Chinnapong/iStock via Getty Images

Co-produced with Beyond Saving

Sometimes, my wife accuses me of working too hard. I guess that comes with the territory when you have the pleasure of doing what you truly love day in and day out. Even during my “off-hours”, my mind just doesn’t stop churning over HDO (High Dividend Opportunities). Sometimes I will hear a phrase, and it inspires me. And that is what happened with this week’s article.

I was watching “Billions” on Showtime the other day, and there was an exchange that perfectly sums up the Income Method. The billionaire, Michael Prince, had bought up a bunch of real estate, which failed to have the value he had expected. His nemesis, Chuck Rhoades, walks into the office and offers to buy all the real estate for “fair market value” (a significant loss for Prince) using the city’s landbank. They had the following exchange:

When I was bootstrapping my first start-up in the Bay area, I was motivated to go down to Geraldine’s Seafood Market early so I could buy the freshest catch before anyone else. Now I just buy the fishing boats.

But cutting out the middleman, that makes you the middleman, no?

No, Chuck, it makes me rich. With no need to unload anything, at any time, for anyone’s reasons. Other than my own.

The fictional Prince is extraordinarily wealthy, with an apparently endless supply of money. He has the luxury of throwing around millions like we might pennies. Most of us don’t have that luxury. Even real billionaires don’t have the luxury of Hollywood writers just creating billions more out of thin air. However, even without billions, or even millions, we can still manage our finances so that we never have to sell anything for anyone’s reasons but our own.

This is the ultimate goal of The Income Method. You can construct a portfolio in a way so that you are never a forced seller. You can sell only for your reasons and when it is beneficial for you.

Buy The Boats

The modern stock market is, in my opinion, one of the most amazing innovations of all time. Sure, the internet is pretty cool. I greatly prefer driving a car to riding a horse. I’m very happy that whether I eat dinner tonight is not dependent upon my hunting skills. Today’s middle-class life is infinitely more comfortable than even the wealthiest people experienced for thousands of years. Yet the stock market has changed the world in a way that I’d argue is more meaningful than any other innovation.

Throughout human history, there have been two types of people-those who owned the means of production and those who didn’t. The social structure varied wildly over the centuries and from culture to culture, but ultimately some were part of the “in” crowd that owned and profited from production, and others were not.

Today, I can buy a portion of ownership in literally thousands of companies from my cell phone. With as little as $1 (in some cases even less), I can buy a fractional share in my chosen company and become part owner. Think about it. For thousands of years, only people who were born into the right family or made the right friends, or won a war could gain access to the benefits of ownership. When I buy a stock, nobody asks who I am, who my father was, who my friends are, or anything else. All that matters is the offer I make to buy the shares and whether someone is willing to sell at that price.

Even a few years ago, the barriers to investing were much higher. There were minimums to set up a brokerage account, which was a lot of money for some people. Trading fees meant that small investments were at an economic disadvantage. I remember I used to let my dividends build up to a couple of thousand dollars to make a meaningful purchase and limit the impact of the fee. Now I’ll invest that extra $10 floating around my account just because I can.

There are no excuses anymore. There are no barriers. Anyone has access to the stock market, and anyone can “buy the boats” and get a portion of the benefits of ownership. And when you buy common stock, that is what you are doing. You are buying partial ownership in the underlying company.

Build Your Income

At HDO, we like to focus on buying businesses that pay dividends. Some people prefer to buy stock with the hope that they can sell it at a higher price in the future.

Why do we focus on dividend-paying companies? When investing with the plan to sell, you are making three bets:

- That the company will do well.

- That other investors will recognize the company is doing well.

- Other investors will be willing to pay more for it.

Number 1 is a reality that you can’t get away from, whatever your investment style. While you might be able to make money on a very poor company with a quick trade, investing in companies that perform poorly is a very high risk. You don’t want to buy just any boat. You want to buy the fishing boats that will come back to port with valuable fish. The most important part of making any investment is determining whether or not the company is a good one that will produce good results.

The problem is that other investors don’t always recognize that a company is doing well. A company might be hitting all its targets, producing significant cash flow, and the market still won’t give it a valuation as high as you might think it should. When you are buying, that is a good thing. It means you can buy cheaper if you see a value in the company that others don’t.

When you want to sell, you want other investors to see the value and pay you more! What if other investors aren’t willing to pay you more, even as the company meets your expectations regarding performance? Many investors are holding shares in companies that are performing very well but are chronically frustrated because the share price isn’t going up.

This is why I like to focus on the dividend. The dividend is an objective reflection of the performance of the company. I don’t have to rely on other people to recognize the company’s value. I don’t have to rely on other people being willing to pay me more.

The only thing I have to do is predict which companies will do well and which won’t. If the company does well, the dividend will keep coming or even be raised. If the company doesn’t do well, the dividend might be cut.

The fate of my investment is not dependent upon someone else having money and wanting to buy from me. It is solely dependent upon the results of the company I own. My analysis is either right or wrong, but ultimately it is mine. When I make a mistake and lose money, I can learn from it. When I make a wise choice and have large gains, I can learn from that too.

I can hold indefinitely as long as the company is still performing and still producing dividends for me. The market’s fickle opinion of value doesn’t matter. My returns are coming with each dividend paid. Focus on filling your portfolio with companies that will pay you dividends for years or even decades if needed. Don’t rely on other people to be willing to pay more in the future.

