Adrian Vidal/iStock via Getty Images

As many reading this article probably know, I love dividend investing and have allocated a portion of my portfolio to generating income from dividend-producing investments. I am a proponent of letting your capital work for you by generating monthly or quarterly dividends and then reinvesting them to grow your future stream of income.

My dividend portfolio consists of individual equities, REITs, Business Development Companies, Closed-End Funds, and Exchange Traded Funds. I had specifically invested in the Schwab U.S. Dividend Equity ETF (SCHD) and the Vanguard High Dividend Yield ETF (VYM) to capture a combination of above-average dividend yield complemented by capital appreciation. Recently I conducted a portfolio review and stumbled across the iShares Select Dividend ETF (NASDAQ:DVY), which I am not currently invested in.

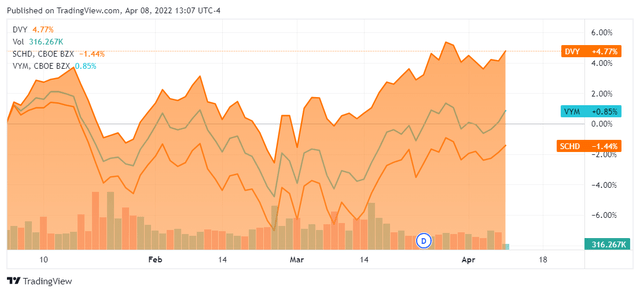

2021 and the beginning of 2022 haven’t been the easiest environments for stocks, as the markets have encountered supply chain constraints, rising rates, inflation, the war in Ukraine, and elevated geopolitical tensions, just to name a few obstacles. To my surprise, DVY has outperformed SCHD and VYM on a YTD and 1-year basis for capital appreciation while producing a slightly larger-yielding dividend. While SCHD and VYM have outperformed DVY over the previous 5-years, DVY has proven it can withstand uncertainty and volatility quite well. DVY has made my short-list for new future allocations to my dividend portfolio, as this is a dividend ETF I am warming up to.

The iShares Select Dividend ETF

DVY tracks the investment results of the Dow Jones U.S. Select Dividend Index, which measures the performance of the U.S leading stocks by dividend yield. The underlying index is composed of 100 of the highest dividend-yielding securities but excludes REITs. For a stock to be included in the index, it must meet the following requirements:

- have a dividend per share greater than or equal to its five-year average dividend per share

- five-year average dividend coverage ratio of greater than or equal to 167%

- have a three-month average daily trading volume of 200,000 shares

- have paid dividends in each of the previous five years

- non-negative trailing 12-month earnings per share

- float-adjusted market cap of at least $3 billion

DVY will invest at least 80% of its assets in the component securities of the Dow Jones U.S. Select Dividend Index while allowing up to 20% of the fund’s assets to be invested in certain futures, options and swap contracts, cash and cash equivalents, and securities not included in the Underlying Index.

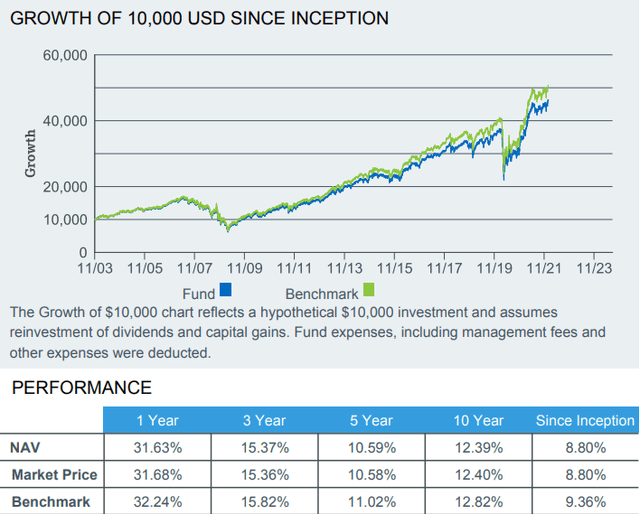

DVY currently has $22.12 billion in net assets invested across 99 positions. If you invest in DVY, you will be paying a 0.38% management fee for their services. Since its inception, DVY has slightly underperformed its respective index. DVY has generated an average 8.8% annual return compared to 9.36% from the benchmark. DVY can become a building block or complement an income-producing portfolio for any investor.

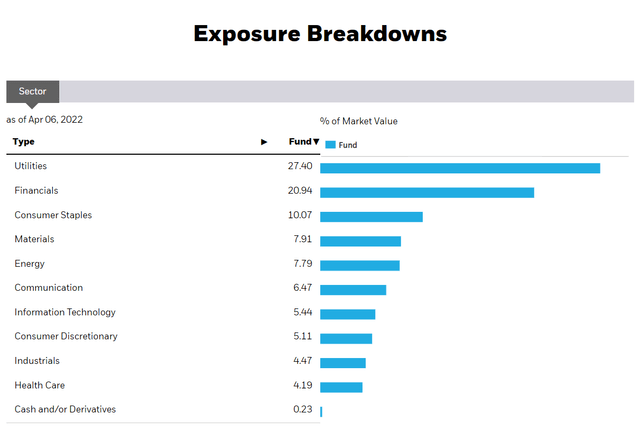

Unlike other dividend funds, utilities are DVY’s largest investment focus, with 27.4% of DVY’s net assets being allocated to this sector. DVY is structured more defensively, as financials, consumer staples, materials, and energy round out its top 5 sector allocations. These 5 sectors represent 74.11% of DVY’s allocations. This would make sense why DVY has done better during periods of volatility compared to SCHD and why SCHD has generated almost double the appreciation over the previous 5-years.

Looking through DVY’s top ten holdings, I have positions in Altria Group (MO), ONEOK, Inc. (OKE), AT&T (T), and Verizon Communications (VZ) individually. I like that the largest weighted position, which happens to be MO, is only 2.46% of the portfolio’s assets. I like this management style because the fund doesn’t become dependent on specific positions, and if a company goes into a downturn, the percentages of the fund being severely impacted are mitigated.

There is a good mix of consumer staples, energy, information technology, healthcare, communications, utilities, and materials in the top ten holdings. Outside of the top ten holdings, you will find industry heavyweights such as Exxon Mobil (XOM), Prudential (PRU), Merck & Co. (MRK), Chevron (CVX), and Walgreen Boots Alliance (WBA).

After reviewing DVY’s holdings, I wouldn’t expect this fund to skyrocket and generate massive amounts of appreciation in a bull market. DVY only has 5 positions in information technology, and quite honestly, I am not sure how Western Union (WU) can be considered a technology company. While I am a fan of Intel (INTC) and HP Inc. (HPQ), these don’t pack the same firepower as Microsoft (MSFT), Apple (AAPL), or one of the original FANG stocks. I think DVY will be a steady grower but should be more resilient during future volatility, as it has previously shown.

DVY’s dividends

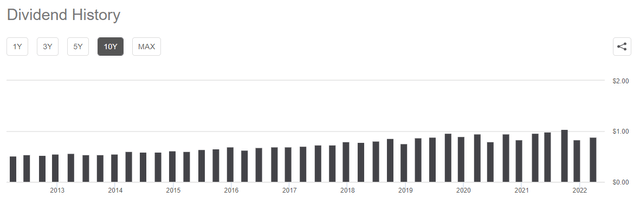

DVY currently pays a dividend of $3.75, with a forward yield of 2.93%. Over the previous decade, DVY has grown its dividend by $1.62 (76.06%) per share, growing from $2.13 to $3.75. DVY doesn’t have a typical dividend growth trajectory as some quarters witness dividend declines from the previous quarter, but overall, the dividend is growing.

The most important aspect is that DVY generates reliable dividend income, which should continue to grow as its holdings increase their dividends. DVY still has a larger yield than the 10-year Treasury Note, which is currently at 2.71%, and should generate some appreciation going forward.

One of the key aspects to keep in mind is that DVY has a mandate to invest in companies that have had positive growth over the previous five years. DVY’s dividend grows in the high-single digits with a track record that spans over a decade. The quarterly declines don’t concern me as a dividend investor since it evens out at the end of the year, and investors recognize YOY dividend growth. Overall I am seeing all of the trends I look for as the combination of continuous dividend growth with a long track record has been maintained through the years.

My final thoughts on DVY and on making an investment in it

DVY may not offer the largest amount of yield, but its performance through the past year and a half can’t be discounted. There are certainly other types of funds offering high yields, but they are not structured similarly to DVY. I am looking at DVY as a purely defensive play, as the allocation to sectors such as information technology is limited. If you’re looking for capital appreciation, it doesn’t matter if it’s DVY, SCHD, or VYM; investing in a simple S&P index fund will certainly generate larger capital appreciation over a multi-year time period.

I would be looking at adding DVY from a pure stability and income perspective and based on its prior performance and structure. I am confident that DVY would be able to offer me an above-average dividend yield with a growing dividend and some capital appreciation going forward. I am putting DVY on my short-list for future investments into dividend equity funds.

Be the first to comment