Joey Ingelhart/E+ via Getty Images

Antero Resources Corporation (NYSE:AR) is one of the largest producers of natural gas in the United States, which positions it quite well given the ongoing energy crisis in Europe. This is because the European Union has been desperately trying to reduce its dependence on Russian supplies given the ongoing crisis in Ukraine. The fact that Antero Resources is the largest supplier of natural gas to the export market further adds to the company’s appeal in this area. Antero Resources achieves this position because of its commanding position in the natural gas-rich Appalachian region, which offers some of the highest quality acreages in the world for the production of natural gas. Finally, as is the case with many other American energy companies, Antero Resources has recently changed its business model to focus on maximizing free cash flow, which should improve its ability to reward shareholders. Overall, there may be a lot to like here.

About Antero Resources

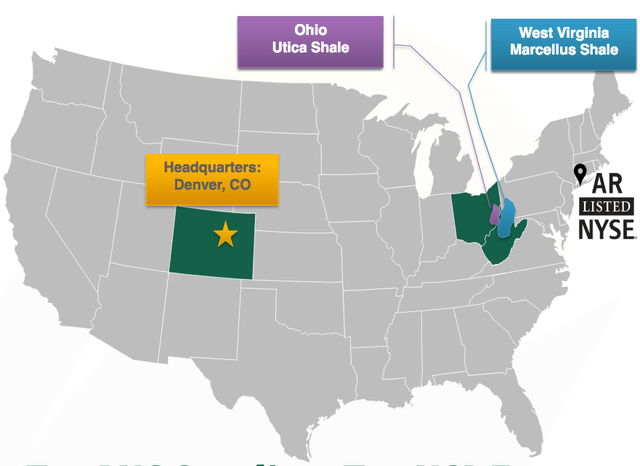

As stated in the introduction, Antero Resources is one of the largest producers of natural gas and natural gas liquids in the United States. It is also one of the only pureplay operators in the Marcellus and Utica basins of Ohio and West Virginia:

Antero Resources Investor Presentation

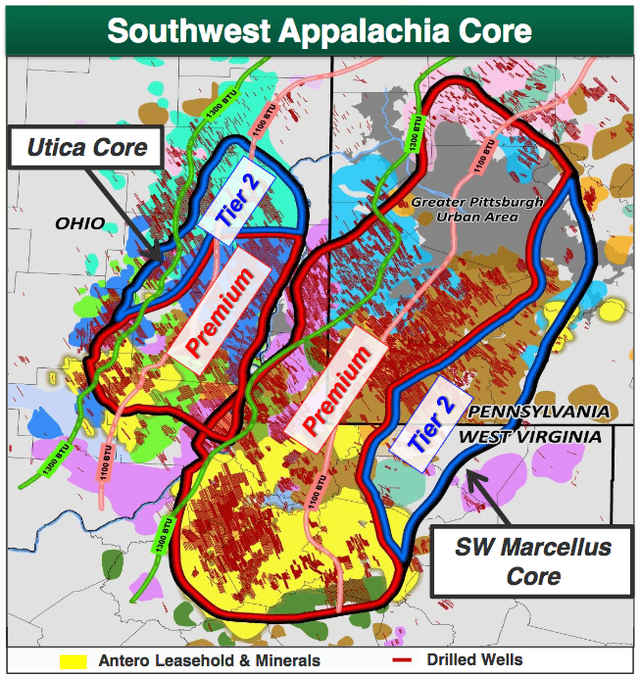

This is a very attractive position for the company to operate in due to the mineral wealth of the area. According to the United States Energy Information Administration, the Marcellus natural gas trend contains 148.7 trillion cubic feet of economically recoverable natural gas based on 2015 prices. As prices today are quite a bit higher, it seems likely that this estimate would be higher were this study conducted today. Although the Marcellus shale encompasses much of New York, Pennsylvania, and Ohio, the richest and most attractive area for natural gas production is the area that is right around Pittsburgh, Pennsylvania. This is fortunately where much of Antero Resources’ acreage is located:

Antero Resources Investor Presentation

This all provides Antero Resources with a substantial quantity of reserves. An energy company’s reserves are often overlooked by investors but they are critically important. This is because the oil and gas industry is by its nature an extractive one. A company like Antero Resources literally obtains the products that it sells by pulling them out of reservoirs in the ground. As these reservoirs only contain a finite quantity of resources, the company’s reserves dictate how long it will be able to continue to produce without discovering or otherwise acquiring new resources. In Antero Resources’ case, the company will be able to continue to produce at its current level for about twenty years. This is one of the largest reserve lives of any independent energy firm and is in fact longer than many of the majors possess. This provides a number of advantages to Antero Resources. One of the most important of these is that the company can be patient. The price of leasing land in the Marcellus is constantly changing so the fact that Antero Resources has sufficient reserves allows it to time its leasing activities for a time when land is cheap. This saves the company money and allows it to use its capital in a way that provides greater benefits to shareholders. Its peers that may not have similarly substantial reserves do not have this advantage and may thus be forced to overpay for their leases.

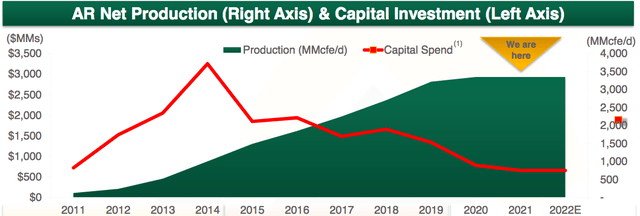

Another advantage that Antero Resources’ large reserve base grants it is the ability to grow its production. Antero Resources was quite aggressive about doing this until 2020:

Antero Resources Investor Presentation

Many readers may not that the company’s production has leveled off. This may be concerning since production growth is one of the few ways that an energy company can grow its top line. After all, Antero Resources has no ability to control the prices that it sells its natural gas and natural gas liquids at. However, note also that the company’s capital expenditures have been declining ever since it stopped attempting to grow its production. This has allowed the company to improve its free cash flow. In 2021, Antero Resources achieved a levered free cash flow of $835.5 million, which is the first time in its history that it had a positive free cash flow:

| 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | |

| Levered Free Cash Flow | 835.5 | (130.7) | (136.8) | (657.4) | (1,306.2) | (1,283.2) | (820.3) | (3,158.3) |

(all figures in millions of U.S. dollars)

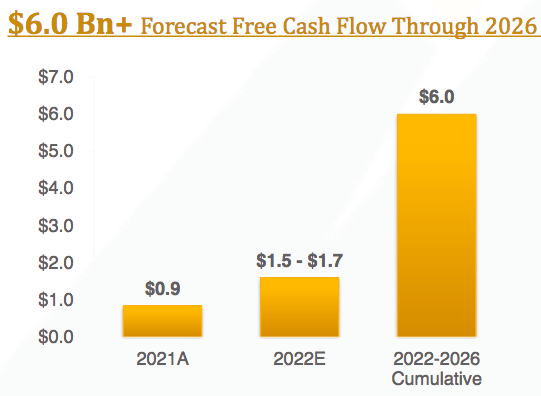

As free cash flow is the money left over after the company pays all of its bills and funds all capital expenses, it is the money that Antero Resources can use to reward its stockholders. As we can clearly see, the company had minimal ability to do that in the past but it appears to have solved that problem going forward. Antero Resources should be able to reward its stockholders fairly generously too as the company expects to produce $6 billion in cumulative free cash flow over the 2021 to 2026 period:

Antero Resources Investor Presentation

The first thing that Antero Resources has been using its newfound free cash flow to accomplish is debt reduction. In fact, the company has reduced its debt by $1.6 billion since the end of 2019. This addresses one of the largest concerns that I have had with the company in the past. As some long-time readers may recall, in numerous articles that I published on the company over the 2018 and 2019 period, I was consistently concerned about Antero Resources’ debt load, particularly when compared to some of its peers. However, at year-end 2021, Antero Resources had a leverage ratio (defined as net debt to EBITDA) of 1.3x, which represents a very marked improvement from the 3.5x that it had at year-end 2014. Antero Resources expects to get this down to under 1.0x in 2022. In other words, the company could conceivably eliminate its debt in under a year if it were to devote all of its pre-tax cash flow to that task. Debt can be riskier for energy companies than for companies in some other companies in other industries because of the volatility of commodity prices so it is nice to see that the company is taking steps to address it. Once the company manages to strengthen its balance sheet sufficiently, it is also quite probable that it will use its free cash flow to further reward shareholders such as through a share buyback or dividend so that is something further to look forward to.

In the introduction, I stated that Antero Resources could be very positioned to prosper from the European energy crisis. As many of those reading this are well aware, tensions have been fairly high between Russia and the European Union for many years, which have only gotten much worse since the Russian invasion of Ukraine. This poses something of a problem because the European Union imports 155 billion cubic meters of natural gas from Russia annually or about 45% of the bloc’s total natural gas supply. As such, the European Union is looking to replace its Russian imports with those from a more friendly nation. An obvious candidate for this replacement supply of natural gas is the United States, which is one of the few nations with the natural gas reserves sufficient to supplant a noticeable proportion of Russia’s supply. In order to accomplish this though, the natural gas must be converted into a liquid. This is because as a gas, it will expand to fill any container that it is put into (such as a ship) so it needs to be a liquid in order to be transported over the ocean. Antero Resources is already the largest exporter of liquefied natural gas in the United States as it has 11 billion cubic feet of liquefied natural gas export capacity under contract and currently operating. This will increase soon though as the company has another 15 billion cubic feet of liquefied natural gas capacity contracted that is currently under construction. Thus, Antero Resources will soon be able to more than double the amount of natural gas that it exports to supply markets such as Europe. This positions it quite well to grow its presence in this quickly emerging new market.

Fundamentals Of Natural Gas

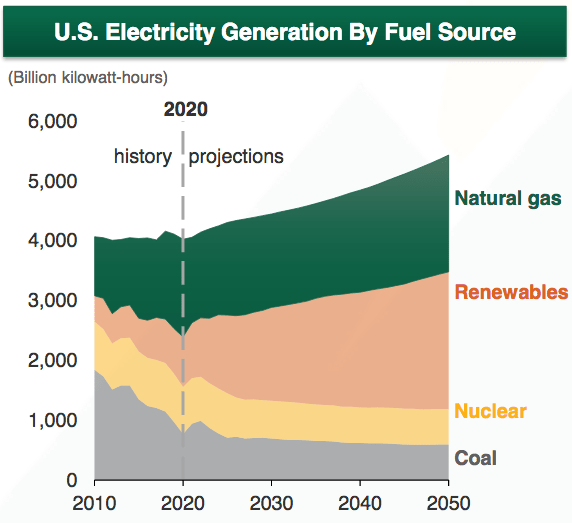

Antero Resources is exclusively a producer of natural gas and natural gas liquids, unlike many other independent operators. Fortunately for it, the fundamentals for these compounds are quite strong. One of the reasons for this comes from the electric generation industry. In response to concerns and demands from regulators and climate activists, utilities across the United States have been shutting down and retiring many of their coal-fired power plants since coal is more heavily polluting than any other source of energy. The utilities have largely been opting for natural gas and renewables to replace this lost capacity. Back in 2018, natural gas produced about 21% of the electricity consumed in the United States but that figure today is about 40%. We can expect this trend to continue going forward. Nationwide, utilities have announced that they will be retiring 29 gigawatts of coal-generation capacity over the 2022 to 2026 period. Although many utilities have been emphasizing that they will be using renewables to replace this lost capacity, it is more likely to be some combination of natural gas and renewables. This is because renewables alone are not reliable enough to support a modern electric grid on their own. Natural gas, however, does enjoy this reliability and burns cleaner than any other fossil fuel. The Energy Information Administration appears to agree with this assessment, expecting that the proportion of natural gas in the American electric generation mix will grow going forward (although not as much as renewables):

Antero Resources Investor Presentation/Data from EIA 2021 Annual Energy Outlook

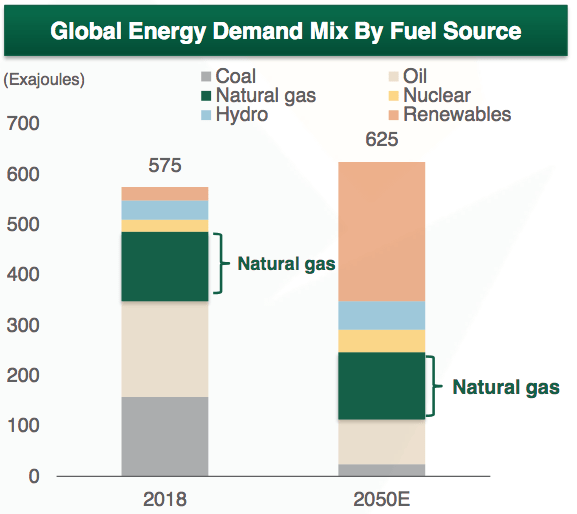

The same trend is expected to occur globally, as renewables and natural gas supplant coal over the next thirty years:

Antero Resources Investor Presentation/Data from BP 2020 Energy Outlook

As already mentioned, the United States is one of the few regions of the world with sufficient reserves to increase its production of natural gas to satisfy this growing global demand. This is one reason why the liquefied natural gas market is expected to grow. Currently, the world produces about 400 million tons of liquefied natural gas annually. As I discussed in a recent article, the European Union would require about 115 million tons to replace all of its current Russian imports while Asia is expected to increase its imports of liquefied natural gas by about 40% by 2030 in order to reduce its pollution problems. As Antero Resources will be able to more than double its export capacity in the near future, it is easy to see how it could take advantage of this growing market. This is particularly true if liquefied natural gas offers more attractive pricing than natural gas consumed domestically. This is because it would allow Antero Resources to achieve higher margins than its peers and thus have a higher free cash flow yield with which to reward investors.

Valuation

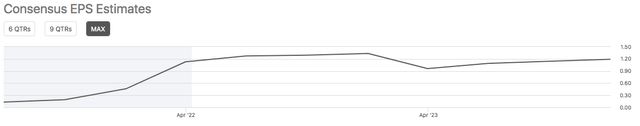

There are some signs that the market may not be appreciating the company’s potential for growth. We can see this by looking at the stock’s forward price-to-earnings ratio, which is 7.97 as of the time of writing. This seems to be incredibly low in today’s market, in which double-digit ratios are much more common. Curiously, this comes in spite of the fact that analysts do expect that the company will be able to grow its earnings per share over the next few quarters:

In fact, the current analyst consensus is for 82.02% year-over-year earnings per share growth in the first quarter of 2022. Although its earnings are expected to decline slightly in 2023 compared to 2022, they are still expected to be well above the comparable 2021 levels:

It is rather surprising that analysts are expecting Antero Resources’ earnings per share to decline in 2023 compared to 2022 levels. The fundamentals for natural gas point toward higher prices, not lower ones. We have already seen this as both Europe and Asia are expected to increase their imports in the form of liquefied natural gas but companies like Antero Resources are not planning to increase their production. This points toward higher prices, not lower ones. As the profits of Antero Resources should increase with steady production and higher prices, it is difficult to believe that its earnings will decline in 2023 compared to 2022 levels (although still higher today). With that said though, currently, only one analyst has made any predictions about 2023 so it is quite possible that as more analysts extend their predictions to include 2023 we will see the consensus rise.

Antero Resources also appears to be somewhat cheap relative to its peers:

| Company | Forward P/E Ratio |

| Antero Resources | 7.97 |

| Range Resources (RRC) | 8.25 |

| EQT Corporation (EQT) | 16.01 |

| Chesapeake Energy (CHK) | 9.03 |

| CNX Resources (CNX) | 9.74 |

This all points to Antero Resources presenting a reasonably attractive value to investors today. It could be worth taking a chance on.

Conclusion

In conclusion, Antero Resources appears to be one of the best positioned natural gas producers in the United States to take advantage of the European energy crisis. The company boasts some of the most attractive acreages in the Marcellus shale that has allowed it to grow its free cash flow even as it holds production steady. The more important thing though is its substantial presence in the American natural gas export industry, a presence that is going to double in the size in the near future. The fact that the stock appears to have a reasonably attractive valuation right now is simply icing on the cake.

Be the first to comment