Diversify Your Income

The unexpected will happen. Owning a business is always a risk. Even the best fishing boat might come back to port without a good catch, or worse, it might not make it back to port. Investing is no different. A company that looked great with fantastic potential might suddenly smell like rotten fish in a way you failed to predict. Or maybe a storm came out of left-field that destroyed the favorable prospects.

The solution? Buy a fleet of boats.

The HDO Model Portfolio has 45 common equity picks plus over 50 preferred stocks and baby bonds. These picks span a wide array of companies in a variety of sectors.

This diversification ensures that our income is not reliant on any single dynamic. If the Fed raises rates, we have picks that benefit. If the Fed cuts rates, we have picks that benefit. Inflation, deflation, booming economy, crashing economy, credit crunch, credit boom – we want to ensure that income keeps coming in whatever happens.

Build A Safety Net Into Your Plan

One of the best things about investing for income is that it provides a clear path for you to follow. Most investors are looking to replace their income when they retire. The day they retire, they don’t need $1 million or $2 million or any other lump sum. They need recurring income.

Well, how much do you need to retire? Are you retiring the month before or the month after a market crash? Because it makes a huge difference. When determining how much you need, you are left with a lot of speculation about how much income you will be able to extract from your portfolio safely.

There is no doubt when your portfolio is focused on generating dividend income. You know how much your portfolio produced in income this year; take out a number less than that. When you were employed and earned a wage, you knew what your paycheck was and spent less than that. Nothing changes when you retire, except your paycheck comes from various different sources.

You can set your income goal and easily track it.

Now we all know that the world isn’t all rainbows and butterflies. Neither is the stock market. Dividends can be cut, sometimes unexpectedly. This is the harsh reality of investing. You will not always be right. If someone tells you they are always right, run away.

I find it somewhat humorous that many investors will use the fear of dividend cuts as a reason to invest in companies that don’t pay any dividend at all. Where does that make sense? A company that isn’t doing well might cut the dividend, and the price will fall. Yet, a company that isn’t doing well that doesn’t pay a dividend might have an earnings report that disappoints the market, and the price will fall.

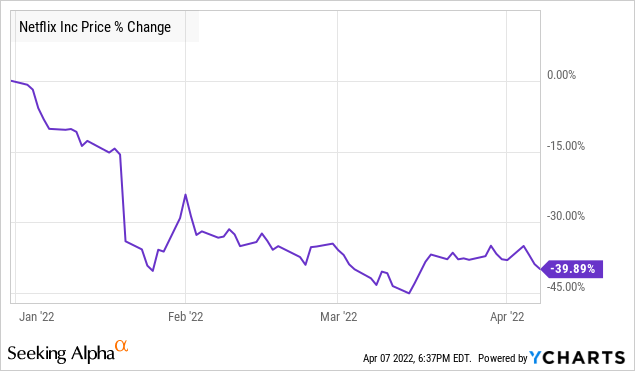

The irony is that NFLX is still a very good company with rising earnings. If NFLX paid a dividend, I can almost guarantee it wouldn’t have been cut. If NFLX paid a dividend, buyers like me would probably be lining up to buy the higher yield.

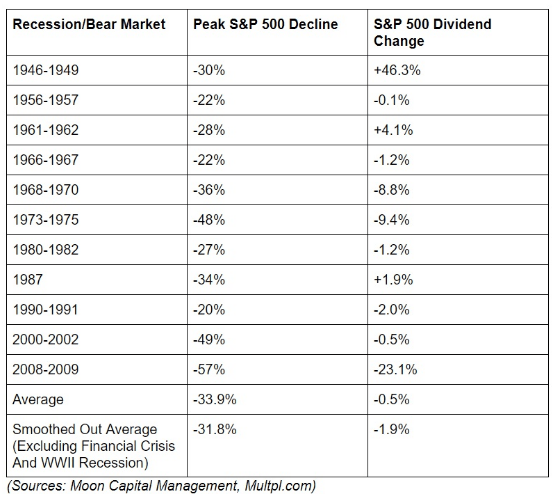

The reality is that dividends are far less volatile than share prices. They are often going up even as share prices go down.

Moon Capital Management

History tells us that we should have a safety cushion. After all, you might love to go gambling during your retirement, but you don’t want your retirement to be a gamble!

As a general rule of thumb, I’d suggest planning on having at least 25% more income than you think you need. If you need $50,000 in income for your retirement, set your income goal at $66,000. In the past 75 years, a nearly 25% cut in average dividends for the S&P 500 only occurred once.

It is just like you manage your budget when you are working. Live on less than you earned, reinvest the excess for the future. Reinvesting the excess will allow you to continue growing your income, protect your personal budget in another Great Financial Crisis, allow your personal budget to keep pace with inflation, and grow your safety net even further.

Shutterstock

You Will Never Be Forced To Sell

With an income portfolio producing enough to meet your income needs and a safety cushion that you are reinvesting every year, you will never be a forced seller. You are not reliant on selling stocks. Instead, you are only taking out dividends and having excess reinvested to grow your income more. Your portfolio will become a perpetual income machine!

Allow the power of compounding to grow your income faster, and you will achieve the peace of mind that comes with being able to say that you will never be forced to sell anything. You will only sell your ownership position in a company when it suits your purposes and achieves your goals. If the market isn’t offering you an attractive price today, you can sit back, collect your dividends and reinvest the excess, so your ownership increases every year.

Don’t let the market and the whims of others control your retirement. You can control your future, without relying on the market.

Be the first to comment