grapestock/iStock via Getty Images

Dear NORDSTERN CAPITAL Partners and Friends:

We are in an era of increased uncertainty with a wide range of possible but very different outcomes for the economy. Trends in globalization, geopolitics, climate, etc. are changing. In this context, central banking is but a mere subset, but could on its own lead markets in vastly different directions.

The FED is communicating that interest rates will stay higher for longer. The bond market, arguably the most important financial market in the world, in a rare occurrence is betting against FED speak and keeps long-term rates at lower prices. What is going to happen? Will the FED cave? Or is the market wrong?

The Japanese central bank is at the cusp of giving up decades of yield curve control. The market certainly seems to believe so. If rates were to increase, the extraordinarily high sovereign debt could force Japan to deleverage. Such a sea change could turn the biggest buyer of US Treasuries into a structural seller.

If outcomes can be so different and are based on so many unknowns, then the best course of action is to increase resilience. Some of Nordstern Capital’s top holdings experienced sizable price declines last year. We believe this is temporary and our portfolio retains mostly the same positions. However, throughout last year we reduced capital concentration and increased emphasis on price versus near-term cash flows.

We believe that 2023 will be a rewarding year for our portfolio holdings. Our companies are expected to generate ample cash. Some of our companies have invested significant amounts in the past. We expect to harvest the fruits this year and in the years to come.

A resilient portfolio of underappreciated assets, which individually can generate double digit free cash flow yields, should do well in any scenario. Strong cash generation offers optionality. We like businesses that can help themselves. Today, many such businesses can be found in natural resources, and we have increased our exposure to these sectors.

Views

“Investors cannot have no view on macroeconomics. You either have an explicit view, or you have an implicit view.”

Humans are fraught with cognitive biases. For instance, our species does not deal well with uncertainty and uncomfortable facts. Ignorance is bliss, but the laws of physics hold regardless.

Humanity will continue moving towards the direction of switching energy usage from fossils towards renewables. However, to build wind, solar and other green infrastructure requires materials.

Many of today’s capital allocators do not like the mining industry. Over the last decade, the world has massively underinvested in future mining supply. So where is it going to come from? According to the International Energy Agency (IEA) “it has taken 16.5 years on average to move mining projects from discovery to first production”[1].

In its roadmap to net zero, the IEA states “the energy transition requires substantial quantities of critical minerals […] total market size of critical minerals like copper, cobalt, manganese and various rare earth metals grows almost sevenfold between 2020 and 2030”[2]. Commodity demand increases of this magnitude would top even the Chinese boom during the 2000s.

If we assume that today China makes up for 50% of the current world commodity demand, the IEA pathway for the energy transition would add the demand equivalent of 14 more Chinas over 10 years.

In NORDSTERN CAPITAL’s view, it is stating the obvious that over the next decade:

- The world will not be able to reach anywhere close to net zero carbon

- Commodity demand will massively increase

- Commodity supply will remain tight

- Commodity prices will increase

- The world will still depend mostly on fossil energy

China

“Once China lifts its zero covid policy, China’s trade with the rest of the world is going to bounce back significantly.”

“President Xi realizes that the next ten years of China’s history will go down as among the most decisive ten years of China’s history ever. Because he knows that in the next ten years the United States will do its best to slow down China, and he is going to make sure that the slow down doesn’t succeed and that China keeps growing.”

– Kishore Mahbubani, Founding Dean Lee Kuan Yew School of Public Policy at NUS[3]

China is responsible for 15% of the world’s exports, 30% of global manufacturing, and more than 50% of the global demand for many commodities. This behemoth was closed for most part of the last three years. Whatever you may think about Xi Jinping, it is clear by now that zero-covid is over and China is opening (for business) again.

The stock prices of our Chinese holdings, e.g. Alibaba (BABA) and Tencent (OTCPK:TCEHY), increased by 100% and more since November. However, the impact of China’s resurgence is not only felt by Chinese stocks: copper is up more than 25%, silver is up more than 30%, iron ore is up more than 50%. Consequentially, our shares of base metals producer Vale S.A. are up 50% as well, but still only cost 5-times 2022 earnings.

We expect China’s demand for commodities to accelerate from the depressed levels of last year, while the supply of many commodities remains tight.

Energy

“We’re already at a 40-year low on SPR for political reasons. The recession historically has not affected all demand that much. And then we all know China is going to come back and come back strong.” – Scott Sheffield, CEO Pioneer Natural Resources[4]

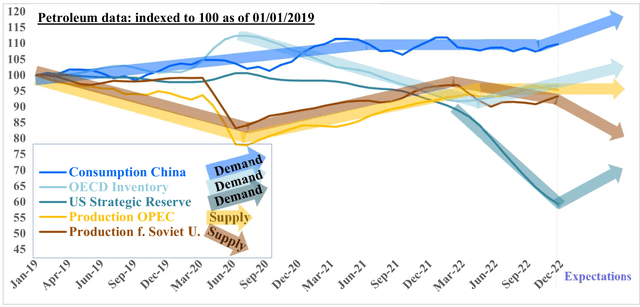

OPEC oil production is not expected to increase for various reasons, while Russian oil production is expected to decline. OECD petroleum inventories and the US strategic petroleum reserve are at low levels. Chinese demand is on the rise. Considering these dynamics, we believe that oil prices are well supported at current levels.

Raw data: EIA, Bloomberg

Just like in the mining sector, the structural issue in fossil energy is decadelong systemic underinvestment in future production capacity. Ongoing investor neglect offers plenty of opportunities.

International Petroleum Corporation (OTCPK:IPCFF) provided free cash flow forecasts until 2026, using oil price scenarios of $75 and $95 per barrel[5]. At those price levels, the company expects to generate annual free cash flow yields between 18% and 27%. Historically, management has been conservative, capital allocation has been excellent, and we expect the current focus on share buybacks and dividends to continue.

Recessions are expected in the US and Europe. However, we are happy owners of well-managed oil and gas producers at 20%+ current free cash flow yields, favorable fundamentals, and structural energy scarcity.

Volatility

“Our network also provides us with a lot of proprietary information that helps us optimize our value chains.

In a way, our asset base is a call option on volatility in the supply chain.”

– Brian Zachman, President Global Risk Management, Bunge Ltd[6]

The world is undergoing large scale changes that might reshape at least the near-term future. Trade route shifts, trade flow disruptions, reshoring…hot wars, cold wars, trade wars…embargos, price caps, excess profits taxes…government and central bank interventions…

Plenty of developments, in our opinion, are resulting not only in increased financial market volatility but also in physical market volatility. It is against the law to trade on material non-public information in public financial markets. However, proprietary information in volatile physical markets can offer fantastic opportunities.

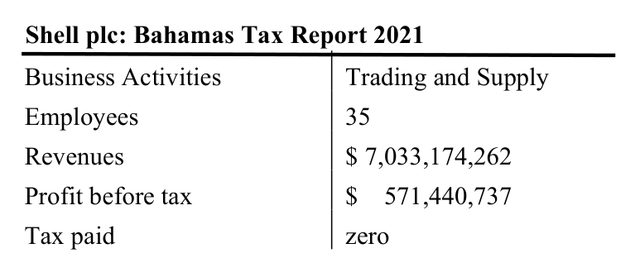

In 2021 alone, Shell (SHEL) Bahamas’ 35 physical commodity traders made close to $600m in after-tax profits, more than $16m on average per employee[7].

Glencore’s physical trading business last year doubled its annual profit run rate compared to the pre-covid era. Bunge’s last twelve months free cash flows are up 2.2-times since pre-covid. Glencore and Bunge shares are both trading at free cash flow yields above 15%.

“With our volume we have in front of us a huge optional component that we trade around. And in volatile markets, options are gold.”

