Nastassia Samal/iStock via Getty Images

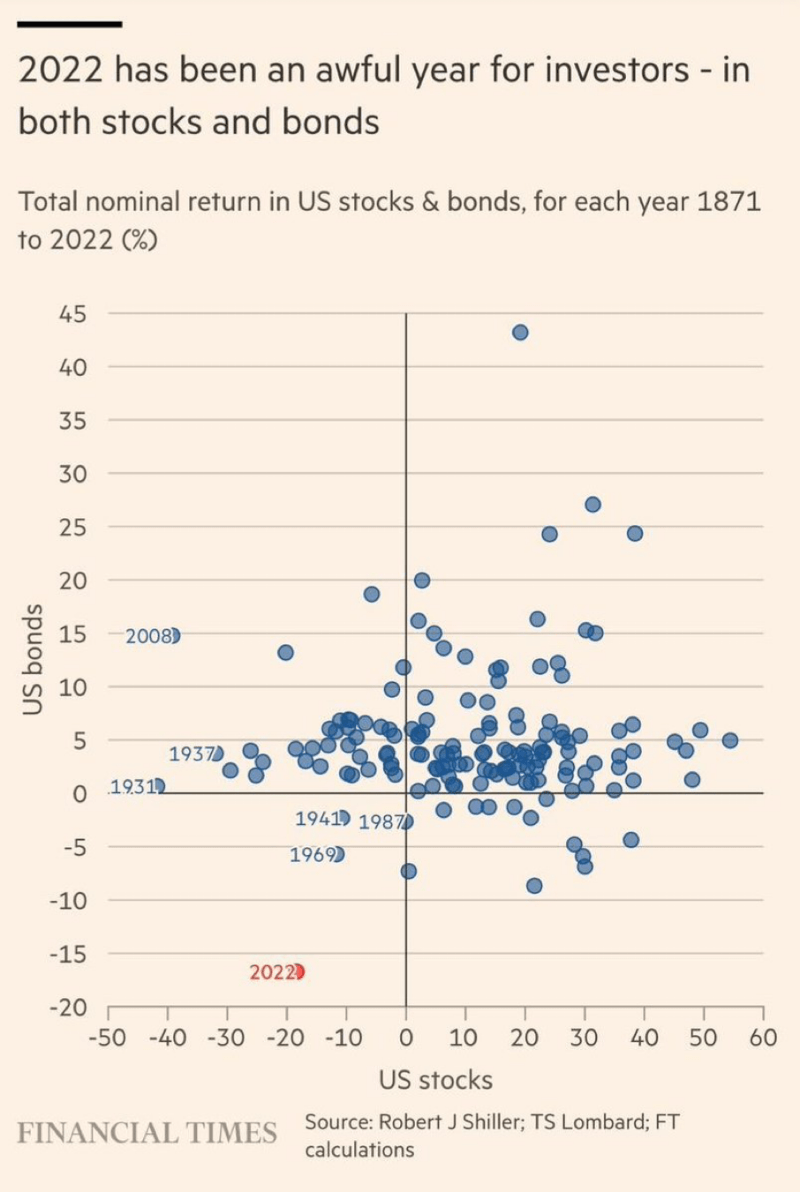

We hope this note finds you healthy and happy. I’m pleased with how our portfolios held up in 2022. And even more than recent price performance, the progress inside our businesses is very encouraging.Last year was difficult for investors. For reference, the S&P 500 was down -18.1%, and the popular bond fund $TLT was down -31.0%. A common 60/40 blended portfolio was -23.3% for the year. I know many smart, capable managers who are down -50%+. There, but for the grace of God, go us. 🙂

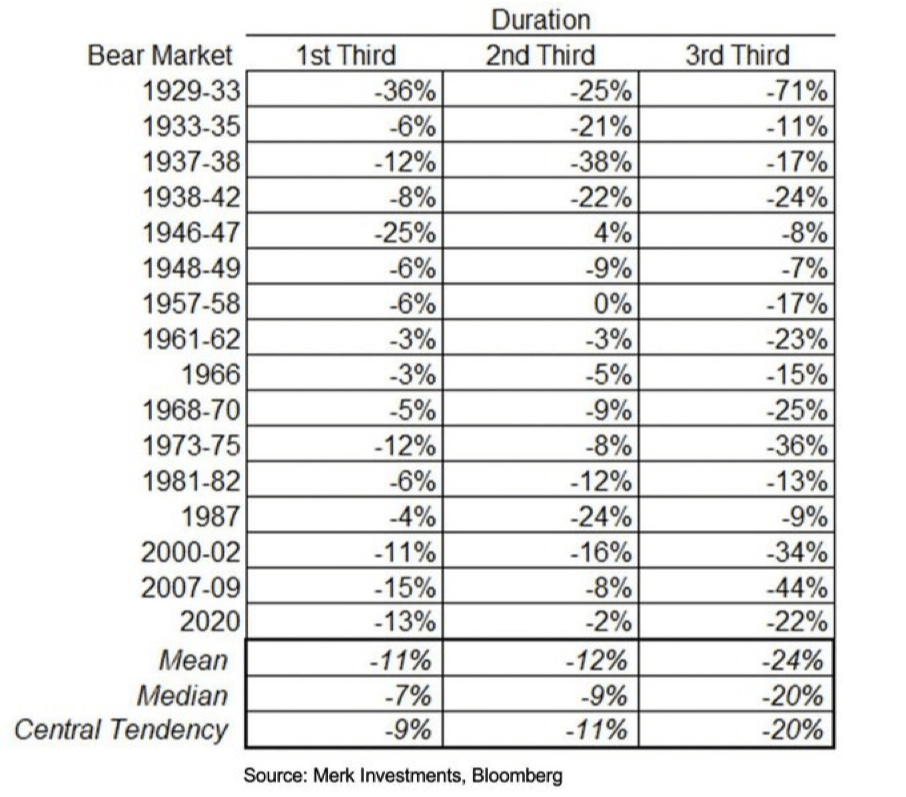

This isn’t a victory lap; markets love to surprise. If history is a guide, 2023 could contain more acute pain than the slow downward grind of 2022. There’s a market adage that bear markets deliver 1/3rd of the losses in the first 2/3rds of the process, and the “third act” delivers the remaining 2/3rds of the pain. Historical data supports this mental model.

We’re unlikely to be spared when true panic sets in… And that’s OK. Prices can go anywhere, but our businesses are generally well-positioned financially (clean balance sheets) and psychologically (opportunistic mindsets) for tough times. That’s how they end up in the portfolio. And our healthy cash balances will come in handy when other market participants are losing their heads. The general takeaway: Steady as she goes.This quarter’s letter explores Annie Duke’s “Kill Criteria,” and how Mother Nature discovered the concept billions of years ago.

January 2023 Client Letter

Deadly Inventions

“Death is very likely the single best invention of life.”

–Steve Jobs

Mother Nature cares very little for the individual. She uses death as a sorting and cleansing mechanism. What can her brutal indifference teach us about investing and good decision-making hygiene?

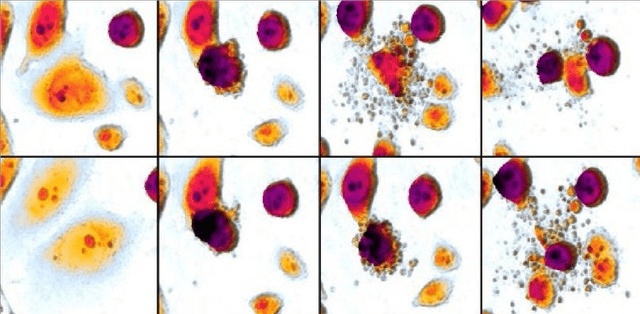

We’re perpetually dying inside. No, really. Apoptosis is a biological process in multicellular organisms that’s best described as programmed cell death. It’s ancient Greek for “falling off,” like leaves from a tree. Apoptosis is a highly regulated process within the body, happening constantly. The average adult loses between 50 and 70 billion cells every day due to apoptosis. That sounds like a lot. But recent estimates put the total cells in the human body around 37 trillion. So we’re only destroying something less than

0.2%. Gotta keep it fresh!

Apoptosis can be triggered in two distinct ways.

The first are called intrinsic pathways because the signal comes from within the cell. A cell can kill itself because it senses damaged DNA, heat, radiation, nutrient deprivation, viral infection, or just general cellular stress.

Secondarily, apoptosis can be triggered externally via extrinsic pathways. Macrophages are specialized cells that act as cleanup crews inside the body. A macrophage can effectively push the self-destruct button on a cell, and then clean up the exploded contents.

Defective apoptosis sensors have been implicated in a wide variety of diseases. Insufficient sensors result in uncontrolled cell proliferations, better known as cancer. Keep that metaphor in your mind for later.

Just like with a herd of animals, removal of the weakest elements allow the remaining collection to move faster, and have more resources available per capita. Nature, efficiently red in tooth and claw, favors addition through subtraction.

Programmed cell death has been part of biology for billions of years. What gets built via our DNA is readily torn down, if the right signaling occurs. There’s a significant data set accumulated at this point to suggest death is a useful tool in biology. How can we apply this insight to improve our decision-making?

Killin’ It

Annie Duke has a new book out called Quit: The Power of Knowing When to Walk Away. Duke is one of my favorite authors due to her knack for boiling down academic research into actionable insights. We’re lucky she primarily focuses her talents on decision-making.

In keeping with our death theme, Duke highlights a concept she calls kill criteria. The idea is simple enough: Kill criteria are predefined events or circumstances that would cause you to reverse a decision.

Kill criteria are the decision-making equivalent of apoptosis. What signals would be required to change your mind and kill that decision? One could make the argument that every important decision could benefit from stapling kill criteria to it before launch. But as this is an investment letter, let’s explore the financial implications.

How Can Investors Use Kill Criteria?

Let’s start with the obvious. For every affirmative buy decision you make, attach a set of kill criteria that would trigger a sell evaluation.

“I’m buying $XYZ, but if it gets to $100/share, I will consider selling.”

“I’m buying $XYZ, but if management reprices their options and effectively steals from me as a shareholder, I will sell.” (I wish I could say this has never happened to me.)

For investments you pass on, attach a set of kill criteria that could make you change your mind and become a willing buyer.

“I’m passing on $XYZ due to valuation. I love the business, but it’s too expensive right now. If it ever gets down to a 10x P/E, I will take another look.”

“I’m not adding more to $XYZ right now, but if I saw revenue growth accelerate by 10%, I will increase my ownership to 5% of the portfolio.”

Most decisions are two-way doors. Occasionally, there’s no undo button. It’s helpful to know when you’re facing an irrevocable decision, and when you aren’t. The majority of the time, we can change our minds, and it’s a profitable habit to identify kill criteria as useful clues when to retreat.

Portfolio Cancer

Recall that cancer is uncontrolled cellular proliferation. The unmindful portfolio can develop cancer as well.

“Never sell” is a common refrain heard late in bull markets. My heroes, Warren and Charlie, are surprisingly somewhat to blame. Buffett has often said his favorite holding period is forever. And Munger is fond of applying Ben Franklin’s nuptial advice to his portfolio: “Keep your eyes wide open before marriage, half shut afterwards.” The sages from Omaha are associated with not selling good businesses, even when valuation rises to a dizzying height.

Here’s what many investors miss: Buffett and Munger were referring to a tiny sliver of truly exceptional businesses. Especially in the late innings of bull markets, price action can convince us we have a whole portfolio stuffed with these rare gems. Odds are, we don’t. Capitalism is unrelenting in its erosion of competitive advantages. It’s telling that Buffett and Munger have only identified a handful of these hold-forever businesses after decades of meticulous searching.

Without establishing kill criteria, our portfolios can drift toward a cancerous mass of ideas and thesis drift. Kill Criteria counteract the sunk-cost and escalation of commitment biases. They let you peek around the corner, and make decisions before you’re emotionally compromised by price action. It’s very human to evaluate a business you own more favorably when the price is rising. The danger of feeling like a genius creeps in, deadening criticality. Pride cometh before the fall.

Simple instructions allow biology to express incredibly complex interactions as emergent behavior. And we can inch closer toward that ideal with some simple decision-making structure.

Great news! You don’t have to wait until your next decision to use this mental tool. You can go through your existing decisions and attach kill criteria retroactively. Truly better late than never.

Let’s borrow more from nature. You can use the “intrinsic pathway” and simply hold yourself accountable internally. It helps to write everything down in an investment journal to see what you were thinking. It’s all too easy to revise history if you operate purely from memory. Researchers call this hindsight bias, and it’s probably the number two Achilles heel for investors behind overconfidence bias.

Or you can use an “extrinsic pathway” and, as Duke recommends, find a “Quitting Coach.” This would be someone you trust to hold you accountable to your own kill criteria.

Either way, don’t be afraid to “scrape the barnacles” off your existing portfolio. As Buffett has often said, “You don’t have to make it back the way you lost it.” The mental clarity afforded by a fresh, clean portfolio could serve you well.

Market Update

The S&P 500 was down -18.1% in 2022, and the popular bond fund $TLT was off -31.0%. A common “60/40” portfolio of those two would have been down -23.3% for the year. There was a lot of pain to go around. Especially if you owned profitable-tomorrow “disruptive” businesses. Representative of that group is Cathie Wood’s ARK Fund ($ARKK), which was down -68% last year[1].

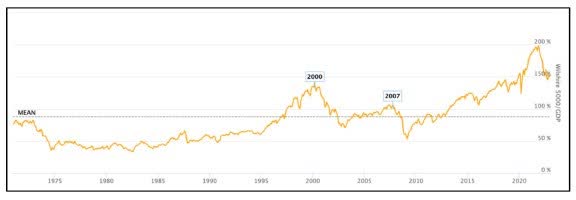

Even with the bubble bursting, 2023 dawns with the general market still relatively expensive against historical norms. The “Buffett Indicator” (Wilshire 5000 market cap / GDP) remains well above its long-term mean.2 Other measuring sticks tell the same story. Never forget that higher starting prices mean lower expected forward returns.

If interest rates continue to rise and profit margins contract, it’s uncontroversial to say the market is still rather expensive. And yet, it’s possible today’s value opportunity set hints at a stretch of generational outperformance.

Joel Greenblatt maintains a website that continually answers the question, “Is now a good time for value?” His data going back to the early 1990s say the answer is a resounding YES. Joel’s basket of the least expensive 20% of stocks[2] ranks today in the 92nd percentile of most attractive in the last thirty years. If you look out two years from today’s level, Joel would say the results are likely to be quite satisfactory.

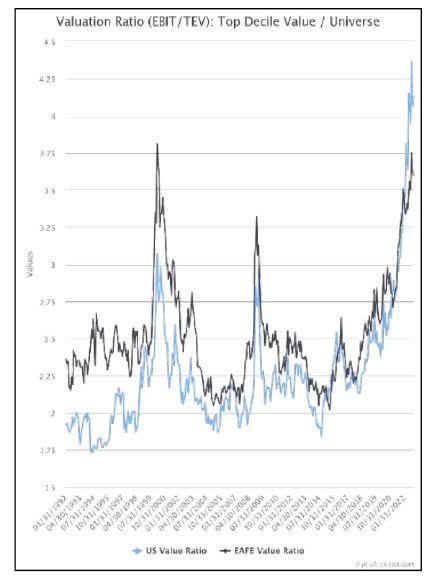

Rhyming with Greenblatt’s findings, Wes Gray at Alpha Architect maintains the spread of the top decile of cheapest stocks measured against the universe’s average. Both the US and International are jumping off the page, suggesting a rich opportunity set.

Never forget that what is cheap today can always get cheaper on you. It will hurt to hold a basket of stocks that transition from the 92nd percentile to the 100th. But the inconvenient truth is, no one knows where rates and economies are going, nor how markets will react. The macro concerns are both important and unknowable. Stick to the basics, and keep asking yourself, “Am I getting a lot of business value for my money?” If the answer is yes, then let the macro chips fall where they inevitably may.[3]

As always, we’re thankful to have such great partners in this wealth creation journey.

Jake

Footnotes[1] I’ll leave it to those smarter than me to explain how $ARKK was able to attract $1.8 billion in fresh inflows in 2022, despite the dismal performance. ARK investors might consider reading the historic rise and fall of Janusduring the Dot Com Bubble, if history is any guide. 2 No single macro measurement is definitive, including the “Buffett Indicator.” And they’re all useless as timing tools. But if every chart is telling you roughly the same thing, it’s worthy of your awareness. [2] Greenblatt uses a proprietary valuation methodology where his team makes economic adjustments to the reported accounting numbers. These adjustments reflect what a sensible business owner might consider. [3] There’s a saying that wisdom is following the advice you give to others. I hope it’s obvious the prescriptions in these quarterly letters are as much advice to myself as anything. Ideally, putting it out is also pounding it in. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment