Nikada/E+ via Getty Images

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on April 8th.

Real Estate Weekly Outlook

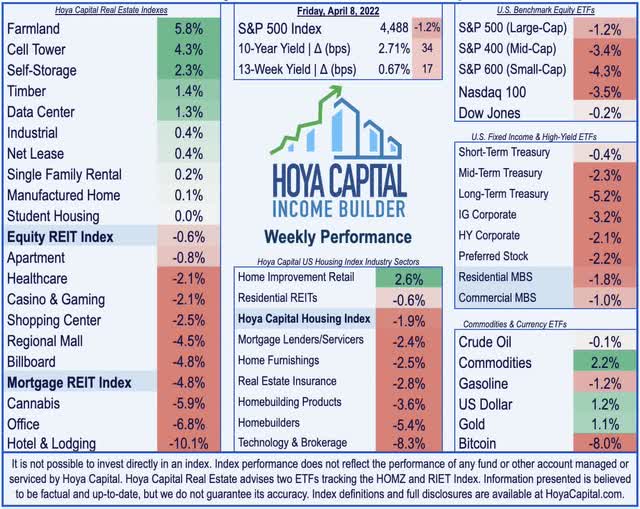

U.S. equity markets were broadly lower this past week amid an ongoing “bond rout” after minutes from the latest Fed meeting revealed an aggressive – perhaps combative – monetary policy posture from the central bank to cool financial conditions. In the published minutes from their March meeting, Federal Reserve officials strongly considered a “double rate hike” of 50 basis points last meeting and outlined a plan to reduce the size of its balance sheet beginning as soon as next month, an unusually swift pivot towards tighter financial conditions that has sent shockwaves through global bond markets.

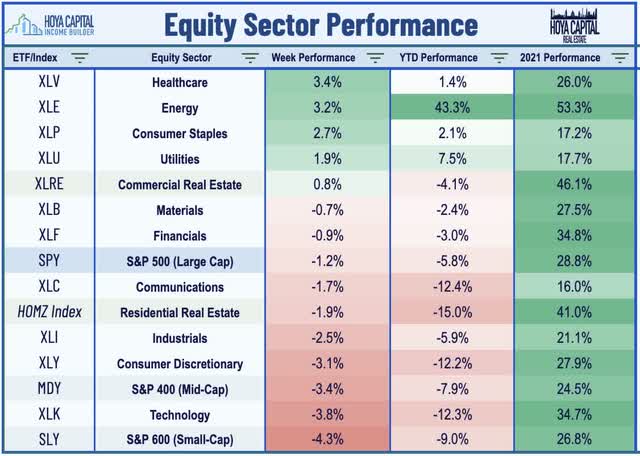

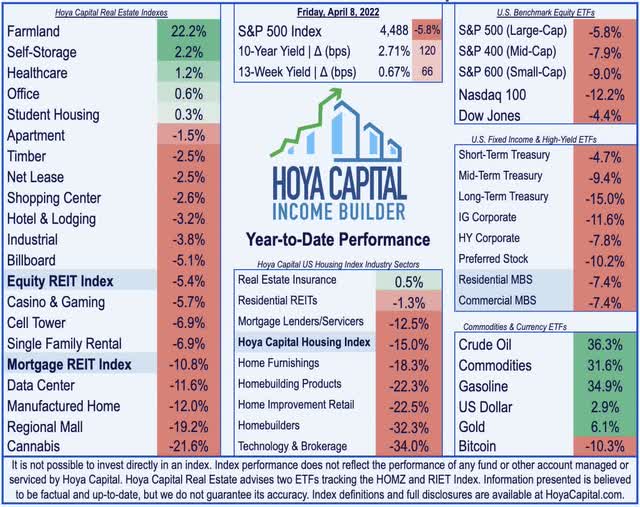

Snapping a three-week winning streak, the S&P 500 declined 1.2% on the week, but the selling was more significant among smaller market-cap tiers as the Mid-Cap 400 declined 3.4% while the Small-Cap 600 dipped 4.3% amid a “flight to quality” pattern following concerning headlines about sweeping COVID lockdowns in China and an apparent “super-spreader” at a political gala event in Washington, D.C. that included many of the highest-ranking public officials. Following their best week in over a year, real estate equities were again among the leaders this week as the Equity REIT Index were lower by 0.6% with 10-of-19 property sectors in positive territory, but Mortgage REITs posted their worst week of 2022 with declines of 4.8%.

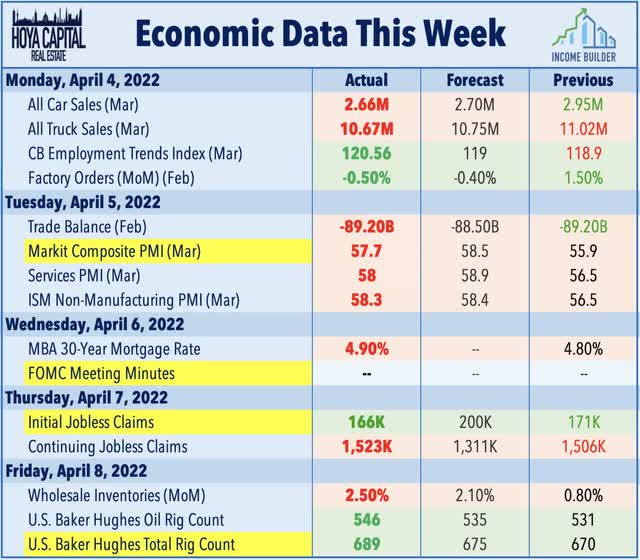

Hawkish comments from Fed officials throughout the week lifted the 10-Year Treasury Yield to its highest level since May 2019, closing the week at 2.71% while the 2-Year Treasury Yield closed at 2.52%. The U.S. Dollar Index strengthened to its highest level since May 2020 while Crude Oil (CL1:COM) was roughly flat on the week at $98/barrel as Rig Counts in the U.S. climbed to a two-year high – a welcome sign that domestic energy production may be finally accelerating. Five of the eleven GICS equity sectors were higher on the week, led to the upside by the Healthcare (XLV) and Energy (XLE) sectors while Technology (XLK) stocks sold off nearly 4%. Homebuilders remained under pressure once again as the 30-year fixed-rate mortgage climbed above 5% across several mortgage indexes – a historically swift increase in rates.

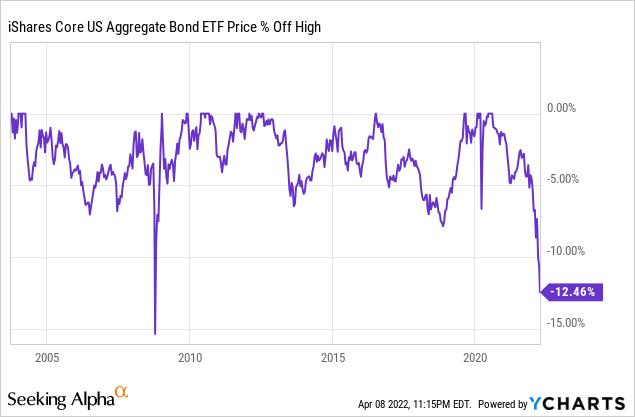

Fixed income securities across the credit and maturity spectrum are in the midst of the most significant pull-back since the Great Financial Crisis, which has started to raise some questions about potential instability if the sell-off deepens. The iShares Core Bond ETF (AGG) – the largest bond fund – has now recorded a drawdown of 12.5% after dipping another 3% this week, its most significant sell-off since the roughly 15% sell-off plunge in 2008 during the worst of the Great Financial Crisis. The typically slow-and-steady iShares MBS ETF (MBB) fell another 1.8% on the week while the iShares CMBS ETF (CMBS) declined 1% to pull their drawdown to roughly 8% – also marking the largest pull-back since the GFC. The nearly 14% decline from the Vanguard Corporate Bond ETF (VCIT) is also historically significant, nearly as large as the 16.8% plunge in March 2020 during the period of violent volatility.

Hoya Capital

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

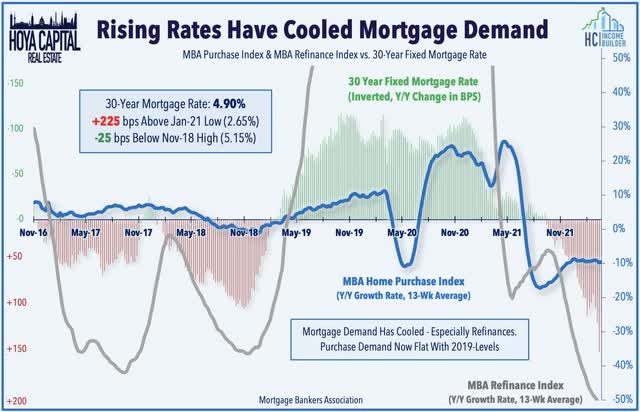

The Mortgage Bankers Association’s weekly mortgage application data has again become a closely-watched report as a high-frequency indicator of the health of the housing market. The MBA’s 30-year fixed mortgage rate increased for the fourth consecutive week to 4.90% and is now more than 1.5 percentage points higher than a year ago – the most significant year-over-year increase since 1995 – and bringing the headline rate to within 25 basis points of its post-GFC high of 5.15%. The surge in rates, naturally, has led to a significant decline in refinancings – which are lower by 62% from last year. Purchase applications – the more relevant indicator to watch – have held their ground thus far in the face of this recent rate surge as activity is roughly even with comparable 2019-levels. Recent data from Redfin has shown that while the historically red-hot conditions have clearly waned this year – and price drops are becoming more common than last year – buyers remain active.

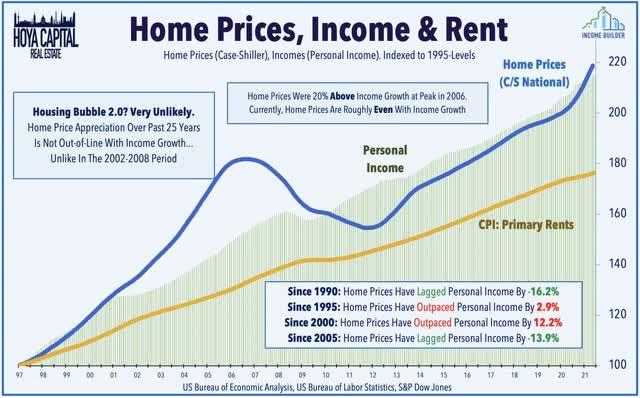

Last week, researchers from the Federal Reserve Bank of Dallas published a much-discussed research report on the state of the housing market. Media reports naturally latched on to the “click-friendly” discussion over a potentially bursting “bubble” despite the research’s core conclusions to the contrary. The report centered on the themes we’ve discussed over the past several months – that while home price appreciation is clearly due (perhaps overdue) for a period of “normalization” to levels that match Personal Income growth, we’re not at a level that implies the fundamental need for a “hard landing” – a period of widespread negative appreciation. National home values have almost perfectly matched the growth in Personal Incomes since 1995, and we believe that a relatively swift deceleration in price appreciation back to the mid-single-digit range by year-end would be an ideal outcome – but won’t come without several months of ominous headlines and anecdotes of stress.

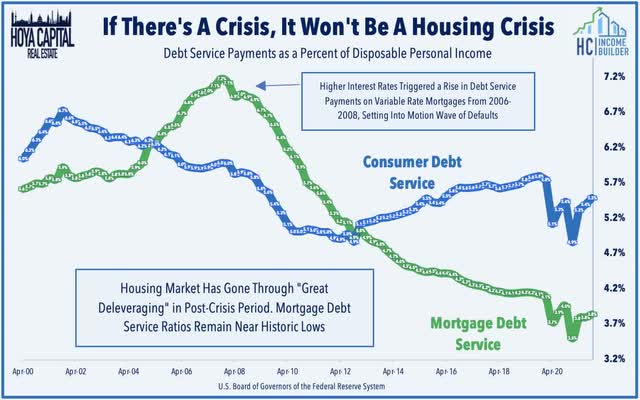

In concluding that it has “no expectation” that a period of correction in home values would be comparable to the 2008 financial crisis, the Dallas Fed report noted that, “household balance sheets appear in better shape, and excessive borrowing doesn’t appear to be fueling the housing market boom.” As we highlighted early in the pandemic when there were similar levels of concern about the housing market, the deep and lasting scars of the GFC resulted in a “great deleveraging” across the housing industry over the last decade. Subprime loans and adjustable-rate mortgages – the dynamite that led to a cascading financial market collapse in 2008 – have been essentially non-existent throughout this cycle. Adjustable-rate mortgages – which would be most “at-risk” from the surge in rates – accounted for nearly a third of all new mortgages at the peak in 2005, but have accounted for less than 5% of mortgages originated since 2009.

Equity REIT & Homebuilder Week In Review

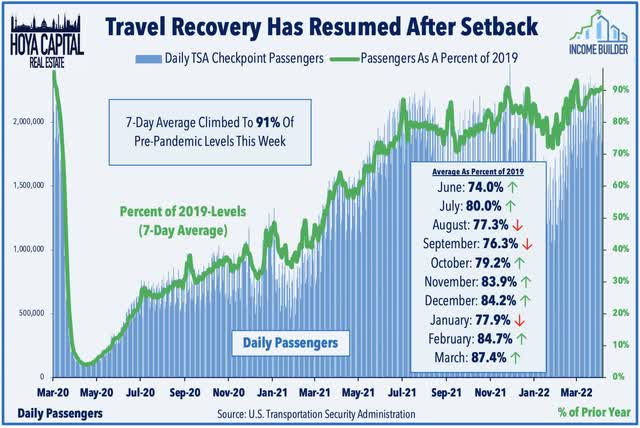

Hotels: Travel and leisure stocks were pressured across the board this week on renewed COVID concerns despite strong high-frequency demand data. TSA Checkpoint throughput data rebounded to 90% of pre-pandemic levels this week while STR’s weekly hotel data showed that Revenue Per Available Room (“RevPAR”) was nearly 5% above pre-pandemic levels last week. The recovery remains uneven across regions, however, as Ashford Hospitality (AHT) tumbled more than 20% after announcing that it expects to report occupancy of 58% and RevPAR of $97, which represents a decrease of 23% compared to Q1 2019. Braemar Hotels (BHR) – which focuses on luxury hotels and resorts – finished lower by 12% despite announcing solid preliminary Q1 data, noting that its RevPAR of $328 was 20% above comparable levels in Q1 2019. BHR commented, “Leisure demand has held up much better than anticipated, as trends in corporate transient and group bookings continue to build.”

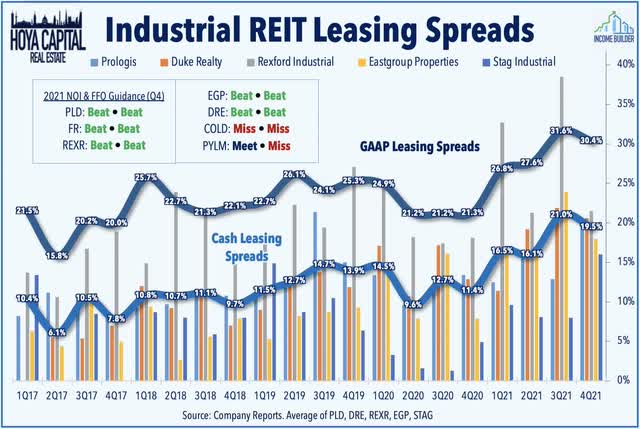

Industrial: LXP Industrial (LXP) dipped more than 16% on the week after announcing that it is no longer pursuing a sale of the company, citing “the significant changes to macroeconomic, geopolitical and financing conditions since it commended the process in early February. LXP – along with a handful of other industrial REITs – also provided preliminary Q1 metrics, with LXP noting that it achieved cash rental spreads of 18.1% on 2.3M of leased space. Terreno (TRNO) was among the leaders on the week after announcing impressive cash spreads of 34.8% in Q1 while increasing occupancy to 96.9% compared to 95.5% at end of Q4 and 96.1% last year. Small-cap Plymouth (PLYM) finished lower by 5% despite reporting a cash rental spread of 16.7% on 1.3M SF of leases in Q1 while INDUS Realty (INDT) slipped 3% despite announcing cash spreads of 15.0% on 49k SF of leases in Q1.

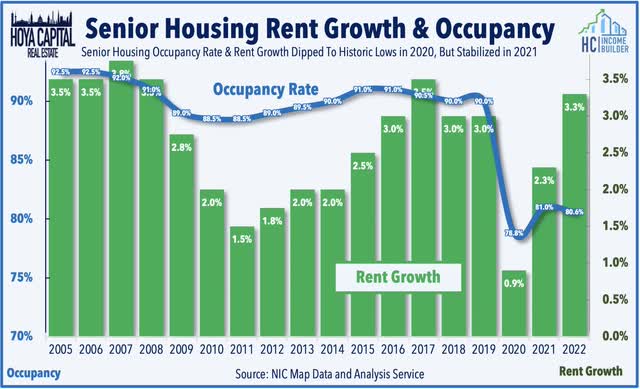

Healthcare: Several healthcare REITs provided business updates this week in conjunction with their participation in the Credit Suisse Healthcare REIT Summit and ahead of the closely-watched National Investment Center (“NIC”) quarterly senior housing report. Welltower (WELL) was among the better performers on the week after that it expects its normalized FFO to exceed its prior guidance range in Q1 and noted that its average occupancy is expected to exceed its previous assumption with a 420-basis point increase from last quarter. The NIC report showed that senior housing occupancy rates were roughly flat in Q1 despite the omicron surge while operators were able to achieve rent growth of 3.3%, the strongest quarter of rent growth since 2017. Also of note, NIC reported a slowdown in inventory growth to the lowest since 2013 – good news for senior housing REITs as supply growth had been the most persistent headwind for the senior housing sector before the pandemic.

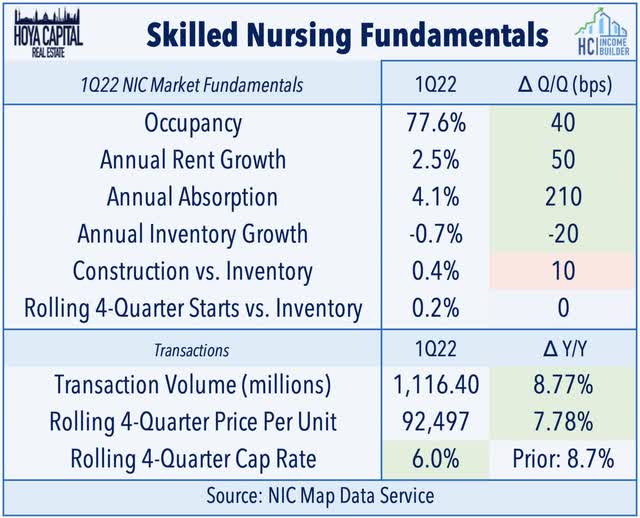

Sticking in the healthcare sector, skilled nursing REIT Omega Healthcare (OHI) dipped 10% after providing a business update in which it noted that an additional operator representing 2.4% of its total had stopped paying rent in March. While OHI collected 93% of its 4Q21 rents, operators representing 18% of its total have stopped paying rent as of March 2022. National Health Investors (NHI) declined more than 7% after reporting that it collected 78.4% of March cash rents – roughly consistent with its Q4 collection rate of 79% – as several troubled skilled nursing and senior housing operators continue to defer rent payments. Operators cite the combination of unemployment benefits, vaccine mandates, and uncompetitive wages for the shortage of available workers. NIC data was notably more upbeat than these REIT updates, however, showing that occupancy rates ticked higher by 40 basis points while transaction volume and pricing were particularly robust.

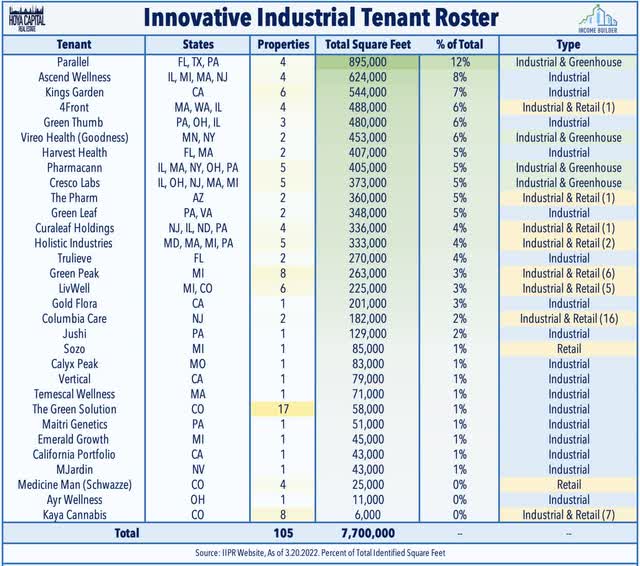

Cannabis: Innovative Industrial (IIPR) provided an operating update in which it noted that it made 4 acquisitions in Q1 for properties in California, Massachusetts, New Jersey, and Pennsylvania, and executed 4 lease amendments for additional improvement allowances at properties in Massachusetts and Michigan. As of Apr. 7, IIPR owned 107 properties – representing roughly 8M rentable square feet. As discussed in Cannabis REITs: Own The Pharmland, cannabis REITs – the best-performing property sector over the past half-decade – have stumbled in early 2022, pressured by the broader growth-to-value rotation and uncertainty over progress on federal legalization, but we believe legalization concerns are overstated.

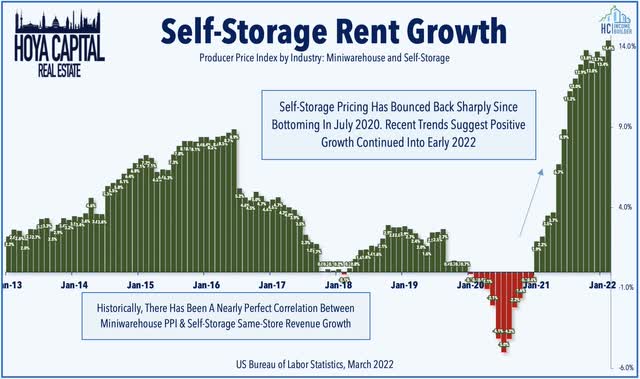

Storage: Self-storage REITs were among the outperformers on the week, led by a 3% advance from Public Storage (PSA). As discussed in an updated report published this week, storage REITs have built on their gains in early 2022 following a jaw-dropping 80% surge last year. Stumbling into the coronavirus pandemic with challenged fundamentals and an outlook for near-zero growth amid oversupply challenges, self-storage demand soared over the past year, powering record occupancy increases, and rent hikes. Storage demand is driven largely by “change”- specifically home sales and rental turnover. The surge in mortgage rates this year appears likely to slow turnover and temper storage demand. Storage REITs have been persistently underestimated over the past two years, however, and we believe that the turnover-driven demand slowdown may be partially offset by the tailwinds from rising residential rental rates.

Mortgage REIT Week in Review

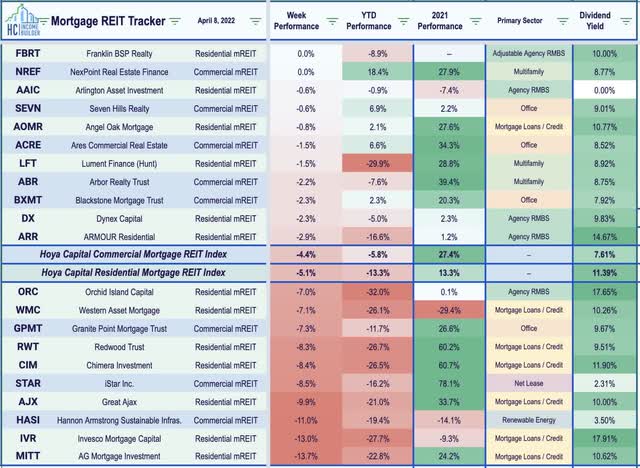

Mortgage REITs were sharply lower on the week amid a deepening of the sell-off in mortgage-backed securities noted above as commercial mREITs declined by 4.4% while residential mREITs slid by 5.1%. The more highly-levered mREITs were under the most pressure with shares of AG Mortgage (MITT) and Invesco Mortgage (IVR) each declining more than 13%. Elsewhere, Hannon Armstrong (HASI) dipped 11% after launching a $200M private placement of non-interest-bearing exchangeable bonds that can be converted into common stock. While the bond sell-off this year has been historically significant, given that the direction of the move has been consistent with the prevailing “hedge bias” of mREIT – unlike in the 2020 period – we think it’s too early to sound the alarm bells on the upper-tier and mid-tier quality mREITs.

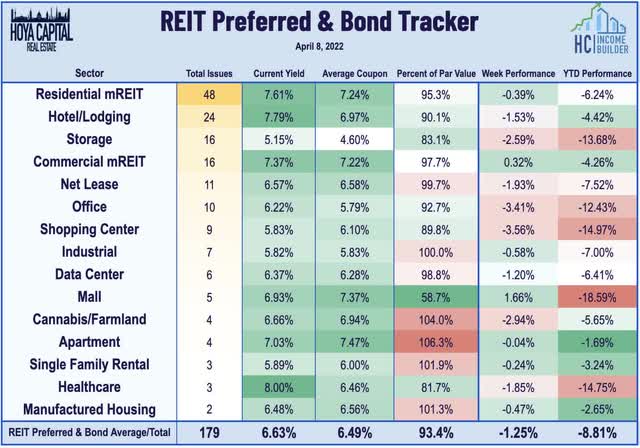

REIT Preferreds & Capital Raising

REIT Preferred stocks advanced 1.59% this week and are now off by 5.6% on the year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. This week, American Homes (AMH) confirmed that it plans to redeem all of its Series F Preferred (AMH.PF) on May 5th. A pair of apartment REITs launched secondary equity offerings this week. AvalonBay (AVB) issued 2M common shares, raising $497M to fund future acquisitions or development while Camden Property (CPT) issued 2.9M common shares, raising $493M to fund its acquisition from the Teacher’s Retirement System of Texas of its 68.7% interest in two of its investment funds.

2022 Performance Check-Up

Through fourteen weeks of 2022, Equity REITs are now lower by 5.4% this year on a price return basis while Mortgage REITs have slipped 10.8%. Interestingly, with the outperformance over the past three weeks, REITs jumped from the worst-performing to the third-best-performing major asset class this year on a total return basis. This compares with the 5.8% decline on the S&P 500 and the 7.9% decline on the S&P Mid-Cap 400. Led on the upside by the farmland, self-storage, and healthcare REIT sectors, 5-of-19 REIT sectors are now in positive territory for the year. At 2.71%, the 10-Year Treasury Yield has climbed 120 basis points since the start of the year and is now closer to its post-Great Financial Crisis peak of 3.25% reached in October 2018 than its August 2020 low of 0.52%.

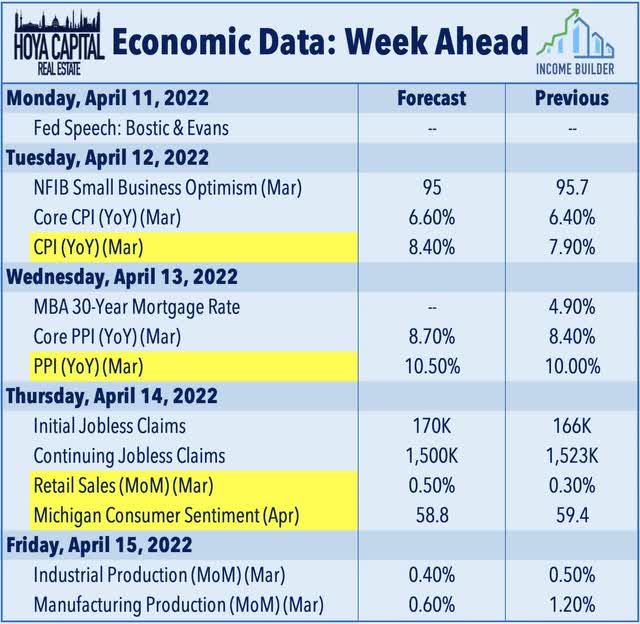

Economic Calendar In The Week Ahead

Inflation data highlights the busy slate of economic data in the week ahead. On Tuesday, the BLS will report the Consumer Price Index for March which is expected to show the highest rate of consumer inflation since 1982 at 8.4% while the Producer Price Index on Wednesday is expected to show a second-straight month of double-digit inflation rates on producers. We’ll see Michigan Consumer Sentiment on Thursday which is expected to show a continued free-fall in consumer confidence in April that some analysts expect could dip below the depths of the Great Financial Crisis when the index bottomed at 55.3 in November 2008. On Thursday, we’ll also see Retail Sales data for March, which investors will be watching for early signs of waning consumer spending. Equity markets will be closed on Friday in observation of the Easter holiday while bond markets will close early.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Prisons, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment