Alex_533/iStock via Getty Images

Introductions

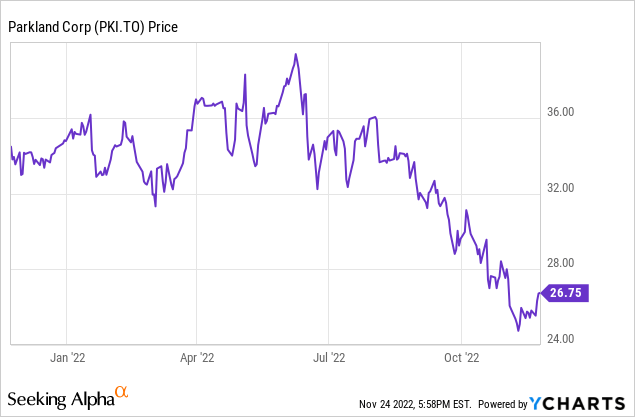

I was bullish on Parkland Corporation (OTCPK:PKIUF) (TSX:PKI:CA) as recently as June when the share price was trading approximately a third higher than the current level. The second quarter performance was good, but the share price started sliding when the company issued a profit warning for the third quarter, just a few weeks before the Q3 earnings were due. This rattled the market, but I’m a little bit surprised as despite the weaker third quarter, the company remains on track to exceed my C$1.5B EBITDA expectation for this year. I’d recommend you to read my previous articles on Parkland to get a better understanding of what the company does.

So why did the share price collapse?

Parkland reported in October its third quarter results would likely come in lower than expected. The company disclosed it expected a Q3 EBITDA of C$325M (the adjusted EBITDA came in at C$328M) due to a combination of several elements. First of all, the margins and bottom line were hit by a lower refining crack spread while the decreasing gas prices at the pump also negatively impacted the margins.

But perhaps it was the impairment charge on the inventory and derivatives losses to the tune of C$65M. Parkland was a little bit caught off-guard by how fast the prices were decreasing faster than anticipated. This means there was an anticipated loss on the value of the end-product which was already produced but hadn’t been sold to the final buyer yet.

That’s in a nutshell what caused the share price to start a spiral and even now, more than five weeks later, the share price still hasn’t recovered.

Meanwhile, Parkland is on track to exceed my expectations

Although it’s never nice to see a profit warning, it feels like the market was overreacting. First of all, Parkland confirmed the C$65M loss on inventory was a non-recurring event. Secondly, Parkland confirmed it was confident in its Q4 outlook and reported it continues to expect to report a full-year adjusted EBITDA of C$1.6-1.7B.

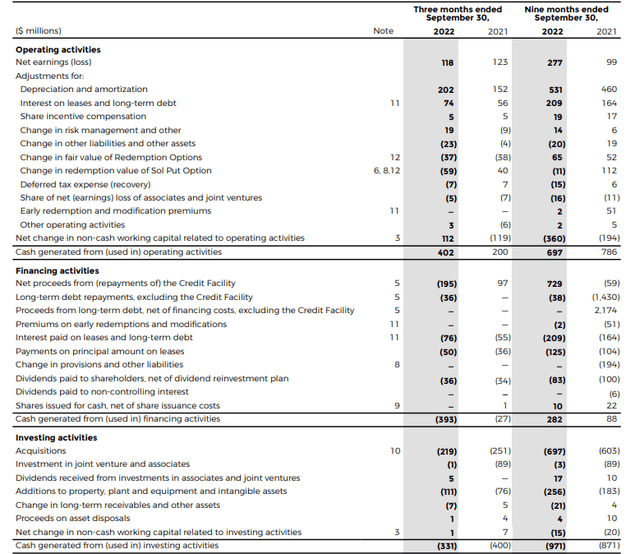

And that full-year guidance is exceptionally important to understand why I think the current share price decrease could be an opportunity. The total adjusted EBITDA in the first nine months of this year was C$1.125B. Not only is that a 12.5% increase compared to the first nine months of last year (thanks to the contribution from newly acquired assets as well), it also implies that in order to meet the low-end of the official guidance, the Q4 EBITDA should come in at C$475M which is almost 50% higher than the Q3 EBITDA. And even the low end of that guidance comfortably exceeds the C$1.5B in EBITDA I was expecting in my June article.

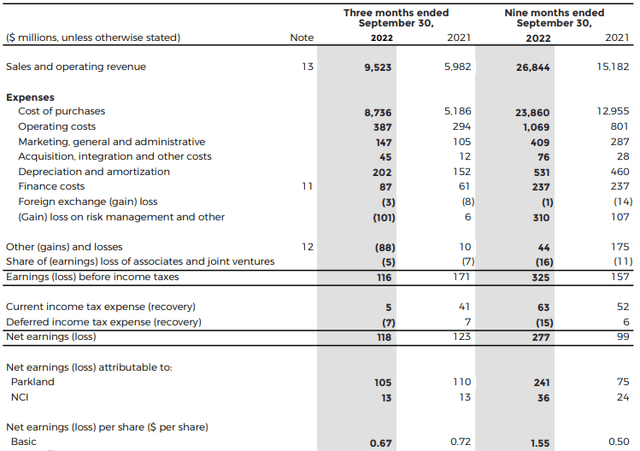

But let’s have a look at how ‘bad’ the third quarter actually was. Despite the weaker than expected EBITDA result, Parkland was still profitable. As you can see below, the company reported a net income of C$118M although this was mainly thanks to a C$88M non-recurring gain and a small tax benefit. So excluding those elements, Parkland likely would have just been able to break even.

That being said, my previous investment thesis is based on the cash flow performance of Parkland, so I think it only makes sense to compare apples to apples. The cash flow statement shows a C$402M operating cash flow but this includes a C$112M working capital contribution and excludes the C$126M in lease and interest payments. This means that on an adjusted basis, the operating cash flow was C$169M (after also including a C$5M dividend income).

The total capex was C$111M which means the free cash flow result was C$58M. That would be approximately C$0.37 per share based on the current share count of 156.2 million shares.

Keep in mind the total capex bill obviously also includes the growth investments and according to the Management Discussion & Analysis, the total sustaining capex was just C$62M. This means that the sustaining free cash flow was C$107M which translates into C$0.68 per share. And that’s a key element why I think Parkland’s beating on the market is undeserved. Even in a rather weak quarter, the company is still generating a very nice amount of free cash flow. The total sustaining free cash flow (adjusted for changes in the working capital position) came in at C$569M or C$3.64 per share. And considering the Q4 performance should be substantially better, I wouldn’t be surprised to see a full-year free cash flow result of close to C$5/share.

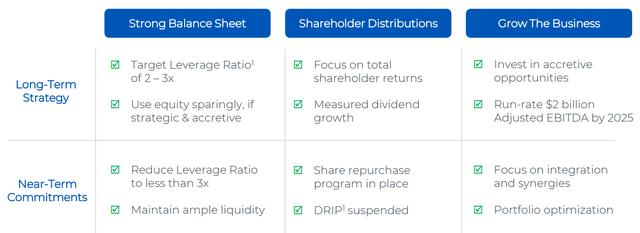

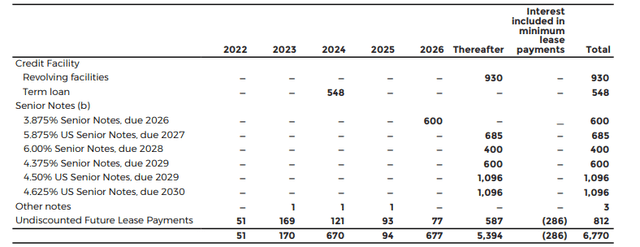

That should help to reduce the net debt (which stood at C$6.4B as of the end of September). Fortunately the majority of the debt consists of fixed rate debt so Parkland has some time to build up its cash position ahead of refinancing the senior notes as the first maturity date is only in 2026. The credit facility expires in 2027 while the C$548M term loan expires in 2024.

Investment thesis

Despite the profit warning and subsequent relatively weak performance in the third quarter, I’m still bullish on Parkland. I think the market has been focusing too much on non-recurring elements and the reported net income. The depreciation and amortization expenses are pretty high while the sustaining capex is substantially lower. In Q3 and 9M 2022 respectively, the D&A expenses came in at C$202M and C$531M while the combination of sustaining capex and lease expenses came in at C$112M and C$260M in the same period. This means the reported net income is not a fair representation of the underlying free cash flow as there was a massive difference of C$271M in the first nine months of this year.

This means I’m still bullish on Parkland. The fourth quarter result should be better and that should confirm the company’s status as cash cow. The high net debt level should be attended to and Parkland will likely have to refrain from more M&A activities in the next few years.

That being said, assuming an adjusted EBITDA of C$1.45B (excluding the lease amortization) and a current enterprise value of approximately C$10.5B, the EV/EBITDA ratio is just over 7. Keep in mind Parkland still aims to reach C$2B EBITDA by 2025 but this may not be achievable if non-organic growth ambitions have to be scaled back due to the current debt levels. But given the strong underlying free cash flow, I’m not too worried about Parkland as the only debt due before the end of 2025 is the C$548M term loan and that shouldn’t be an issue at all.

I have started to slowly build a long position in Parkland Corporation. I’m in no rush.

Be the first to comment