– Jan Rindbo, CEO Dampskibsselskabet NORDEN A/S

152-year old Danish shipping company Dampskibsselskabet Norden A/S (OTCPK:DPBSF, NORDEN) is unique in that it has transformed itself into a data-heavy but asset-light physical trading business in recent years. NORDEN has 425 employees, of which about 100 are traders. The company forecasts approximately $750m in profits for 2022. This equates to $7.5m profit per trader. Not quite as good as Shell Bahamas, however, with a net cash position and a market capitalization of $2bn, NORDEN trades at less than 3-times profits.

In addition to the general commodity demand tailwinds for NORDEN, dry bulk and product tanker supply is constrained by historically low ship newbuildings, regulatory requirements to reduce vessel speeds, longer journeys due to changing trade patterns, and a ban on Russian oil products that will go into effect on February 5th.

Buffett

Warren Buffett received attention for a $1bn stake in Amazon (AMZN) and his tech investments in Snowflake (SNOW), StoneCo (STNE) and the like. However, each of these holdings is well below $1bn for Berkshire Hathaway (BRK.A, BRK.B) . In contrast, Buffett also recently invested more than $40bn into energy companies and more than $10bn into Japanese commodity trading firms. Maybe he is on to something…maybe it is a good idea to own the stuff that the world needs…

Trust

The NORDSTERN CAPITAL partnership can flourish thanks to our partners’ trust, which empowers us to ignore short-term stock price volatility and to focus on decision making for long-term investment success. I am convinced that the dedicated focus on the long-term cash flow prospects of our investments will result in better long-term returns.

Long-term oriented accredited investors who are not partners yet are encouraged to apply. Looking forward to hearing from all of you.

Sincerely,

Johannes Arnold, Nordstern Capital Investors LLC

|

This report is based on the views and opinions of Dr. Johannes Arnold, which are subject to change at any time without notice. The information contained in this report is intended for informational purposes only and is qualified in its entirety by the more detailed information contained in the offering memorandum of Nordstern Capital, LP (the “Offering Memorandum”). This report is not an offer to sell or a solicitation of an offer to purchase any investment product, which can only be made by the Offering Memorandum. An investment in the Partnership involves significant investment considerations and risks which are described in the Offering Memorandum. The material presented herein, which is provided for the exclusive use of the person who has been authorized to receive it, is for your private information and shall not be used by the recipient except in connection with its investment in the Partnership. Nordstern Capital Investors, LLC is soliciting no action based upon it. It is based upon information which we consider reliable, but neither Nordstern Capital Investors, LLC nor any of its managers or employees represents that it is accurate or complete, and it should not be relied upon as such. Performance information presented herein is historic and should not be taken as any indication of future performance. Among other things, growth of assets under management of Nordstern Capital, LP may adversely affect its investment performance. Also, future investments will be made under different economic conditions and may be made in different securities using different investment strategies. The comparison of the Partnership’s performance to a single market index is imperfect because the Partnership’s portfolio may include the use of margin trading and other leverage and is not as diversified as the Standard and Poor’s 500 Index or other indices. Due to the differences between the Partnership’s investment strategy and the methodology used to compute most indices, we caution potential investors that no indices are directly comparable to the results of the Partnership. Statements made herein that are not attributed to a third-party source reflect the views, beliefs and opinions of Nordstern Capital Investors, LLC and should not be taken as factual statements. |

Footnotes[1] IEA: The Role of Critical Minerals in Clean Energy Transitions. March 2022 [2] IEA: Net Zero by 2050. A Roadmap for the Global Energy Sector. October 2021 [3] SALT iConnections Asia conference, Singapore, Nov 16th, 2022 [4] Goldman Sachs Energy Conference, Miami, Jan 5th, 2023 [5] International Petroleum Corporation, company presentation January 2023 [6] Kingsman, Jonathan. The New Merchants of Grain: Out of the Shadows. Independently Published. 2019 |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment