fatihhoca/E+ via Getty Images

Understanding the differences between energy sources including crude oil (CL1:COM) and delivery systems will or should play a critical role in any future energy investment decisions. For investors, it’s about enjoying the benefit of lucrative opportunities presented with future energy direction. Efficient societies require many characteristics with one being access to affordable energy. We seek to sort or add order to what seems a fuzzy world.

The First Sort

We begin our first sort by defining differences between sources and delivery. Energy sources by definition equal an existing entity “from which useful energy can be extracted or recovered either directly or by means of a conversion or transformation process.” Examples include fossil fuels (coal, natural gas, natural gas liquids crude oil and shale oil), nuclear fuels (uranium), radiation (sun), wind, wave and hydro-electric. A secondary category defines renewable types, or “energy from a source that is not depleted when used, such as wind or solar power.”

A system or delivery system makes up a means to transport energy. We include two, one, which is now the primary means, electricity, and the second one that is likely to become significant in coming years, hydrogen.

Sources

With a first sort completed, a description for the sources follows. We begin with nuclear sources followed by fossil fuels, shale oil, wind and end with solar.

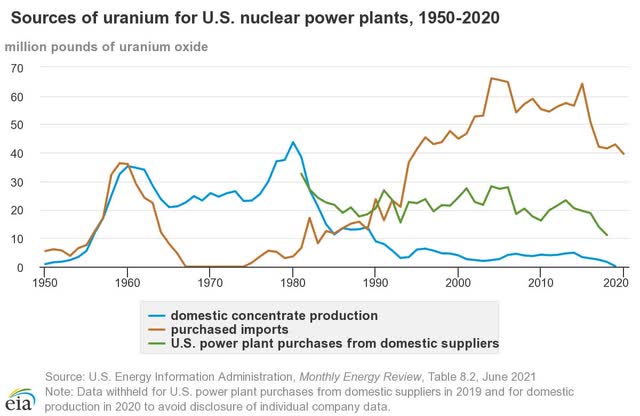

Nuclear power as a source generally begins with uranium, which generates electricity through the process of fission. Included below is a graph showing America’s sources of uranium.

//www.eia.gov/energyexplained/nuclear/where-our-uranium-comes-from.php

Although America imports most of its uranium, the country does have significant reserves. But the largest reserves lie in Kazakhstan with approximately 344 thousand metric tons, followed closely by Canada. The obvious advantage with nuclear for some is the zero carbon emission coupled with base loading supply abilities. The obvious objections arise from several dangerous, world dangerous, mishaps and with the continued problems to forever dispose of deadly fission by-products including plutonium.

The United States, for a short period, produced enough fossil fuel to become energy neutral, mainly through the implementation of fracking technology. With natural gas production being a natural companion, our natural gas opportunities for both internal and export uses are also enormous. The Bureau of Land Management reported, “The United States has the largest known deposits of oil shale in the world,…and holds an estimated 2.175 trillion barrels (345.8 km3) of potentially recoverable oil.” Note, since late in 2021, our nation isn’t energy neutral, but the resources for this form is enormous and makes energy neutrality possible when accompanied by government support.

Within fossil fuels resides coal. Five states produce most of our coal, North Dakota, Illinois, Wyoming, West Virginia and Pennsylvania. EIA estimates U.S. recoverable coal reserves at about 252 billion short tons,…” Again, at 500 million short tons mined a year, the opportunities and longevities are enormous.

Our reference here to shale oil isn’t the frackable oil located in many parts of the United States, rather it’s about hard rock shale primarily in the Rocky Mountains. The internet describes one region thusly, “The Powder River basin in Wyoming is a prospective shale-oil play. It has 5,000 feet of stacked pay – layers that contain oil and gas – which is an enormous thickness.” This source is enormous in size, but difficult to extract with existing technology.

Wind mills or turbines convert wind into electricity by transferring moving air across blades. Verdeenergy noted, “but wind turbines turn roughly 50% of captured wind into energy,” with several qualifications. Some disagree with the esthetics derived from these farms. Others complain about the number of wildlife killed. Obviously, when the winds die as did happen in the North Sea last year, electrical generation collapses to zero. Wind isn’t a base load source, rather might require storage.

Generating electricity using solar sources requires sun light and light sensitive materials called solar panels. Cells are assembled together creating the panel. The light sensitive cells are comprised of silicon dioxide, gallium or boron and glass. Most of the panels are made in Asia, primarily in China. A panel is approximately 20% efficient. During night or cloudy periods, solar production ceases.

Hydro-electric energy is produced by passing flowing water through a turbine generally at dam-sites. This type of energy is clean, but changes, sometimes drastically, the natural environment including its beauty (Glen Canyon Dam). The U.S. Department of Energy estimates there is nearly 50 GW of untapped hydropower potential. In America, 103000 MW of power generating capacity is installed. Immense baseline loading capability stills exist in American that again for those looking for carbon zero approaches, this fits perfectly.

Delivery Systems

Again, our focus comprises two primary delivery systems, hydrogen and electricity. We begin with a new, up and coming system, green hydrogen or hydrogen converted into ammonia.

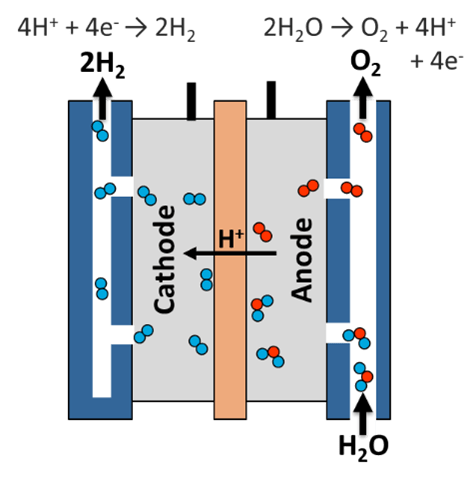

Hydrogen produced through electrical means generally uses electrolysis. Pictured next is a diagram of the process. The hydrogen produced contains about 80% of the electrical energy inputted. When considering that the efficiency of solar cells is 20%, the total efficiency is about 15% (20% times 0.80). For wind, the efficiency equals 40% (50% times 0.80).

//www.energy.gov/eere/fuelcells/hydrogen-production-electrolysis

The value from converting solar or wind energy (non-completely reliable sources) into hydrogen creates a storage issue. Hydrogen can be stored in underground cavities. Transporting hydrogen maybe and will likely be difficult with its smaller molecular size. Existing pipelines may or may not be suitable. This source can be used in powering vehicles not through in internal combustion, but through a hydrogen fuel with debatable efficiency.

In addition to storing energy into hydrogen, hydrogen can be converted into ammonia. Obviously, the efficiency drops when doing so. One source wrote, “assuming that ammonia is produced from completely renewable power, cracked into high-purity hydrogen, and used in a PEMFC to power a vehicle, the “net efficiency for worst and best case scenario … is between 11% and 19%.” A key advantage is that this could use existing pipelines without major modifications.

A foreign thought for some, electricity is nothing more than a delivery system. To store electrical energy generally means storage batteries, currently, an untenable problem.

Availability

When developing renewable energy sources, different resources are required. The change moves from natural resources based on fossil fuels to elements. Batteries require minerals or metals. ZeroHedge included a list of critical elements required for the production of batteries, “Specifically, the DPA will be authorized to support the production and processing of minerals and materials used for large capacity batteries–such as lithium, nickel, cobalt, graphite, and manganese—” A deep search fines that these essential elements aren’t domestically available for purchase.

The following table summarizes locations.

* Can be manufactured synthetically.

** Elon Musk is working on opening a new mine.

Continuing, renewable hydrogen manufacturing from solar power and water requires a catalyst. Again, platinum’s resources are located foreign, almost solely in South Africa. A note to our readers: We found conflicting information on sources while searching about critical elements. What was common is the simple fact that the sources exist in foreign places.

The necessary elements needed for producing large measures of renewable energy reside in foreign, sometimes hostel, nations. With the inclusion of significant levels, America will forfeit a significant level of control to its destiny.

Estimation & Transition

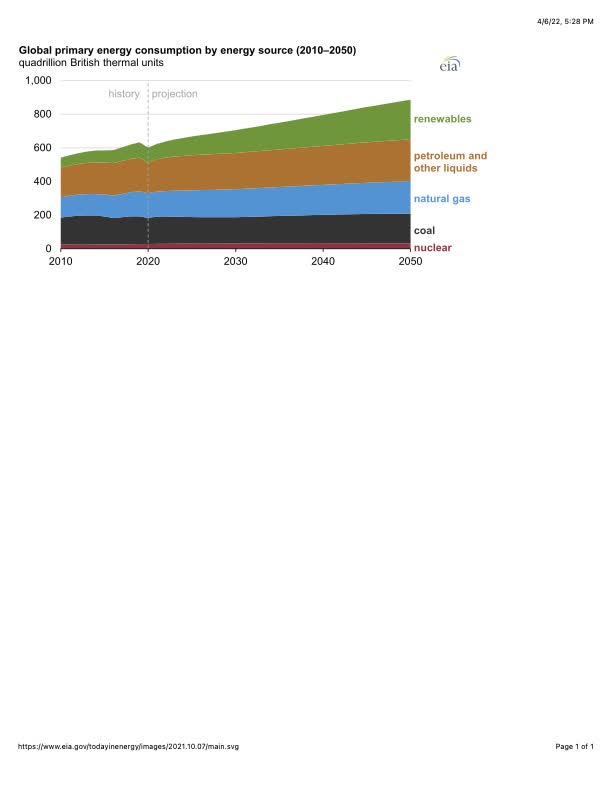

A chart included below generated by the EIA shows its estimate in total energy usage in America through 2050. Nuclear and coal remain neutral. Natural gas and other fossil fuels grow materially, but the big growth comes from renewables. A closer examination predicts that fossil type fuels will continue to provide 70-75% of the total needs.

Source: EIA

From the editors at Oilprice in an article entitled, Why We Cannot Just “Unplug” Our Current Energy System, the article contained the following quote from OPEC, “The role of oil and gas is guaranteed for the foreseeable future,” said Mohammad Sanusi Barkindo, Secretary General, OPEC. “It will continue to account for 50% of the global energy mix to 2045.””

The importance of continued fostering of existing sources of energy can’t be understated. We included in our heading the word, transition. A more accurate typing suggests addition, not transition.

Countries in Europe tried the concept of transition. Last year England found the North Sea almost windless. With its dependence on wind for electricity suffered, prices soared. Germany, having abandoned its nuclear network, found the price of natural gas, intolerable. Recent events in other parts left countries lurching. “French power prices spiked to 3,000 euros, a 13-year high, due to an increase in heating demand as grid operator RTE requested households and businesses to reduce energy-intensive devices.”

For Americans, other issues influence what kind of addition or transition might be optimal. While being extremely rich in traditional sources, basic minerals or metals needed otherwise are not found in North America with the exception of uranium to the north. What level of risk are we willing to accept as we watch current events and the results in Europe from dependence of foreign nations, even enemies. Investors in energy will need to add this concept into their own decisions.

Yet, one analyst from a very reputable business news program stated that the price of natural gas at its peak in Europe equated to $600 a barrel oil, a completely destructive and untenable result. Without a means to supplement existing resources, we are forced to ask, could our world solve this without supplemental means?

An Investment Thesis (Long-term)

With at least 70% of America’s energy coming via traditional sources, the role of renewable resources seems more like an additive growth strategy than a transition. It could buffer untenable spikes in traditional forms. It seems to us that buying renewable, for growth and traditional for income plus, represents the best of the best strategies for long-term investors. The addition of renewables will come with foreign intervention risks, even with possible enemies. The increased usage and value for natural gas might make it a place to be overweight.

We aren’t equipped to offer definite stock purchases, but we found Warren Buffett’s recent purchases telling. “To wit, the legendary investor has added new shares in red-hot E&P companies Occidental Petroleum Corp. (OXY) and Chevron Inc. (CVX) despite both currently trading at multi-year highs.” Other than our holdings in Calumet Specialty Products (CLMT) and its coming pure play exposure to renewable heavy distillates, we leave it up to our readers to find and discuss other alternatives.

Risks

In particular, investment in many renewables come with the risk from changing political whims shouted through megaphones in Washington. A change from one party to another will change the message from the megaphone. At this point, it is full-speed ahead on renewables, neglect traditional. That could and will likely change maybe as soon as coming months. With all the political posturing driving costs, we excluded any reference to cost analysis. But in more free-market environments, our own abundant resources will provide affordable energy especially if it is supplemented. Even with risks, the result of the sort seems rather definitive, renewable for growth and traditional for income.

Be the first to comment