tdub303

I had way too many drinks with family friends this past weekend, and I was impressed and stupefied by the fact that they treat their three dogs like children. Each dog had its own space, and one has its own room. I’m a vegan, so I’m interested in the compassionate treatment of animals, but even I have my limits. While I found this tiresome, and I told them so, I later thought that they’re not alone. We treat our animal companions very well, and I think it’s possible to earn money from this “hyper-compassionate” trend. For that reason, I want to start investigating “pet themed’ stocks, starting with PetMed Express Inc. (NASDAQ:PETS).

Welcome to the ubiquitous “thesis statement” portion of the article, where I give you the “gist” of my thinking in a short, pithy paragraph in order that you won’t have to wade through the whole tangled screed below. While I’m a fan of this business, and I think the dividend is reasonably secure given the strong capital structure, I don’t want to buy at current prices. They’re not cheap enough. That said, I think short puts represent great value at the moment, so I’ll be selling deep (32%) out of the money puts on this name. These are “win-win” trades because the outcome is positive regardless. If the shares drop in price, I’ll buy aggressively, as I see great opportunity here at the right price.

Company Background

In case you’re not in the mood to read the “Company Profile” section at the bottom of the list of articles published on this name, or have no interest in perusing “Item 1” of the latest 10-K, I’ll give you the background to this company, because this article isn’t quite long enough yet, am I right?

Anyway, PetMed Express is a pet pharmacy that serves approximately two million customers. Their product line contains approximately 3,000 SKUs of the most popular pet medications for dogs, cats, and horses. The company also offers pet supplies like food, beds, crates, stairs, and other popular pet supplies on their website. The company sells its products through the internet and a telephone contact centre.

The internet channel attracted over 28 million visits to the website in 2022, and 8.5% of those visits resulted in an order. As you might imagine, an overwhelming amount of the company’s revenue (84%) came from the website. In an effort to increase visibility of future business, in July of 2021 the company launched the new AutoShip program, which is a convenient way for the company’s customer base to have future pet medication orders delivered directly to them without the need to place an order each time. Approximately 37% of sales were generated via AutoShip, and the company hopes that 50% of sales will ship via AutoShip in 2023.

Most interesting of all is the fact that the company attracted 443,000 new customers in 2021, and 263,000 customers in 2022. This is a fast growing industry.

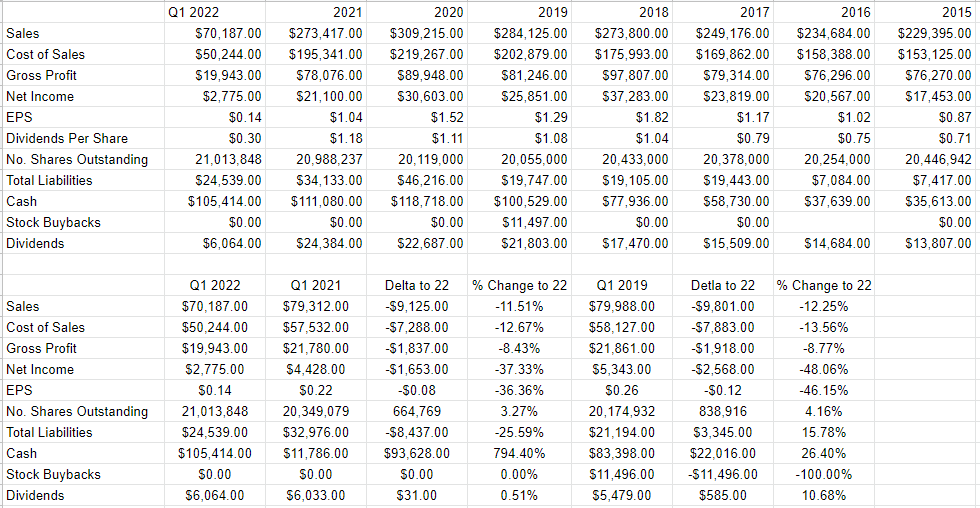

Financial Snapshot

PetMed has grown at a moderate clip since 2015 in my estimation, with revenue and net income growing at a CAGR of about 2.5% and 2.75% respectively. It should be noted that growth was far superior before 2021, which is when operations seem to have hit the proverbial “wall.” Unbowed by this slowdown in the business, management continued to grow the dividend, to the point where dividend payments now dwarf both net income and cash operations. The future performance of this investment turns on the dividend in my view. If it’s sustainable, this will be an extraordinarily good investment. If it is cut, the opposite is true. This is why I want to think mostly about the dividend here.

Before getting into the specifics about the dividend, I also feel a need to mention that the slowdown in sales during the most recent quarter compared to the previous ones in both 2021 and 2019 relate to a slower start of the flea and tick season because of unseasonably cold weather. This is relevant in my view because it signals that this company is affected by weather. Revenue can drop fully 11.5% if the Spring thaw comes a bit later than normal. This is obviously beyond the company’s control, but it is a risk that should be factored by investors in my view.

Dividend Sustainability

When I consider investing in a stock like this one, my first question involves whether the dividend is sustainable or not. I start to obsess about this for two reasons. First, and most importantly, having a sustainable dividend makes planning my future, somewhat eccentric, consumption patterns much easier. If I know that I’m very likely to receive X in dividend income over the year, I know exactly how much stuff I can fill my place with. Second, a sustainable dividend is supportive of price. If the dividend won’t go away, that means that there’s a very high likelihood that there’ll always be a decent bid for the stock.

In order to accomplish this, and gauge the sustainability of the dividend, I like to compare the size and timing of future obligations to the current and likely future sources of cash. I’m normally an “accruals guy”, with all of the consequences to my social life that that implies, but when it comes to dividends, it’s all about cash flow.

I normally look at the schedule of upcoming debt repayments and review the delta between cash from operations and cash from investing activities. In this case, though, the exercise is much simpler. This is because the company currently has very little in the way of obligations. In fact, cash on hand of about $105.4 million is about 4.3 times greater than total liabilities of $24.5 million. To reiterate, that’s not 4.3 times greater than debt. It’s 4.3 times greater than total liabilities. This is maybe one reason why the company has been growing its dividends for 12 years. I find it compelling that the amount of cash on hand is about 4.5 times greater than the most recent annual dividend payment.

There are some concerns about sustainability, though. For instance, since 2021, the company’s dividend payment has been about 33% greater than cash generated from operations, and the payout ratio currently sits at an eye watering 214%. I think that in order to improve this situation, the company will need to start to grow again, a feat it hasn’t really managed since 2020.

That said, as the company pointed out on the most recent conference call, the pet medication market is currently about $10 billion and is growing rapidly. I think there’s potential for growth from this $275 million business, and so I’d be happy to buy the stock at the right price.

PetMed Express Financials (PetMed Express investor relations)

The Stock

One of the reasons I write for this forum is because I like doing my part to destroy what I consider to be myths. If the evidence from my comments section is any indication, one of the most pernicious myths that investors cling to is that a great, fast growing company is obviously also a great stock to invest in. While it may be, it certainly isn’t inevitably so. If you pay a near infinite price for very healthy growth, you’ll eventually lose money. This is why I drive home the point that the “business” and the “stock” are very different things, and that’s why I write about them separately. Simply put, stocks are affected by forces that are in addition to, and in many ways distinct from, the ups and downs of the firm. For instance, a stock may move up or down in price because of what an influential analyst said about a related, or only peripherally related, business. Also, the stock is also very definitely affected by our collective views about the overall market, and stocks as an asset class. For this reason, we need to consider the stock as a thing distinct from the business. It may be tiresome that your stock gets buffeted around by forces having very little to do with the company, but in my experience this creates tremendous opportunity also. The only way to consistently make money trading stocks is to spot discrepancies between the crowd’s view about a given company, and subsequent results. Further, we want to go long a stock when the crowd becomes overly pessimistic, and we want to avoid stocks when the crowd becomes overly sanguine. Given the worries I just expressed about the dividend, it may be the case that the crowd is at least nervous about the stock, and that would be a good thing in my view.

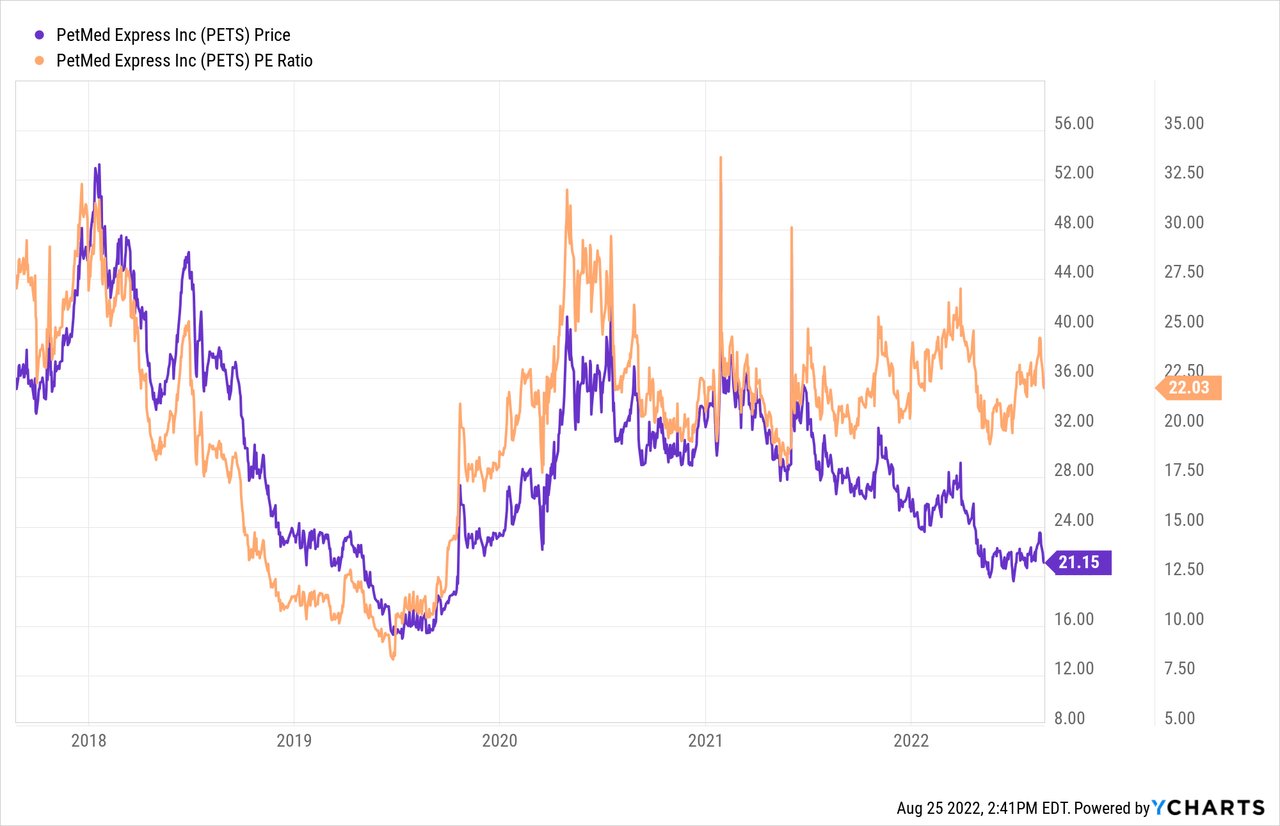

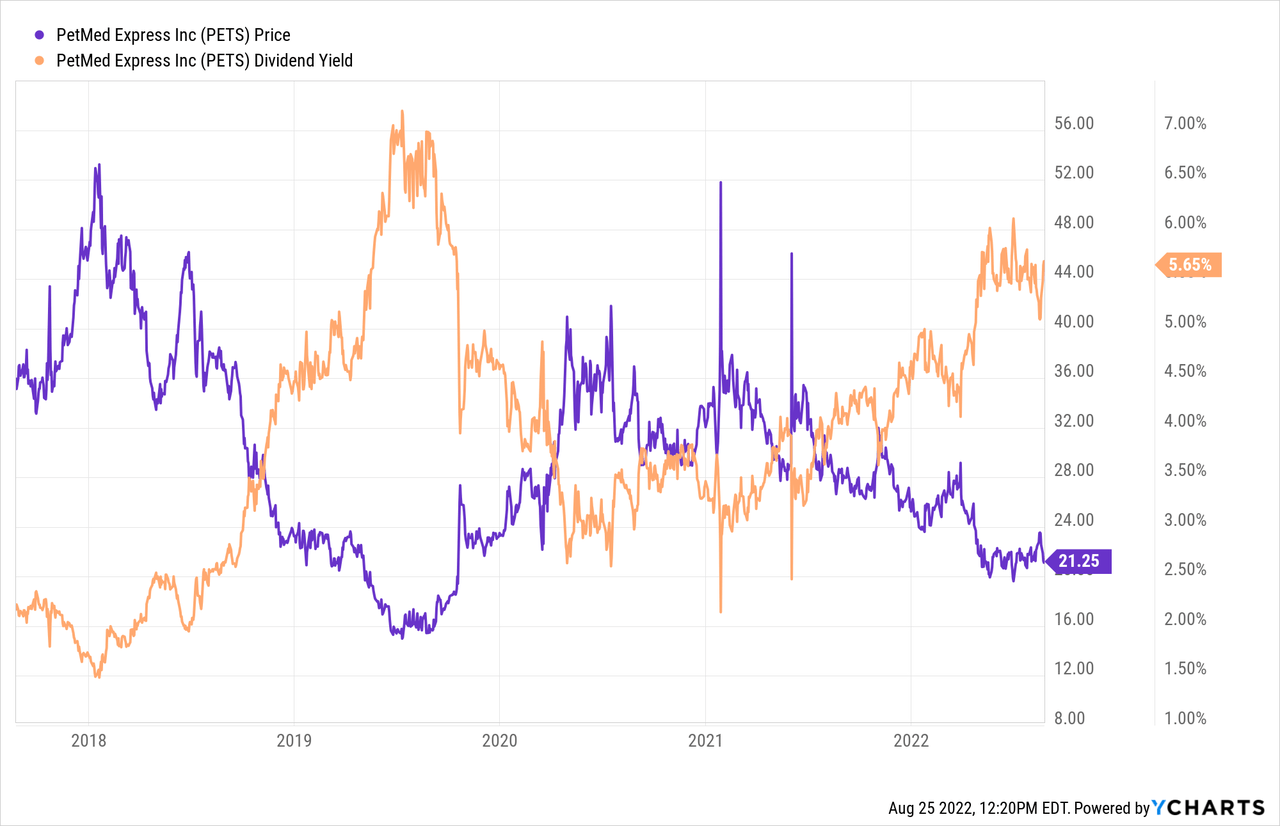

I want to buy when the crowd is particularly pessimistic and I measure pessimism in a few ways, ranging from the simple to the more complex, and I publish some of those measures on this forum. On the simple side, I look at the ratio of price to some measure of economic value like earnings, free cash flow, the dividend yield and the like. I want to see a stock trading at a discount to both the overall market and its own history. At the moment, things are neither the cheapest nor the most dear they’ve ever been, per the following:

While the shares aren’t exactly cheaply priced, I think it’s relevant that people who buy today are receiving a decent yield of over 5.5%. Even if dividend growth slows to a crawl from here, that’s not a terrible income stream in my estimation.

In addition to looking at simple ratios, I actually use a large number of other, more complex valuation measures, one of which involves trying to understand the assumptions currently embedded in price. If you read me regularly, you know that I rely on the work of Professor Stephen Penman, and increasingly Mauboussin and Rappaport to do this. This approach uses a company’s stock price itself as a source of information. It involves “reverse engineering” the assumptions that cause the current price. When I apply this to PetMed, I forecast a growth rate of ~6% for this company. I considered that to be fairly optimistic, and thus relatively risky.

In spite of the attractive dividend yield, the shares aren’t unambiguously cheap enough for me and for that reason I’m going to have to take a pass until the price falls to the $15 range. People who are long this stock may well conclude that I’m a bit of a coward. While my fearful nature has definitely caused me to miss out on some great short term gains, it has protected me against massive loss in the past, and I think that’s worth it. This approach preserves the purchasing power of capital over time, and that’s really the name of the game in my view.

Options As Alternative

Just because I don’t want to buy at current levels doesn’t mean I see no value here, obviously. I haven’t done it in a while, but I think there’s an opportunity to make some decent risk adjusted returns with short puts. Specifically, I like the January 2023 puts with a strike of $15. These are currently priced at $075-$0.90. I consider this to be a “win-win” trade because the results will be great no matter the outcome. If the shares remain above $15 per share over the next five months, the investor will pocket a decent 5% yield ($0.75/$15). If the shares fall in price, the investor will be obliged to buy, but will do so at a price that lines up with a dividend yield of ~8.4%. The valuation at that net price of $14.25 is also attractive, at a PE of ~14.8, which is very attractive in my view.

Now that you’re hopefully excited about the prospects of a “win-win” trade, it’s time when I get to indulge in my semi-sadistic tendency to spoil people’s moods by pointing out that the phrase “win-win” is really just a bit of rhetoric. This trade, like all others, comes with risk. I consider the risks associated with these instruments to fall into two broad categories: the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. So, I would never advocate that people simply sell puts with the highest premia. In my view, that strategy would lead to disastrous results. Take my word on this one, as it’s informed by some very painful trades over the years. So, as a general rule, only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay.

Also, understand that put options are generally less liquid than stocks. That means that if you need to exit a position in a pinch, there’s a good chance that you will take a relatively large loss, given the large gap between bid and ask prices. Thus, I would urge you to treat most options as though they were of the European variety, meaning that they can’t be traded until expiration.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on the upside. To use this trade as an example, let’s assume that the stock price of PetMed shoots to $35 per share. Obviously, in that happy circumstance, my puts will expire worthless, which is a great outcome in some ways. I will not catch any of the upside in the stock price, though. So, short put returns are capped by the premium received. This is emotionally painful for some more hopeful souls. Thankfully for me, my expectations have been so diminished by a life of trading that this isn’t really an emotional hardship for me. In other words, I’m very happy to accept a 5% return over five months because I’ve learned to control my greed.

Secondly, it can be emotionally painful when the shares crash below your strike price. This has happened to me more than a few times over the years. While it always works out well because my strike prices are usually “screaming buys”, it is emotionally painful in the short term. The fact is that it’s not fun when the stock crashes well below the strike price. I can make a reasonable argument that PetMed would be a steal at a net price of $15, but if the shares drop to $10, for instance, that will take an emotional toll, at least in the short run. I think people who sell puts should be aware of these emotional risks before selling.

If you understand these risks and can tolerate them, I would recommend that you sell puts in lieu of buying shares. The return may be lower, but in my experience, this game isn’t about trying to capture maximum returns. It’s about trying to capture maximum risk-adjusted returns, and a deep out of the money put is a far less risky proposition than the stock in my view.

Be the first to comment