gesrey/iStock via Getty Images

Co-produced by Austin Rogers

Raging Inflation With No End In Sight

It’s safe to say that inflation has run hotter and lasted longer than most people thought it would.

Supply chains keep suffering setback after setback, with the most recent examples including lockdowns in China and sanctions (voluntary and imposed) on Russia. Ever since the original sin of inflation during the pandemic (massively increasing consumers’ purchasing power when services were unavailable and goods production capacity was limited), the supply-demand imbalance has not been able to equilibrate in order to stabilize prices.

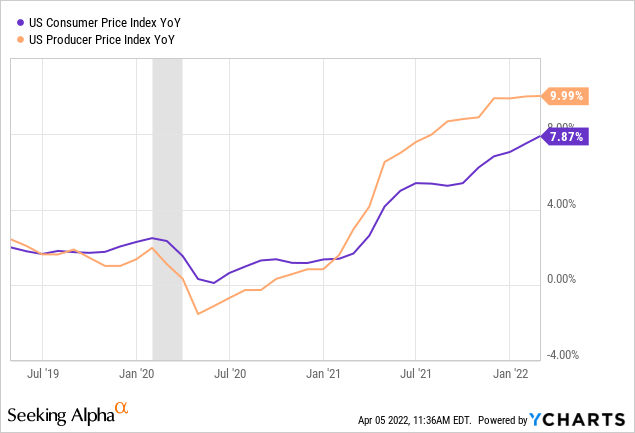

Producer prices have grown ~10% on average in the last year, while consumer prices are up nearly 8%.

US CPI is at a 40-year high (YCharts)

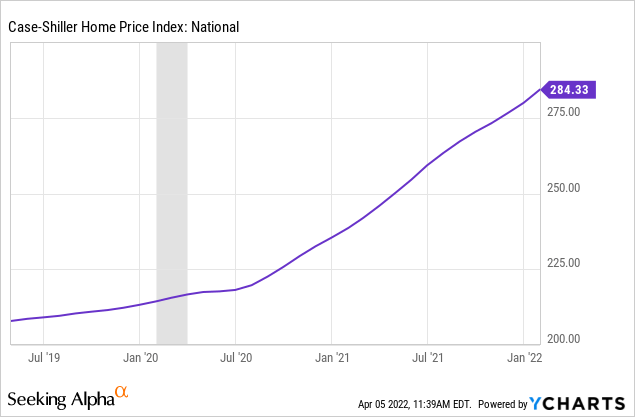

And this price growth has been broad-based, ranging from soaring commodity prices to surging sticker prices on cars to incredible increases in home values. Since April 1st, 2020, home prices across the nation have risen by an average of 30%.

Home prices are surging (YCharts)

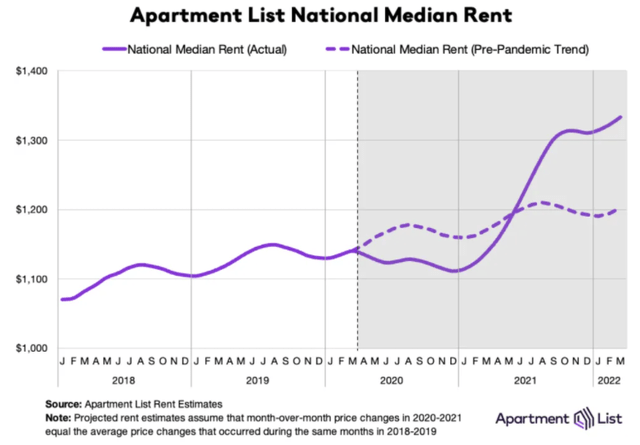

As home affordability has slipped further and further away for many would-be homeowners, apartment rent rates have climbed rapidly.

Apartment rents are surging (Apartment List)

As of March 2022, nationwide average apartment rents are about 11% higher than they would be if the pre-pandemic trend had held.

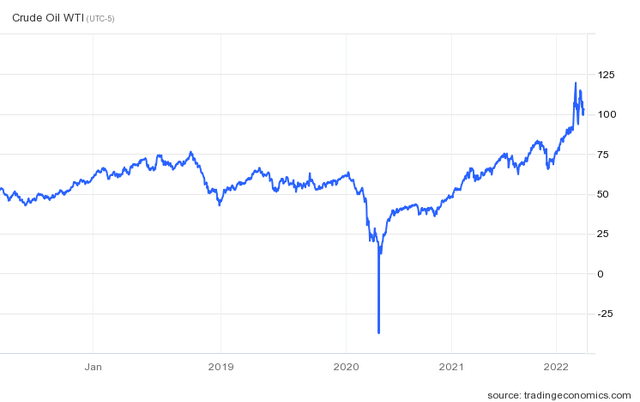

And then there’s the price of oil, which affects innumerable other prices via transportation costs, recently surging to its highest level in years.

Oil price is surging (Trading Economics)

Between oil producers prioritizing cash returns to shareholders over increasing production capacity and decoupling from Russian imports, it seems unlikely that the price of oil will decline anytime soon.

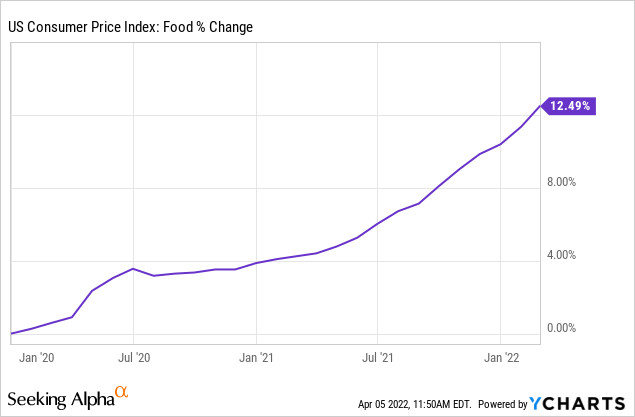

The third-largest source of consumer spending is food. Given productivity enhancements in farming as well as competitive pressures in the grocery and food service sectors, food price increases have tended to be very limited in the past. But since the beginning of 2020, the cost of putting food on the table has risen by 12.5%.

Food prices are surging (YCharts)

Though the U.S. imports very few food commodities like wheat from Russia or Ukraine, the war in Eastern Europe has diminished the world’s food supply and is leading to massive shortages in the Middle East and North Africa. Spiking food prices elsewhere in the world may pressure food prices here in the U.S. as well.

In short, despite heroic efforts by companies all over the world, the supply-demand imbalance does not seem to be nearing its end yet.

That makes it a good idea to continue seeking out investments that can hedge against elevated inflation rates. Many investors are aware of the inflation-hedging traits of real estate, but there are many varieties of real estate, and some are better at keeping up with inflation than others.

In this article, let’s look at three REITs with long-term leases and inflation-based rent escalations in their contracts with tenants.

1. Medical Properties Trust, Inc. (MPW)

MPW owns the real estate of hospitals, behavioral health facilities, and inpatient rehabilitation centers across North America, Europe, Australia, and South America. A little over 3/4ths of the portfolio is concentrated in hospitals.

Hospital net lease property investment (Medical Properties Trust)

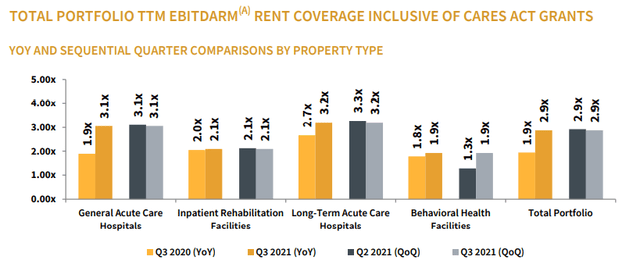

MPW owns 438 properties leased to 53 tenant-operators across nine countries. The vast majority of the portfolio (98% of revenue) either operates under a master lease or has a parent company guaranty. The REIT has only two properties with rent coverage below 1.5x of EBITDARM (earnings before interest, taxes, depreciation, amortization, rent, and management fees), and the rest of the portfolio continues to exhibit strong rent coverage.

MPW has high rent coverage (Medical Properties Trust)

Moreover, MPW’s leases are quite long. The portfolio has a 17.7-year weighted average remaining lease term, and about 91% of leases by revenue expire after 2031.

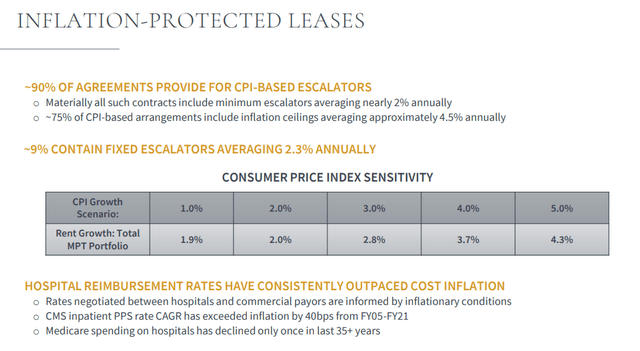

Most relevant to the current discussion, however, is MPW’s impressive contractual protection from inflation.

First of all, all of MPW’s properties are leased on a triple-net basis. This means that rent is net of all property maintenance, insurance, and taxes. The tenant is responsible for shouldering these costs. Thus, MPW is shielded from all inflationary increases in operational expenses.

Virtually all (~99%) of MPW’s leases also include either contractually fixed rent hikes or CPI-based escalations. The vast majority (~90%) are tied to CPI with a ceiling of 4.5%.

MPW enjoys strong inflation protection (Medical Properties Trust)

With inflation running well over 5% so far this year, MPW’s rent bumps should come in at 4% or higher for this year. That organic rent growth should drop straight to the bottom line, as it requires no additional investment or work from management to achieve it.

Moreover, in the case that inflation eventually turns the other way and sinks to very low levels, MPW’s contractual rent escalations also include floors such that organic rent growth will never fall to zero.

Investors can earn a 5.6% dividend yield from this fast-growing hospital REIT while they wait for the 20% upside to fair value to be priced in.

2. W. P. Carey Inc. (WPC)

WPC also owns triple-net leased properties, but its portfolio is much more diversified than that of MPW.

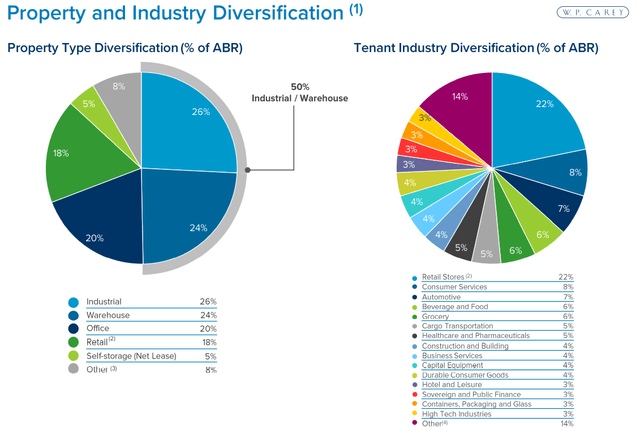

The diversified REIT owns 1,304 properties across the U.S. and Europe. The total portfolio has a weighted average remaining lease term of 10.8 years and is 98.5% occupied.

WPC has increasingly concentrated its portfolio in industrial real estate, which now makes up half of all properties.

W. P. Carey is very well diversified (W. P. Carey)

Most of the one-fifth of the portfolio in offices either serves as corporate headquarters or is leased to government entities that cannot switch to a work-from-home model. Meanwhile, most of the retail segment is in European essential retail like supermarkets, general merchandise stores, and home improvement stores.

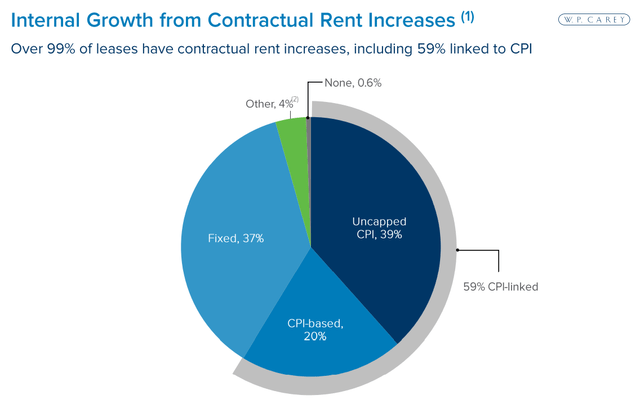

Best of all, WPC’s portfolio is overwhelmingly geared toward inflation protection, with 99.4% of leases by revenue including some form of rent increase, 59% specifically tied to the CPI, and 39% with uncapped CPI-based escalators.

W. P. Carey has superior inflation protection (W. P. Carey)

Uncapped CPI-based escalations means that there is no contractual ceiling on the rent bump. It will go as high as the CPI goes in its given region.

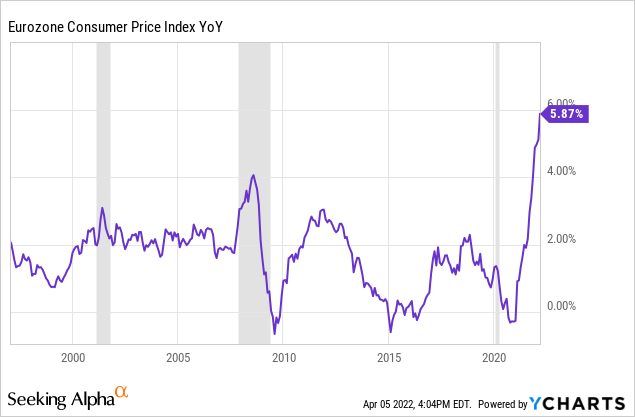

Now, investors should note that many of WPC’s CPI-based rent escalations are for properties located in Europe, where inflation rates have not been quite as high as in the United States.

Inflation is surging in Europe (YCharts)

However, the Russia-Ukraine war is surely gumming up supply chains and sending prices of food and energy much higher on the continent, which should result in even higher Eurozone CPI and ultimately higher rent bumps for WPC’s European leases.

Perhaps this is why CEO Jason Fox recently boasted that WPC is the best positioned net lease REIT for higher inflation in a letter to shareholders.

In the fourth quarter earnings conference call, Fox explained (emphasis added):

Among net lease REITs, we have constructed what we view as the best position[ed] net lease portfolio for inflation with over 99% of ABR coming from leases with built-in rent growth and 59% with rent increases tied to inflation. Although CPI-linked rent growth was not a dramatic contributor in 2021 given the lagged effect on rents, we expect it to provide a meaningful tailwind in 2022, both as further leases go through scheduled rent increases and because inflation has moved higher than originally anticipated. As a result, we estimate our contractual same-store rent growth will increase to between 2.5% and 3% this year, with the bulk of the increase occurring in the first quarter. And of course, if inflation continues to move higher or runs for longer than currently forecast, we would expect to see additional upside.

That statement was made in mid-February, before the Russian invasion of Ukraine set off a renewed spiral of inflationary pressures. Surely same-store rent growth will either come in higher than 3% for this year or will overflow into higher rent bumps in future years, or both.

Between WPC’s 5.3% dividend yield and mid-single-digit earnings growth, investors are looking at 10%+ total returns today even assuming no valuation upside.

3. VICI Properties Inc. (VICI)

VICI is the largest owner of casino real estate in the world, or at least it will be once its $17 billion acquisition of MGM Growth Properties (MGP) closes in the coming months. In February, VICI closed on the $4 billion acquisition of The Venetian, which means that the REIT’s total acquired real estate in 2022 will top $21 billion.

Casinos owned by VICI Properties (VICI Properties)

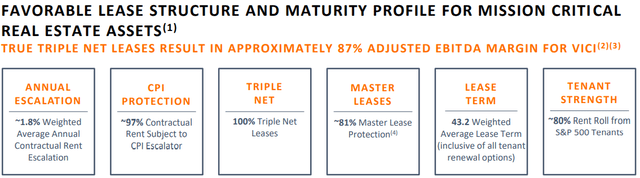

Like MPW and WPC, VICI also utilizes the triple-net lease model, as well as master leases and CPI-based rent escalations.

VICI Properties enjoys strong inflation protection (VICI Properties)

When the MGP acquisition is complete, 87% of VICI’s revenue will be derived from three top-tier casino operators: Caesars Entertainment (CZR) (42%), MGM Resorts (MGM) (36%), and Apollo Global Management (APO) (10%).

Despite existing as a public REIT since Caesars emerged from bankruptcy in 2017, VICI’s portfolio is still very newly constructed. Many of its leases are still in an initial 5-year phase of lower rent escalations before higher bumps kick in thereafter.

Here are some notable examples of how rent escalations work in VICI’s leases:

- Caesars Las Vegas Master Lease: The greater of 2% fixed or the CPI (uncapped).

- Caesars Regional Master Lease: The greater of 2% fixed or the CPI (uncapped) starting November 2022.

- Caesars Southern Indiana: 1.5% fixed through 2026, and the greater of 2% fixed or the CPI (uncapped) thereafter.

- The Venetian: The greater of 2% fixed or the CPI (capped at 3%) starting in 2023.

- MGM Master Lease: 2% fixed from 2023 to 2032, and the greater of 2% fixed or the CPI (capped at 3%) thereafter.

Keep in mind that the first three leases above, all of which feature uncapped CPI-based escalations, represent over $1.1 billion in annual rent. And the longer elevated inflation lasts, the more of VICI’s leases that will begin increasing rents at higher than 2% fixed rates.

Also, note that VICI’s leases include requirements for tenants to spend 1-2% of revenues on property-related capital expenditures every year. This ensures that properties are kept up-to-date and refreshed to retain appeal to guests over time.

Between VICI’s 5.1% dividend yield, 2-3% average rent escalations, and earnings growth from acquisitions in the mid-single-digits, VICI’s total returns going forward should easily reach 12%.

Bottom Line

It is scary facing the highest rate of inflation in 40 years, but investors can rest a little bit easier when they know that their REIT holdings are largely protected from inflation.

That is the case for these three net lease REITs, who not only don’t suffer at all from inflationary operational expense increases but also enjoy inflation-based rent escalations that translate overwhelmingly into profit growth.

At High Yield Investor, we invest in REITs mainly to hedge our high-yielding portfolio against inflation.

Be the first to comment