palinchakjr/iStock via Getty Images

Alibaba (NYSE:BABA) has been making headlines for two years, the vast majority of which was negative. Each event related to China, the Chinese government, or China’s economy has resulted in a bunch of new articles and posts on how adversely it influences Alibaba and its valuation. On October 11, 2021, I wrote an article Common Sense Investing in Alibaba and the investment thesis presented in the article remains up-to-date. Contrary to the majority of market participants, I believe that the past 12 months didn’t have nearly as big an influence on Alibaba’s value as the stock price decline would suggest. What makes a good investment is the quality of the acquired asset and most of all, the price an investor pays for it. With Alibaba’s marked capitalization being hammered, and its valuations so low, the risk-reward ratio creates an investment opportunity that in my view may generate ample returns.

In this article, I’d like to reiterate my favorable view on investing in Alibaba from a perspective of its business fundamentals, a macro stance, and a business-related standpoint. Besides that, one more pillar of the investment thesis needs to be introduced which dictates the current price of the business and helps to understand why the stock fell so low – sentiment. The current price of the company was decoupled from the business fair value some time ago, and even more after the recent ~13% single-day drop. However, investors often forget that what matters, in the end, are fundamentals and valuation. The price of a stock, on the other hand, is just a mixture of fundamentals and human emotions. And emotions often take over by driving prices to irrational levels, both to the upside as well as to the downside. A job of a value investor is to recognize a mismatch between the value and the price of an asset and to act accordingly. As the legendary investor Warren Buffett points out:

Price is what you pay. Value is what you get.

Sentiment

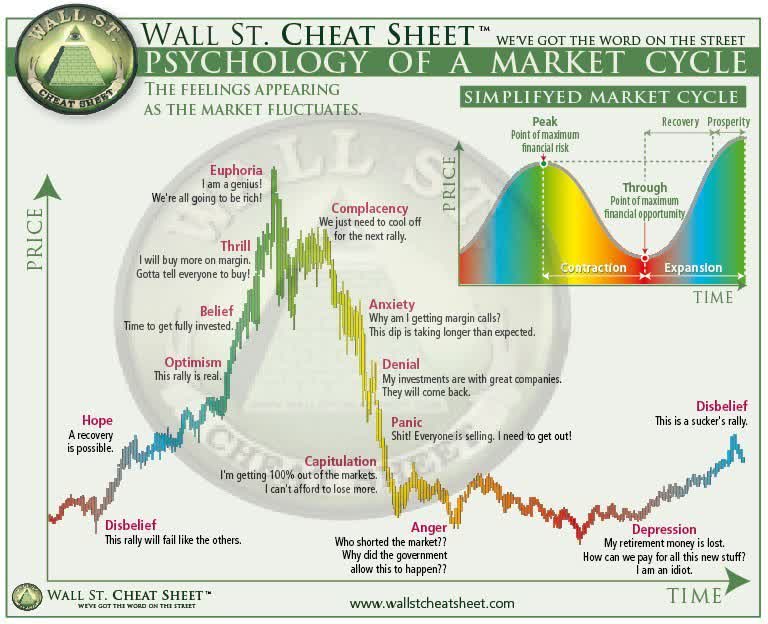

Alibaba hasn’t been trading based on fundamentals for quite some time. Instead, based on sentiment – an overall attitude of market participants towards the stock. It’s driven by emotions and it corresponds to crowd psychology which dictates the activity and price movement of the security. Rising prices of the stock indicate bullish market sentiment. Falling prices, on the other hand, indicate bearish market sentiment. Alibaba fits the latter one and after months of a constant decline in its market cap, the crowd got into a panic.

Psychology of a market cycle (financialhorse)

For two years there has been a steady flow of bad press concerning China, Alibaba, and many other Chinese companies. Worth noting is that the negative news spread last year is not mentioned anymore. They were instead replaced by other pessimistic information, and now, current concerns act as new catalysts to further slash the stock price as the negative sentiment deepens. The latest news includes:

- Chinese Prime Minister Xi Jinping remains in office for the third term.

Despite that it was known long before, Hang Seng – the Hong Kong index – fell on this news 6.36%. Among the companies that led the biggest losses was Alibaba.

- New members of the government are more ideological rather than economically focused. The president supposedly surrounds himself with loyalists who were chosen as members of the Politburo standing committee. Besides that, Xi is compared to Mao Zedong who embodies communism in its pure form. Apart from that, appointing Li Quiang as the Prime Minister was interpreted as a move away from a market-oriented economy.

First of all, assuming now that China will become less market-friendly is pure speculation. There is no evidence of that. Besides that, Li Quiang is a politician who supported foreign investments and the growth of private sectors in the past.

Li is a tech-savvy supporter of high-tech entrepreneurship who believes that China’s future lies in the digital economy. Xi, the Western press insisted with near unanimity, had reverted to Maoism.

Among other things, Li was one of Jack Ma’s most visible supporters in the China Communist Party leadership. He brought Elon Musk’s Tesla to Shanghai. His appointment affirms the leadership’s support for private-led high-tech industry.

- A zero-Covid policy that affects China’s GDP growth.

It’s clear that the shutdowns are affecting the country’s economic growth. Covid policies differ from country to country and China is particularly stringent about it. That’s a known factor that will influence the growth of most Chinese companies. However, it’s unlikely that the idea of shutdowns is to purposefully handicap the economy.

- The real estate bubble will put China in a recession.

In 2007 the USA went into a crisis known as the Great Recession caused by a real estate bubble. On March 9, 2009, S&P 500 closed at 676.5 points. On November 8, 2021, it hit 4701.7 points. Anybody who invests in the stock market with a long-term view has to be prepared for recessions and big market declines along the way. It was well put by Peter Lynch who once said:

Far more money has been lost by investors trying to anticipate corrections than lost in the corrections themselves.

- A possibility of China invading Taiwan.

It’s another risk that concerns all Chinese companies, not only Alibaba. If that happens, it’ll cause a major shake-up in the financial markets, especially among Chinese equities. However, the USA can be also involved in a war anytime with unknown consequences. But nobody includes it as a part of his investment thesis when it comes to investing in US stocks.

All the sentiment drivers mentioned above are often called risks by the media. Yet, they are mostly macroeconomic uncertainties that always exist in some form. Bubbles, wars, crises, and changes in power are always there. It should be stressed that they are not changing business fundamentals in the long term.

What used to constitute a negative sentiment just recently is not talked about anymore and it includes the following factors:

- Chinese companies being delisted from American exchanges

- Violating human rights by the government of China

- Regulatory actions against tech enterprises

- VIE structure of Chinese companies

- Education companies being converted into non-profits

I finished the previous article with the quote: “Buy when there’s blood in the streets, even if the blood is your own.” Blood has been there for quite some time and there is no sign it’ll be wiped soon. While headlines are screaming SELL from all directions, the recent market reaction to Xi tightening his power as a president added fuel to the fire. On October 24th, investors dumped shares of Chinese companies. Chinese tech leaders Alibaba and Tencent closed down more than 11%. Search firm Baidu was 12% down while food delivery company Meituan plunged more than 14%.

Such an extreme price action in this stage of the still ongoing sell-off of Chinese securities resembles panic. Nobody knows how long it will take for these stocks to gain ground and attract investors again. But as long as the negative sentiment weighs on the perception of the Chinese businesses, the price of Alibaba will remain detached from the company’s fair value.

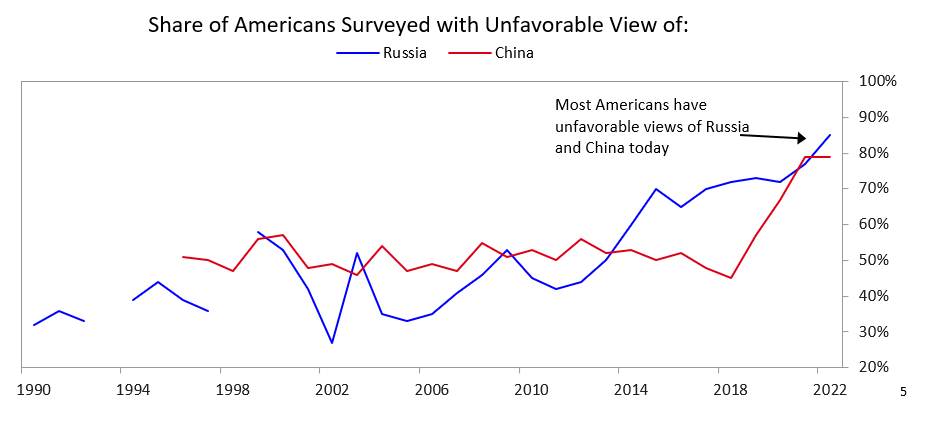

Gallop poll data shows that 80% of Americans now have an unfavorable view of China (Ray Dalio)

In the end, the essential reason why Alibaba’s market capitalization has gotten obliterated over the last two years is shown in the chart above. A spike in unfavorable views, in other words – a negative sentiment, toward China correlates with the beginning of the trade war started in 2018. It was followed by a series of political events between the USA and China, as well as unfavorable macroeconomics. These factors influenced the view of China by the public and drove the sentiment in the equity markets down along the way.

Big Picture

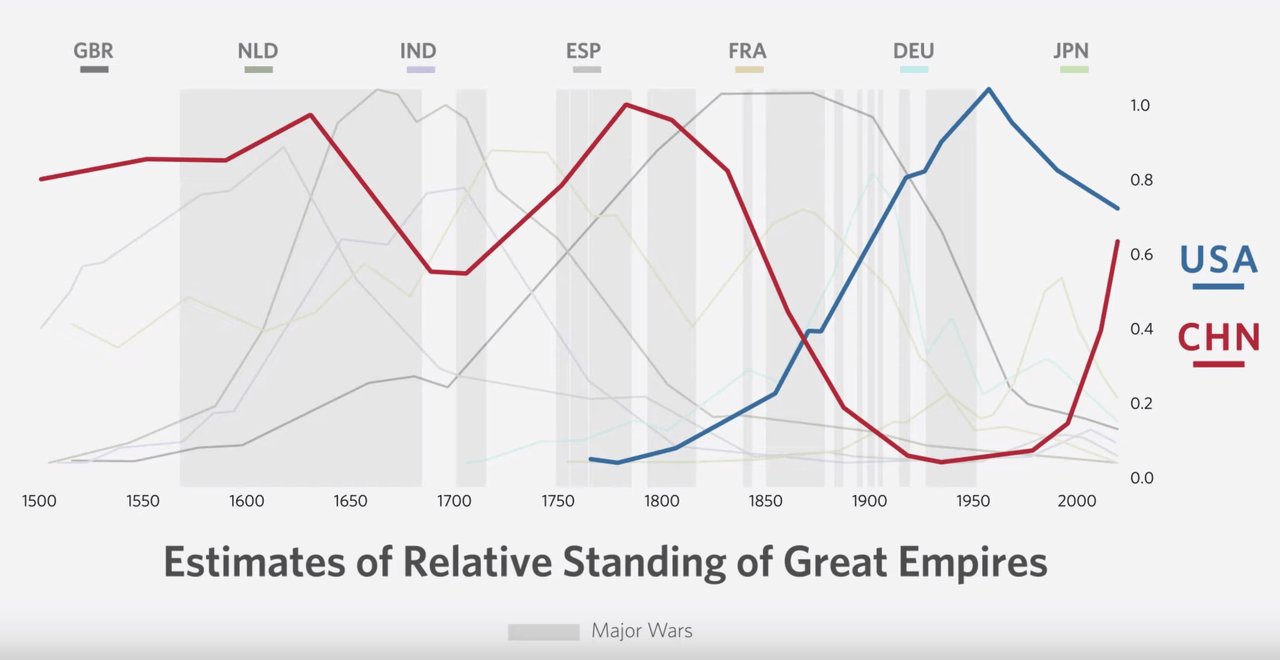

After recognizing the influence of the negative sentiment on the stock price, the focus can be put on a bigger time frame where the whole trend and the direction of the Chinese economy can be assessed. Although political and economical developments are rarely indicators of whether a business will perform well, one can get a sense of the big picture regarding China. Probably, it’d be hard to find anybody who has more authority on the Chinese financial market, macroeconomics, and the history of the Chinese rise than Ray Dalio – Founder, CIO Mentor, and Member of the Bridgewater Board of Bridgewater.

Ray Dalio has been visiting China for over 30 years and witnessed the enormous transformation the country has gone through. He gained experience working there on both personal and professional levels and shared his thoughts in his valuable books, and multiple in-depth publications. In one of his articles Understanding China’s Recent Moves in Its Capital Markets, he touched on the common mistake investors make which is believing that the only way to wealth and prosperity is the path the Western World has gone.

I have found that most Western observers who do not have direct contact with policy makers’ and don’t follow in detail the patterns of the changes have tended to not believe that the Chinese Communist Party’s usage of capital markets to foster development is real. They interpret moves like these two recent ones as the Communist Party leaders showing their true anti-capitalist stripes even though the trend over the last 40 years has clearly been so strongly toward developing a market economy with capital markets, with entrepreneurs and capitalists becoming rich. As a result, they’ve missed out on what’s going on in China and probably will continue to miss out.

Another tendency that Western investors show, is a strong distrust of the actions of the Chinese government which results in often false assumptions and in the end – missed opportunities.

I remember the Chinese currency plunge in 2015-16 resulting from the PBoC widening the band and how that led to many investors pointing to these developments as evidence that policymakers were turning away from developing capital markets. Some skeptical investors looked at these moves as inappropriate anti-free market interventions even though these same moves happened many times in many capitalist markets and even though the fiscal and monetary policy interventions in the U.S. and other developed markets dwarf the Chinese government interventions in its markets.

Misunderstanding China comes from a lack of knowledge and fear of the unknown. It leads to misconceptions about its financial and political environment. Ray Dalio emphasizes that comparing the Chinese with Western capitalism isn’t prudent when making investment decisions.

Assume such things will happen in the future and invest accordingly. But don’t misinterpret these wiggles as changes in trends, and don’t expect this Chinese state-run capitalism to be exactly like Western capitalism.

The author concludes that the level of transparency of the Chinese government is substantially different from what people in Western countries are used to. The reasons behind the decisions made by Chinese dissidents are largely unknown to Western observers and induce misinterpretations followed by incorrect conclusions.

Having said that, I do think that it is unfortunate that Chinese policymakers don’t publicly communicate the reasoning behind their moves more clearly.

A conclusion drawn from Dalio’s publication is that anybody who invests in China has to be prepared for a full scope of unknowns and needs to adapt to an unfamiliar investing environment. Any comparisons to the domestic market should be taken with caution. Besides that, getting familiar with the country-specific way of handling certain matters may be of great help.

Rises and Falls of the Great Empires (Ray Dalio)

China has the fastest-growing middle class in the world. The country becomes a stronger economy by steadily growing its gross domestic product [GDP] even during pending shutdowns. Its GDP grew 3.9% YoY in the third quarter as data from the National Bureau of Statistics recently showed. The number beat analysts’ expectations who projected a 3.4% growth. However, the power of the negative sentiment doesn’t cause an inflow of funds into Chinese equities, despite a positive surprise and an optimistic outlook in terms of the country’s economical strength.

Fundamentals & Progress

Having an overview of the current sentiment toward China and its roots, as well as a perspective on the second-largest economy, one can focus on things that matter the most – the fundamentals and the valuation of the business. Alibaba remains a fundamentally sound business facing various challenges which impacted its balance sheet in the last two fiscal years. Despite that, the company has been delivering strong performance and doesn’t seem to slow down.

- Alibaba reached a milestone of 1 billion annual active consumers in China.

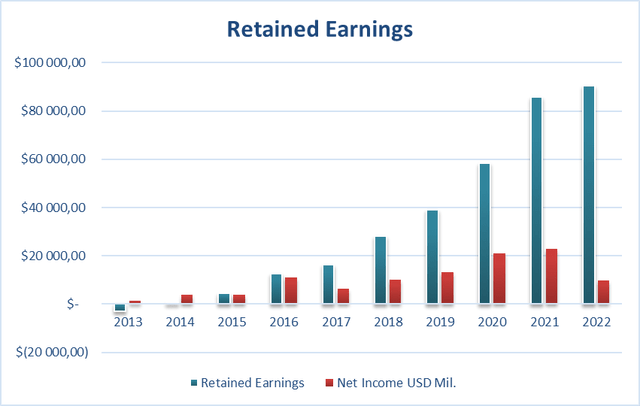

- The company’s retained earnings which are the cumulative net earnings or profits after accounting for dividend payments have been constantly growing. Net income was impacted negatively due to substantial investments in some business segments such as Taocaicai, Taobao Deals, or international business. However, these investments are expected to pay off and result in the growth of the bottom line.

Retained Earnings (Author: Based on Data from Seeking Alpha)

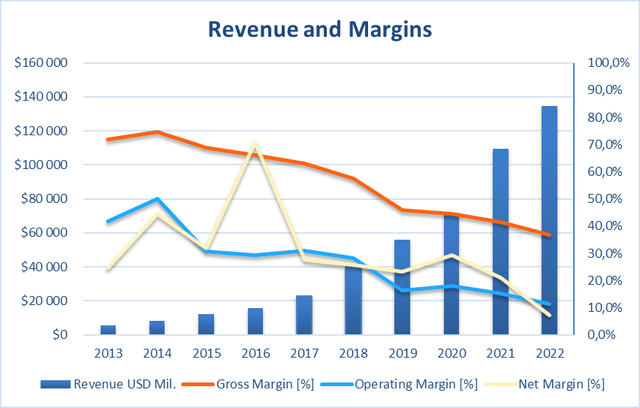

- Revenues have grown and are expected to increase ~2.5x over the next 10 years, according to analysts. Alibaba’s sales increased by 41% in the fiscal year 2021, and further by 19% in the fiscal year 2022.

Alibaba Revenues (Author: Based on Data from Seeking Alpha)

- Alibaba Cloud holds a leading position in the Chinese market and achieved profitability on annual basis for the first time. By 2025, the Chinese cloud computing market is expected to surpass RMB1 trillion, which is three times bigger compared to the current market size.

These are just a few examples of Alibaba’s advancements. A full picture of the business with its expanding segments and various initiatives can be found in the annual report for the fiscal year 2022.

Valuation

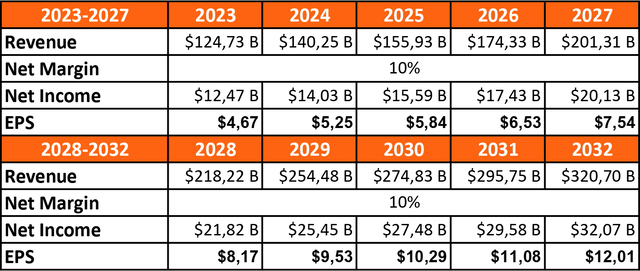

Analysts expect Alibaba to grow its revenues by 12.7% CAGR in the next five years and by 10.1% CAGR in the following five years. To calculate the intrinsic value of Alibaba’s business following assumptions were made:

- a historically low net income margin of 10%,

- constant shares count of 2.67 billion, unchanged since FY 2022.

Revenue Assumptions (Author: Based on Data from Seeking Alpha)

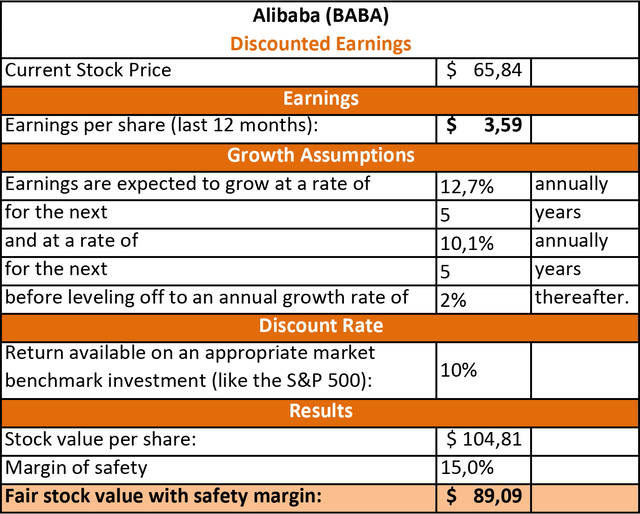

Besides that, it was assumed that the perpetual growth rate amounts to 2% and a discount rate is 10%. Additionally, a 15% margin of safety was applied.

Discounted Earnings Model (Author: Based on Data from Seeking Alpha)

With these conservative assumptions, the fair value of Alibaba comes at $89.09 which equals a 35.3% discount.

However, none of the models or valuation methods can’t beat the signal given by Alibaba’s management indicating significant stock undervaluation. The company raised its share buyback program to $25 billion which followed a hike from $10 to $15 billion in August 2022. Chief Financial Officer Toby Xu gave the company’s perspective on the increased repurchase in a press release.

The upsized share buyback underscores our confidence in Alibaba’s long-term, sustainable growth potential and value creation.

Alibaba’s stock price does not fairly reflect the company’s value given our robust financial health and expansion plans.

This statement was released on the 22nd of March, 2022 when Alibaba stock was trading at around $104 a share.

During the earnings call for the March 2022 quarter, an update on the buyback was given.

Since April 1st to May 25th, we have repurchased another USD3.4 billion in ADSs. As of 25th May, we still have an unused amount of USD12 billion under the share repurchase program.

Seeing Alibaba repurchasing $3.4 billion in less than two months, it’s entirely possible that the remaining $12 billion worth of shares can be repurchased by the end of the fiscal year 2023. Assuming that the company buys back shares for $70.0 on average, its EPS in FY 2023 jumps from $4.67 to $4.99. It translates to a 39% YoY earnings growth.

This scenario may not materialize. It can be also dampened by the stock-based compensation which dilutes the number of shares outstanding. However, it’s just another example that gives a perspective on how things may unfold. And it can happen very quickly. When analysts start raising forecasts for the EPS numbers, the market will turn bullish again.

Conclusion

Alibaba has been under pressure for two years together with other Chinese companies. What keeps on driving their prices lower and lower is a negative sentiment that worsened the day Xi Jinping was confirmed to stay in office for the third term. Alibaba remains a profitable, solid, cash-generating business that has been out of favor for an extended period of time. The management indirectly confirms that the stock is undervalued by repurchasing significant amounts of shares. However, no valuation metric or even the most solid fundamentals will not encourage investors, especially on Wall Street, to buy Alibaba. The looming global recession gives them another reason to claim that Chinese companies are “uninvestable”. Nevertheless, emotions should be put aside and little to no investment activity are probably the smartest solution in this volatile environment. Panic will go away and the sentiment will eventually revert. As Peter Lynch once said:

Everyone has the brainpower to make money in stocks. Not everyone has the stomach.

If you are susceptible to selling everything in a panic, you ought to avoid stocks and mutual funds altogether.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment