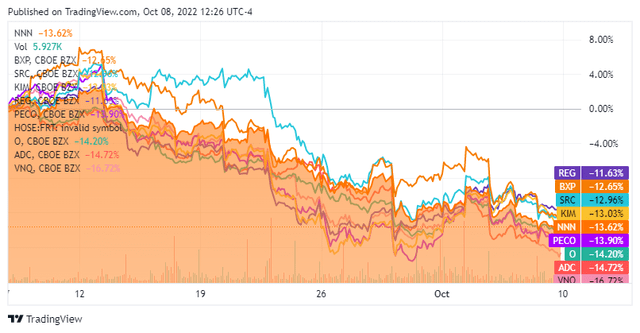

While VNQ has declined by -16.72% over the past month, NNN, and its extended peer group have all significantly declined. The extended peer group I compare NNN to is:

- Agree Realty Corp. (ADC)

- Federal Realty Investment Trust (FRT)

- Kimco Realty (KIM)

- Phillips Edison & Company (PECO)

- Realty Income (O)

- Regency Centers Corporation (REG)

- Spirit Realty (SRC)

Higher interest rates are taking a toll on REITs as the cost of capital has increased, and investors can find larger-than-average yields in Treasury Notes. This is exactly when I want to add to my REIT positions because even through tough economic environments, quality REITs are producing much larger yields than Treasuries, which can sequentially increase by reinvesting the dividends and providing an opportunity for capital appreciation when the cycles reverse.

National Retail Properties has created a large moat around its business and it’s one of my favorite REITs

Most investors follow Warren Buffett’s advice about identifying businesses that have established moats around their operations. When it comes to real estate, capacity is a term that many people overlook, and its rarely discussed in articles. There is an old saying to invest in land because we’re not making any more of it, and it’s an important concept. When you look at well-established areas, capacity in the most populated areas is limited or non-existent. Unless you’re building on the outskirts, there isn’t room for new commercial properties to be built in many populated areas, or there isn’t enough capacity for additional commercial properties.

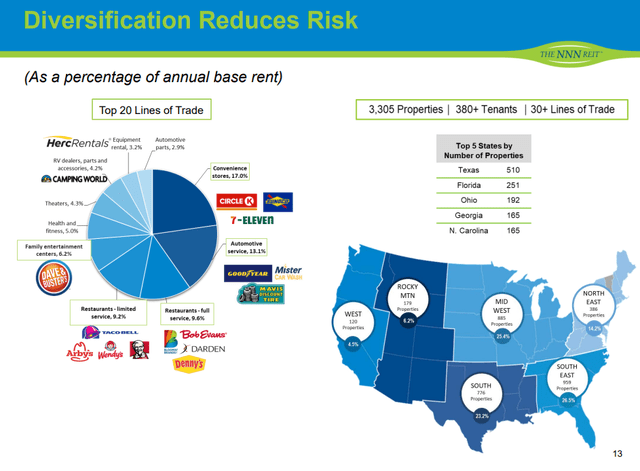

NNN has a portfolio of 3,305 properties across 48 states, occupied by more than 380 tenants. NNN is the landlord to America’s most established brands, which include 7-Eleven, Sunoco, Best Buy, and Flynn Restaurant Group. NNN has a 99.1% occupancy rate across its properties and has diversified its footprint throughout the lower 48’s most desirable markets. Anyone can become a real estate investor, and over time with hard work and some luck, can graduate to owning commercial properties. What I tend to look at is which REITs have portfolios that can’t easily be replicated and which ones truly have moats around their business. While a group of investors can pool money together and jumpstart a real estate investment venture, it goes back to capacity. NNN’s portfolio can’t be easily replicated, and when you combine NNN’s portfolio with Realty Income, Federal Realty Investment Trust, Kimco Realty, and STOR Capital which was recently acquired, my question becomes how much additional commercial real estate is needed to support commerce?

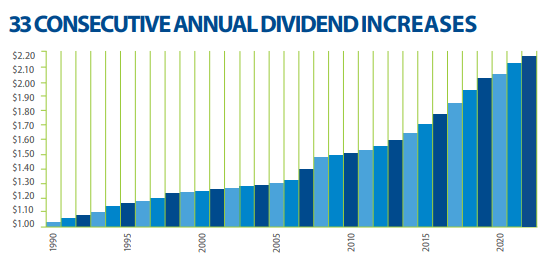

NNN has a long track record of success and has provided 33 consecutive dividend increases to its shareholders. Today, NNN pays an annual dividend of $2.20 which is a 5.64% dividend yield as shares are trading at $38.73. NNN recently provided its latest increase for its dividend paid on 8/15, and its next ex-dividend date should be approaching in the final days of October. Regardless of where we have been in the economic cycle, NNN has provided increases throughout the dot-com burst, mortgage crisis, financial crisis, and pandemic. This is a testament to their viable business model, and I would rather invest in NNN as a real estate option than a younger REIT that’s trying to become established.

National Retail Properties

National Retail Properties is trading at an attractive valuation compared to its peers

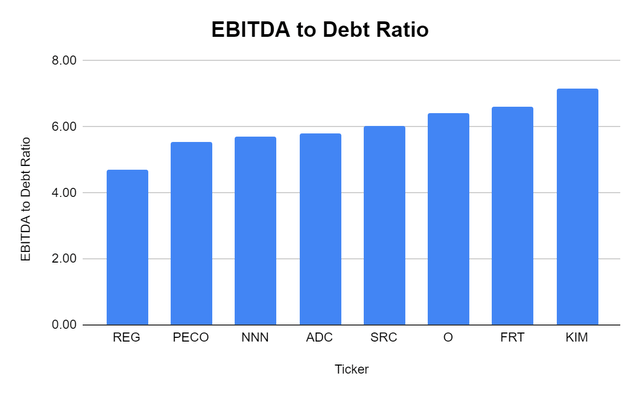

I have provided an extended peer group from what can be found on the peers tab of Seeking Alpha, because I wanted to add Realty Income. When I compare REITs I am looking to see how their dividend yield stacks up, what the funds from operations (FFO) coverage ratio is, what the price to FFO valuation is, and what a REITs EBITDA to total debt ratio is. These metrics allow me to see how different REITs compare to each other and if there is an opportunity among a specific sector within the REIT asset class.

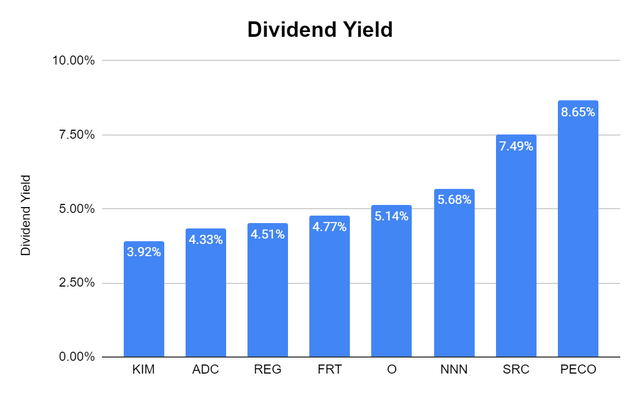

Since income is my primary investment focus with respect to REITs, I am starting with the Dividend Yield. The average yield across NNN’s extended peer group is 5.56%, and NNN currently has the 3rd largest yield, which is above the peer average at 5.68%.

Steven Fiorillo, Seeking Alpha

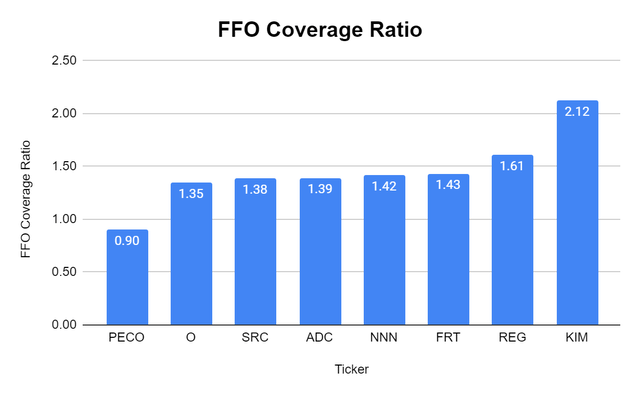

NNN’s dividend is well covered with a 1.42x FFO coverage ratio. NNN produces more than enough capital from the FFO to continue its track record of annual dividend increases. NNN has a slightly lower than its peer group average FFO coverage ratio of 1.45x, but it’s still more than enough to indicate that its dividend is well covered.

Steven Fiorillo, Seeking Alpha

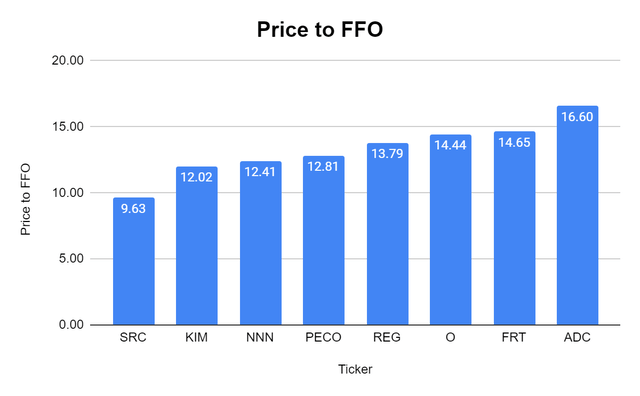

NNN trades at a price to FFO of 12.41x, which is significantly under its peer group average of 13.29x. Today, O trades at a 14.44x price to FFO, and while O is considered by most as the gold standard in commercial retail space, you’re paying a more attractive multiple for NNN.

Steven Fiorillo, Seeking Alpha

The peer group has an EBITDA to Total Debt average ratio of 5.99x. On average, it would take 5.99 years to pay off the total debt load from these REITs from their EBITDA. NNN has a 5.7x ratio which is slightly below its peer group.

Steven Fiorillo, Seeking Alpha

Conclusion

The current economic environment hasn’t been kind to REITs, particularly NNN, as it declined by -19.21% in 2022 and -13.62% in the past month. I believe now is a good time to add to or establish a position in NNN. Its portfolio is difficult to replicate; it has over a 99% occupancy rating and is the landlord to many of America’s largest brands. Rising rates have hurt REIT valuations, but this cycle won’t last forever. I believe income investors are presented with a long-term opportunity, and NNN should be at the top of the list, as investors should benefit from future dividend increases and capital appreciation.

Be the first to comment